Nj Sales Tax Login

Welcome to the comprehensive guide on the NJ Sales Tax Login, a crucial tool for businesses and individuals navigating the complex world of sales tax compliance in the state of New Jersey. This expert-level article will delve into the intricacies of the NJ Sales Tax Login system, offering a detailed analysis of its features, benefits, and practical implementation. By the end of this article, you'll have a thorough understanding of how to effectively utilize this platform to manage your sales tax obligations and ensure compliance with New Jersey's tax regulations.

Understanding the NJ Sales Tax Login

The NJ Sales Tax Login is an online portal provided by the New Jersey Division of Taxation, designed to streamline the process of managing sales tax obligations for businesses and individuals registered to collect and remit sales tax in the state. This secure platform offers a range of tools and services to assist taxpayers in navigating the complex landscape of sales tax regulations, ensuring compliance and minimizing the risk of penalties.

With the NJ Sales Tax Login, taxpayers can access a host of features that simplify the often-daunting task of sales tax management. From registration and reporting to payment and record-keeping, this platform serves as a one-stop solution for all sales tax-related needs. By utilizing this online system, taxpayers can benefit from increased efficiency, improved accuracy, and enhanced transparency in their tax compliance processes.

Key Features of the NJ Sales Tax Login

The NJ Sales Tax Login offers a comprehensive suite of features tailored to meet the diverse needs of taxpayers. Here's an overview of some of the key functionalities:

- Registration and Account Management: Users can easily register for a sales tax account, update their business information, and manage their tax registration details through the portal.

- Filing and Reporting: The platform provides a user-friendly interface for taxpayers to file their sales tax returns, submit supporting documentation, and manage their reporting obligations.

- Payment Options: NJ Sales Tax Login offers a range of payment methods, including electronic funds transfer, credit card, and direct debit, ensuring convenience and flexibility for taxpayers.

- Real-time Reporting and Tracking: Taxpayers can access real-time updates on their tax filings, payments, and account balances, allowing for better financial planning and compliance monitoring.

- Electronic Record-Keeping: The platform enables users to store and access electronic records of their sales tax transactions, providing a secure and organized system for tax-related documentation.

- Notification and Alert System: Taxpayers can receive notifications and alerts regarding upcoming deadlines, tax law changes, and other important updates, ensuring they stay informed and compliant.

Benefits of Utilizing the NJ Sales Tax Login

Implementing the NJ Sales Tax Login offers a multitude of benefits to taxpayers, streamlining their sales tax compliance processes and enhancing overall efficiency. Here are some key advantages:

| Benefit | Description |

|---|---|

| Enhanced Compliance | The platform provides a centralized system for managing sales tax obligations, ensuring taxpayers stay up-to-date with their reporting and payment responsibilities, thus reducing the risk of non-compliance and associated penalties. |

| Improved Efficiency | With a user-friendly interface and streamlined processes, the NJ Sales Tax Login saves taxpayers time and effort, allowing them to focus on their core business operations rather than navigating complex tax procedures. |

| Increased Accuracy | By utilizing the online portal, taxpayers can reduce the likelihood of errors in their sales tax calculations and filings, as the system is designed to guide users through the process and provide real-time validation checks. |

| Convenience and Flexibility | The platform offers 24/7 accessibility, enabling taxpayers to manage their sales tax obligations at their convenience. Additionally, the range of payment options provided caters to different preferences and financial situations. |

| Transparent Record-Keeping | The electronic record-keeping feature ensures taxpayers have easy access to their sales tax transaction records, promoting transparency and facilitating efficient financial management and audit preparedness. |

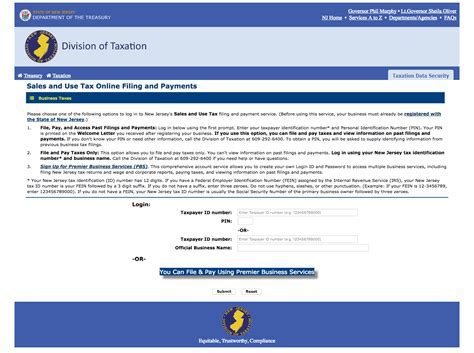

Navigating the NJ Sales Tax Login Process

To effectively utilize the NJ Sales Tax Login, it's essential to understand the step-by-step process involved. Here's a detailed guide to help you navigate the platform:

Step 1: Registration and Account Setup

If you're a new user, the first step is to register for an account on the NJ Sales Tax Login portal. Follow these steps:

- Visit the NJ Sales Tax Login website and click on the "Register" button.

