Post Tax Deductions: The Ultimate Guide to Maximizing Your Savings

Imagine a sprawling, intricate garden with countless pathways, each leading to hidden treasures of savings and financial advantages. Navigating this garden effectively requires not only a map but also a keen understanding of the terrain—much like understanding post-tax deductions in the complex landscape of personal finance. While the phrase "post-tax deductions" might seem simple on the surface, it embodies a layered strategy that can significantly influence your net income, akin to discovering secret fountains of wealth within that sprawling garden. Grasping their nuances is essential for anyone aiming to optimize their financial health, especially in an era where tax landscapes grow increasingly sophisticated and personalized.

Understanding Post-Tax Deductions: The Foundation of Savings Optimization

At its core, a post-tax deduction is an expense or deduction that reduces your taxable income after you’ve calculated your gross income and applied initial adjustments. To understand it fully, it’s helpful to compare this concept to managing a household gardening project. Consider your gross income as the entire garden—full of potential and resources, but also subject to various rules that determine what you can harvest or prune.

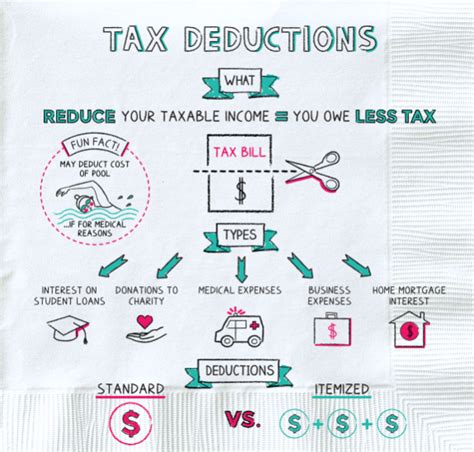

During the tax process, you first identify your gross income, then subtract pre-tax deductions like 401(k) contributions or health savings accounts (HSAs), which are akin to watering and fertilizing your garden—preparing it for the final yield. Post-tax deductions, on the other hand, are like pruning or removing dead branches after the main harvest, directly impacting your final net gain. These deductions include items such as charitable contributions, certain medical expenses, and miscellaneous deductions that can be itemized after your initial tax calculations.

Understanding the distinction between pre-tax and post-tax deductions is vital, as each affects your taxable income differently and can be optimized depending on your financial situation. The strategic use of post-tax deductions can sometimes be overlooked, yet they hold considerable potential for maximizing your savings—akin to discovering a rare flower species that blossoms only when specific pruning techniques are employed.

The Mechanics of Post-Tax Deductions and Their Impact on Your Net Income

To contextualize post-tax deductions in practical terms, envisage them as the final layer on your personal financial cake. After your primary ingredients—income and pre-tax deductions—are processed, the topping layer comprises these post-tax perks and reductions. They include charitable donations, medical expenses exceeding a certain threshold, investment-related expenses, and miscellaneous deductions.

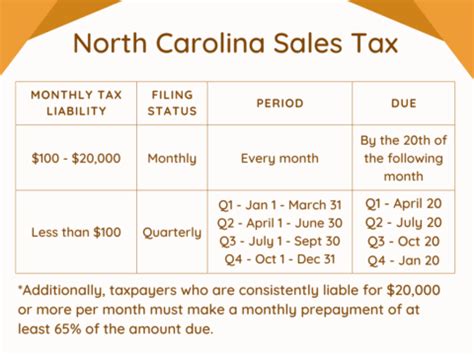

Quantitatively, the impact of these deductions varies depending on your income level, filing status, and eligibility criteria. For example, charitable contributions can reduce taxable income if you itemize deductions on Schedule A, which in turn can lower taxable income by the amount of your donation, subject to certain limits. In 2023, the IRS allows for a deduction for charitable contributions up to 60% of adjusted gross income (AGI), illustrating the potential magnitude of these deductions in the right circumstances.

Furthermore, medical expenses that surpass 7.5% of AGI are deductible, which can be substantial given rising healthcare costs—these are comparable to pruning branches that, once removed, allow the fruit of your financial tree to flourish more freely. By carefully tracking and documenting such expenses throughout the year, you position yourself to benefit at tax time, optimizing the overall yield of your fiscal garden.

| Relevant Category | Substantive Data |

|---|---|

| Charitable Contributions | Deductible up to 60% of AGI with itemized deductions |

| Medical Expenses | Deductible if exceeding 7.5% of AGI; potential for significant savings |

| Miscellaneous Deductions | Limited by IRS rules; includes investment expenses and unreimbursed employee expenses |

Strategies for Maximizing Your Post-Tax Deductions

Maximizing post-tax deductions necessitates a disciplined, informed approach, comparable to a gardener meticulously choosing the right pruning techniques to foster healthy growth. Here are key strategies, aligned with expert tax planning principles, that can help you to yield the highest benefits:

Keep Detailed Records and Documentation

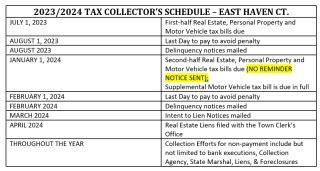

Just as a gardener keeps detailed logs of planting dates, watering schedules, and pruning cuts, taxpayers should maintain meticulous records of all potential deductions. Receipts, bank statements, and detailed logs of medical expenses or charitable contributions serve as the bedrock for substantiating deductions in the event of an audit.

