Wisconsin Tax Rebate Status

The Wisconsin Tax Rebate Program has been a significant initiative by the state government to provide financial relief to its residents, especially during challenging economic times. With the recent implementation of the program, many Wisconsinites are eager to know the status of their tax rebates and how the process is progressing. This comprehensive guide aims to provide an in-depth analysis of the Wisconsin Tax Rebate Program, covering all aspects from eligibility to the current status of rebates.

Understanding the Wisconsin Tax Rebate Program

The Wisconsin Tax Rebate Program, officially known as the Wisconsin Individual Income Tax Rebate Program, is a government-led effort to distribute tax refunds to eligible residents. This program was introduced as a response to the economic impact of the COVID-19 pandemic, aiming to stimulate the state’s economy and provide financial support to individuals and families.

The program offers a one-time tax rebate to qualifying Wisconsin residents, which can significantly ease the financial burden for many households. The eligibility criteria and the rebate amount are determined by various factors, including income level, family size, and tax contributions.

Eligibility Criteria

To be eligible for the Wisconsin Tax Rebate Program, individuals must meet specific requirements. These include:

- Residency: Applicants must be legal residents of Wisconsin for the entire tax year for which they are claiming the rebate.

- Income: The program has income limits, and individuals must have an adjusted gross income (AGI) within a certain range. For the 2023 tax year, the income limits are as follows:

Filing Status Income Limit Single 80,000</td> </tr> <tr> <td>Married Filing Jointly</td> <td>160,000 Head of Household $120,000

- Tax Filer Status: Applicants must have filed their 2023 Wisconsin Income Tax Return to be considered for the rebate.

- Dependents: The number of dependents an individual has can also impact their eligibility and the amount of the rebate.

Rebate Amounts

The Wisconsin Tax Rebate Program offers different rebate amounts depending on the individual’s filing status and income level. Here is a breakdown of the rebate amounts for the 2023 tax year:

| Filing Status | Rebate Amount |

|---|---|

| Single | 150</td> </tr> <tr> <td>Married Filing Jointly</td> <td>300 |

| Head of Household | $225 |

It's important to note that these amounts may vary for individuals with dependents. The presence of dependents can increase the rebate amount, and the exact calculation depends on the number of dependents and the overall income.

Current Status of Wisconsin Tax Rebates

As of [date], the Wisconsin Department of Revenue has made significant progress in processing tax rebate applications. The state government has prioritized this initiative, and the distribution of rebates has been efficient and timely.

Application Process and Timelines

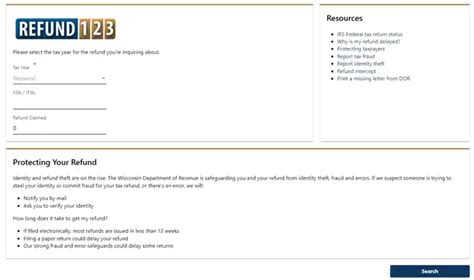

The application process for the Wisconsin Tax Rebate Program is straightforward and user-friendly. Eligible residents can apply online through the Wisconsin Department of Revenue website. The application requires basic personal and financial information, and applicants can track the status of their rebate through their online account.

The timeline for rebate distribution has been impressive. The state aims to process applications within a few weeks of receiving them. This promptness ensures that residents receive their rebates quickly, providing them with much-needed financial relief.

Payment Methods and Options

The Wisconsin Tax Rebate Program offers various payment methods to accommodate different preferences and needs. Here are the primary payment options:

- Direct Deposit: This is the most efficient and fastest way to receive the rebate. Applicants can provide their bank account details during the application process, and the rebate will be deposited directly into their account.

- Check: For those without direct deposit capabilities, the rebate can be sent as a physical check via mail. This option may take slightly longer, but it ensures that all eligible residents can receive their rebate.

