Real Estate Taxes Vs Property Taxes

When it comes to navigating the complex world of homeownership, one often encounters terms like "real estate taxes" and "property taxes." These two concepts are closely related but have subtle differences that can impact your financial planning and understanding of local tax obligations. In this comprehensive guide, we will delve into the nuances of real estate taxes and property taxes, shedding light on their definitions, calculations, implications, and more.

Understanding Real Estate Taxes

Real estate taxes, often simply referred to as “real estate tax,” represent a crucial aspect of homeownership, especially for those looking to invest in property or already owning a home. These taxes are levied by local governments and play a significant role in funding essential public services, such as schools, roads, and emergency services. Real estate taxes are a key source of revenue for municipalities, enabling them to maintain and improve the infrastructure and amenities that enhance the quality of life for residents.

The calculation of real estate taxes involves a complex process that varies from one jurisdiction to another. In general, it begins with an assessment of the property's value, which is then used as a basis for determining the tax amount. Assessments are typically conducted by a local government agency, and they may be based on factors such as the property's size, location, improvements, and recent sales of comparable properties. Once the assessment is complete, a tax rate is applied to the assessed value, resulting in the final real estate tax bill.

It's important to note that real estate taxes are often calculated annually and are due at specific times throughout the year. Failure to pay these taxes on time can lead to penalties, interest charges, and, in extreme cases, even the loss of the property through a tax lien or foreclosure. Therefore, it's crucial for homeowners to stay informed about their tax obligations and make timely payments to avoid any adverse consequences.

In addition to their financial implications, real estate taxes also have a significant impact on the housing market. They influence the overall affordability of homes in a particular area, as higher tax rates can make it more challenging for potential buyers to enter the market. On the other hand, well-managed tax revenues can contribute to the development and improvement of public amenities, which can, in turn, enhance the desirability and value of the area.

Property Taxes: A Broader Perspective

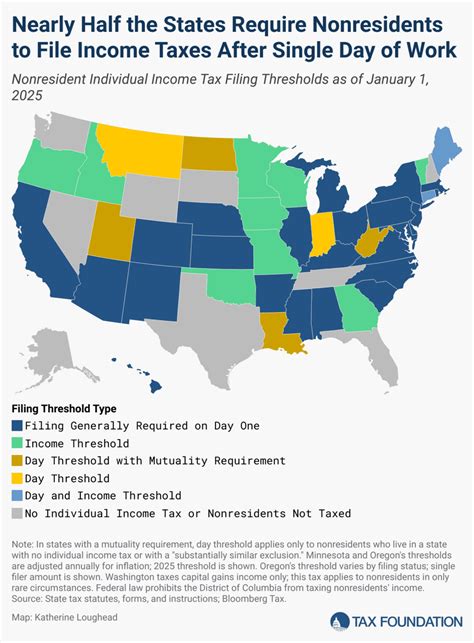

While real estate taxes specifically target real property, property taxes encompass a broader range of assets. In addition to real estate, property taxes also apply to personal property, such as vehicles, boats, and even business equipment. These taxes are levied by local governments and serve as a primary source of revenue for funding public services and infrastructure improvements.

The calculation of property taxes follows a similar process to real estate taxes. Assessments are conducted to determine the value of the property or asset, and a tax rate is applied to this assessed value. However, the assessment process for personal property can be more intricate, as it often involves considering factors such as depreciation, usage, and the property's condition. As with real estate taxes, property tax bills are typically issued annually, and timely payment is essential to avoid penalties and other legal consequences.

Property taxes play a crucial role in shaping the local economy and community. They not only provide funding for essential services but also contribute to economic development and job creation. The revenue generated from property taxes can be used to support local businesses, attract new investments, and improve the overall quality of life in the community. Additionally, property taxes can impact the affordability of living in a particular area, as higher tax rates may make it more challenging for residents to maintain their properties.

Key Differences and Implications

Although real estate taxes and property taxes share many similarities, there are some key differences that are worth exploring. One of the primary distinctions lies in the scope of the taxes. Real estate taxes are exclusively focused on real property, such as land and buildings, while property taxes encompass a wider range of assets, including personal property.

Another significant difference lies in the assessment process. Real estate tax assessments primarily consider factors related to the property itself, such as its size, location, and improvements. In contrast, property tax assessments for personal property take into account additional factors, including depreciation and usage. This distinction highlights the complexity involved in assessing the value of different types of assets and the potential variations in tax rates between real estate and personal property.

From a homeowner's perspective, understanding the differences between real estate taxes and property taxes is crucial for effective financial planning and compliance with tax obligations. Real estate taxes are a major expense that must be factored into the cost of homeownership, while property taxes may apply to other assets owned by the homeowner. Being aware of these distinctions can help individuals make informed decisions about their investments and manage their financial responsibilities effectively.

