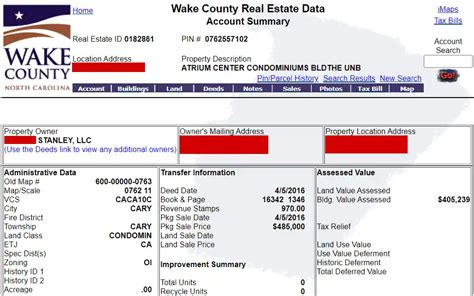

Wake Tax Records

Welcome to an in-depth exploration of Wake Tax Records, a vital aspect of the real estate landscape in Wake County, North Carolina. This article aims to delve into the intricacies of property taxes, offering a comprehensive guide to understanding and navigating the tax system in this vibrant region. From the historical context to the latest assessments and payment processes, we will uncover the key elements that define Wake Tax Records, providing valuable insights for homeowners, investors, and anyone with an interest in the local property market.

The History and Evolution of Wake Tax Records

The story of Wake Tax Records is deeply intertwined with the growth and development of Wake County itself. With a rich history dating back to its establishment in 1771, Wake County has witnessed significant transformations, both in its urban landscapes and its tax structures. Early tax records primarily focused on agricultural assessments, with taxes levied on land and crops, reflecting the county’s agrarian roots.

As Wake County evolved, so did its tax system. The late 20th century saw a rapid shift towards urbanization, with Raleigh, the county seat, becoming a major hub for technology, healthcare, and education. This transformation brought about a need for a more complex and nuanced tax system, one that could accommodate the diverse range of properties, from sprawling estates to modern condominiums.

Key milestones in the evolution of Wake Tax Records include the introduction of the ad valorem tax system in the 1980s, which assessed taxes based on the value of the property. This system, still in place today, ensures a fair and equitable distribution of tax responsibilities among property owners. The turn of the millennium also brought about significant changes, with the implementation of online tax record databases, making property information more accessible to the public.

| Key Milestone | Impact on Wake Tax Records |

|---|---|

| Ad Valorem Tax System (1980s) | Introduced a value-based tax assessment, ensuring fairness. |

| Online Tax Record Databases (2000s) | Enhanced transparency and accessibility of property information. |

Today, Wake Tax Records is a sophisticated system, managing the tax assessments and collections for over 200,000 properties across the county. With a focus on efficiency and accuracy, the system plays a crucial role in funding public services, from schools and hospitals to road infrastructure.

Understanding Property Assessments in Wake County

At the heart of Wake Tax Records lies the process of property assessment, a complex task undertaken by the Wake County Tax Office. Assessments are conducted periodically to determine the fair market value of each property, which forms the basis for tax calculations.

The assessment process involves a thorough evaluation of the property's physical characteristics, including its size, location, age, and any improvements or additions. This data is then compared to recent sales of similar properties in the area, ensuring that the assessed value aligns with the local real estate market. Assessors also consider factors such as zoning regulations and any restrictions that might impact the property's value.

Key Factors Influencing Property Assessments

- Location: Properties in desirable neighborhoods or with scenic views tend to have higher assessments.

- Size and Amenities: Larger properties with additional features like pools or garages often carry higher values.

- Age and Condition: Older properties may require more maintenance and thus impact their assessed value.

- Market Demand: Properties in high-demand areas, especially near amenities or schools, often command higher assessments.

Once the assessment is complete, property owners receive a notice of their assessed value, along with their estimated tax liability. This transparency allows homeowners to understand the factors influencing their tax bill and provides an opportunity for appeals if they believe the assessment is inaccurate.

Navigating the Wake Tax Payment Process

Understanding how to navigate the tax payment process is essential for property owners in Wake County. The Wake County Tax Office offers a range of convenient payment options, designed to cater to different preferences and needs.

Payment Methods

- Online Payments: Property owners can make secure payments through the Wake County Tax Office website, using a credit or debit card. This method offers real-time confirmation and is ideal for those seeking convenience and speed.

- E-Check: This option allows for electronic payments directly from a checking or savings account. It’s a secure and cost-effective method, often preferred by those who want to avoid transaction fees associated with credit card payments.

- Mail-In Payments: Traditionalists can still pay by mail, sending a check or money order to the Tax Office. This method requires careful attention to deadlines to avoid late fees and penalties.

- In-Person Payments: For those who prefer a more personal approach, the Tax Office accepts payments in cash, check, or money order at their physical location. This option is particularly useful for those who need to make last-minute payments or have specific questions.

Regardless of the payment method chosen, property owners are encouraged to keep records of their payments, including confirmation numbers or receipts, to ensure timely and accurate processing. The Wake County Tax Office also provides resources and assistance for those facing financial difficulties, offering payment plans or deferrals in certain circumstances.

Payment Due Dates and Penalties

Wake County has a strict tax payment schedule, with two semiannual deadlines: January 5th and July 1st. Failure to pay by these dates can result in late fees and penalties, which accrue over time. It’s crucial for property owners to mark these dates on their calendars and plan their payments accordingly.