Optimize Itemized Deductions versus Standard Deduction

At certain income levels, itemizing deductions may surpass the standard deduction, much like choosing between different pruning methods based on the type of plant. In 2023, the standard deduction ranges from 13,850 for single filers to 27,700 for married couples filing jointly. A detailed calculation of potential itemized deductions ensures you’re pruning only the unnecessary branches and not missing out on valuable savings.

Plan Charitable Giving Strategically

Timing your charitable donations at year-end can maximize their impact. Consider bunching contributions into one year to surpass the threshold for itemized deductions, creating a larger, more effective “cut” that reduces taxable income significantly. This approach mirrors strategic pruning—cutting at the right time for optimal growth.

Leverage Medical Expense Deductions

Accumulating eligible medical expenses throughout the year and submitting them as a comprehensive deduction can provide substantial savings—akin to a gardener removing excess foliage to foster healthier growth elsewhere.

Utilize Tax-Advantaged Accounts for Future Savings

While technically pre-tax, contributions to accounts like HSAs or Flexible Spending Accounts (FSAs) are intertwined with post-tax planning, as withdrawals for qualified expenses are tax-free. Coordinating these accounts with your post-tax deductions enables a holistic approach to fiscal health, akin to a gardener using a nutrient-rich compost to nourish their plants.

Key Points

- Effective recordkeeping enhances the ability to claim legitimate deductions, akin to detailed garden mapping.

- Itemizing deductions can lead to significant savings, especially when bunching contributions or expenses strategically.

- Understanding tax law thresholds, like the 7.5% AGI medical expense limit, is critical for effective planning.

- Combining various deductions with strategic timing maximizes overall tax efficiency—much like orchestrating a well-timed pruning schedule.

- A comprehensive approach, encompassing both pre- and post-tax planning, creates an optimal environment for wealth growth.

Potential Limitations and Common Pitfalls in Post-Tax Deduction Planning

Just as an overzealous gardener can inadvertently harm their plants, overestimating or misapplying post-tax deductions can lead to unintended consequences, including audits or disallowed claims. For instance, improper documentation or claiming deductions without meeting IRS criteria can jeopardize your tax position. Moreover, the ever-changing landscape of tax laws—like seasonal weather patterns—requires ongoing education and adaptation.

Another pitfall involves the temptation to maximize deductions at the expense of sustainability. Overly aggressive strategies, such as attempting to deduct non-qualifying expenses, risk scrutiny, and potential penalties. Instead, a measured, rule-compliant approach ensures your financial “garden” remains healthy and thriving, yielding consistent benefits over time.

Integrating Post-Tax Deductions into a Broader Financial Strategy

Post-tax deductions should not exist in isolation but as part of a comprehensive financial plan—comparable to a well-designed landscape architecture. Combining traditional deductions with retirement planning, investment strategies, and tax-efficient savings accounts can create a resilient framework for wealth accumulation and retention. Consider, for example, how charitable giving can be integrated with estate planning, or how medical expense deductions can align with insurance planning for maximum efficiency.

Analytics and technology also play a pivotal role. Utilizing tax software with deduction tracking features, or consulting with a financial advisor—like hiring a landscape architect—can optimize your approach, ensuring every “branch” of your financial garden is cultivated for maximum yield.

What are some common post-tax deductions I might overlook?

+Common overlooked post-tax deductions include unreimbursed medical expenses, charitable donations, job-related expenses, and investment-related costs. Maintaining meticulous records throughout the year can help uncover these hidden savings opportunities.

Can I combine post-tax deductions with pre-tax savings strategies?

+Yes, integrating both approaches creates a balanced strategy. Contributions to pre-tax accounts, like a 401(k) or HSA, reduce taxable income upfront, while post-tax deductions, such as charity or medical expenses, further enhance your net benefit when claimed appropriately.

How often should I review my deductions to optimize savings?

+Quarterly reviews of your expenses, records, and ongoing changes in tax laws are recommended. Regular check-ins help adapt strategies and seize new opportunities for deductions, much like seasonal pruning enhances garden health.

Are there risks associated with aggressive deduction strategies?

+Overreaching without proper documentation or claiming deductions improperly can trigger audits and penalties. Staying compliant with IRS regulations and consulting professionals ensures your efforts remain sustainable and beneficial.