California State Sales Tax

The California State Sales Tax is a significant component of the state's revenue system, playing a crucial role in funding public services and infrastructure. With a diverse economy and a population of over 39 million people, California's sales tax landscape is intricate and ever-evolving. This article delves into the intricacies of the California State Sales Tax, exploring its history, current structure, and the impact it has on businesses and consumers alike.

A Historical Perspective

The journey of sales tax in California began in the early 20th century, with the first sales tax law introduced in 1933. This initial tax was a mere 2.5% and was implemented as a temporary measure to address the financial challenges brought on by the Great Depression. Over the years, the tax rate has undergone several adjustments, reflecting the state’s evolving fiscal needs and economic climate.

A notable shift occurred in 1957 when the state moved towards a system of shared tax revenue between the state and local governments. This decentralization aimed to provide local authorities with more financial autonomy, allowing them to tailor tax rates to their specific needs and priorities. This system, known as the Bradley-Burns Uniform Local Sales and Use Tax Law, remains in effect today, with certain modifications.

The Current Sales Tax Structure

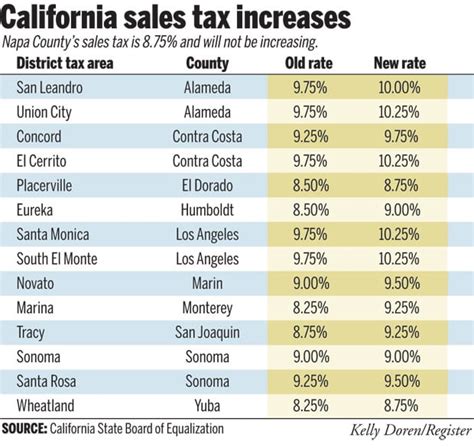

California’s sales tax system is a combination of state and local taxes, with rates varying across the state’s 58 counties and nearly 500 cities. The state sales tax rate is set at 7.25%, which includes a base rate of 6% levied by the state and a 1.25% local tax. However, this is just the starting point, as local governments have the authority to add additional taxes, leading to a wide range of sales tax rates across the state.

For instance, in San Francisco, the total sales tax rate stands at 8.75%, with a local tax of 1.5%. On the other hand, some counties, like Butte and Lassen, have a lower combined rate of 7.75%, with a local tax of just 0.5%. These variations can significantly impact businesses operating in multiple locations or consumers who frequently shop across county lines.

Local Taxes and Their Impact

Local governments have the discretion to impose additional sales taxes to fund specific projects or services. These taxes can be general or designated for particular purposes. For example, a city might levy an extra tax to support public transportation or to finance infrastructure improvements. While these local taxes can provide essential funding, they also add complexity to the sales tax landscape, making it crucial for businesses to stay informed about the rates applicable in their areas of operation.

To illustrate, the city of Los Angeles has a general purpose tax of 0.5% on top of the state and county rates, bringing the total sales tax to 9.5%. Meanwhile, a city like Oakland might have a transportation tax of 1% on top of the state and county rates, resulting in a total sales tax of 9.25%.

| County/City | Total Sales Tax Rate | Local Tax Rate |

|---|---|---|

| San Francisco | 8.75% | 1.5% |

| Los Angeles | 9.5% | 2% |

| Oakland | 9.25% | 1.75% |

| Butte County | 7.75% | 0.5% |

Sales Tax Exemptions and Special Cases

California’s sales tax system is not a one-size-fits-all approach. Various exemptions and special provisions exist, catering to different industries, products, and situations. Understanding these exemptions is crucial for businesses and consumers to navigate the tax landscape effectively.

Exemptions for Specific Industries

Certain industries enjoy sales tax exemptions, often to promote economic growth or support essential services. For instance, sales of prescription drugs are exempt from sales tax, as are sales to nonprofit organizations. Additionally, manufacturers and certain agricultural producers are exempt from sales tax on their purchases of machinery and equipment used in the production process.

Exemptions for Specific Products

A range of products are exempt from sales tax, including food items for home consumption, certain clothing items, and over-the-counter medications. This can provide significant savings for consumers, especially on essential goods. Additionally, certain services, like legal and medical services, are exempt from sales tax, further benefiting consumers.

Special Provisions for Online Sales

With the rise of e-commerce, California has implemented specific rules for online sales. Businesses that make sales through the internet, catalogs, or other remote means must collect and remit sales tax based on the destination of the sale. This is known as destination-based sourcing, where the tax rate is determined by the buyer’s location, not the seller’s.

To facilitate compliance, the California Department of Tax and Fee Administration provides resources and tools, including the California Sales and Use Tax Rate API, which businesses can integrate into their systems to automatically calculate the correct tax rate for each sale.

Compliance and Enforcement

Ensuring compliance with California’s sales tax laws is a critical aspect for businesses. The California Department of Tax and Fee Administration (CDTFA) is responsible for enforcing these laws and ensuring businesses collect and remit the appropriate taxes. Failure to comply can result in penalties, interest, and even criminal charges in severe cases.

