Wisconsin Tax Refund Status

Are you eagerly awaiting your Wisconsin tax refund and wondering how to check its status? Look no further! In this comprehensive guide, we'll delve into the process of tracking your Wisconsin tax refund and provide you with all the information you need to stay informed. From understanding the timeline to utilizing the available tools, we've got you covered. Get ready to navigate the world of tax refunds with confidence and ensure you receive your well-deserved money back.

Understanding Wisconsin Tax Refund Processing

The Wisconsin Department of Revenue handles the processing of tax refunds for residents and businesses within the state. It’s important to note that the timeline for receiving your refund can vary depending on several factors, including the method of filing, the complexity of your tax return, and the overall volume of tax returns being processed.

For those who choose to file their taxes electronically, the processing time is typically faster compared to traditional paper filings. The state aims to issue refunds within 21 business days for e-filed returns, provided there are no issues or errors identified during the review process. However, it's worth mentioning that this timeline may be subject to change due to various factors, such as system updates or high-volume filing periods.

Paper returns, on the other hand, tend to take longer to process. The Department of Revenue estimates a 6 to 8 week timeframe for paper filings to be reviewed and refunds to be issued. This extended period is primarily due to the manual handling and verification process required for paper returns.

Checking Your Wisconsin Tax Refund Status

The Wisconsin Department of Revenue offers several convenient methods for taxpayers to check the status of their refunds. By utilizing these tools, you can stay informed and track the progress of your refund journey.

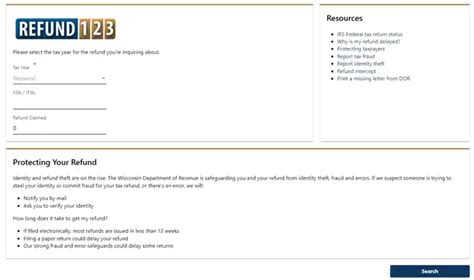

Online Refund Lookup Tool

The Wisconsin Refund Lookup tool is a user-friendly online platform that allows taxpayers to quickly and easily check the status of their refunds. To access this tool, simply visit the official website of the Wisconsin Department of Revenue and navigate to the dedicated section for refund inquiries. Here’s a step-by-step guide to using the Refund Lookup tool:

- Open your preferred web browser and go to the Wisconsin Department of Revenue website.

- Locate the "Refund Status" or "Refund Lookup" section on the homepage.

- Click on the link provided to access the online tool.

- Enter your Social Security Number or Individual Taxpayer Identification Number (ITIN) in the designated field.

- Provide your refund amount or expected refund amount as indicated in your tax return.

- Click on the "Submit" or "Search" button to retrieve the status of your refund.

The tool will display real-time information regarding your refund, including the current processing stage, estimated timeframe for issuance, and any potential delays or issues encountered.

Wisconsin Tax Refund Hotline

For taxpayers who prefer a more personalized approach, the Wisconsin Department of Revenue operates a dedicated refund hotline. By calling the hotline, you can speak directly with a customer service representative who can provide you with up-to-date information regarding your refund status. Here are the details you need to know:

| Hotline Number | Operating Hours |

|---|---|

| 1-866-357-2418 | Monday to Friday, 7:45 AM to 4:30 PM Central Time |

When calling the hotline, be prepared to provide your personal information, such as your name, Social Security Number, and the details of your tax return. This will help the representative locate your refund status promptly.

Mobile App for Refund Status

In today’s digital age, the Wisconsin Department of Revenue has embraced technology to enhance taxpayer convenience. They have developed a mobile app specifically designed to provide taxpayers with easy access to their refund status. The app, available for both iOS and Android devices, offers a user-friendly interface and real-time updates on refund progress.

To use the mobile app, simply download it from the respective app store on your device. Once installed, launch the app and follow the on-screen instructions to register and link your tax account. From there, you can conveniently check your refund status anytime, anywhere, without the need for a computer or internet browser.

Common Issues and Resolutions

While the majority of tax refunds are processed smoothly, there are instances where issues may arise. It’s essential to be aware of these potential challenges and know how to address them effectively.

Refund Delays

Delays in receiving your Wisconsin tax refund can occur for various reasons. Some common causes include:

- Errors or Incomplete Information: Inaccurate or missing information on your tax return can trigger a delay in processing. This may include incorrect Social Security Numbers, missing signatures, or discrepancies in reported income.

- Additional Review or Audit: In some cases, the Department of Revenue may require further review or audit of your tax return to ensure accuracy and compliance with tax laws. This process can extend the refund issuance timeline.

- System Updates or Technical Issues: Periodically, the Department of Revenue may implement system updates or experience technical difficulties, which can temporarily impact the processing of refunds.

- High-Volume Filing Periods: During peak tax filing seasons, such as the early months of the year, the volume of tax returns being processed increases significantly. This may result in slightly longer wait times for refunds.

Addressing Refund Delays

If you encounter a delay in receiving your Wisconsin tax refund, there are several steps you can take to address the issue:

- Check the Status Online: Utilize the Wisconsin Refund Lookup tool or the mobile app to check the current status of your refund. This will provide you with valuable insights into any potential delays or issues.

- Contact the Department of Revenue: If the online tools indicate a delay or error, reach out to the Department of Revenue's refund hotline. Explain your situation, provide the necessary details, and inquire about the next steps.

- Review Your Tax Return: Take the time to review your tax return for any errors or discrepancies. Ensure that all information is accurate and complete. If necessary, make the required corrections and resubmit your return.

- Stay Informed: Keep yourself updated on any official communications or announcements from the Department of Revenue regarding tax refund processing. They may provide valuable insights or instructions to help resolve delays.

