What States Have The Lowest Taxes

When it comes to state taxes, it's important to consider the overall tax burden on residents and businesses, as this can significantly impact personal finances and the economy. The tax climate of a state encompasses various tax categories, including income tax, sales tax, property tax, and business taxes. In this article, we will delve into the states with the lowest taxes, analyzing the tax landscape and its implications.

Understanding State Tax Climates

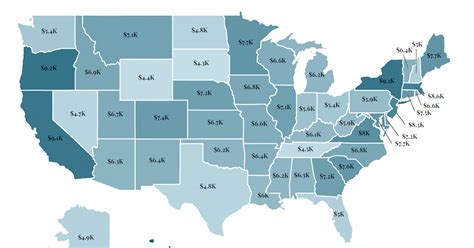

State tax climates vary significantly across the United States, offering different advantages and considerations for individuals and businesses. While some states boast no income tax, others have low sales tax rates or favorable property tax policies. Understanding these variations is crucial for taxpayers seeking the most tax-friendly jurisdictions.

Income Tax: A Key Factor

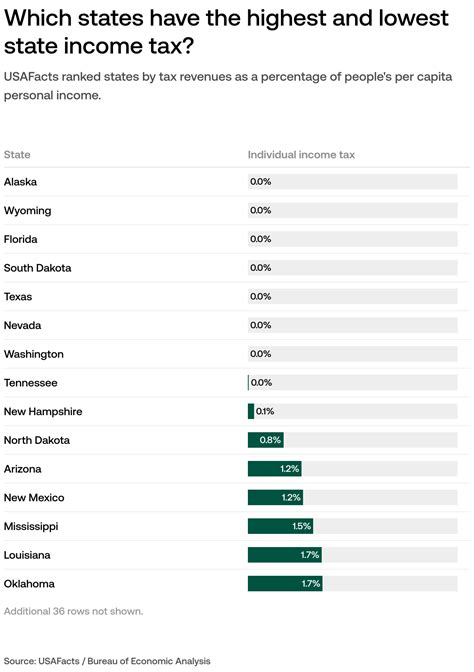

Income tax is a significant component of a state’s tax climate. Seven states, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, have no income tax at all. This absence of income tax makes these states attractive destinations for individuals seeking to minimize their tax obligations.

On the other hand, states like California, New York, and New Jersey have some of the highest income tax rates in the country. For instance, California's top income tax rate is 13.3%, while New York's top rate is 8.82%, and New Jersey's is 10.75%. These high income tax rates can have a substantial impact on individuals' disposable income and financial planning.

Sales Tax: A Consumer Perspective

Sales tax is another important consideration when evaluating state tax climates. While some states have no sales tax, such as Alaska, Delaware, Montana, New Hampshire, and Oregon, others have relatively low rates. For example, Wyoming has a sales tax rate of just 4%, making it an appealing destination for consumers.

In contrast, states like California and Tennessee have higher sales tax rates, with California's rate at 7.25% and Tennessee's at 7%. These rates can significantly impact the cost of living and consumer purchasing power.

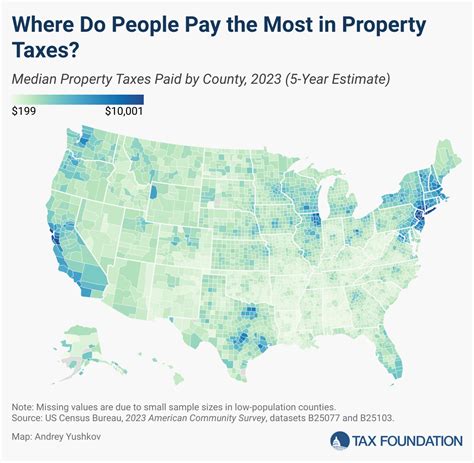

Property Tax: A Homeowner’s Concern

Property tax is a critical factor for homeowners, as it directly affects their annual expenses. States with low property tax rates can be particularly attractive to individuals looking to reduce their tax burden. For instance, Hawaii has one of the lowest effective property tax rates in the country, at 0.28%.

On the other hand, states like New Jersey and Illinois have some of the highest property tax rates. New Jersey's effective property tax rate is 2.25%, while Illinois' is 2.31%. These high rates can significantly impact homeowners' budgets and overall financial well-being.

Business Taxes: A Competitive Advantage

The tax climate for businesses is also a significant consideration, as it can influence a company’s decision to operate in a particular state. States with low corporate income tax rates and favorable business tax policies can attract new businesses and encourage economic growth.

For example, Wyoming and Nevada have no corporate income tax, making them attractive destinations for businesses seeking to minimize their tax liabilities. In contrast, states like Iowa and Minnesota have relatively high corporate income tax rates, which can impact a business's bottom line.

States with the Lowest Taxes

Now, let’s explore the states that consistently rank among the lowest in terms of overall tax burden.

Alaska: The Tax-Free Frontier

Alaska is unique in its tax structure, as it is one of the few states with no income tax and no sales tax. This makes Alaska an attractive destination for individuals and businesses seeking to minimize their tax obligations. Additionally, Alaska has a relatively low property tax rate of 1.11%, making it an appealing choice for homeowners.

Florida: A Tax Haven for Retirees

Florida is renowned for its favorable tax climate, particularly for retirees. The state has no income tax, making it an attractive retirement destination for those looking to preserve their savings. Additionally, Florida’s sales tax rate is relatively low at 6%, providing consumers with some relief.

Nevada: A Business-Friendly State

Nevada is known for its low taxes and business-friendly environment. The state has no income tax, making it an appealing choice for businesses and individuals alike. Additionally, Nevada’s sales tax rate is 6.85%, which is relatively low compared to other states.

Tennessee: A Balanced Tax Approach

Tennessee has a balanced tax approach, with no income tax for wages or salaries. However, the state does have a Hall income tax, which applies to investment income such as dividends and interest. Tennessee’s sales tax rate is 7%, which is on the higher end but still manageable for consumers.

Wyoming: A Tax-Free Paradise

Wyoming is often referred to as a tax-free paradise due to its absence of income tax and corporate income tax. The state also has a low sales tax rate of 4%, making it an attractive destination for consumers and businesses. Wyoming’s property tax rate is 0.88%, which is among the lowest in the country.

| State | Income Tax | Sales Tax | Property Tax |

|---|---|---|---|

| Alaska | 0% | 0% | 1.11% |

| Florida | 0% | 6% | 0.88% |

| Nevada | 0% | 6.85% | 0.88% |

| Tennessee | 0% (wages/salaries) | 7% | 0.46% |

| Wyoming | 0% | 4% | 0.88% |

Conclusion

The tax climate of a state plays a significant role in the financial well-being of individuals and the success of businesses. States with low taxes, such as Alaska, Florida, Nevada, Tennessee, and Wyoming, offer unique advantages and considerations. By understanding the tax landscape and its implications, taxpayers can make informed decisions about their financial future and business operations.

FAQ

What are the benefits of living in a state with low taxes?

+Living in a state with low taxes can provide several benefits, including more disposable income, lower cost of living, and increased savings. Additionally, businesses may find it easier to operate and expand in low-tax states, leading to potential job opportunities.

Are there any drawbacks to living in a state with low taxes?

+While low taxes can be advantageous, it’s important to consider other factors. Some states with low taxes may have limited public services or infrastructure, which can impact quality of life. Additionally, low-tax states may have fewer funding options for education, healthcare, and other essential services.

How do states with low taxes attract businesses?

+States with low taxes often have business-friendly environments, offering incentives such as tax breaks, grants, and reduced regulatory burdens. These measures can make it more attractive for businesses to set up operations and create jobs in these states.