Sales Tax Registration and Reporting

Businesses engaged in taxable activities in California must register with the CDTFA and obtain a seller’s permit. This permit authorizes the business to collect and remit sales tax on its transactions. The registration process involves providing detailed information about the business, its activities, and its expected sales.

Once registered, businesses must report their sales tax liabilities periodically, typically on a quarterly basis. These reports must be filed by the 20th day of the month following the end of the reporting period. Late filings can result in penalties, so it's essential for businesses to stay on top of their reporting obligations.

Audits and Penalties

The CDTFA conducts audits to ensure businesses are complying with sales tax laws. These audits can be random or targeted based on specific risk factors. During an audit, the CDTFA examines the business’s records, including sales invoices, purchase orders, and tax returns, to verify the accuracy of the reported tax liabilities.

If an audit reveals underreporting or non-compliance, the CDTFA can impose penalties and interest on the outstanding tax amount. Penalties can range from 5% to 50% of the underpaid tax, depending on the severity of the violation and the business's cooperation during the audit process.

The Future of California’s Sales Tax

As California’s economy continues to evolve, so too will its sales tax system. The state’s commitment to funding public services and infrastructure means that sales tax will remain a critical revenue source. However, the ever-changing landscape of e-commerce and the digital economy presents new challenges and opportunities for tax authorities and businesses alike.

The Rise of E-Commerce and Remote Sales

With the rapid growth of online shopping, California’s sales tax system must adapt to ensure it captures revenue from remote sales. The state’s adoption of destination-based sourcing for remote sales is a step in this direction, ensuring that taxes are collected based on the buyer’s location, not the seller’s.

However, the complexity of e-commerce transactions, especially those involving multiple jurisdictions, can make compliance challenging. Businesses must stay abreast of the latest regulations and use technology to streamline their sales tax obligations. Tools like automated tax calculation software and e-invoicing platforms can significantly ease the burden of compliance.

Potential Reforms and Modernization

As the sales tax landscape evolves, discussions around reform and modernization are ongoing. Some proposed reforms include simplifying the tax structure, reducing the number of local taxes, and introducing a uniform tax rate across the state. These reforms aim to reduce complexity, improve compliance, and provide a more stable revenue stream for local governments.

Additionally, there are discussions around expanding the scope of sales tax to include services, which could provide a significant boost to state revenue. While such a move would impact consumers and businesses, it could also help address the evolving nature of the economy, where services are playing an increasingly important role.

The Impact of Economic Trends

California’s sales tax system is inherently tied to the state’s economic performance. During economic downturns, sales tax revenue can decline, impacting the state’s ability to fund public services. Conversely, during periods of economic growth, sales tax revenue can surge, providing a windfall for the state’s coffers.

As California navigates the post-pandemic economic recovery, the sales tax system will play a crucial role in funding critical services and infrastructure projects. The state's ability to adapt its tax system to changing economic conditions will be a key factor in its long-term fiscal health and stability.

Conclusion

California’s sales tax system is a complex yet crucial component of the state’s revenue structure. From its historical origins to the current landscape of varying local taxes and exemptions, the sales tax system has evolved to meet the needs of a diverse and dynamic economy. While it presents challenges, particularly for businesses operating across multiple jurisdictions, it also provides essential funding for public services and infrastructure.

As California continues to adapt to the changing economic landscape, particularly in the digital age, the sales tax system will remain a key focus for tax authorities, businesses, and consumers. Staying informed, seeking professional advice when needed, and embracing technology can help navigate this complex system, ensuring compliance and contributing to the state's fiscal health.

How often are sales tax rates updated in California?

+Sales tax rates in California are not updated frequently. The state sales tax rate of 7.25% has remained unchanged since 1991. However, local governments can change their tax rates, and these changes typically occur annually or semi-annually. It’s essential to stay informed about these local rate changes to ensure compliance.

Are there any plans to simplify California’s sales tax structure?

+There have been discussions about simplifying the sales tax structure in California, including proposals to reduce the number of local taxes and introduce a uniform tax rate across the state. While these proposals aim to reduce complexity, they are still in the discussion phase and have not been implemented as of yet.

How does California handle sales tax for online purchases made from out-of-state sellers?

+California has implemented a destination-based sourcing system for remote sales, which means that sales tax for online purchases is based on the buyer’s location, not the seller’s. This means that even if the seller is located out of state, they must collect and remit sales tax based on the destination of the sale.

What are the consequences of non-compliance with sales tax laws in California?

+Non-compliance with sales tax laws in California can result in significant penalties and interest charges. The severity of the penalties depends on the nature and extent of the violation. In severe cases, non-compliance can even lead to criminal charges. It’s crucial for businesses to understand their sales tax obligations and seek professional advice when needed to avoid these consequences.