The Wake County Tax Office is committed to transparency and offers a range of resources to help property owners understand their tax obligations. This includes online tools for estimating tax liabilities, as well as educational materials and workshops to demystify the tax process.

The Impact of Wake Tax Records on the Local Community

Beyond its administrative function, Wake Tax Records plays a crucial role in shaping the social and economic fabric of Wake County. Property taxes are a significant source of revenue for the county, funding essential services that directly impact the quality of life for residents.

Funding Public Services

- Education: A substantial portion of property taxes goes towards funding public schools, from elementary to high schools, ensuring a quality education for all children in the county.

- Public Safety: Taxes contribute to maintaining a robust police and fire department, keeping the community safe and secure.

- Healthcare: Property taxes help support local hospitals and healthcare facilities, providing accessible and affordable medical care to residents.

- Infrastructure: Roads, bridges, and public transportation systems are maintained and improved through property tax revenue, enhancing the county’s connectivity and accessibility.

The fair and efficient management of Wake Tax Records ensures that these essential services are adequately funded, benefiting the entire community. It also encourages responsible property ownership, as residents understand that their tax contributions directly impact the quality of their local environment.

Community Engagement and Transparency

The Wake County Tax Office is committed to fostering a culture of community engagement and transparency. They actively encourage residents to participate in the tax process, offering opportunities for feedback and input. This engagement helps to build trust and ensures that the tax system remains fair and responsive to the needs of the community.

The office also maintains an open-door policy, providing opportunities for residents to meet with tax officials, ask questions, and voice concerns. This level of transparency and accessibility is a cornerstone of Wake Tax Records, ensuring that the tax system remains a collaborative effort between the government and the people it serves.

Future Outlook: Innovations and Challenges in Wake Tax Records

As Wake County continues to thrive and evolve, so too must its tax system. The Wake County Tax Office is actively exploring innovative solutions to enhance the efficiency and fairness of Wake Tax Records, while also navigating potential challenges.

Emerging Technologies and Data Analytics

The integration of emerging technologies, such as artificial intelligence and machine learning, offers exciting possibilities for the future of Wake Tax Records. These technologies can enhance the accuracy and speed of property assessments, as well as improve the overall efficiency of the tax system.

Data analytics can provide valuable insights into property values, market trends, and potential areas of improvement. By leveraging these tools, the Tax Office can make more informed decisions, ensuring that the tax system remains fair and equitable for all property owners.

Addressing Income Inequality and Tax Burdens

One of the key challenges facing Wake Tax Records is the issue of income inequality and its impact on tax burdens. As property values rise, so too do tax liabilities, which can disproportionately affect lower-income homeowners. The Tax Office is committed to addressing this challenge, exploring strategies to ease the tax burden on those who may be struggling to keep up with increasing property values.

Potential solutions include implementing a more progressive tax system, where higher-value properties contribute a larger share of the tax revenue. This approach could help alleviate the tax burden on lower-income homeowners, ensuring that the tax system remains fair and sustainable.

Climate Change and Resilient Infrastructure

With the growing impact of climate change, Wake County, like many other regions, is facing the challenge of building resilient infrastructure. Property taxes play a crucial role in funding these efforts, from implementing green initiatives to fortifying critical infrastructure against extreme weather events.

The Wake County Tax Office is actively engaged in conversations around sustainable development and climate resilience, ensuring that property taxes contribute to a more resilient and environmentally conscious future for the county.

Conclusion: A Fair and Efficient Tax System for Wake County

In conclusion, Wake Tax Records stands as a testament to the county’s commitment to fairness, transparency, and community engagement. From its historical roots to its modern-day innovations, the tax system has evolved to meet the needs of a dynamic and diverse population.

As Wake County continues to thrive, the Wake County Tax Office will play a crucial role in ensuring a fair and efficient tax system. By embracing emerging technologies, addressing income inequality, and investing in resilient infrastructure, the Tax Office is positioned to lead the county into a sustainable and prosperous future.

For property owners, understanding and engaging with Wake Tax Records is not just a financial obligation but an opportunity to contribute to the vibrant community of Wake County. With a fair and transparent tax system in place, residents can rest assured that their tax contributions are making a positive impact on the places they call home.

How often are property assessments conducted in Wake County?

+Property assessments are conducted every eight years in Wake County, with the most recent assessment cycle occurring in 2022. This ensures that property values are kept up-to-date and reflect the current real estate market.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in late fees and penalties. It’s important to note that these fees accrue over time, so it’s best to pay your taxes on time to avoid additional costs.

How can I appeal my property assessment if I believe it’s inaccurate?

+If you believe your property assessment is inaccurate, you have the right to appeal. The Wake County Tax Office provides a clear appeals process, which includes submitting an appeal form and providing supporting documentation. It’s important to note that appeals must be filed within a certain timeframe, so it’s advisable to act promptly.