Do Amish Pay Taxes

In the realm of unique cultural and religious practices, the Amish community often sparks curiosity, especially regarding their interaction with modern societal norms and legal frameworks. One prevalent question that arises is whether the Amish pay taxes. This inquiry delves into the intricate relationship between a traditional, secluded community and the contemporary economic system, shedding light on the complexities of tax law and cultural accommodations.

The Intersection of Faith and Finance: Understanding Amish Tax Practices

The Amish, known for their commitment to a simple, agrarian lifestyle, maintain a distinct approach to various aspects of modern life, including their engagement with the tax system. While it is a common misconception that the Amish are exempt from all taxes, the reality is more nuanced and shaped by a combination of legal provisions and cultural adaptations.

Federal and State Tax Obligations

Contrary to popular belief, the Amish are not entirely exempt from paying taxes. They are subject to various federal and state taxes just like any other U.S. citizen. This includes income tax, which is levied on their earnings, although their traditional lifestyle often results in lower taxable incomes compared to the general population.

Furthermore, the Amish community is not exempt from Social Security taxes and Medicare taxes. These contributions ensure that they, like other Americans, have access to social safety nets and healthcare coverage.

| Tax Category | Amish Obligation |

|---|---|

| Federal Income Tax | Subject to tax |

| Social Security Tax | Mandatory contribution |

| Medicare Tax | Mandatory contribution |

| Sales Tax | Dependent on state laws |

| Property Tax | Usually paid, but with community-based strategies |

Sales and Property Taxes: A Community-Centric Approach

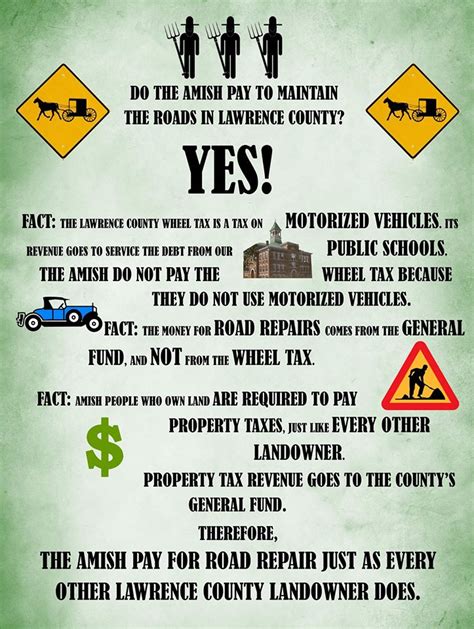

Sales taxes and property taxes present a more complex picture. The obligation to pay sales tax depends on the specific state laws where the Amish community resides. In some states, sales tax is applied to all transactions, including those within the Amish community, while other states offer exemptions for religious communities.

Property taxes are an area where the Amish have developed unique strategies. They often pay property taxes collectively, using community funds to cover these expenses. This approach not only ensures fairness within the community but also provides a means to maintain good relations with local authorities.

Exemptions and Accommodations: Navigating Legal Frameworks

The Amish community has historically sought and been granted certain exemptions and accommodations within the tax system. These accommodations respect their religious beliefs and unique lifestyle, allowing them to maintain their traditions while fulfilling their legal obligations.

One notable exemption is the Social Security exemption granted to certain religious groups. The Amish, along with other similar groups, can opt out of the Social Security system if their religious beliefs oppose participation. However, this exemption is not automatic and requires a formal application process.

Additionally, the Amish often seek exemptions from specific taxes related to modern technologies, such as telephone and electricity taxes. These exemptions are based on the premise that these technologies contradict their religious beliefs and way of life.

The Impact of Tax Practices on Amish Communities

The tax practices of the Amish community have significant implications for their economic and social dynamics. While they are not exempt from the financial obligations that come with modern life, their approach to taxation reflects their commitment to community, tradition, and religious principles.

The collective payment of taxes fosters a sense of unity and shared responsibility within Amish communities. It also allows them to maintain their traditional lifestyle while contributing to the broader society they are a part of.

Economic Self-Sufficiency and Community Support

The Amish community’s approach to taxes aligns with their overall philosophy of economic self-sufficiency and community support. By paying taxes collectively and strategically seeking exemptions, they ensure their economic stability while upholding their religious values.

For instance, their focus on community-based solutions for property taxes demonstrates their commitment to collective decision-making and shared resources. This approach also allows them to navigate the complexities of the tax system without compromising their traditional way of life.

Engaging with Modern Society: A Balancing Act

The question of whether the Amish pay taxes is more than a legal inquiry; it reflects the intricate relationship between a traditional community and modern society. The Amish, through their tax practices, demonstrate a unique balance between engagement with the wider world and the preservation of their cultural and religious identity.

While they participate in the economic system through tax contributions, they do so on their terms, adapting and negotiating to maintain their distinct way of life. This balance is a testament to their resilience and adaptability, as they navigate the complexities of modern life while staying true to their beliefs.

Conclusion: A Complex Interplay of Tradition and Modernity

In examining the tax practices of the Amish, we uncover a complex interplay of tradition, faith, and modern economic realities. Their approach to taxation, characterized by a mix of compliance and exemptions, reflects their unique position in society.

As we delve into the specifics of their tax obligations and strategies, we gain a deeper understanding of the Amish community’s commitment to both their religious principles and their role as contributing members of society. This exploration highlights the fascinating ways in which traditional communities navigate and engage with the modern world, offering valuable insights into the diverse tapestry of American life.

Are the Amish exempt from all taxes?

+No, the Amish are not exempt from all taxes. They are subject to federal income tax, Social Security tax, and Medicare tax, among others. However, they may seek exemptions for specific taxes based on their religious beliefs.

How do the Amish pay property taxes?

+The Amish often pay property taxes collectively, using community funds to cover these expenses. This ensures fairness and maintains good relations with local authorities.

Can the Amish opt out of Social Security?

+Yes, certain religious groups, including the Amish, can opt out of the Social Security system if their religious beliefs oppose participation. However, this requires a formal application process.