Tax Refund Fraud and Identity Theft

In today’s digital world, it’s essential to be vigilant about tax refund fraud and identity theft. Scammers and cybercriminals often target tax refunds, aiming to steal personal information and divert funds to their accounts.

Recognizing Tax Refund Fraud

Here are some common signs that may indicate tax refund fraud:

- Unexpected Refunds: If you receive a refund that you didn't anticipate or haven't filed a tax return, it could be a sign of fraud. Scammers may use stolen identities to file false tax returns and claim refunds.

- Communication from Unknown Sources: Be cautious of emails, phone calls, or text messages claiming to be from the IRS or tax authorities. Official communications should only come from trusted sources, and you should never share personal or financial information unless you've initiated the contact.

- Unusual Account Activity: Monitor your bank accounts and credit card statements regularly. If you notice unauthorized transactions or unexpected changes in your account balance, it could indicate that your tax refund has been compromised.

Protecting Yourself from Tax Refund Fraud

To safeguard your tax refund and personal information, consider the following precautions:

- Secure Your Personal Information: Treat your personal and financial details with utmost care. Avoid sharing sensitive information online or with unknown individuals. Use strong passwords and enable two-factor authentication for added security.

- File Your Taxes Early: By filing your taxes promptly, you reduce the risk of fraudsters using your identity to claim a refund. The earlier you file, the less time fraudsters have to exploit your information.

- Use Secure Filing Methods: Opt for secure filing methods, such as electronic filing or reputable tax preparation software. These methods provide enhanced security measures to protect your information during transmission.

- Monitor Your Accounts: Regularly review your bank statements, credit card transactions, and tax-related documents. Look for any suspicious activities or discrepancies. If you notice anything unusual, report it to your financial institution and the appropriate authorities immediately.

Future of Wisconsin Tax Refunds

As technology advances and the tax landscape evolves, the Wisconsin Department of Revenue is continuously working to improve the tax refund process. Here are some potential future developments to keep an eye on:

Enhanced Online Services

The Department of Revenue aims to enhance its online services, making it even more convenient for taxpayers to access their refund status and other tax-related information. Expect improvements in the user experience, additional features, and streamlined processes to ensure a seamless and efficient refund journey.

Digital Payment Options

In an effort to provide taxpayers with more flexibility, the Department of Revenue may introduce digital payment options for tax refunds. This could include direct deposit to bank accounts or the use of mobile wallets, allowing taxpayers to receive their refunds quickly and securely.

Improved Security Measures

With the increasing threat of cybercrime, the Department of Revenue is committed to strengthening its security measures to protect taxpayer information. Expect enhanced encryption protocols, two-factor authentication, and other advanced security features to safeguard your personal and financial data.

Expanded Taxpayer Assistance

The Department of Revenue recognizes the importance of providing comprehensive support to taxpayers. In the future, they aim to expand their taxpayer assistance programs, offering additional resources, educational materials, and personalized guidance to ensure a smooth tax refund process for all residents.

Integration with State Services

To streamline government services, the Department of Revenue may explore integration with other state agencies and services. This could lead to a more interconnected system, allowing taxpayers to access various government services through a single platform, making the overall experience more efficient and user-friendly.

Conclusion

Checking the status of your Wisconsin tax refund has never been easier, thanks to the tools and resources provided by the Wisconsin Department of Revenue. By utilizing the online Refund Lookup tool, mobile app, and refund hotline, you can stay informed and ensure a smooth refund process. Remember to remain vigilant against tax refund fraud and take necessary precautions to protect your personal information. With the Department of Revenue’s ongoing efforts to enhance services and security measures, the future of Wisconsin tax refunds looks promising, offering convenience, efficiency, and peace of mind to taxpayers.

What happens if my Wisconsin tax refund is delayed due to errors or discrepancies?

+If your Wisconsin tax refund is delayed due to errors or discrepancies, the Department of Revenue will communicate with you through the contact information provided on your tax return. They will inform you of the issue and guide you through the necessary steps to resolve it. In most cases, you’ll need to correct the errors, provide additional documentation, or clarify certain information to facilitate the processing of your refund.

Can I track the status of my Wisconsin tax refund if I filed jointly with my spouse or partner?

+Yes, you can track the status of your Wisconsin tax refund even if you filed jointly with your spouse or partner. When checking the refund status, ensure that you have the necessary information, such as the primary filer’s Social Security Number and the expected refund amount. This information will allow you to access the status of your joint refund and stay informed about its progress.

How long does it typically take to receive my Wisconsin tax refund after filing electronically?

+For taxpayers who file their Wisconsin tax returns electronically, the Department of Revenue aims to issue refunds within 21 business days, provided there are no issues or errors identified during the review process. However, it’s important to note that this timeline may vary based on factors such as system updates or high-volume filing periods.

What should I do if I haven’t received my Wisconsin tax refund within the estimated timeframe?

+If you haven’t received your Wisconsin tax refund within the estimated timeframe, it’s recommended to take the following steps: First, verify the status of your refund using the online Refund Lookup tool or the mobile app. If the tool indicates a delay or issue, contact the Department of Revenue’s refund hotline for further assistance. They will provide guidance and help resolve any potential problems with your refund.

Are there any penalties or interest applied to Wisconsin tax refunds?

+Wisconsin tax refunds are generally not subject to penalties or interest. However, it’s important to note that in certain situations, such as late payment of taxes or failure to file tax returns, penalties and interest may apply. It’s always advisable to stay informed about your tax obligations and file your returns promptly to avoid any potential penalties.