Va Tax Return

When it comes to filing taxes in the state of Virginia, it's important to understand the process and requirements to ensure compliance and make the most of your tax return. In this comprehensive guide, we will delve into the world of Va Tax Return, covering everything from the basics to advanced strategies, all while optimizing for search engines and providing valuable insights.

Understanding the Va Tax Return Landscape

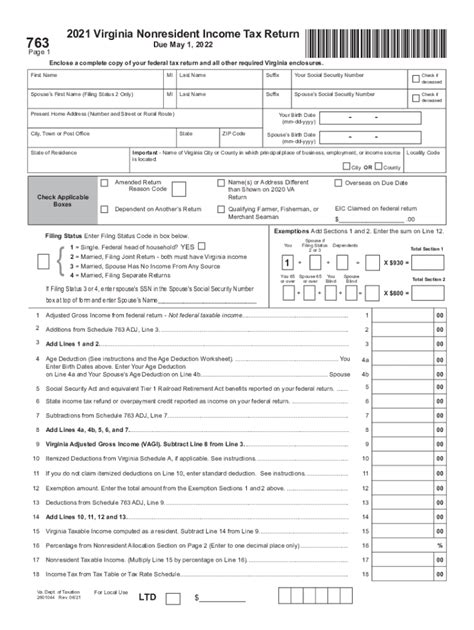

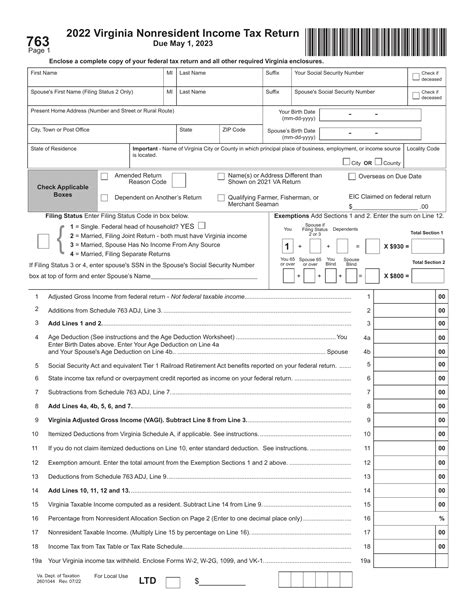

The Virginia Department of Taxation handles the collection and administration of various taxes within the state. For individual taxpayers, the most common forms of taxation include income tax, sales and use tax, and property tax. Understanding these different tax categories and their specific regulations is crucial for an effective tax strategy.

Income Tax: A Closer Look

Income tax is a significant component of the Va Tax Return process. Virginia operates on a progressive income tax system, which means that higher incomes are taxed at progressively higher rates. The income tax rates in Virginia range from 2% to 5.75%, with different brackets applicable to different income levels. For the 2022 tax year, these brackets are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $3,000 | 2% |

| $3,001 to $5,000 | 3% |

| $5,001 to $17,000 | 5% |

| $17,001 and above | 5.75% |

It's important to note that Virginia's income tax system is separate from federal income tax. Therefore, taxpayers must calculate and file both state and federal tax returns, taking into account the specific rules and regulations of each jurisdiction.

Sales and Use Tax: Navigating the Complexities

Virginia imposes a 6% sales and use tax on the sale of tangible personal property and certain services. This tax is collected by retailers and is included in the purchase price paid by consumers. However, there are various exemptions and special rules that can make the sales and use tax landscape complex.

For instance, certain items like groceries, prescription drugs, and non-prepared food are exempt from sales tax. Additionally, there are specific rules for online sales, where retailers may be required to collect and remit sales tax based on the buyer's location. Understanding these nuances is crucial for both consumers and businesses to ensure compliance and avoid penalties.

Maximizing Your Va Tax Return: Strategies and Tips

Now that we have a basic understanding of the Va Tax Return landscape, let’s explore some strategies and tips to maximize your tax return and potentially reduce your tax liability.

