Arkansas Car Sales Tax

The Arkansas car sales tax is an important consideration for anyone looking to purchase a vehicle in the state. Understanding how this tax works, the rates involved, and the potential exemptions can help buyers navigate the process smoothly and ensure they are not caught off guard by unexpected costs. This comprehensive guide will delve into the intricacies of the Arkansas car sales tax, providing an in-depth analysis of the current regulations, real-world examples, and valuable insights to assist buyers in making informed decisions.

Understanding the Arkansas Car Sales Tax

The Arkansas car sales tax is a levy imposed on the purchase of motor vehicles within the state. It is an essential revenue source for the state government, contributing to the maintenance of infrastructure, public services, and various state programs. The tax is calculated as a percentage of the vehicle’s sales price and is typically paid at the time of registration.

Arkansas, like many other states, has a progressive tax structure for vehicle purchases. This means that the tax rate increases with the vehicle's sales price, ensuring that those who can afford more expensive vehicles contribute a larger share of the tax. This progressive system aims to distribute the tax burden fairly across different income levels.

The Arkansas Department of Finance and Administration (DFA) is responsible for overseeing and collecting the car sales tax. They provide clear guidelines and regulations to ensure compliance and facilitate a smooth transaction process for both buyers and dealers.

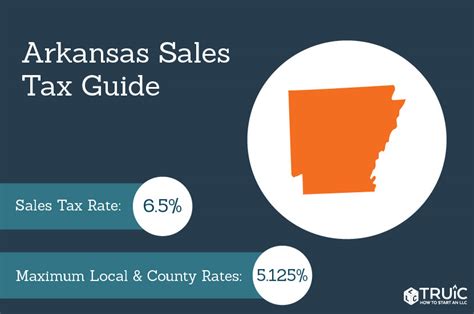

Current Tax Rates and Exemptions

As of the latest update, the Arkansas car sales tax rates are as follows:

| Vehicle Sales Price | Tax Rate |

|---|---|

| $4,000 or less | 3% |

| $4,001 to $10,000 | 4% |

| $10,001 to $25,000 | 6% |

| Over $25,000 | 7% |

These rates are subject to change, so it's advisable to check the DFA's official website for the most current information. Additionally, there are certain exemptions and special considerations that buyers should be aware of:

- Military Personnel: Active-duty military members stationed in Arkansas are exempt from paying the sales tax on vehicle purchases. This exemption extends to their dependents as well.

- Disabled Individuals: Those with a permanent disability can apply for a sales tax exemption. This applies to the purchase of vehicles that are modified to accommodate their disability.

- Trade-Ins: When trading in an old vehicle for a new one, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This helps reduce the overall tax burden for buyers.

Example Calculations

Let’s look at some real-world examples to better understand how the Arkansas car sales tax works:

Example 1: Buying a Used Car

Sarah decides to purchase a used car in Arkansas. The sales price of the vehicle is $8,500. Using the current tax rates, the sales tax due would be calculated as follows:

For the first $4,000: 3% tax = $120

For the remaining $4,500: 4% tax = $180

Total Sales Tax: $120 + $180 = $300

So, Sarah would need to pay an additional $300 in sales tax on top of the vehicle's purchase price during registration.

Example 2: Purchasing a New Vehicle

John wants to buy a brand new truck with a sales price of $30,000. The tax calculation for this purchase would be:

For the first $10,000: 6% tax = $600

For the remaining $20,000: 7% tax = $1,400

Total Sales Tax: $600 + $1,400 = $2,000

John would have to pay an additional $2,000 in sales tax when registering his new truck.

Registration and Payment Process

When purchasing a vehicle in Arkansas, buyers typically have the option to register and pay the car sales tax at the time of purchase from the dealer or do so separately at a local revenue office. The dealer can assist with the registration process and provide guidance on the necessary documentation.

The required documents for registration include:

- A completed Vehicle Registration Application (Form 1001)

- Proof of ownership (bill of sale or title)

- Proof of insurance

- Valid driver's license

- Payment for the sales tax and registration fees

It's important to note that registration and tax payments must be made within a certain timeframe to avoid penalties. The specific deadlines and requirements can be found on the DFA's website.

