What Is Nj Sales Tax

Understanding the intricacies of sales tax is essential for both businesses and consumers, especially in a state as diverse and economically vibrant as New Jersey. New Jersey's sales tax is a crucial aspect of the state's revenue system, influencing various industries and consumer behaviors. Let's delve into the specifics of what constitutes the NJ Sales Tax, its implications, and how it shapes the economic landscape of the Garden State.

The Basics of New Jersey Sales Tax

New Jersey imposes a general sales and use tax on retail sales, leases, or rentals of tangible personal property, as well as certain services. The sales tax is a consumption tax, meaning it is paid on the purchase of goods and services. The tax is collected by the seller and remitted to the state, with the responsibility for payment ultimately resting with the consumer.

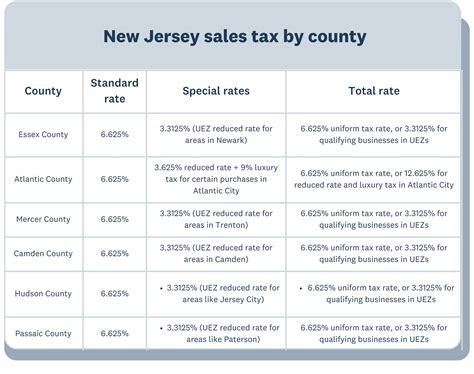

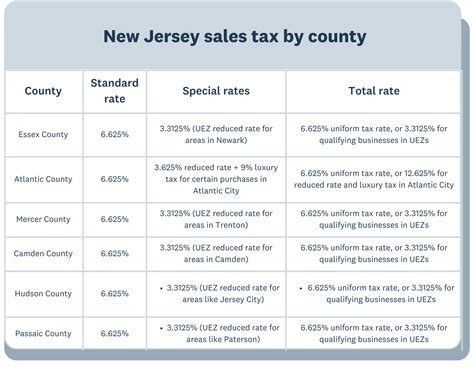

The rate of sales tax in New Jersey varies based on several factors. The state's base sales tax rate is 6.625%, which is applied to most retail sales. However, this rate can be higher in certain municipalities due to additional local taxes. These local add-on rates can vary from 0% to 3%, resulting in a combined state and local sales tax rate that can range from 6.625% to 9.625%.

Taxable Items and Services

New Jersey’s sales tax applies to a wide range of goods and services. Tangible personal property, such as clothing, electronics, furniture, and vehicles, are generally subject to sales tax. However, there are exemptions for certain items, including most groceries, prescription drugs, and certain medical devices.

In addition to physical goods, New Jersey also taxes certain services, such as repair and maintenance services, professional services, and admission charges to certain events. However, services like healthcare, legal services, and educational services are typically exempt from sales tax.

| Taxable Items | Tax Rate |

|---|---|

| General Merchandise | 6.625% (base rate) |

| Local Add-On Taxes | Varies (up to 3%) |

| Vehicle Sales | 6.625% (plus additional fees) |

| Repair Services | 6.625% |

Compliance and Registration

Businesses operating in New Jersey or selling goods or services to New Jersey residents are generally required to register for a sales tax permit with the New Jersey Division of Taxation. This registration process ensures that businesses collect and remit the appropriate taxes on behalf of the state.

Compliance with sales tax regulations is essential to avoid penalties and legal issues. Businesses must keep accurate records of sales, ensure proper tax collection, and file regular sales tax returns. Failure to comply can result in fines, interest charges, and potential legal consequences.

Sales Tax Holidays

New Jersey occasionally offers sales tax holidays, during which certain items are exempt from sales tax for a limited time. These holidays are typically designed to boost consumer spending and provide relief for specific items, such as school supplies or clothing. However, the occurrence and specifics of these holidays can vary from year to year.

Impact on Businesses and Consumers

The NJ sales tax has a significant impact on both businesses and consumers. For businesses, it represents a substantial source of revenue for the state, which can be reinvested into public services and infrastructure. However, it also adds complexity to pricing strategies and can impact competitive positioning.

For consumers, the sales tax is a visible component of their spending, influencing purchasing decisions and overall financial planning. Understanding the sales tax rate in different locations can help consumers make more informed choices, especially when comparing prices across states or municipalities.

E-Commerce and Remote Sellers

With the rise of e-commerce, New Jersey has implemented regulations to ensure that remote sellers also collect and remit sales tax. This ensures that online businesses contribute to the state’s revenue and level the playing field for local brick-and-mortar stores. Remote sellers must comply with the state’s economic nexus rules, which determine when they are required to register for and collect sales tax.

Future Outlook and Considerations

As the economic landscape continues to evolve, New Jersey’s sales tax system is likely to face ongoing changes and challenges. The state’s reliance on sales tax revenue may be impacted by shifts in consumer behavior, such as increased online shopping and the growth of subscription-based services.

Additionally, the ongoing debate surrounding sales tax fairness and the potential for a national sales tax could have significant implications for New Jersey's tax system. The state will need to adapt its strategies to ensure a sustainable and equitable tax structure that supports economic growth while also meeting the needs of its residents.

Conclusion

New Jersey’s sales tax is a critical component of the state’s revenue system, influencing the daily lives of both businesses and consumers. Understanding the intricacies of this tax, from its rates to its implications, is essential for navigating the economic landscape of the Garden State. As the state continues to evolve, staying informed about sales tax regulations and their impact will be key to making informed financial decisions.

What is the current base sales tax rate in New Jersey?

+

The current base sales tax rate in New Jersey is 6.625%.

Are there any sales tax exemptions in New Jersey?

+

Yes, New Jersey has various sales tax exemptions, including for groceries, prescription drugs, and certain medical devices.

How do I register for a sales tax permit in New Jersey?

+

You can register for a sales tax permit through the New Jersey Division of Taxation’s website. The process involves completing an application, providing business details, and obtaining a sales tax registration number.

Are there any sales tax holidays in New Jersey?

+

Yes, New Jersey occasionally offers sales tax holidays for specific items like school supplies or clothing. These holidays are usually announced in advance and provide temporary tax relief to consumers.

What are the consequences of non-compliance with sales tax regulations in New Jersey?

+

Non-compliance with sales tax regulations in New Jersey can result in fines, interest charges, and potential legal consequences. It’s important for businesses to stay informed about their tax obligations and comply with the state’s sales tax laws.