Ia State Income Tax Rate

When it comes to state income taxes, Iowa stands out as one of the most competitive states in the Midwest. With a robust economy and a favorable tax climate, Iowa offers residents and businesses a range of benefits. In this article, we will delve into the specifics of Iowa's state income tax rate, its implications, and how it compares to other states.

Understanding Iowa’s State Income Tax Structure

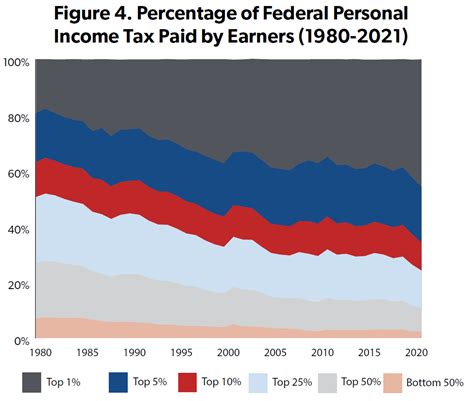

Iowa employs a progressive income tax system, which means that the state income tax rate increases as taxable income rises. This approach aims to ensure fairness and balance, allowing higher-income earners to contribute a larger proportion of their income towards state revenues.

The state income tax in Iowa is administered by the Iowa Department of Revenue. This department oversees the collection, enforcement, and distribution of taxes, ensuring compliance with state laws and regulations. Iowa's progressive tax system is designed to support vital state services, such as education, infrastructure, and healthcare, while maintaining a competitive business environment.

| Tax Rate | Income Range |

|---|---|

| 0.36% | $0 - $20,999 |

| 0.67% | $21,000 - $35,999 |

| 1.08% | $36,000 - $65,999 |

| 2.41% | $66,000 - $139,999 |

| 8.53% | $140,000 and above |

As shown in the table, Iowa's tax rates vary depending on an individual's taxable income. The lowest tax rate of 0.36% applies to incomes below $21,000, while the highest rate of 8.53% is imposed on incomes exceeding $140,000. This progressive structure ensures that individuals with higher incomes contribute a larger share to the state's revenue.

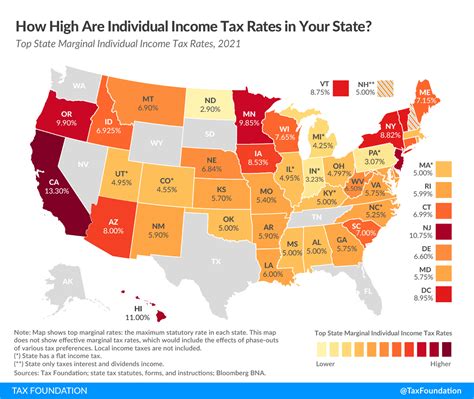

Comparison with Other States

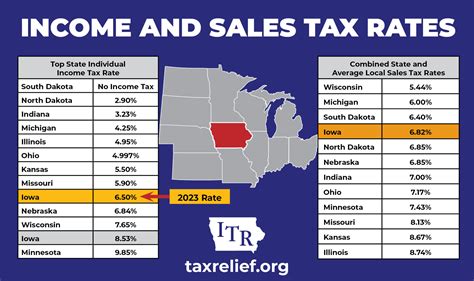

When compared to other states, Iowa’s state income tax rate is relatively moderate. Many states in the Midwest and across the country have higher tax rates, especially for higher-income earners. Iowa’s progressive structure, however, allows it to maintain a competitive advantage, attracting businesses and individuals seeking a favorable tax climate.

For instance, let's compare Iowa's top tax rate of 8.53% with other states in the region. Nebraska has a top tax rate of 6.84%, while Kansas and Missouri have rates of 4.9% and 5.9%, respectively. This puts Iowa in a competitive position, offering a slightly higher tax rate but with the advantage of a robust economy and a well-developed infrastructure.

Impact on Businesses and Residents

Iowa’s state income tax rate has a significant impact on both businesses and residents. For businesses, a moderate tax rate can be a key factor in attracting investments and fostering economic growth. Iowa’s competitive tax structure makes it an attractive destination for companies seeking to expand or relocate.

Residents, too, benefit from Iowa's tax structure. While the state income tax is an important source of revenue for essential services, the progressive nature of the tax system ensures that lower- and middle-income earners are not disproportionately burdened. This balance is crucial in maintaining a healthy and prosperous society.

Economic Growth and Development

Iowa’s state income tax rate plays a vital role in supporting the state’s economic growth and development. The revenue generated through taxes is reinvested into various sectors, including education, healthcare, and infrastructure. This investment fosters a skilled workforce, attracts businesses, and enhances the overall quality of life for residents.

Furthermore, Iowa's competitive tax environment has led to the state being recognized as a top destination for businesses. According to a recent study by Area Development, Iowa ranked highly in terms of business friendliness, tax climate, and overall economic competitiveness. This recognition further strengthens Iowa's position as a prime location for economic growth and business expansion.

Tax Credits and Incentives

In addition to its moderate state income tax rate, Iowa offers a range of tax credits and incentives to support businesses and individuals. These initiatives aim to promote economic development, encourage investment, and provide relief to specific sectors or communities.

One notable tax credit is the Research Activities Credit, which provides a credit against Iowa income tax for qualified research expenses. This credit aims to stimulate innovation and technological advancements by incentivizing businesses to invest in research and development activities within the state.

Moreover, Iowa offers targeted tax incentives for specific industries, such as manufacturing, renewable energy, and agriculture. These incentives include tax credits, exemptions, and abatements, aimed at attracting businesses and creating job opportunities in these sectors. By providing these incentives, Iowa ensures a diverse and resilient economy, benefiting both businesses and the local communities.

Conclusion

Iowa’s state income tax rate is a critical component of its economic landscape, offering a balance between competitiveness and fairness. The progressive tax structure ensures that higher-income earners contribute proportionally more, supporting vital state services while maintaining a favorable business environment.

By understanding Iowa's state income tax rate and its implications, individuals and businesses can make informed decisions about their financial strategies. Whether it's deciding on a business location or planning personal finances, Iowa's competitive tax climate offers a range of benefits and opportunities. As Iowa continues to thrive and develop, its tax system remains a key factor in its economic success and prosperity.

How does Iowa’s state income tax rate compare to neighboring states?

+Iowa’s state income tax rate is generally lower than that of neighboring states such as Nebraska, Kansas, and Missouri. This competitive advantage makes Iowa an attractive destination for businesses and individuals seeking a favorable tax climate.

What are the benefits of Iowa’s progressive tax system for residents?

+Iowa’s progressive tax system ensures that lower- and middle-income earners are not disproportionately burdened by taxes. This fairness promotes economic stability and allows residents to have more disposable income, which can be reinvested into the local economy.

How does Iowa’s tax structure support economic growth and development?

+Iowa’s tax structure, including its state income tax rate, generates revenue that is reinvested into essential sectors such as education, healthcare, and infrastructure. This investment fosters a skilled workforce, attracts businesses, and enhances the overall quality of life, contributing to sustained economic growth.