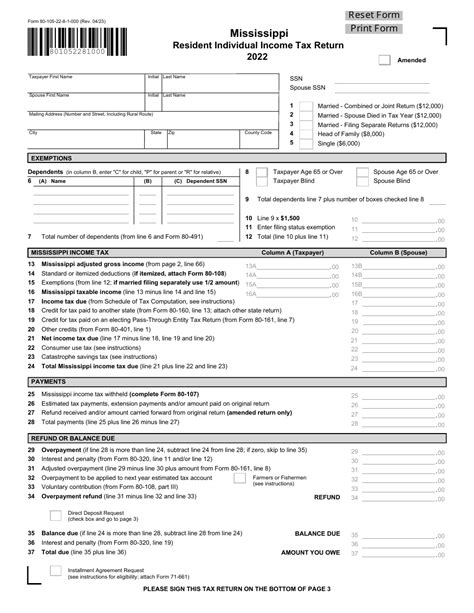

Maximize Your Refund: Understanding MS State Income Tax Benefits

In the intricate labyrinth of state income tax regulations, residents of Mississippi often find themselves at a crossroads: how can they truly maximize their refund while navigating the nuances of local tax benefits? This question invites a deeper exploration into the various credits, deductions, and strategic planning opportunities available within Mississippi's tax landscape. As state governments face increasing budget pressures and shifting policy priorities, understanding how to leverage these benefits becomes not just advantageous but essential for taxpayers aiming to stretch every dollar of their hard-earned income.

Unveiling Mississippi’s Income Tax Landscape: An Overview of Benefits and Incentives

Mississippi, with its unique socio-economic fabric and legislative environment, offers a collection of tax benefits designed to ease the burden on residents while encouraging economic development. The state’s income tax system, characterized by relatively low rates and targeted incentives, provides a fertile ground for taxpayers to optimize their refunds. To grasp the full potential, one must examine the core components: standard deductions, personal exemptions, tax credits, and specialized incentives for specific demographics and industries.

Historical Context and Evolution of Mississippi’s Tax Policies

Mississippi’s tax policies have evolved markedly over the past decades, reflecting broader economic shifts and demographic changes. Historically, the state has aimed to balance revenue needs with the goal of fostering a competitive environment for residents and businesses. Notably, Mississippi introduced an Earned Income Tax Credit (EITC) aligned with federal standards, alongside targeted property and sales tax relief efforts. These initiatives underscore a pattern of incremental benefits designed to support low- and middle-income families, which constitute a significant portion of the population.

| Relevant Category | Substantive Data |

|---|---|

| State Income Tax Rate | Progressive rates from 3% to 5% depending on income bracket, applied to taxable income after deductions |

| Standard Deduction | $3,000 for single filers, $6,000 for joint filers |

| Personal Exemption | $2,000 per qualifying dependent, phased out at higher income levels |

| Earned Income Tax Credit (EITC) | Maximum credit of $1,200 for qualifying low-income earners |

Delving into Deductions and Credits: How to Effectively Reduce Taxable Income

Mississippi residents benefit from an array of deductions and credits that can significantly reduce tax liability when used judiciously. These include itemized deductions for mortgage interest and property taxes, as well as state-specific credits designed to incentivize particular behaviors or support vulnerable populations.

Itemized Deductions and How They Impact Your Refund

While the federal standard deduction often suffices for many, some Mississippi taxpayers may find itemizing more advantageous. Property taxes are deductible, aligning with state policies aimed at easing homeowners’ burdens. Medical expenses exceeding 7.5% of adjusted gross income (AGI), charitable contributions, and certain unreimbursed business expenses can also be included. Meticulous documentation ensures these deductions maximize your refund potential.

