Sales Tax In North Carolina

Welcome to an in-depth exploration of the sales tax system in the vibrant state of North Carolina. With its diverse economy and thriving business landscape, understanding the intricacies of sales tax is crucial for both consumers and businesses alike. This comprehensive guide will delve into the specifics of North Carolina's sales tax laws, offering a clear and detailed analysis of the rates, exemptions, and unique features that make up this essential component of the state's revenue system.

Unraveling the Sales Tax Structure in North Carolina

North Carolina imposes a state sales and use tax on the retail sale, lease, or rental of most tangible personal property, as well as certain services. The state tax rate is set at 4.75%, which serves as a base for the overall sales tax rate applied across the state. However, the total sales tax rate is not uniform; it varies depending on the location of the sale and the type of goods or services being purchased.

In addition to the state sales tax, local governments, including counties and municipalities, are authorized to levy their own local option sales and use taxes. These local taxes can be as high as 3.25%, bringing the combined state and local sales tax rate to a maximum of 8% in certain areas. It's important to note that not all jurisdictions within the state impose the maximum local tax rate, so the actual sales tax rate can vary significantly from one location to another.

Sales Tax Exemptions and Special Considerations

North Carolina’s sales tax landscape is not limited to standard retail transactions. The state also imposes a use tax, which is essentially a sales tax on purchases made outside the state but brought into North Carolina for use, storage, or consumption. This ensures that all transactions, regardless of where they are made, contribute to the state’s revenue. The use tax rate mirrors the sales tax rate, including both the state and local components, making it an important consideration for both businesses and individuals.

Moreover, North Carolina offers a range of sales tax exemptions to specific goods and services. These exemptions are designed to support certain industries, promote economic development, and provide relief to specific consumer groups. For instance, many agricultural purchases, manufacturing inputs, and certain professional services are exempt from sales tax. Additionally, the state provides tax holidays, during which certain items, such as school supplies or hurricane preparedness items, are exempt from sales tax.

| Exemption Category | Examples |

|---|---|

| Food and Drugs | Prepared foods, prescription drugs, vitamins |

| Clothing and Footwear | Apparel, shoes, accessories |

| Education | Textbooks, tuition, school supplies |

| Manufacturing | Machinery, raw materials, certain equipment |

However, it's crucial to understand that these exemptions come with specific conditions and qualifications. For example, while clothing and footwear may be exempt up to a certain price point, items exceeding this threshold may still be subject to sales tax. Similarly, the education exemption often has limitations on the types of items and the contexts in which they are purchased.

Navigating Sales Tax Compliance and Collection

Compliance with North Carolina’s sales tax laws is a shared responsibility between businesses and consumers. Businesses are responsible for collecting, reporting, and remitting the appropriate sales tax to the North Carolina Department of Revenue (NCDOR). This involves accurate tax calculation, proper record-keeping, and timely filing of sales tax returns. Failure to comply with these obligations can result in penalties, interest charges, and even revocation of business licenses.

For consumers, understanding sales tax is crucial for making informed purchasing decisions. While the tax is typically added to the purchase price at the point of sale, it's important to be aware of the rates and any applicable exemptions to ensure fair transactions. Consumers also have a role in reporting non-compliance by businesses, which can help ensure a level playing field for all businesses and protect consumers from unfair pricing practices.

Sales Tax Registration and Reporting

Businesses engaging in taxable sales or purchases in North Carolina are required to register with the NCDOR and obtain a sales and use tax permit. This permit serves as authorization to collect and remit sales tax on behalf of the state. The registration process involves providing detailed information about the business, its operations, and the types of goods and services it provides.

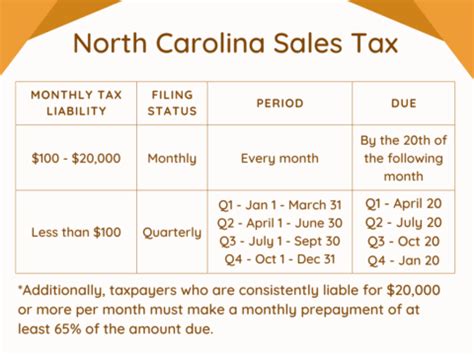

Once registered, businesses must collect sales tax on each taxable sale and maintain accurate records of these transactions. These records are crucial for preparing sales tax returns, which are typically due on a monthly, quarterly, or annual basis, depending on the business's sales volume and the type of business entity.

