Nj Property Tax Lookup

Welcome to this comprehensive guide on understanding and exploring the intricate world of property taxes in New Jersey, also known as the Garden State. Property taxes play a crucial role in funding essential public services and infrastructure, making it a topic of great importance for every homeowner and prospective buyer. In this article, we will delve deep into the specifics of New Jersey's property tax system, shedding light on the factors that influence tax assessments, the processes involved in determining tax liabilities, and the various tools available for taxpayers to navigate this complex landscape.

Understanding New Jersey’s Property Tax System

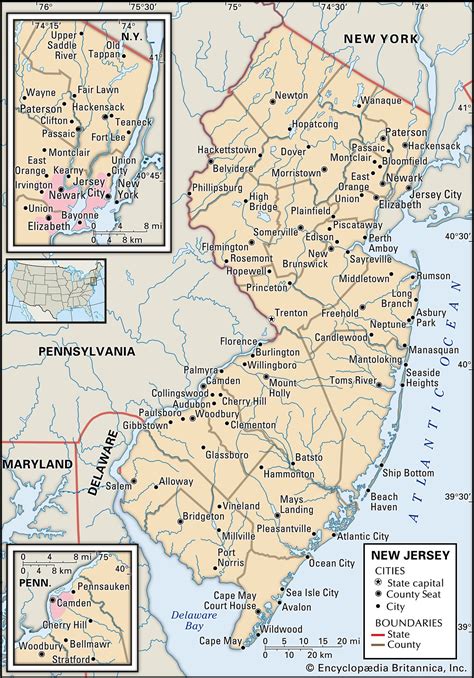

New Jersey’s property tax system is renowned for its complexity and, at times, its high rates. Property taxes are a significant source of revenue for local governments, which use these funds to support schools, police and fire departments, public works projects, and other vital services. The state’s property tax system is governed by a set of laws and regulations, ensuring uniformity and fairness across its 21 counties and 565 municipalities.

The property tax rate in New Jersey is determined by the local tax levy and the assessed value of the property. The tax levy is the amount of money a municipality needs to raise through property taxes to fund its operations and services. This levy is then divided by the total assessed value of all properties in the municipality to determine the tax rate.

For instance, consider the fictional town of Greenvale. If Greenvale needs to raise $10 million through property taxes and the total assessed value of properties in the town is $1 billion, the tax rate would be 1% ($10 million divided by $1 billion). So, for every $100,000 of assessed value, homeowners in Greenvale would pay $1,000 in property taxes.

However, it's important to note that the assessed value of a property does not necessarily equate to its market value. New Jersey uses a "true value" assessment method, which aims to determine the property's fair market value. This value is then subject to a county-wide equalization process to ensure fairness across municipalities.

| County | Median Home Value | Average Effective Tax Rate | Average Annual Property Tax |

|---|---|---|---|

| Bergen | $470,000 | 2.19% | $10,323 |

| Morris | $485,000 | 2.32% | $11,260 |

| Somerset | $450,000 | 2.24% | $10,140 |

| Essex | $380,000 | 2.14% | $8,132 |

| Union | $420,000 | 2.20% | $9,240 |

The Factors Influencing Property Tax Assessments

Property tax assessments in New Jersey are influenced by a myriad of factors, each playing a unique role in determining the final tax liability. These factors include the property’s location, its physical characteristics, recent sales of comparable properties, and the overall real estate market trends.

Location, Location, Location

The adage “location, location, location” holds true when it comes to property taxes as well. Properties situated in desirable neighborhoods or sought-after school districts often command higher assessments due to their premium locations. Additionally, the tax rate itself can vary significantly between municipalities, with some towns offering more services or having higher operating costs, thus leading to higher tax rates.

Property Characteristics

The physical attributes of a property, such as its size, age, number of rooms, and any special features or improvements, can impact its assessed value. For instance, a newly renovated home with modern amenities is likely to have a higher assessment than a similar-sized property in need of repairs. The local tax assessor takes into account these characteristics when determining the property’s value for tax purposes.

Comparable Sales

One of the key methods used by tax assessors is the comparison of a property to recent sales of similar properties in the same area. If a homeowner’s property is similar in size, age, and features to a recently sold property, the assessor may use the sale price of the latter as a basis for determining the former’s assessed value. This ensures that properties are taxed fairly in relation to their market value.

Real Estate Market Trends

The overall real estate market also plays a role in property tax assessments. During periods of high demand and rising property values, assessors may increase assessments to keep up with the market. Conversely, in a soft market, assessments may be adjusted downward. It’s important for homeowners to stay informed about local market trends to understand how they might impact their property taxes.

Navigating the Property Tax Landscape

For New Jersey residents, understanding and managing property taxes can be a daunting task. Fortunately, there are various resources and tools available to help taxpayers navigate this complex system.