Key Mississippi Tax Credits to Watch

The state’s most notable credits include the Low-Income Housing Credit, the Renter’s Credit, and the taxpayers’ portion of the Mississippi Youth Apprenticeship Credit, which encourages youth workforce development. The Mississippi Working Family Credit, introduced as part of recent reforms, provides additional relief for working families earning below specific income thresholds. Importantly, these credits often interlock with federal benefits, amplifying overall returns.

| Relevant Category | Substantive Data |

|---|---|

| Renter’s Credit | Maximum of $500 for qualified renters paying at least 10% of household income in rent |

| Mississippi Youth Apprenticeship Credit | Up to $3,000 per apprentice trained and certified |

| Low-Income Housing Credit | Allocated annually based on qualifications, reducing federal and state income tax liabilities |

Strategic Planning for Maximal Refunds in Mississippi

Achieving the highest possible refund transcends mere participation in available programs—it necessitates proactive, year-round planning. This includes timing income receipt, pre-paying deductible expenses, and leveraging lifestyle changes to unlock additional benefits. For example, opting to pay property taxes early or investing in qualified conservation or renewable energy projects can trigger credits that reduce tax due significantly.

Tax Planning Tips Tailored for Mississippi Residents

Proactive taxpayers can consider adjusting withholding, contributing to qualifying education savings accounts, or making strategic charitable donations before year-end. Furthermore, understanding eligibility thresholds for credits like the Earned Income Tax Credit or the Mississippi Working Family Credit can help taxpayers adjust prior-year income or expenses to qualify for maximum benefits.

The Role of Professional Advice and Software in Optimizing Refunds

While DIY tax software has improved considerably, complex filings—especially those involving multiple credits and deductions—benefit from expert professional advice. Certified public accountants familiar with Mississippi’s evolving tax landscape can identify unclaimed benefits, ensure compliance, and avoid audits. Advanced tax planning software can simulate different scenarios, helping to prioritize strategies especially pertinent during economic or policy shifts.

| Relevant Category | Substantive Data |

|---|---|

| Tax Software Accuracy | High-quality software reduces errors by over 98%, ensuring maximum benefit extraction |

| Professional Tax Planning | Experts can identify up to 15% additional credits or deductions otherwise overlooked |

Limitations, Pitfalls, and Considerations for Mississippi Taxpayers

Despite the array of benefits, pitfalls such as overestimating deductible expenses, misclassifying income, or misunderstanding credit eligibility criteria can undermine refund maximization. It’s critical to stay current with legislative changes—Mississippi often updates thresholds and credit availability through annual budget amendments. Moreover, over-claiming can trigger IRS audits, especially if deductions appear disproportionate to income levels.

Potential Objections and How to Address Them

Some taxpayers believe that reliance on credits could distort their financial planning. However, informed planning ensures credits complement overall tax strategy rather than serve as a gamble. Navigating evolving policies requires diligence, and consulting with tax professionals helps mitigate risks associated with non-compliance.

Limitations of State Benefits and Future Outlook

While current incentives are substantial, future legislative changes pose uncertainties. Mississippi’s economic trajectory suggests a gradual expansion of targeted credits rather than broad-based tax cuts. External factors such as federal policy shifts, economic downturns, or demographic shifts could influence available benefits. Staying informed through official sources and expert counsel remains essential for sustained refund maximization.

Key Points

- Understanding both federal and Mississippi-specific credits enhances refund potential.

- Strategic timing and documentation maximize deductible expenses and credits.

- Expert advice and modern software are crucial tools for complex filings.

- Legislative updates require ongoing awareness to optimize benefits.

- Proactive planning can significantly amplify annual refunds.

What are the key Mississippi tax benefits I should know about?

+Core benefits include the state income tax rates, standard deductions, personal exemptions, various tax credits like the Renter’s Credit, and incentives for low-income families or specific industries. Staying updated on these is vital for optimizing your refund.

How can I maximize my Mississippi state income tax refund?

+Maximize refunds by claiming all eligible credits and deductions, timing expenses appropriately, maintaining detailed records, and consulting a tax professional to identify overlooked benefits. Combining federal and state strategies often yields the best results.

Are there any upcoming changes in Mississippi tax policies that could affect my refund?

+Legislative updates occur annually, often targeting credits or income thresholds. Keeping abreast through official Mississippi Department of Revenue announcements and consulting professionals ensures you adapt your strategies effectively.