Is Tax Id The Same As Ein

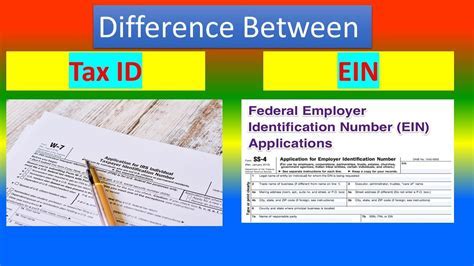

In the realm of business and tax administration, understanding the nuances of various identification numbers is crucial. One common question that arises is whether a Tax ID is the same as an EIN. While these terms are often used interchangeably, there are distinct differences between them. Let's delve into the specifics to gain a comprehensive understanding.

Tax ID: Unraveling the Identity

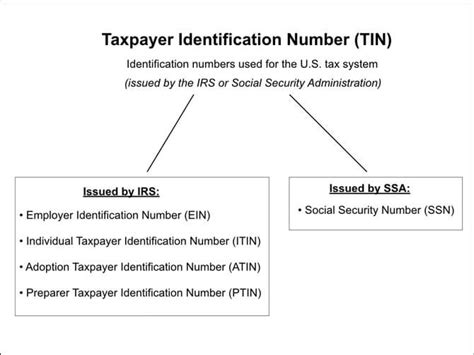

A Tax ID, formally known as an Employer Identification Number (EIN), serves as a unique identifier assigned to businesses by the Internal Revenue Service (IRS) in the United States. This number is akin to a Social Security Number for businesses, enabling the IRS to track and manage tax-related activities effectively.

Tax IDs are not limited to traditional businesses; they are also allocated to various entities, including trusts, estates, government agencies, certain types of non-profit organizations, and more. The primary purpose of a Tax ID is to facilitate tax reporting and ensure compliance with federal tax laws.

When a business entity applies for a Tax ID, it provides relevant information such as the nature of its activities, ownership structure, and location. This information is crucial for the IRS to categorize the entity accurately and assign the appropriate tax responsibilities.

Tax IDs are particularly crucial for businesses engaging in specific activities, such as employing staff, operating a sole proprietorship, or forming partnerships. These entities are required to obtain a Tax ID to meet their tax obligations and maintain compliance.

Key Specifications of Tax IDs

- Format: Tax IDs typically consist of nine digits, arranged in the format XX-XXXXXXX.

- Application Process: Businesses can apply for a Tax ID through the official IRS website or by completing Form SS-4.

- Validity: Once issued, Tax IDs remain valid indefinitely, unless there is a change in the entity’s structure or ownership.

- Usage: Tax IDs are utilized for various purposes, including filing tax returns, opening business bank accounts, and establishing business credit.

EIN: The Employer Identification Number

While the term “EIN” is often used synonymously with “Tax ID,” it specifically refers to the Employer Identification Number. As the name suggests, this number is primarily associated with employers and their tax-related responsibilities.

EINs are essential for businesses that have employees. These numbers are used to identify the employer when filing tax forms and making payments to the IRS. They play a critical role in ensuring accurate tax withholding, reporting, and remittance processes.

Moreover, EINs are often required when applying for various business licenses, permits, and other regulatory requirements. They serve as a unique identifier, enabling government agencies and businesses to track and manage their interactions effectively.

Key Specifications of EINs

- Format: Similar to Tax IDs, EINs also consist of nine digits, arranged in the same format.

- Application: Businesses can apply for an EIN through the IRS website or by completing Form SS-4. The process is straightforward and typically takes a few minutes.

- Validity: EINs, like Tax IDs, remain valid indefinitely unless there is a significant change in the business structure or ownership.

- Usage: EINs are crucial for tax reporting, payroll management, and establishing business credibility. They are also used for opening business accounts and applying for business loans.

The Interplay: Tax ID vs. EIN

While Tax IDs and EINs share many similarities, there are key distinctions that set them apart. Understanding these differences is essential for businesses to navigate their tax obligations effectively.

Scope of Usage

Tax IDs have a broader scope of usage, applicable to a wide range of entities, including sole proprietorships, partnerships, corporations, and even certain types of trusts and estates. On the other hand, EINs are specifically associated with employers and their tax-related duties.

Tax Reporting

Both Tax IDs and EINs are crucial for tax reporting. However, the nature of the tax forms and the entities involved differ. Tax IDs are used for various tax-related activities, such as filing business tax returns, while EINs are primarily utilized for employer-specific tax forms and payroll tax reporting.

Applicability

Tax IDs are mandatory for certain entities, such as corporations, partnerships, and LLCs, regardless of whether they have employees. EINs, on the other hand, become necessary when a business starts employing staff, as they are crucial for payroll and employment tax purposes.

The Bottom Line

In essence, while the terms “Tax ID” and “EIN” are often used interchangeably, they refer to distinct identifiers with specific purposes. Tax IDs serve as a broader identification number for various business entities, while EINs are specifically tailored to employers and their tax obligations.

Understanding the nuances of these identification numbers is crucial for businesses to ensure compliance with tax laws and regulations. Whether it's applying for a Tax ID or obtaining an EIN, businesses must navigate the process diligently to maintain a smooth relationship with the IRS and other regulatory bodies.

Frequently Asked Questions

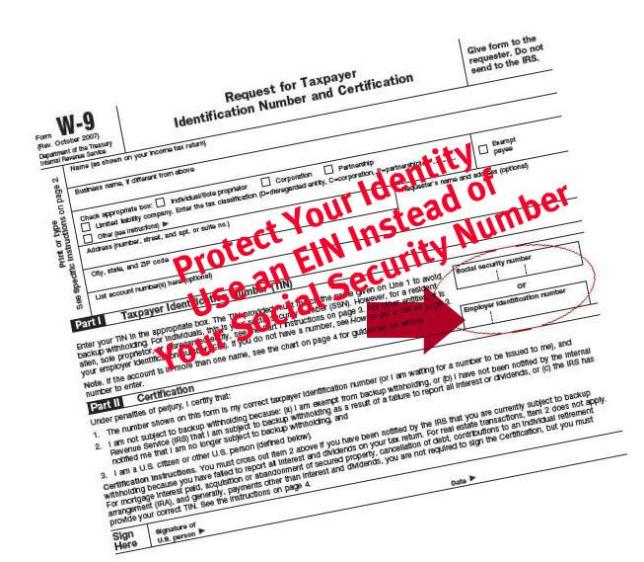

Can I use my Social Security Number as a Tax ID for my business?

+

No, it is not recommended to use your Social Security Number as a Tax ID for your business. A separate Tax ID or EIN is required for business purposes to maintain privacy and compliance.

Do I need a Tax ID if I’m a sole proprietor without employees?

+

While not mandatory, obtaining a Tax ID is recommended for sole proprietors. It simplifies tax reporting and provides a unique identifier for business-related activities.

How long does it take to receive a Tax ID or EIN after application?

+

The processing time varies. Online applications are typically processed within a few minutes, while mailed applications may take up to 4 weeks. Expedited processing is available for an additional fee.

Can I change my Tax ID or EIN if my business structure changes?

+

Yes, if there is a significant change in your business structure, ownership, or location, you may need to apply for a new Tax ID or EIN. The IRS guidelines provide specific instructions for such cases.