California Federal Tax Id Search

In the vast landscape of business and finance, understanding the intricacies of tax identification numbers is crucial for compliance and efficient operations. This article delves into the world of California Federal Tax ID Search, exploring its significance, process, and implications for businesses operating within the Golden State.

Understanding Federal Tax IDs

A Federal Tax ID, also known as an Employer Identification Number (EIN), is a unique numerical identifier assigned by the Internal Revenue Service (IRS) to businesses in the United States. It serves as a critical tool for tax administration, allowing the IRS to track business activities and ensure compliance with tax regulations.

For businesses operating in California, the Federal Tax ID takes on added significance due to the state's unique tax landscape and its position as a hub for diverse industries. Understanding how to obtain and manage this identifier is essential for businesses to navigate their tax obligations successfully.

The Importance of California Federal Tax ID Search

The process of California Federal Tax ID Search holds significant importance for businesses for several key reasons:

- Legal Compliance: Obtaining a valid Federal Tax ID is a legal requirement for businesses operating in California. It ensures that businesses meet their tax obligations and avoid penalties for non-compliance.

- Tax Administration: The Federal Tax ID is a critical tool for the IRS and the California Franchise Tax Board to administer taxes effectively. It helps in identifying businesses, tracking their financial activities, and ensuring accurate tax reporting.

- Business Operations: For businesses, the Federal Tax ID is essential for various operational tasks. It is required for opening business bank accounts, applying for business licenses and permits, and establishing business credit. Without a valid Federal Tax ID, many essential business functions would be severely hindered.

The Process of Obtaining a Federal Tax ID

Obtaining a Federal Tax ID in California involves a straightforward process, primarily managed by the IRS. Here’s a step-by-step guide:

Step 1: Determine Eligibility

Not all entities require a Federal Tax ID. The IRS mandates that the following entities must obtain an EIN:

- Corporations

- Partnerships

- Limited Liability Companies (LLCs)

- Estates and Trusts

- Employee Retirement Plans

- Certain types of Businesses (e.g., sole proprietorships with employees)

If your business falls into one of these categories, you are required to obtain a Federal Tax ID.

Step 2: Gather Necessary Information

To apply for a Federal Tax ID, you will need the following information:

- Business Name and Address

- Business Entity Type

- Business Activity Code (NAICS Code)

- Name and Title of Responsible Party (usually the business owner or an authorized representative)

- Contact Information (phone number and email)

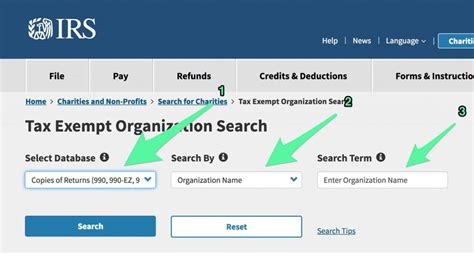

Step 3: Choose the Application Method

The IRS offers three methods for applying for a Federal Tax ID:

- Online Application: This is the fastest and most convenient method. You can apply online through the IRS website. The process is secure and typically takes less than an hour.

- Fax Application: If you prefer a non-digital method, you can fax your application to the IRS. The fax number and necessary forms can be found on the IRS EIN page.

- Mail Application: The traditional method involves mailing your application to the IRS. The address and necessary forms are available on the IRS website. This method is the slowest, typically taking several weeks.

Step 4: Complete the Application

Regardless of the application method, you will need to provide the necessary information and complete the application form. The form will ask for details about your business and its activities.

Step 5: Receive Your Federal Tax ID

Once your application is processed, you will receive your Federal Tax ID. If you applied online, you will receive it immediately after submission. For fax and mail applications, it may take several days to receive your EIN.

Managing and Protecting Your Federal Tax ID

Once you have obtained your Federal Tax ID, it is essential to manage and protect it effectively. Here are some best practices:

- Record-Keeping: Keep a record of your Federal Tax ID in a secure location. Ensure that it is easily accessible for future reference.

- Secure Sharing: Only share your Federal Tax ID with authorized parties. Be cautious when providing it to third-party service providers or financial institutions.

- Regular Review: Periodically review your business's tax obligations and ensure that your Federal Tax ID is up-to-date and accurate. Any changes in your business structure or activities may require an update to your EIN.

Conclusion: Navigating the Tax Landscape

The California Federal Tax ID Search process is a critical step for businesses operating in the state. By understanding the importance of Federal Tax IDs and following the application process, businesses can ensure compliance with tax regulations and facilitate efficient operations. As California’s business landscape continues to evolve, staying informed and proactive about tax obligations is essential for long-term success.

Can I use my Social Security Number instead of a Federal Tax ID for my business in California?

+

Using your Social Security Number for business purposes is generally not recommended. It’s best to obtain a separate Federal Tax ID (EIN) for your business to maintain a clear separation between personal and business finances and to comply with tax regulations.

How long does it take to receive a Federal Tax ID in California?

+

The time it takes to receive a Federal Tax ID can vary depending on the application method. If you apply online, you’ll receive your EIN immediately. Fax applications typically take a few days, while mail applications can take several weeks. It’s always best to plan ahead and allow for processing time.

What if I need to change or update my Federal Tax ID information in California?

+

If your business information changes, such as a change in ownership, entity type, or business address, you’ll need to update your Federal Tax ID information. You can do this by completing and submitting Form SS-4 to the IRS. It’s important to keep your tax records and EIN information up-to-date to avoid any compliance issues.

Are there any fees associated with obtaining a Federal Tax ID in California?

+

Obtaining a Federal Tax ID in California is free. There are no fees charged by the IRS for applying for an EIN. However, if you use a third-party service to obtain your EIN, they may charge a fee for their assistance.