Furthermore, the implications of these taxes extend beyond individual homeowners. They have a significant impact on the local economy and community development. Real estate taxes and property taxes provide the necessary funding for essential public services, infrastructure improvements, and economic initiatives. The revenue generated from these taxes enables local governments to invest in education, healthcare, public safety, and other vital areas, ultimately shaping the overall well-being and prosperity of the community.

Factors Influencing Tax Rates

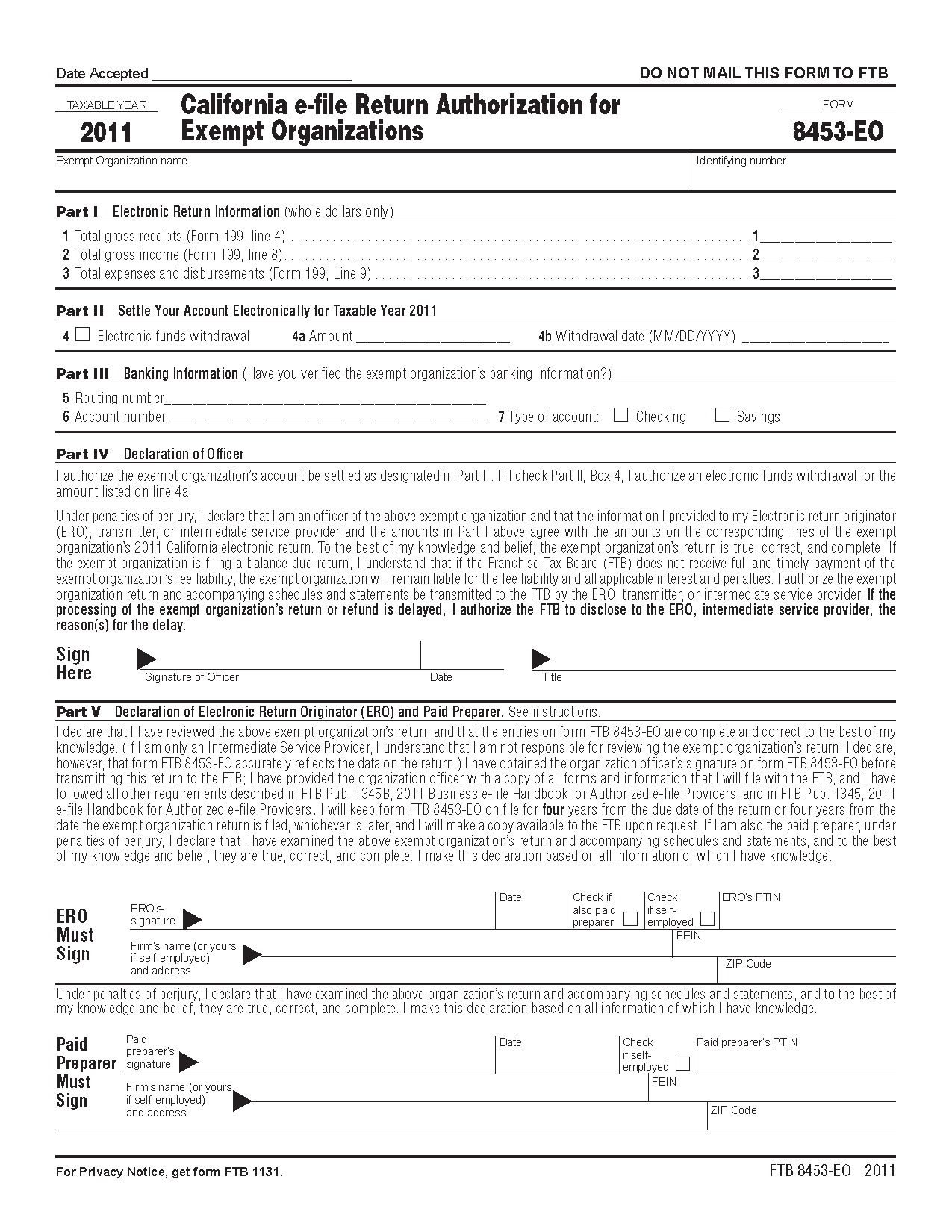

The tax rates for real estate and property taxes can vary significantly from one jurisdiction to another, and they are influenced by a multitude of factors. One of the primary determinants is the cost of living in a particular area. Higher living costs often translate to higher tax rates, as local governments require more revenue to fund essential services and maintain infrastructure.

Another crucial factor is the local economy. Areas with a strong and thriving economy tend to have higher tax rates, as they can afford to invest in various public projects and initiatives. Conversely, regions with a weaker economy may have lower tax rates, as they may struggle to generate sufficient revenue to support public services and development.

The population density of an area also plays a role in determining tax rates. More densely populated areas often have higher tax rates due to the increased demand for public services and infrastructure. On the other hand, less densely populated regions may have lower tax rates, as the demand for services is relatively lower.

Additionally, the level of public services and amenities available in an area can impact tax rates. Communities with extensive public services, such as well-maintained parks, recreational facilities, and efficient public transportation, often have higher tax rates to support these amenities. In contrast, areas with more limited public services may have lower tax rates.

