What Is The Gift Tax Rate

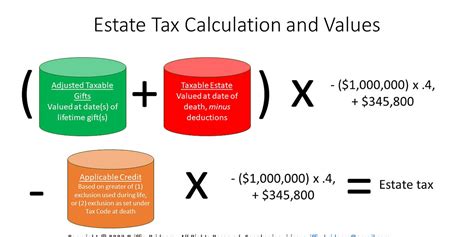

The gift tax is a federal tax imposed on certain transfers of property or assets from one individual to another, typically from a donor to a recipient. It is an important aspect of estate planning and wealth management, as it can have significant financial implications for both parties involved in the gift transaction. Understanding the gift tax rate and its associated regulations is crucial for individuals looking to make substantial gifts while navigating the complexities of the tax system.

Understanding the Gift Tax Rate

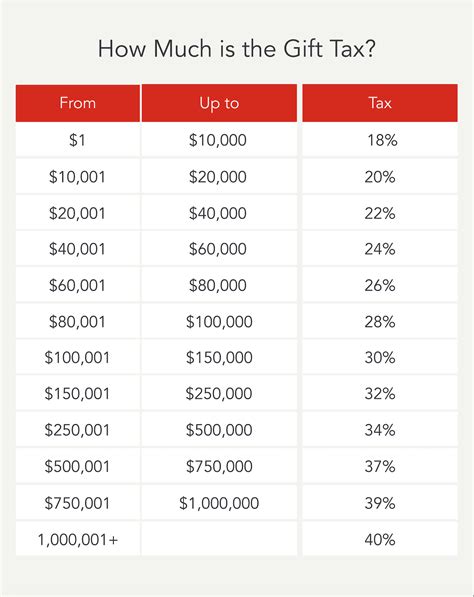

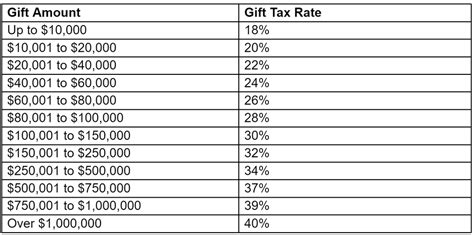

The gift tax rate in the United States is currently set at 40% for the year 2023. This rate applies to the portion of the gift that exceeds the annual exclusion amount, which is $16,000 per recipient for the same calendar year. The gift tax is levied on the donor, not the recipient, and it is applied to the fair market value of the gifted property at the time of transfer.

For example, if an individual decides to gift their friend a valuable painting worth $20,000, the gift tax would be calculated on the amount exceeding the annual exclusion. In this case, the tax would be applied to $4,000 (the excess over the $16,000 exclusion), resulting in a potential tax liability of $1,600 (40% of $4,000).

However, it is important to note that the gift tax system allows for various exclusions and exemptions that can reduce or eliminate the tax liability. These exclusions and exemptions are designed to encourage gift-giving and provide flexibility in estate planning.

Annual Exclusion

As mentioned earlier, the annual exclusion is a key component of the gift tax system. Each calendar year, an individual can gift up to $16,000 to any number of recipients without triggering the gift tax. This exclusion is adjusted periodically by the IRS to account for inflation.

For instance, if an individual has three children and wishes to gift each of them $16,000 in a given year, they can do so without incurring any gift tax liability. This exclusion allows individuals to make substantial gifts to their loved ones tax-free, provided they stay within the annual limit.

Gift Tax Exemption

In addition to the annual exclusion, individuals have a lifetime gift tax exemption, which is currently set at $12.06 million for the year 2023. This exemption allows individuals to make cumulative gifts exceeding the annual exclusion without incurring gift tax until the total value of the gifts surpasses the exemption amount.

For example, if an individual has a net worth of $15 million and wishes to gift their children a total of $10 million over their lifetime, they can do so without paying gift tax, as long as they remain within the lifetime exemption limit.

| Gift Tax Component | Amount |

|---|---|

| Annual Exclusion | $16,000 |

| Lifetime Exemption | $12.06 million |

Gift Tax Strategies and Planning

Efficient gift tax planning can significantly impact an individual’s overall wealth management and estate planning strategy. By understanding the gift tax rate and its associated exemptions, individuals can make informed decisions to minimize tax liabilities and maximize the benefits for both themselves and their beneficiaries.

