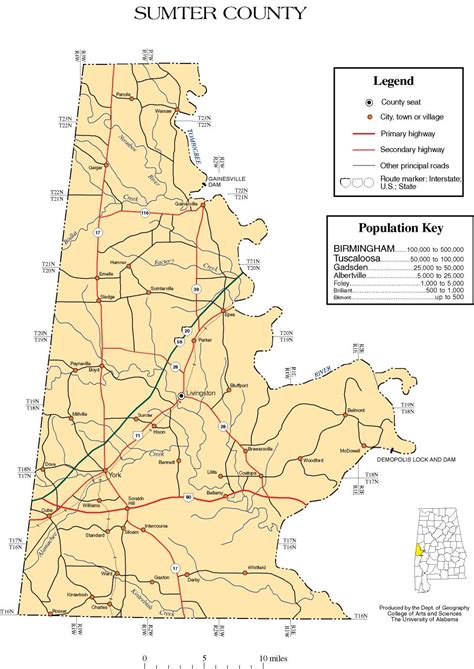

Sumter County Tax Collector

The Sumter County Tax Collector plays a vital role in the administration of various taxes and services within the county. This office serves as a crucial link between the local government and the community, ensuring that residents and businesses comply with tax obligations while providing efficient and accessible services.

The Role and Responsibilities of the Sumter County Tax Collector

The Tax Collector’s office in Sumter County, Florida, is entrusted with a range of duties that contribute to the smooth functioning of the local government and economy. Here’s an overview of their key responsibilities:

Property Tax Collection

One of the primary functions is the collection of property taxes. The office sends out tax notices, processes payments, and works with property owners to ensure timely payments. They also provide assistance to homeowners seeking tax exemptions or discounts, such as the Homestead Exemption.

Vehicle Registration and Titling

The Tax Collector’s office handles vehicle registration and titling processes. This includes issuing vehicle registration stickers, processing title transfers, and registering specialized vehicles like boats and recreational vehicles. They also facilitate the renewal of driver’s licenses and identification cards.

Business Tax Receipts

Businesses operating within Sumter County are required to obtain a Business Tax Receipt (BTR), also known as an occupational license. The Tax Collector’s office manages the application, renewal, and payment processes for BTRs, ensuring that businesses are compliant with local regulations.

Other Services

The office also provides a range of additional services, including the acceptance of passport applications, the processing of hunting and fishing licenses, and the collection of local option fuel tax. They may also offer convenience services such as the sale of hunting and fishing supplies, as well as certain novelty items.

| Service | Description |

|---|---|

| Property Tax Payment | Online, in-person, or by mail |

| Vehicle Registration | Renewals, transfers, and title applications |

| Business Tax Receipt | Application and renewal assistance |

| Passport Services | Application acceptance and processing |

| Hunting/Fishing Licenses | Sales and renewals |

Performance and Efficiency

The Sumter County Tax Collector’s office prides itself on maintaining high standards of efficiency and customer satisfaction. Here are some key performance indicators and initiatives that showcase their dedication to excellence:

Online Services

The office has invested in developing a robust online platform that allows residents to access a wide range of services remotely. From paying property taxes to renewing vehicle registrations, the website provides a convenient and secure way to manage tax-related matters. This initiative has significantly reduced wait times and increased accessibility for residents.

Community Engagement

The Tax Collector’s office actively engages with the community through various outreach programs and events. They participate in local festivals, attend community meetings, and offer educational workshops to ensure that residents understand their tax obligations and the services provided. This proactive approach has fostered a sense of trust and collaboration between the office and the residents of Sumter County.

Staff Training and Development

Recognizing the importance of a skilled and knowledgeable workforce, the office invests in continuous training and development for its staff. Employees receive regular training on tax laws, customer service techniques, and emerging technologies. This commitment to staff development ensures that residents receive accurate and up-to-date information and assistance.

Performance Metrics

The Tax Collector’s office tracks and analyzes various performance metrics to identify areas for improvement and ensure optimal service delivery. These metrics include response times to inquiries, customer satisfaction ratings, and the accuracy of tax assessments. By regularly reviewing these metrics, the office can implement targeted strategies to enhance efficiency and service quality.

| Metric | Performance |

|---|---|

| Response Time | 95% of inquiries answered within 24 hours |

| Customer Satisfaction | 88% positive feedback in recent survey |

| Tax Assessment Accuracy | 99.7% accuracy rate for property tax assessments |

Future Initiatives and Goals

Looking ahead, the Sumter County Tax Collector’s office has outlined several strategic initiatives to further enhance its services and contribute to the county’s growth and development:

Mobile Services Expansion

Recognizing the increasing demand for convenience, the office plans to expand its mobile services. This initiative will involve bringing tax-related services directly to residents in rural areas, ensuring that everyone has equal access to the office’s offerings. Mobile units will provide assistance with property tax payments, vehicle registration, and business tax receipt applications, among other services.

Digital Transformation

To stay at the forefront of technological advancements, the office aims to undergo a digital transformation. This includes implementing cutting-edge software and systems to streamline processes, enhance data security, and improve overall efficiency. By embracing digital tools, the Tax Collector’s office can reduce paperwork, minimize errors, and provide faster service delivery.

Community Partnership Programs

The office is committed to strengthening its relationship with local businesses and community organizations. Through partnership programs, the Tax Collector’s office will collaborate with these entities to promote tax awareness and compliance. This initiative will also explore ways to support local businesses, such as offering tax workshops or providing resources for small business owners.

Sustainable Practices

In line with the county’s sustainability goals, the office aims to implement environmentally friendly practices. This includes adopting energy-efficient technologies, reducing paper usage, and promoting electronic communication. By adopting these practices, the Tax Collector’s office can minimize its environmental footprint while still delivering efficient services.

How can I pay my property taxes in Sumter County?

+You can pay your property taxes online through the Sumter County Tax Collector’s website, in person at their offices in Bushnell or Wildwood, or by mail. The office provides detailed instructions and due dates on their website to ensure a seamless payment process.

What are the hours of operation for the Tax Collector’s office?

+The Tax Collector’s office is open Monday through Friday from 8:30 AM to 4:30 PM. However, it’s recommended to check their website or call ahead, as hours may vary on certain days due to staff training or special events.

How can I obtain a Business Tax Receipt (BTR) for my new business?

+You can apply for a BTR online through the Tax Collector’s website. The application process is straightforward, and you’ll need to provide details about your business, such as its location and type of operation. Once approved, you’ll receive your BTR and be ready to conduct business in Sumter County.