Honolulu Property Tax

Understanding property taxes is essential for homeowners and prospective buyers, as these taxes significantly impact the cost of homeownership. In Honolulu, property taxes play a crucial role in the local economy and are a key consideration for residents and investors alike. This comprehensive guide will delve into the specifics of Honolulu property taxes, covering everything from assessment processes to payment options and potential exemptions.

Honolulu’s Property Tax System

The city and county of Honolulu levy property taxes on all real estate properties within its jurisdiction. These taxes are a primary source of revenue for the local government, funding essential services like education, infrastructure, and public safety.

Tax Assessment Process

The Honolulu Department of Taxation is responsible for assessing property values and determining tax liabilities. Properties are reassessed every year, and the assessment takes into account various factors such as:

- Property type (residential, commercial, agricultural)

- Location and size of the property

- Market conditions and recent sales in the area

- Improvements or additions made to the property

- Any applicable exemptions or deductions.

Property owners receive an annual assessment notice detailing the assessed value of their property and the corresponding tax liability. This notice is typically mailed in February, providing homeowners with an opportunity to review and appeal the assessment if they believe it to be inaccurate.

| Assessment Timeline | Description |

|---|---|

| February | Assessment notices are mailed to property owners. |

| March - April | Owners can file appeals if they disagree with the assessment. |

| May | Final tax bills are sent out based on the assessed values. |

| July - December | Tax payments are due in two installments. |

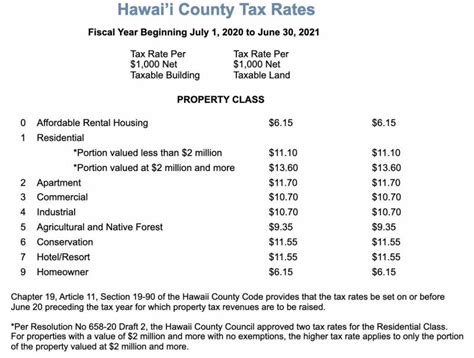

Tax Rates and Calculations

The property tax rate in Honolulu is determined by the Office of the Mayor and is subject to approval by the Honolulu City Council. The tax rate is expressed as a percentage of the assessed value of the property. For the fiscal year 2023-2024, the tax rate is set at 5.925% for residential properties and 8.7375% for commercial properties.

To calculate the property tax liability, the assessed value is multiplied by the applicable tax rate. For example, a residential property with an assessed value of $500,000 would have a tax liability of $29,625 (5.925% x $500,000) for the year.

Payment Options and Due Dates

Property owners in Honolulu have several options for paying their taxes:

Online Payment

The most convenient method is to make payments online through the Honolulu Department of Taxation’s website. Property owners can create an account, view their tax bills, and make payments securely using a credit or debit card, eCheck, or PayPal. Online payments are processed immediately and are available 24⁄7.

In-Person Payments

Tax payments can also be made in person at the Department of Taxation offices. Property owners can visit the office during business hours and pay by cash, check, or money order. The main office is located at 643 South Street, Honolulu, HI 96813, and there are also satellite offices on the island for added convenience.

Payment Plans and Installments

Honolulu offers a convenient installment plan for property taxes, allowing homeowners to divide their tax liability into two equal payments. The first installment is due on July 20 and the second on December 20. Late payments are subject to penalties and interest.

| Installment Payment Due Dates | Description |

|---|---|

| July 20 | First installment due for the current fiscal year. |

| December 20 | Second installment due. Payments received after this date are subject to late fees. |

Property Tax Exemptions and Deductions

Honolulu offers several exemptions and deductions to eligible property owners, which can significantly reduce their tax liabilities. These include:

Homestead Exemption

The Homestead Exemption is available to homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property by $80,000, resulting in a lower tax liability. To qualify, homeowners must meet specific residency and ownership requirements and file an application with the Department of Taxation.

Senior Citizen Exemption

Honolulu provides an exemption for senior citizens who are 65 years or older and meet certain income and residency criteria. This exemption can reduce the assessed value of the property by $100,000 for eligible homeowners. Applications for this exemption must be submitted annually.