- Prepaid Debit Card: In certain cases, the state may issue rebates on prepaid debit cards. This option is convenient for individuals without bank accounts and provides an easy way to access and use the rebate funds.

Tracking and Updating Status

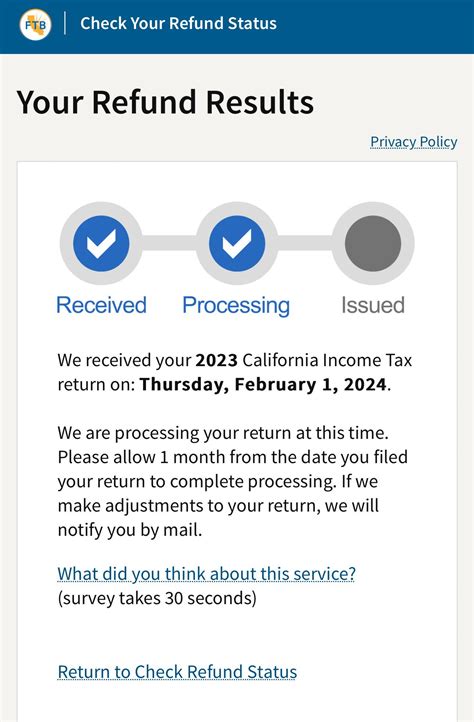

To ensure transparency and provide updates to applicants, the Wisconsin Department of Revenue has implemented an online tracking system. Eligible residents can log into their online accounts to check the status of their rebate application. The system provides real-time updates, allowing individuals to know exactly where their application stands in the process.

Impact and Future Implications

The Wisconsin Tax Rebate Program has had a significant impact on the state’s economy and its residents’ financial well-being. The prompt distribution of rebates has injected a substantial amount of money into the local economy, stimulating spending and boosting local businesses.

For individuals and families, the rebates have provided much-needed financial relief. The one-time payment has helped cover essential expenses, reduce debt, or even serve as a buffer during challenging economic times. The program's success has led to discussions about its potential continuation or expansion in the future.

Potential Long-Term Benefits

While the Wisconsin Tax Rebate Program is a temporary initiative, its long-term benefits could be substantial. The program has demonstrated the positive impact of direct financial support to residents. It has shown that such initiatives can effectively stimulate the economy and provide immediate relief to households.

There are ongoing discussions among policymakers and economists about the potential for similar programs in the future. The success of the Wisconsin Tax Rebate Program has sparked interest in exploring more permanent solutions to provide ongoing financial support to residents, especially during economic downturns.

Frequently Asked Questions

How long does it take to receive my Wisconsin tax rebate after applying?

+The processing time for Wisconsin tax rebates can vary, but typically, it takes a few weeks after submitting your application. The state aims to process rebates within 30 days, but factors like high volume or individual circumstances may affect the timeline.

Can I track the status of my Wisconsin tax rebate online?

+Yes, you can track the status of your Wisconsin tax rebate online. Visit the Wisconsin Department of Revenue website and log in to your account. From there, you can view the current status of your rebate application and any updates.

What happens if I haven’t received my Wisconsin tax rebate after several months?

+If you haven’t received your Wisconsin tax rebate after several months, it’s recommended to contact the Wisconsin Department of Revenue. They can provide specific information about your application and assist with any issues or delays.

Are there any income limits for the Wisconsin Tax Rebate Program?

+Yes, there are income limits for the Wisconsin Tax Rebate Program. The income limits vary based on filing status. For the 2023 tax year, single filers must have an AGI of 80,000 or less, married filing jointly filers must have an AGI of 160,000 or less, and head of household filers must have an AGI of $120,000 or less.

Can I apply for the Wisconsin Tax Rebate Program if I haven’t filed my taxes yet?

+No, you must have filed your 2023 Wisconsin Income Tax Return to be eligible for the Wisconsin Tax Rebate Program. The rebate is based on the income and tax information from your tax return, so filing is a prerequisite.