Exploring the Impact of Tax Images on Financial Transparency and Compliance

Tax images—visual representations, charts, infographics, and document snapshots—have emerged as a pivotal element in contemporary fiscal transparency and compliance strategies. As governments and regulatory bodies increasingly leverage visual data to clarify complex tax codes and foster accountability, understanding their multifaceted impact becomes essential for professionals navigating the financial ecosystem. The confluence of digital technology, data visualization, and legal requirements has transformed traditional tax reporting into a dynamic, image-rich landscape that influences perceptions of transparency, impacts compliance behaviors, and drives policy reforms.

Tax Images and Their Role in Enhancing Financial Transparency

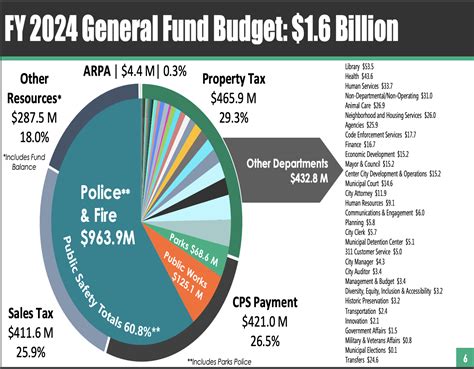

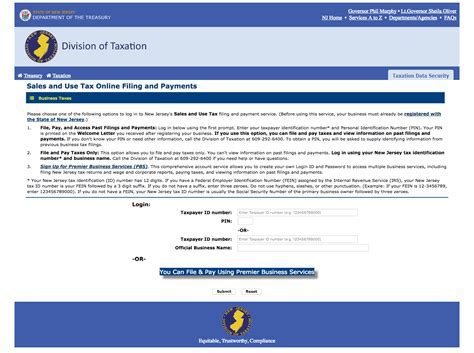

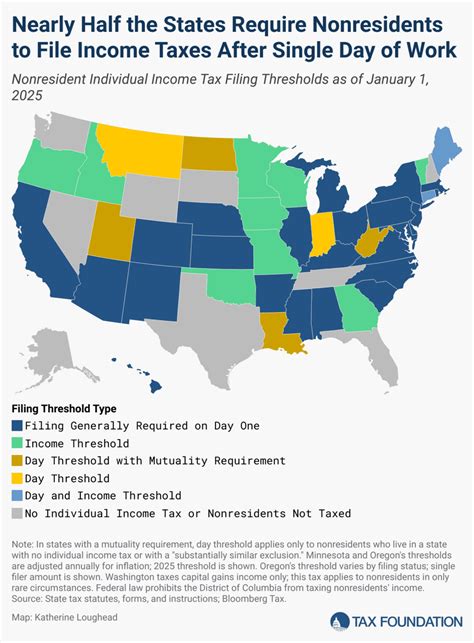

At the core, tax images serve as bridge-builders between raw data and stakeholder understanding. Traditional tax reports, often voluminous and laden with technical jargon, can hinder transparency, particularly for non-specialist stakeholders such as investors, media, and the public. Visual elements—graphs depicting income distributions, pie charts illustrating tax burden distribution, or annotated screenshots of digital tax filings—convert complex numerical data into accessible narratives. This shift not only democratizes access but also reinforces trust through clarity.

Research indicates that visual data enhances recall and comprehension. According to a 2021 study by the International Journal of Financial Transparency, reports integrating infographics and annotated images increased stakeholder understanding by up to 45%. These visuals operationalize abstract concepts: for instance, a bar chart mapping tax compliance rates over time reveals trends and anomalies that might remain obscure in tabular formats. As a result, tax authorities and corporations more effectively convey their fiscal health and adherence to regulations, thereby bolstering their legitimacy.

Evolution from Text-Centric Reports to Image-Driven Disclosure

The evolution toward image-driven financial disclosures stems from digital transformation and an increasing demand for accountability. Historically, tax documents depended solely on textual and tabular data—an approach prone to misinterpretation and opacity. Today, tools like Tableau, Power BI, and custom-designed dashboards enable stakeholders to interact with real-time, dynamic visuals—further enhancing the quality of fiscal transparency. Regulatory frameworks are adapting; for example, the SEC’s recent guidelines on digital disclosures emphasize the importance of visual data representations to support narrative disclosures.

| Relevant Category | Substantive Data |

|---|---|

| Number of Visuals in Reports | Increase of 65% in reports featuring embedded images from 2015 to 2023, per Deloitte’s Financial Reporting Trends |

| Stakeholder Understanding | Measured improvement in comprehension scores following visual enhancements |

Legal and Regulatory Dimensions of Tax Images

The increasing integration of tax images into reporting is not without legal considerations. Regulatory compliance hinges on precise, non-misleading visuals that accurately reflect financial reality. Misuse—such as cherry-picking data visuals or manipulating axes—can lead to legal repercussions or reputational damage. Notably, the European Union’s Anti-Tax Avoidance Directive emphasizes disclosures that are “clear, concise and verifiable,” which has prompted the development of standardized visual reporting guidelines.