- Fill out the registration form with your business details, including legal name, address, and contact information.

- Choose a secure username and password for your account, ensuring it meets the platform's security requirements.

- Review and accept the terms and conditions of the service.

- Submit your registration and wait for confirmation. You will receive an email with further instructions and a temporary password.

Step 2: Logging In and Account Management

Once your account is registered, you can log in to the NJ Sales Tax Login portal to manage your sales tax obligations. Here's how:

- Go to the NJ Sales Tax Login website and click on the "Login" button.

- Enter your username and password.

- Click on the "Sign In" button to access your account dashboard.

- From the dashboard, you can update your business information, manage your tax registration details, and access various tools and services.

Step 3: Filing Sales Tax Returns

One of the primary functions of the NJ Sales Tax Login is to facilitate the filing of sales tax returns. Follow these steps to file your returns:

- Log in to your account and navigate to the "File Returns" section.

- Select the appropriate tax period for which you are filing.

- Enter the required information, including sales revenue, taxable items, and any applicable exemptions.

- Review your return for accuracy and completeness.

- Submit your return and make the necessary payment, either through electronic funds transfer, credit card, or direct debit.

- Keep a record of your filed return and payment confirmation for future reference.

Step 4: Payment Options and Management

The NJ Sales Tax Login offers a variety of payment options to accommodate different taxpayer preferences. Here's an overview:

- Electronic Funds Transfer (EFT): You can set up an EFT account to automatically deduct sales tax payments from your bank account on the due date. This option ensures timely payments and avoids late fees.

- Credit Card: The platform accepts major credit cards, providing a convenient and secure way to make sales tax payments online.

- Direct Debit: Taxpayers can authorize the Division of Taxation to directly debit their bank account for sales tax payments, offering a hassle-free payment method.

To manage your payments, log in to your account and navigate to the "Payment Options" section. Here, you can view your payment history, update payment methods, and make changes to your EFT or direct debit settings.

Step 5: Record-Keeping and Reporting

The NJ Sales Tax Login provides a robust system for electronic record-keeping and reporting. By utilizing this feature, taxpayers can:

- Store and access sales tax transaction records, including filed returns and payment confirmations.

- Generate reports and analyze sales tax data for financial planning and compliance purposes.

- Download and print copies of filed returns and supporting documentation for audit or reference.

To access your records, log in to your account and navigate to the "Record-Keeping" or "Reporting" section. Here, you can search and filter your transaction history, download reports, and manage your sales tax documentation.

FAQs: Common Questions About the NJ Sales Tax Login

How often do I need to file sales tax returns in New Jersey?

+The frequency of filing sales tax returns depends on your business's sales volume and tax liability. Most businesses file quarterly, but monthly filing may be required for those with higher sales. You can check your filing frequency on the NJ Division of Taxation website.

Can I change my filing frequency on the NJ Sales Tax Login portal?

+Yes, you can request a change in filing frequency by logging into your account and submitting a request through the "Change Filing Frequency" option. However, changes are subject to approval by the Division of Taxation based on your business's sales volume and tax liability.

What happens if I miss a sales tax filing deadline?

+Missing a sales tax filing deadline can result in late filing penalties and interest charges. It's crucial to stay on top of your filing deadlines to avoid these penalties. The Division of Taxation may also take enforcement actions for repeated late filings.

How do I calculate my sales tax liability in New Jersey?

+Sales tax liability is calculated based on your taxable sales and the applicable sales tax rate. You can use the NJ Sales Tax Calculator provided by the Division of Taxation to estimate your sales tax liability. However, it's essential to consult the specific tax regulations and guidelines for accurate calculation.

Can I make estimated sales tax payments on the NJ Sales Tax Login portal?

+Yes, the NJ Sales Tax Login portal allows you to make estimated sales tax payments. This feature is particularly useful for businesses with fluctuating sales volumes or those who prefer to make periodic payments throughout the year. You can set up estimated payments and manage them through the "Payment Options" section.

The NJ Sales Tax Login portal is a powerful tool for taxpayers to manage their sales tax obligations effectively. By understanding the features, benefits, and step-by-step process of utilizing this platform, businesses and individuals can streamline their sales tax compliance, ensuring accuracy, efficiency, and peace of mind. Remember to stay informed about any updates or changes to the tax regulations and leverage the resources provided by the New Jersey Division of Taxation to stay compliant.