Capital Gains Tax Washington

When it comes to investing and real estate, understanding the intricacies of tax regulations is crucial. In the state of Washington, the capital gains tax landscape presents a unique set of considerations that investors and homeowners should be well-versed in. This comprehensive guide aims to demystify the Washington capital gains tax, offering an in-depth analysis of its implications and providing practical insights to help you navigate this complex financial terrain.

Unraveling the Washington Capital Gains Tax

The capital gains tax is a critical component of an investor’s financial strategy, especially in a state like Washington, known for its vibrant economy and diverse investment opportunities. In this section, we’ll delve into the specifics of how capital gains tax works in Washington, exploring the rates, exemptions, and key considerations that impact your financial decisions.

Understanding Capital Gains

At its core, capital gains refer to the profit made from selling an asset, whether it’s a stock, bond, real estate property, or other investments. When you sell an asset for more than its purchase price, you incur a capital gain. In Washington, these gains are subject to taxation, which is where the capital gains tax comes into play.

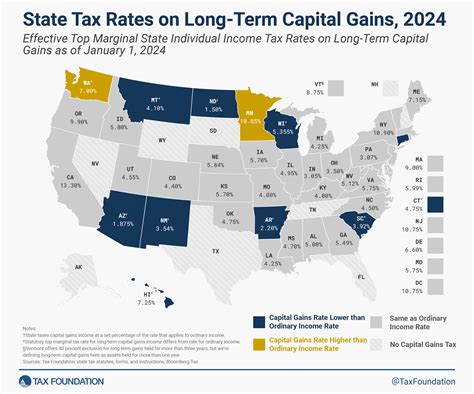

The tax rate for capital gains in Washington is set at 7% for most assets. This includes gains from the sale of stocks, bonds, mutual funds, and other financial instruments. However, it's important to note that Washington does not impose a capital gains tax on the sale of personal residences or real estate that is classified as a primary residence. This exemption is a significant benefit for homeowners and investors in the state.

Tax Rates and Exemptions

Washington’s capital gains tax operates on a straightforward rate structure. The 7% tax rate applies to both short-term (held for less than a year) and long-term capital gains (held for a year or more). This uniformity simplifies tax calculations, making it easier for investors to estimate their potential tax liabilities.

However, the absence of a capital gains tax on primary residences is a notable exemption. This means that when you sell your primary home, you won't be subject to state capital gains tax, regardless of the profit you make. This exemption is a significant incentive for homeowners and a unique feature of Washington's tax landscape.

Filing and Payment Process

Filing capital gains taxes in Washington involves a few key steps. First, you’ll need to determine your capital gains for the year. This is calculated by subtracting the purchase price (or basis) of the asset from the sale price. If you have a capital gain, you’ll need to report it on your Washington state tax return, using the appropriate form (usually the WA-2 or WA-3). The deadline for filing your state tax return is typically aligned with the federal deadline, which is usually April 15th.

When it comes to payment, Washington offers several options. You can pay your capital gains tax online, by phone, or by mail. The state also accepts credit card payments, making the process more convenient for taxpayers. It's important to ensure that your payment is made by the deadline to avoid any late fees or penalties.

| Tax Rate | Capital Gains Tax |

|---|---|

| Short-Term Gains | 7% |

| Long-Term Gains | 7% |

Strategies for Maximizing Benefits

Understanding the nuances of Washington’s capital gains tax can open up opportunities for strategic financial planning. Here are a few strategies to consider:

- Hold Long-Term: Given the uniform tax rate, holding assets for the long term can be beneficial. Long-term capital gains are often taxed at lower rates than short-term gains in other states, making Washington an attractive destination for investors with a long-term investment horizon.

- Real Estate Exemption: Take advantage of the primary residence exemption by strategically timing the sale of your home. If you're planning to move, consider the tax implications and the potential for significant savings by selling your primary residence.

- Diversify Your Portfolio: Washington's capital gains tax applies to a wide range of assets. By diversifying your portfolio, you can potentially offset gains with losses, reducing your overall tax liability.

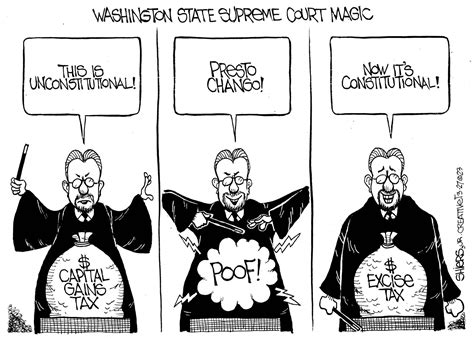

The Future of Capital Gains Tax in Washington

As with any tax landscape, the future of Washington’s capital gains tax is subject to change. While the current structure provides a stable and predictable environment for investors, it’s essential to stay informed about potential policy shifts. The state’s commitment to economic growth and its focus on maintaining a business-friendly environment suggest that significant changes to the capital gains tax are unlikely in the near term.

However, it's always prudent to stay engaged with the latest tax news and updates. Keeping abreast of any proposed legislation or changes in tax policy can help you make informed decisions and adapt your financial strategies accordingly.

Conclusion

Washington’s capital gains tax offers a straightforward and investor-friendly environment, with a uniform tax rate and a notable exemption for primary residences. By understanding the intricacies of this tax landscape, investors and homeowners can make informed decisions that maximize their financial benefits. Stay tuned for further insights and updates on Washington’s tax policies, and remember to consult with tax professionals for personalized advice.

What is the capital gains tax rate in Washington for 2023?

+The capital gains tax rate in Washington remains at 7% for both short-term and long-term gains as of 2023.

Are there any exemptions for capital gains tax in Washington?

+Yes, Washington exempts capital gains from the sale of a primary residence. This exemption applies to both short-term and long-term gains.

How do I calculate my capital gains tax in Washington?

+Calculate your capital gains tax by subtracting the purchase price (or basis) of the asset from the sale price. Multiply the resulting capital gain by the tax rate of 7% to determine your tax liability.