Sales tax returns must be filed with the NCDOR, providing a detailed breakdown of taxable sales, applicable exemptions, and the total tax due. Late filing or non-filing can result in significant penalties, so it's crucial for businesses to stay on top of their reporting obligations.

The Impact of Sales Tax on North Carolina’s Economy

Sales tax plays a pivotal role in North Carolina’s economy, contributing significantly to the state’s revenue stream. The funds generated from sales tax support a wide range of public services and infrastructure projects, including education, healthcare, transportation, and public safety initiatives. It’s a key component of the state’s fiscal policy, helping to balance the budget and fund essential programs and services.

However, the impact of sales tax extends beyond its role in revenue generation. It also influences consumer behavior and business operations. For consumers, sales tax can affect purchasing decisions, particularly when comparing prices across different states or online retailers. Businesses, on the other hand, must navigate the complexities of sales tax compliance, which can impact their operational costs and pricing strategies.

Sales Tax and Economic Development

North Carolina’s sales tax system is designed to support economic development and growth. By offering strategic exemptions and tax incentives, the state aims to encourage investment, job creation, and innovation. For instance, the state’s Job Development Investment Grant program provides tax benefits to businesses that create new jobs and invest in certain industries. Similarly, the One North Carolina Fund offers performance-based grants to support business recruitment and expansion projects.

These initiatives, coupled with a competitive sales tax rate and a robust business environment, make North Carolina an attractive destination for businesses. The state's commitment to fostering economic growth through strategic tax policies has contributed to its reputation as a business-friendly environment, driving investment and job opportunities.

The Future of Sales Tax in North Carolina

As North Carolina’s economy continues to evolve, so too will its sales tax system. The state’s commitment to staying competitive in the global marketplace means that sales tax policies will likely undergo periodic reviews and updates to ensure they remain effective and relevant. This could include adjustments to tax rates, revisions to exemptions, or the introduction of new tax incentives to support specific economic sectors.

Additionally, the rise of e-commerce and remote sales presents new challenges and opportunities for sales tax collection. North Carolina, like many other states, is navigating the complexities of taxing online transactions, particularly those made across state lines. The state's response to these trends will shape the future of its sales tax system, ensuring it remains adaptable and effective in the digital age.

Conclusion

North Carolina’s sales tax system is a dynamic and integral part of the state’s economic landscape. From its base rate to the varied local options, the state’s sales tax reflects a complex interplay of revenue generation, consumer behavior, and economic development strategies. As businesses and consumers navigate this system, understanding the specifics of North Carolina’s sales tax laws is essential for compliance, strategic decision-making, and contributing to the state’s vibrant economy.

What is the current state sales tax rate in North Carolina?

+

The current state sales tax rate in North Carolina is 4.75%.

Are there any areas in North Carolina with a higher sales tax rate than the state rate?

+

Yes, local governments in North Carolina are authorized to levy additional sales taxes, which can bring the total sales tax rate to a maximum of 8% in certain areas.

What types of purchases are exempt from sales tax in North Carolina?

+

North Carolina offers exemptions for various goods and services, including certain food items, clothing, educational materials, and manufacturing inputs. However, these exemptions come with specific conditions and limitations.

How often do businesses need to file sales tax returns in North Carolina?

+

The frequency of filing sales tax returns depends on the business’s sales volume and entity type. Businesses with higher sales volumes may need to file monthly or quarterly, while others may file annually.

What are the potential consequences for businesses that fail to comply with North Carolina’s sales tax laws?

+

Non-compliance with sales tax laws can result in penalties, interest charges, and even the revocation of business licenses. It’s crucial for businesses to stay informed about their obligations and seek professional guidance if needed.