Other Exemptions and Deductions

Additionally, there are exemptions for disabled veterans, military personnel, and properties used for religious, charitable, or educational purposes. Deductions are also available for qualified improvements, such as solar energy systems and energy-efficient upgrades.

| Exemption/Deduction | Description |

|---|---|

| Homestead Exemption | Reduces assessed value by $80,000 for primary residences. |

| Senior Citizen Exemption | Reduces assessed value by $100,000 for eligible seniors. |

| Veteran's Exemption | Available to disabled veterans, reducing assessed value by $120,000. |

| Energy Deduction | Deduction for solar energy systems and energy-efficient improvements. |

Challenging Property Assessments

If a property owner believes that their assessment is incorrect, they have the right to appeal the decision. The Honolulu Department of Taxation provides an appeal process to address concerns about valuation and potential errors.

Steps to Appeal

- Receive the assessment notice in February.

- Review the notice for any errors or discrepancies.

- File an appeal within the specified deadline, typically in March or April.

- Provide supporting documentation and evidence to support your case.

- Attend a hearing if necessary, where the assessment will be reviewed by an independent board.

- Receive a decision on the appeal, which can result in a change to the assessed value or a denial of the appeal.

Future Outlook and Tax Considerations

Honolulu’s property tax system is subject to ongoing review and potential changes to align with economic trends and budgetary needs. Here are some key considerations for the future:

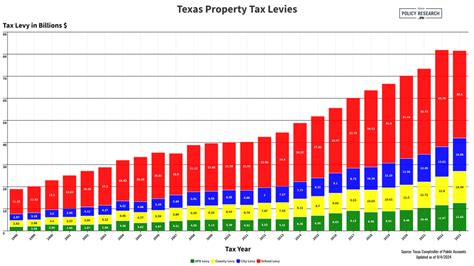

Economic Impact

Property taxes play a significant role in Honolulu’s economy, funding essential services and infrastructure projects. As the city continues to grow and develop, property tax revenue becomes increasingly important for sustaining these initiatives.

Tax Rate Stability

Honolulu’s tax rates have been relatively stable in recent years, providing predictability for homeowners. However, it’s important for property owners to stay informed about any proposed changes, as these can impact their financial planning and budgeting.

Potential Tax Reform

There have been discussions and proposals for tax reform in Honolulu, aiming to make the system more equitable and efficient. These reforms could include changes to assessment methods, tax rates, and exemption policies. Staying informed about these potential changes is essential for property owners to understand how they may be affected.

Conclusion

Honolulu’s property tax system is a vital component of the local economy, providing revenue for essential services and infrastructure. Understanding the assessment process, payment options, and available exemptions is crucial for homeowners and prospective buyers. By staying informed and taking advantage of available resources, property owners can navigate the tax landscape effectively and ensure they are contributing to the community’s prosperity.

What happens if I miss the deadline for property tax payments in Honolulu?

+

If you miss the payment deadline, you will incur late fees and interest on the outstanding amount. It’s important to stay updated on the due dates and make timely payments to avoid these penalties.

Can I apply for exemptions online, or do I need to visit the Department of Taxation office?

+

While some applications can be started online, you may need to visit the Department of Taxation office to complete the process. It’s recommended to check the specific exemption requirements and application procedures on the official website.

How often are property assessments conducted in Honolulu?

+

Property assessments are conducted annually in Honolulu. This ensures that the tax liability is based on the most current information and market conditions.

Are there any programs or assistance available for low-income homeowners to help with property taxes?

+

Yes, Honolulu offers the Property Tax Relief Program for eligible low-income homeowners. This program provides a partial refund of property taxes paid, helping to alleviate the financial burden. To qualify, homeowners must meet specific income and residency requirements.

Can I pay my property taxes with a credit card or PayPal, and are there any additional fees for these payment methods?

+

Yes, you can pay your property taxes online using a credit card, debit card, eCheck, or PayPal. There may be convenience fees associated with these payment methods, which are typically a small percentage of the transaction amount. These fees are not imposed by the government but by the payment processing service providers.