Property Tax Lookup Tools

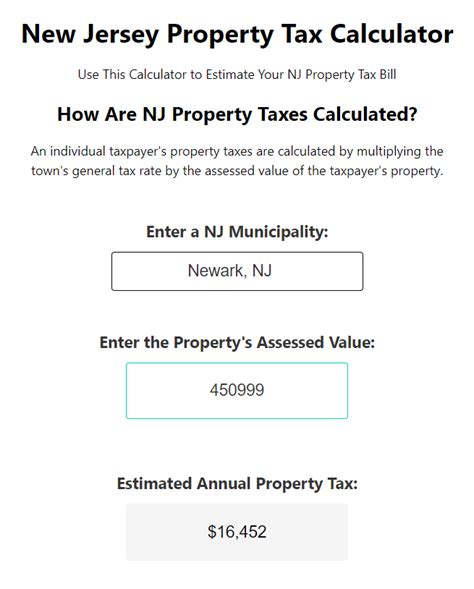

One of the most valuable resources for New Jersey residents is the property tax lookup tool provided by the state’s Department of Community Affairs. This online tool allows users to search for property tax information by entering the municipality, block, and lot number. The tool provides detailed information about the property’s assessed value, tax rate, and estimated taxes due. It’s an essential resource for homeowners, prospective buyers, and real estate professionals.

Additionally, many county websites offer similar property tax lookup tools, providing residents with quick access to their property's tax information. These tools often include features like tax history, assessment details, and information about any recent changes or appeals.

Understanding Tax Bills

Tax bills can be confusing, with various line items and calculations. It’s important for homeowners to understand what they are paying for and how their tax liability is calculated. The tax bill typically includes the assessed value of the property, the tax rate, and any applicable exemptions or credits. It also breaks down the taxes due for different services, such as schools, county operations, and local infrastructure projects.

Tax Exemptions and Credits

New Jersey offers several tax exemptions and credits to eligible homeowners, which can significantly reduce their tax liability. These include the Homestead Rebate Program, the Senior Freeze Program, and various veterans’ exemptions. Understanding these programs and qualifying for them can provide much-needed relief for homeowners facing high property taxes.

Appealing Your Property Tax Assessment

If a homeowner believes their property’s assessment is inaccurate or unfair, they have the right to appeal. The appeal process typically involves submitting documentation and evidence to support the claim that the property’s assessed value is too high. It’s a complex process, but with the right guidance and preparation, homeowners can successfully challenge their assessments and potentially reduce their tax burden.

The Future of Property Taxes in New Jersey

The future of property taxes in New Jersey is a topic of ongoing debate and discussion. With the state’s high tax rates and the burden they place on homeowners, there is a growing demand for reform. Proposals range from reforming the school funding formula to reduce property taxes to implementing a statewide property tax cap.

Additionally, the rise of remote work and the subsequent shift in housing preferences has led to discussions about how to fairly tax properties that are now being used for both residential and business purposes. As the state's real estate market continues to evolve, so too must its property tax system to ensure fairness and sustainability.

In conclusion, understanding New Jersey's property tax system is essential for homeowners and prospective buyers. By familiarizing themselves with the factors that influence assessments, the resources available for tax lookup, and the appeal process, individuals can make informed decisions and take control of their property tax liabilities. As the Garden State continues to grapple with the complexities of its property tax system, staying informed and engaged is more important than ever.

How often are property tax assessments conducted in New Jersey?

+Property tax assessments in New Jersey are typically conducted every year, with the goal of keeping property values up to date. However, some municipalities may reassess properties on a rolling basis, reassessing a certain percentage of properties each year. This ensures that assessments remain fair and accurate over time.

Can I contest my property tax assessment if I believe it’s inaccurate?

+Yes, if you believe your property tax assessment is inaccurate, you have the right to appeal. The appeal process typically involves submitting documentation and evidence to support your claim. It’s important to gather as much information as possible and consult with professionals who can guide you through the process.

Are there any tax relief programs available for New Jersey homeowners?

+Absolutely! New Jersey offers a range of tax relief programs to help eligible homeowners reduce their tax burden. These include the Homestead Rebate Program, which provides a direct payment to eligible homeowners, and the Senior Freeze Program, which helps seniors maintain their property tax payments at a stable level. There are also various veterans’ exemptions and credits available.

How can I stay informed about changes to my property taxes and the overall tax landscape in New Jersey?

+Staying informed is crucial when it comes to property taxes. Regularly check your county and municipal websites for updates and announcements related to tax rates and assessments. Subscribe to newsletters or alerts from these sources to receive timely information. Additionally, consider following local news outlets and real estate blogs to stay abreast of any changes or proposed reforms.

What resources are available to help me understand and navigate the property tax system in New Jersey?

+There are several resources available to help you understand and navigate New Jersey’s property tax system. The state’s Department of Community Affairs provides comprehensive guides and resources, including the property tax lookup tool mentioned earlier. County and municipal websites often offer additional tools and information specific to their jurisdictions. Additionally, real estate professionals and tax advisors can provide valuable guidance and support.