Illinois Tax On Vehicle Sales

When purchasing a vehicle in Illinois, it's important to understand the tax implications to ensure a smooth and compliant transaction. The Vehicle Sales Tax is a crucial aspect of the process, and it can vary depending on several factors. In this comprehensive guide, we will delve into the intricacies of the Illinois Vehicle Sales Tax, providing you with all the information you need to navigate this aspect of your vehicle purchase efficiently.

Understanding the Illinois Vehicle Sales Tax

The Vehicle Sales Tax in Illinois is a state-imposed tax levied on the purchase of motor vehicles. It is an essential revenue source for the state and contributes to various infrastructure and public service projects. The tax rate and applicable regulations can impact the overall cost of your vehicle purchase, so it's beneficial to have a clear understanding of how it works.

Tax Rate and Calculation

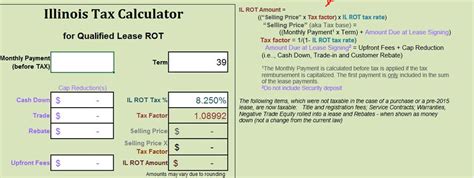

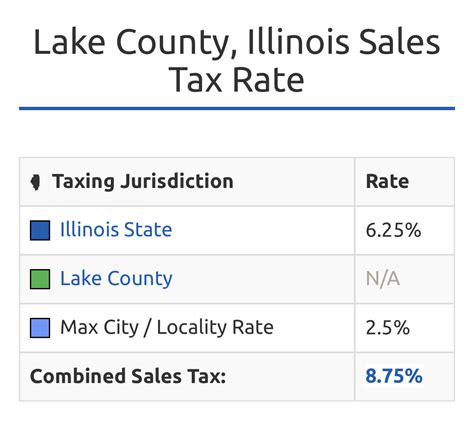

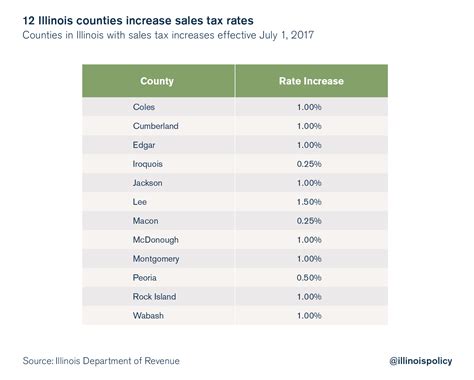

The Vehicle Sales Tax in Illinois is currently set at 6.25% of the total purchase price of the vehicle. This rate is uniform across the state and applies to both new and used vehicle sales. However, it's important to note that local municipalities and counties may impose additional taxes, known as Local Vehicle Surcharges, which can increase the overall tax burden.

To calculate the tax amount, simply multiply the purchase price of the vehicle by the applicable tax rate. For example, if you purchase a vehicle for $25,000, the Vehicle Sales Tax would be calculated as follows:

Vehicle Purchase Price: $25,000 Vehicle Sales Tax Rate: 6.25% Tax Amount: $25,000 x 0.0625 = $1,562.50

In this case, the total tax amount payable would be $1,562.50. However, it's crucial to remember that additional local surcharges may apply, increasing the overall tax liability.

Exemptions and Special Considerations

While the Vehicle Sales Tax applies to most vehicle purchases, there are certain exemptions and special considerations to be aware of. These exemptions can significantly impact the overall tax burden and should be understood to maximize any potential savings.

- Military Personnel: Active-duty military personnel and their spouses are eligible for a Sales Tax Exemption when purchasing a vehicle in Illinois. This exemption applies to both new and used vehicles and can provide significant savings. To claim this exemption, you must provide valid military identification and complete the necessary paperwork at the time of purchase.

- Disabled Individuals: Illinois offers a Sales Tax Exemption for individuals with certain disabilities. This exemption applies to the purchase of a vehicle equipped with specialized modifications or adaptations to accommodate the disability. To qualify, you must obtain a Disabled Person's Identification Card from the Illinois Secretary of State's office and provide it at the time of purchase.

- Vehicle Trade-Ins: When trading in your old vehicle as part of the purchase process, the value of the trade-in is deducted from the total purchase price. This deduction can reduce the taxable amount and lower the overall Vehicle Sales Tax liability. Ensure that the trade-in value is accurately assessed to maximize this benefit.

- Business Vehicles: If you are purchasing a vehicle for business purposes, you may be eligible for a Sales Tax Deduction or Exemption. This is applicable if the vehicle is primarily used for business activities and not for personal use. Consult with a tax professional to understand the specific requirements and documentation needed to claim this benefit.

Vehicle Registration and Title Transfer

In addition to the Vehicle Sales Tax, there are other fees and processes involved when purchasing a vehicle in Illinois. Understanding these steps is crucial to ensure a seamless registration and title transfer process.

Registration Fees

Along with the Vehicle Sales Tax, you will also need to pay Registration Fees to register your vehicle with the Illinois Secretary of State. These fees vary depending on the type of vehicle and its weight class. The registration process ensures that your vehicle is legally operated on Illinois roads and helps maintain public safety standards.

| Vehicle Type | Registration Fee |

|---|---|

| Passenger Car | $101.50 (2-year registration) |

| Truck or Commercial Vehicle | Varies based on weight class |

| Motorcycle | $78.50 (2-year registration) |

Title Transfer

When purchasing a used vehicle, a Title Transfer is required to establish your ownership rights. This process involves completing the necessary paperwork, including the Vehicle Title Application and Bill of Sale, and submitting them to the Illinois Secretary of State. The cost of the title transfer is $150, and it is a crucial step to ensure your vehicle is legally registered in your name.