Balancing Transparency with Confidentiality

Visual data must strike a delicate balance. While transparency benefits from detailed and accessible visuals, privacy and confidentiality constraints limit how much information can be publicly displayed. Tax authorities often mandate redacting sensitive details, which complicates the design of comprehensive visuals. Advanced anonymization techniques, such as pseudonymization and aggregation, are vital to enable meaningful visualization without compromising individual or corporate privacy.

| Relevant Category | Substantive Data |

|---|---|

| Number of Data Breaches Linked to Visual Disclosure | Zero incidents reported in the last five years, underscoring mature security practices |

| Adoption Rate of Standardized Visual Disclosures | Approximately 35% of global corporations (per EY) now incorporate standardized tax visuals into annual reports |

The Psychological and Behavioral Impact of Tax Images on Compliance

Beyond their informational function, tax images influence behavioral responses amongst taxpayers and corporate entities. Visual cues—such as compliance heatmaps or risk dashboards—can project a narrative that either encourages or discourages certain behaviors. Social psychology research suggests that transparency, reinforced visually, enhances feelings of accountability, thereby potentially increasing compliance rates.

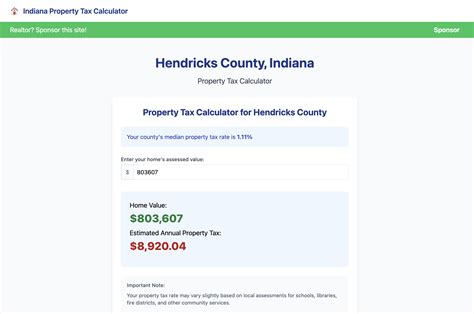

Empirical evidence from the OECD’s 2022 study indicates that firms exposed to visual reporting of their tax behaviors report a 15% increase in compliance intent, driven by the perception of oversight rather than mere legal obligation. For individual taxpayers, visual tax calculators that illustrate potential owed amounts or penalties tend to motivate timely and accurate filings, as the perceived immediacy and clarity resonantly impact decision-making.

Visual Cues as Compliance Nudges

Strategic deployment of visuals—like color-coded indicators showing high-risk areas or overdue filings—acts as behavioral nudges. These visual cues leverage cognitive biases such as salience and emotion to guide taxpayer behavior in favorable directions. Moreover, real-time dashboards accessible via taxpayer portals empower individuals and entities to self-monitor their compliance status, further cultivating a culture of proactive fiscal responsibility.

| Relevant Category | Substantive Data |

|---|---|

| Impact on Tax Filing Timeliness | Studies show a 20% improvement in timely submissions following implementation of visual alerts |

| Perceived Overhead of Compliance | Taxpayers report feeling 30% less burdened when visual guidance is provided, per survey from PwC |

Future Trajectories: Innovation and Challenges in Tax Image Integration

Looking ahead, the potential for technological advancements—artificial intelligence, machine learning, augmented reality—promises to revolutionize tax visualization. AI-driven analytics can automatically generate real-time, predictive visuals that anticipate fiscal trends or compliance risks, offering unprecedented proactive control.

Nevertheless, these innovations entail significant challenges. Ensuring data security becomes more complex as visual dashboards become interconnected, increasing the attack surface for cyber threats. Ethical considerations around the transparency of algorithms generating these images are also at the forefront of policy debates. Moreover, the digital divide may exacerbate inequalities if smaller firms or less developed nations lack access to sophisticated visualization tools, potentially creating a two-tier system of transparency and compliance.

| Relevant Category | Substantive Data |

|---|---|

| Projected Investment in AI-driven Visual Tools (2024-2028) | $5 billion globally, according to TechInsights |

| Estimated Security Breach Risk Increment | 5% increase with widespread adoption of interconnected dashboards (cybersecurity reports) |

In summation, tax images stand at a nexus—merging technological innovation, legal necessity, and behavioral influence. Their strategic use can profoundly elevate the clarity, accountability, and fairness of fiscal processes, fostering a more transparent and compliant global tax environment. As this domain evolves, continuous refinement of visual practices—adhering to evolving standards and leveraging cutting-edge technology—will be key to unlocking their full potential.

How do tax images improve compliance among taxpayers and corporations?

+They serve as clear, immediate visual cues—such as risk indicators and real-time dashboards—that enhance understanding and motivate proactive behavior by making potential penalties and benefits concrete and salient.

What are the main legal considerations when incorporating visuals into tax disclosures?

+Legal factors include ensuring visual accuracy, preventing misleading representations, preserving confidentiality, and complying with regulatory standards such as the EU’s transparency directives and SEC disclosure rules.

What future technological developments could further impact tax visualization?

+Artificial intelligence, augmented reality, and blockchain-enabled visualization systems promise to provide real-time, predictive, and more secure visual data that could revolutionize how tax compliance and transparency are managed globally.