The Impact of Property Value

The value of a property is a critical factor in determining real estate and property tax rates. In general, properties with higher values are subject to higher tax rates, as they are considered to have a greater capacity to contribute to the local tax base. This means that homeowners with more valuable properties may pay a higher proportion of their income in taxes compared to those with lower-value properties.

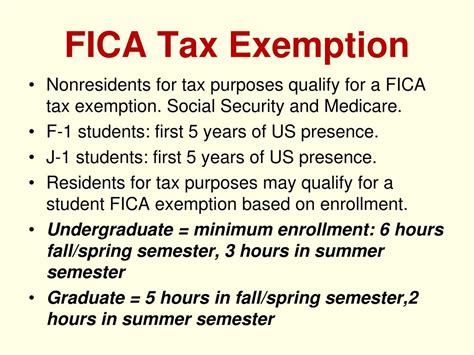

However, it's important to note that the relationship between property value and tax rates is not always linear. Some jurisdictions may implement tax relief programs or exemptions for certain types of properties, such as homesteads or senior citizen-owned properties. These programs aim to provide financial relief to specific groups of homeowners, recognizing the potential challenges they may face in paying higher taxes.

Strategies for Managing Tax Obligations

Managing real estate and property tax obligations can be a complex task, but there are strategies that homeowners and property owners can employ to navigate these responsibilities effectively.

Stay Informed

One of the most crucial steps is to stay informed about tax laws, regulations, and changes in your jurisdiction. Local governments may periodically adjust tax rates, assessment methodologies, and other tax-related policies. By staying up-to-date, you can anticipate any potential increases in tax obligations and plan your finances accordingly.

Understand Your Assessments

Real estate and property tax assessments are critical in determining your tax obligations. It’s essential to understand how your property’s value is assessed and the factors considered in the process. This knowledge can help you identify any potential errors or discrepancies and ensure that your tax bill is accurate.

Appeal Your Assessment

If you believe that your property’s assessment is incorrect or unfair, you have the right to appeal. Many jurisdictions provide a process for homeowners to challenge their assessments and request a review. By gathering supporting evidence and presenting your case, you may be able to achieve a more favorable assessment and, consequently, a lower tax bill.

Explore Tax Relief Programs

As mentioned earlier, some jurisdictions offer tax relief programs to provide financial assistance to specific groups of homeowners. These programs may include homestead exemptions, senior citizen discounts, or other incentives. Researching and applying for these programs can help reduce your tax burden and make homeownership more affordable.

Utilize Tax Deductions and Credits

Tax deductions and credits can provide significant relief for homeowners and property owners. Depending on your jurisdiction and personal circumstances, you may be eligible for various tax benefits, such as deductions for mortgage interest, property taxes, or improvements made to your property. Understanding and utilizing these deductions and credits can help lower your taxable income and reduce your overall tax liability.

The Future of Real Estate and Property Taxes

As the landscape of homeownership and the economy continues to evolve, so too will the dynamics of real estate and property taxes. Technological advancements, changing demographics, and shifts in the housing market will undoubtedly influence the way these taxes are calculated, assessed, and collected.

One potential development is the increasing use of technology in tax administration. Governments may leverage advanced data analytics and digital platforms to streamline the assessment and collection processes, making them more efficient and accurate. This could lead to a more transparent and accessible tax system for homeowners and property owners.

Additionally, the housing market's fluctuations and the changing needs of communities may prompt local governments to reevaluate their tax policies. They may introduce new initiatives or adjust existing ones to address emerging challenges and ensure that tax revenues are allocated effectively to support the well-being of residents.

As we navigate these changes, it becomes even more crucial for homeowners and property owners to stay informed and engaged in the tax conversation. By understanding the evolving dynamics of real estate and property taxes, individuals can actively participate in shaping their local communities and ensure that their tax obligations are fair and aligned with their financial capabilities.

What happens if I don’t pay my real estate taxes on time?

+Failing to pay your real estate taxes on time can result in penalties, interest charges, and, in some cases, legal action. In extreme situations, your property may be subject to a tax lien or foreclosure if you consistently fail to meet your tax obligations.

How often do I need to pay property taxes?

+Property taxes are typically due annually, and the payment schedule may vary depending on your jurisdiction. It’s essential to stay informed about the payment due dates to avoid late fees and other penalties.

Are there any tax relief programs available for homeowners?

+Yes, many jurisdictions offer tax relief programs to provide financial assistance to homeowners. These programs may include homestead exemptions, senior citizen discounts, or other incentives. It’s worth researching and applying for these programs to reduce your tax burden.

How can I appeal my property tax assessment?

+If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. Most jurisdictions have a process in place for homeowners to challenge their assessments. Gather evidence and supporting documentation to present your case during the appeal process.

What factors influence property tax rates?

+Property tax rates can be influenced by various factors, including the cost of living, local economy, population density, and the level of public services available in an area. Additionally, the value of your property plays a significant role in determining your tax rate.