Performance Analysis and Comparison

To provide a comprehensive understanding of the Illinois Vehicle Sales Tax, let's analyze its performance and compare it to other states. This analysis will offer valuable insights into the effectiveness and impact of this tax system.

Revenue Generation

The Vehicle Sales Tax in Illinois has consistently generated significant revenue for the state. In the fiscal year 2022, the tax generated approximately $2.1 billion in revenue. This revenue is vital for funding various public services, infrastructure projects, and maintaining the state's transportation network.

The tax's effectiveness in generating revenue can be attributed to the state's strong vehicle sales market. Illinois is home to a diverse range of automotive dealerships and manufacturers, contributing to a robust vehicle sales industry. Additionally, the uniform tax rate across the state simplifies the tax collection process and ensures fairness for both consumers and businesses.

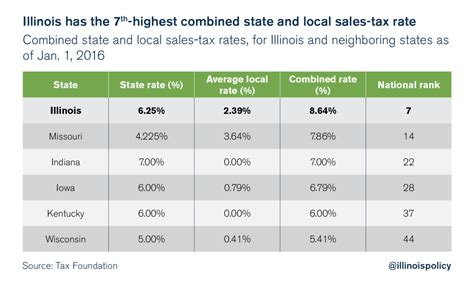

Comparison with Other States

When comparing the Illinois Vehicle Sales Tax to other states, it is essential to consider both the tax rate and the additional surcharges or fees that may apply. While the base tax rate of 6.25% is relatively competitive, the potential for local surcharges can increase the overall tax burden.

| State | Vehicle Sales Tax Rate | Additional Surcharges |

|---|---|---|

| Illinois | 6.25% | Local Vehicle Surcharges |

| California | 7.25% | County Sales Taxes (varies) |

| Texas | 6.25% | County and City Sales Taxes (varies) |

| New York | 4% | Local Sales Taxes (varies) |

As illustrated in the table above, while Illinois has a competitive base tax rate, the potential for local surcharges can impact the overall tax liability. It is crucial for consumers to research and understand the specific tax rates and surcharges applicable in their local area to make informed purchasing decisions.

Future Implications and Potential Changes

The Illinois Vehicle Sales Tax, like any tax system, is subject to potential changes and updates. Understanding the future implications and possibilities can help consumers and businesses prepare for any adjustments to the tax landscape.

Potential Rate Adjustments

The tax rate for the Vehicle Sales Tax in Illinois has remained relatively stable over the years. However, there have been discussions and proposals for rate adjustments to address various fiscal needs. While a rate increase could generate additional revenue, it may also impact consumer behavior and the overall vehicle sales market.

Tax Reform Proposals

In recent years, there have been proposals for tax reform in Illinois, including potential changes to the Vehicle Sales Tax. These proposals aim to simplify the tax system, reduce administrative burdens, and promote fairness. Some suggestions include consolidating various fees and surcharges into a more straightforward tax structure or implementing a flat tax rate for all vehicle purchases.

Impact on the Automotive Industry

Any changes to the Vehicle Sales Tax can have significant implications for the automotive industry in Illinois. Higher tax rates or additional surcharges may impact vehicle affordability and consumer purchasing decisions. Conversely, tax reforms that simplify the system or reduce overall tax burdens could stimulate vehicle sales and benefit dealerships and manufacturers.

Potential for Incentives and Exemptions

As the state explores tax reform options, there is also a possibility of introducing new incentives or expanding existing exemptions. For example, the state could consider offering tax incentives for the purchase of electric or hybrid vehicles to promote sustainable transportation options. Additionally, expanding exemptions for specific demographics or vehicle types could encourage certain purchases and support targeted initiatives.

Frequently Asked Questions (FAQ)

How often do I need to pay the Vehicle Sales Tax in Illinois?

+The Vehicle Sales Tax is a one-time payment due at the time of vehicle purchase. It is calculated based on the total purchase price and any applicable local surcharges.

Are there any online resources to estimate my Vehicle Sales Tax liability before purchase?

+Yes, the Illinois Department of Revenue provides an online Vehicle Tax Calculator to estimate your sales tax liability. You can access it on their official website.

Can I negotiate the Vehicle Sales Tax with the dealership?

+No, the Vehicle Sales Tax is a state-imposed tax, and dealerships are required to collect and remit it. However, you can negotiate other aspects of the purchase, such as the vehicle price or financing options.

What happens if I fail to pay the Vehicle Sales Tax?

+Failing to pay the Vehicle Sales Tax can result in penalties, fines, and legal consequences. It is crucial to pay the tax in a timely manner to avoid these issues and maintain compliance with state regulations.

Are there any tax incentives or rebates available for vehicle purchases in Illinois?

+Currently, there are no state-wide tax incentives or rebates for vehicle purchases in Illinois. However, it is recommended to check for any local or regional initiatives that may offer such benefits.

Purchasing a vehicle in Illinois involves understanding the intricacies of the Vehicle Sales Tax and its potential impact on your finances. By comprehending the tax rate, applicable surcharges, and available exemptions, you can make informed decisions and navigate the purchase process efficiently. Remember to stay updated on any potential changes or reforms to the tax system to ensure you are prepared for any adjustments.