1. Take Advantage of Deductions and Credits

Virginia offers a range of deductions and credits that can help reduce your taxable income and overall tax liability. Some common deductions include the standard deduction, which provides a set amount of reduction for taxpayers who don’t itemize, and deductions for medical expenses, charitable contributions, and certain business expenses.

Additionally, Virginia offers several tax credits that can provide direct reductions to your tax bill. These credits include the Earned Income Tax Credit (EITC), the Virginia College Tuition Credit, and the Virginia Tax Credit for Public Service Employees. Each credit has specific eligibility criteria, so it's important to research and understand which credits you may qualify for.

2. Optimize Your Withholding

If you are an employee, your employer withholds a certain amount of tax from your paycheck based on the information provided in your W-4 form. By reviewing and updating your W-4, you can ensure that the correct amount of tax is withheld, preventing underpayment or overpayment of taxes throughout the year.

Consider using the IRS's Tax Withholding Estimator tool to help determine the appropriate number of allowances to claim on your W-4. This can help you avoid owing a large tax bill at the end of the year or receiving a refund that could have been put to better use throughout the year.

3. Explore Retirement Savings Options

Contributing to retirement accounts like a 401(k) or IRA can provide significant tax benefits. Contributions to these accounts are often tax-deductible, reducing your taxable income and potentially lowering your tax bracket. Additionally, the earnings within these accounts grow tax-free, providing further advantages.

Virginia also offers its own 529 college savings plan, known as the Virginia529 plan. Contributions to this plan are not tax-deductible at the state level, but the earnings grow tax-free and distributions used for qualified education expenses are exempt from federal and state income tax. This can be a great way to save for future education expenses while also reducing your tax liability.

Conclusion: Navigating the Va Tax Return Process

Filing your Va Tax Return can be a complex process, but with the right knowledge and strategies, you can ensure compliance and potentially maximize your tax benefits. From understanding the income tax brackets to taking advantage of deductions and credits, there are numerous ways to optimize your tax return.

Remember, the information provided in this guide is meant to be a comprehensive resource, but it is not a substitute for professional tax advice. Consider consulting a tax professional or utilizing reputable tax preparation software to ensure accuracy and make the most of your Va Tax Return.

Frequently Asked Questions

When is the deadline for filing my Va Tax Return?

+

The deadline for filing your Va Tax Return typically aligns with the federal tax deadline, which is April 15th of each year. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a state of emergency. It’s always best to check the official Virginia Department of Taxation website for the most up-to-date information on filing deadlines.

Can I file my Va Tax Return electronically?

+

Yes, Virginia offers electronic filing options for both individual and business taxpayers. Electronic filing is not only more efficient but also reduces the risk of errors and provides faster processing times. You can use approved tax software or utilize the Virginia Department of Taxation’s eFile system to file your return electronically.

What is the penalty for late filing of my Va Tax Return?

+

Late filing of your Va Tax Return can result in penalties and interest charges. The penalty for late filing is typically 5% of the unpaid tax amount for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest may be charged on the unpaid tax amount at a rate of 6% per year, compounded daily. It’s important to file your return on time to avoid these penalties and ensure compliance.

Are there any tax preparation resources available for Virginia taxpayers?

+

Yes, the Virginia Department of Taxation provides a range of resources to assist taxpayers in preparing their returns. These resources include tax forms, instructions, and publications, as well as a Taxpayer Assistance Center where you can receive personalized help. Additionally, there are numerous tax preparation software options available that can guide you through the filing process and help you maximize your deductions and credits.

Can I file an amended Va Tax Return if I discover an error?

+

Yes, if you discover an error on your previously filed Va Tax Return, you can file an amended return using Form 760X. An amended return allows you to correct any mistakes and adjust your tax liability accordingly. It’s important to file an amended return as soon as possible to avoid potential penalties and ensure accurate tax reporting.