Online Registration and Payment

Arkansas offers an online platform for vehicle registration and tax payment. This convenient option allows buyers to complete the process from the comfort of their homes. The online system provides a step-by-step guide and ensures a secure transaction. However, certain documents, such as the title and insurance proof, may still need to be mailed or delivered physically.

Potential Savings and Strategies

While the Arkansas car sales tax is a mandatory expense, there are strategies buyers can employ to potentially save money or manage the tax burden more effectively.

Shopping Around for the Best Deal

Comparing prices and negotiating with different dealers can lead to significant savings. By finding a lower sales price, buyers can reduce the overall tax liability. Additionally, some dealers may offer incentives or discounts that can further lower the effective tax rate.

Considering Trade-Ins

Trading in an old vehicle can not only reduce the purchase price of the new vehicle but also lower the sales tax. As mentioned earlier, the tax is calculated based on the difference between the trade-in value and the purchase price. By negotiating a higher trade-in value, buyers can minimize their tax liability.

Exemptions and Special Programs

As discussed earlier, there are certain exemptions and special programs in place that can help buyers avoid paying the sales tax. Military personnel, disabled individuals, and those purchasing specific types of vehicles (e.g., electric or hybrid) may be eligible for these exemptions. It’s important to research and understand the criteria for these programs to take advantage of them.

Timing Your Purchase

In some cases, the timing of a vehicle purchase can impact the sales tax. Certain periods or events, such as tax-free weekends or dealership promotions, can offer opportunities to save on taxes. Staying informed about these events and planning purchases accordingly can be a smart strategy.

Future Implications and Potential Changes

The Arkansas car sales tax is subject to change based on various factors, including economic conditions, legislative decisions, and budgetary needs. While it’s difficult to predict specific changes, understanding the potential implications can help buyers make more informed choices.

Economic Factors

Economic downturns or recessions may prompt the state government to adjust tax rates to generate more revenue. Conversely, periods of economic growth could lead to tax rate reductions or incentives to stimulate vehicle sales.

Legislative Decisions

Changes in state legislation can have a direct impact on the car sales tax. New laws or amendments may introduce different tax structures, exemptions, or special programs. Staying updated on legislative news and proposed bills can provide valuable insights into potential future changes.

Budgetary Needs

The state’s financial requirements and budget deficits can influence tax policies. In times of financial strain, the government may consider increasing tax rates or introducing new taxes to balance the budget. On the other hand, a surplus may lead to tax reductions or exemptions to stimulate the economy.

Conclusion

Understanding the intricacies of the Arkansas car sales tax is essential for anyone considering a vehicle purchase in the state. By familiarizing themselves with the current tax rates, exemptions, and potential savings strategies, buyers can navigate the process more confidently and make informed decisions. Additionally, staying updated on potential future changes ensures buyers can adapt their plans and take advantage of any beneficial adjustments.

Frequently Asked Questions

Are there any online tools to calculate the car sales tax in Arkansas?

+Yes, the Arkansas Department of Finance and Administration provides an online sales tax calculator on their website. This tool allows users to input the vehicle’s sales price and instantly calculate the applicable tax rate and amount due.

Can I pay the sales tax in installments?

+No, the sales tax is typically due in full at the time of registration. However, there may be financing options available through dealerships or lenders that can help spread out the cost of the vehicle and the associated taxes over time.

Are there any additional fees besides the sales tax I should be aware of?

+Yes, there are other fees associated with vehicle registration in Arkansas. These include title fees, license plate fees, and registration fees. It’s important to budget for these additional expenses when purchasing a vehicle.

Can I transfer my out-of-state vehicle registration to Arkansas without paying the sales tax?

+In most cases, when transferring an out-of-state vehicle registration to Arkansas, you will be required to pay the applicable sales tax based on the vehicle’s current fair market value. However, there may be exceptions for certain circumstances, such as military transfers or specific tax-exempt programs.