Utilizing the Annual Exclusion

The annual exclusion is a powerful tool for individuals looking to make regular gifts to their loved ones without incurring gift tax. By staying within the $16,000 limit per recipient, individuals can provide financial support to their family members or charitable organizations without triggering the gift tax. This strategy is particularly beneficial for those with multiple children or beneficiaries, as it allows for tax-free transfers of wealth over time.

Strategic Gifting to Maximize Exemptions

For individuals with substantial wealth, strategic gifting can be an effective way to utilize the lifetime gift tax exemption. By carefully planning and executing gifts, individuals can transfer a significant portion of their wealth to their beneficiaries tax-free. This strategy is often employed in estate planning to minimize the overall tax burden on the estate and ensure that more assets are passed on to the intended heirs.

Gift Splitting

Gift splitting is a technique where married couples can effectively double their annual exclusion amount. By splitting the gift, each spouse can claim a portion of the gift as their own, thereby reducing the overall tax liability. For example, if a couple decides to gift their daughter 32,000</strong>, they can each claim <strong>16,000 as their contribution, ensuring that the gift remains within the annual exclusion limit for both spouses.

Charitable Giving

Charitable donations are another way to leverage the gift tax system. Gifts to qualified charitable organizations are not subject to the gift tax, and they can also provide significant tax benefits for the donor. By making charitable contributions, individuals can support causes they care about while also reducing their overall tax liability. Additionally, charitable giving can be a valuable tool for estate planning, as it can help reduce the taxable value of an estate and provide a lasting legacy.

Gift Tax Implications and Considerations

While the gift tax system provides numerous opportunities for wealth transfer and estate planning, there are several considerations and implications to keep in mind.

Gift Tax Return Requirements

Gifts that exceed the annual exclusion amount may require the donor to file a gift tax return (Form 709). However, it is important to note that filing a gift tax return does not necessarily mean the donor will owe gift tax. The return is used to report the gift and track the donor’s lifetime gift tax exemption usage.

Gift Tax and Generation-Skipping Transfers

The gift tax system also includes provisions for generation-skipping transfers, which are gifts made to individuals who are at least 37.5 years younger than the donor. These transfers are subject to an additional tax known as the generation-skipping transfer (GST) tax. The GST tax rate is currently the same as the gift tax rate, which is 40% for 2023.

State Gift Tax Variations

It is essential to note that gift tax laws can vary from state to state. Some states have their own gift tax laws, while others may impose inheritance or estate taxes that can impact the overall tax liability. It is crucial to consult with a tax professional or legal expert to understand the specific gift tax regulations in your state.

The Future of Gift Tax Rates

The gift tax rate and associated exemptions are subject to change based on legislative decisions and economic conditions. While the current gift tax rate of 40% has been stable for several years, there is always the potential for adjustments in the future. It is important for individuals to stay informed about any changes to the gift tax laws to ensure they are making informed decisions regarding their gift-giving and estate planning strategies.

Additionally, the lifetime gift tax exemption amount is indexed for inflation and may be adjusted periodically. Monitoring these changes is crucial for individuals with substantial wealth, as it can impact their overall estate planning and wealth transfer strategies.

Conclusion

Understanding the gift tax rate and its associated regulations is an essential aspect of effective wealth management and estate planning. By utilizing the annual exclusion, strategic gifting, and other tax-efficient strategies, individuals can maximize the benefits of the gift tax system while minimizing their overall tax liability. Consulting with tax professionals and staying informed about changes in the gift tax laws are key steps in navigating this complex area of financial planning.

Can I gift any amount without incurring gift tax if I stay within the annual exclusion limit?

+Yes, as long as the total value of gifts to each recipient does not exceed the annual exclusion amount, you can gift any amount without triggering the gift tax. This exclusion provides a tax-free way to support your loved ones financially.

What happens if I exceed the annual exclusion in a given year?

+If you exceed the annual exclusion, you may need to file a gift tax return to report the gift. However, this does not necessarily mean you will owe gift tax. The return is used to track your lifetime gift tax exemption usage.

Are there any exceptions or special considerations for certain types of gifts?

+Yes, there are exceptions and special considerations for certain types of gifts. For example, gifts to qualified charitable organizations are not subject to the gift tax, and gifts to your spouse (if they are a U.S. citizen) are generally exempt from the gift tax.