Income Tax In Idaho Rate

Income tax is a crucial aspect of personal finance and plays a significant role in the economic landscape of any state. Idaho, with its diverse population and unique tax structure, offers an interesting case study for understanding the intricacies of income taxation. This comprehensive guide aims to delve into the specifics of income tax rates in Idaho, providing a detailed analysis of the current system and its implications.

Understanding Idaho’s Income Tax Structure

Idaho, like many states, employs a progressive income tax system, which means that higher incomes are taxed at progressively higher rates. This approach ensures that individuals with higher earning capabilities contribute a greater share to the state’s revenue, fostering a more equitable distribution of tax burden. The state’s income tax rates are set by the Idaho State Legislature and are subject to periodic adjustments to reflect economic conditions and fiscal needs.

The Idaho State Tax Commission is the governing body responsible for administering and enforcing the state's tax laws, including income tax. They provide detailed guidelines and resources to help taxpayers understand their obligations and ensure compliance with the state's tax regulations.

Tax Brackets and Rates

Idaho’s income tax system operates on a series of tax brackets, with each bracket corresponding to a specific income range and its associated tax rate. As of the 2023 tax year, Idaho has five tax brackets, each with its unique rate. These brackets are as follows:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | $0 - $2,100 | 1.6% |

| 2 | $2,101 - $4,200 | 2.4% |

| 3 | $4,201 - $10,500 | 4.4% |

| 4 | $10,501 - $21,000 | 5.9% |

| 5 | $21,001 and above | 7.4% |

These tax brackets and rates are applicable to individuals and married couples filing jointly. For married couples filing separately and heads of households, the income ranges and tax rates may differ slightly.

Taxable Income and Deductions

When calculating taxable income, Idaho residents can take advantage of various deductions and exemptions. These deductions can significantly reduce the taxable income and, consequently, the tax liability. Some common deductions available to Idaho taxpayers include:

- Standard Deduction: Idaho offers a standard deduction based on the taxpayer's filing status. For the 2023 tax year, the standard deduction amounts are: $2,600 for single filers, $5,200 for married couples filing jointly, and $4,100 for heads of households.

- Itemized Deductions: Taxpayers can opt for itemized deductions instead of the standard deduction if their total itemized deductions exceed the standard deduction amount. Itemized deductions may include medical expenses, charitable contributions, mortgage interest, state and local taxes, and certain business expenses.

- Personal Exemptions: Idaho allows personal exemptions for the taxpayer, spouse, and each dependent. These exemptions reduce the taxable income by a certain amount for each eligible individual.

Tax Credits

In addition to deductions, Idaho taxpayers may also benefit from various tax credits, which directly reduce the amount of tax owed. Some notable tax credits available in Idaho include:

- Low-Income Tax Credit: This credit is designed to provide relief to low-income individuals and families. It offers a refundable tax credit of up to $100 for each qualifying child under the age of 18.

- Dependent Care Tax Credit: Taxpayers who incur eligible expenses for the care of dependent children or adults may be eligible for this credit, which can offset a portion of those costs.

- Property Tax Credit: Certain Idaho residents may qualify for a property tax credit, which provides a refund of a portion of the property taxes paid.

Tax Filing and Payment Options

Idaho offers a range of convenient options for taxpayers to file their income tax returns and make payments. The Idaho State Tax Commission provides an online filing system, IDAHOtax, which allows taxpayers to file their returns electronically and securely. This system also provides real-time status updates and facilitates easy tracking of refunds.

For those who prefer traditional methods, paper tax forms are available and can be mailed to the appropriate tax office. Idaho also accepts tax payments through various methods, including direct debit, credit or debit cards, and electronic funds transfer.

Due Dates and Penalties

Idaho’s tax due dates align with the federal tax deadlines. The deadline for filing and paying income taxes is typically April 15th of the year following the tax year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

Failure to file or pay taxes on time may result in penalties and interest charges. The Idaho State Tax Commission imposes penalties for late filing and late payment, which can significantly increase the taxpayer's overall liability. It's crucial for taxpayers to stay informed about these deadlines and penalties to avoid unnecessary financial burdens.

Analysis and Implications

Idaho’s income tax structure, with its progressive nature and range of deductions and credits, aims to strike a balance between revenue generation and taxpayer fairness. The state’s tax rates are relatively moderate compared to some other states, which can make Idaho an attractive option for individuals and businesses considering relocation.

The availability of deductions and credits provides taxpayers with opportunities to reduce their tax liability, especially for those with higher incomes. However, the effectiveness of these deductions and credits can vary based on individual circumstances, and some taxpayers may find themselves in higher tax brackets due to their income level.

Economic Impact

The income tax system in Idaho has broader economic implications. It influences the state’s revenue stream, which, in turn, affects the funding of public services, infrastructure development, and social programs. A well-structured and fairly administered tax system is crucial for maintaining a healthy economy and ensuring the state’s long-term financial stability.

Moreover, Idaho's tax policies can influence business decisions, investment flows, and job creation. A competitive and predictable tax environment can attract businesses and entrepreneurs, fostering economic growth and development. On the other hand, complex or burdensome tax structures may deter investment and hinder economic opportunities.

Comparative Analysis

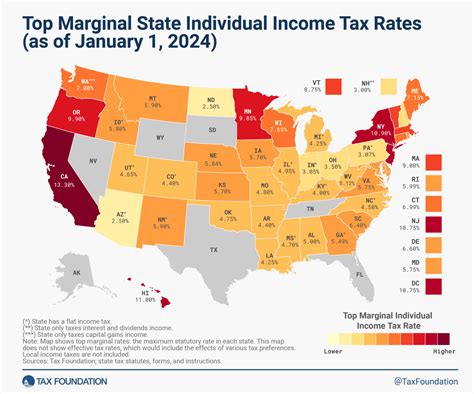

When compared to other states, Idaho’s income tax rates are generally considered to be moderate. Some states, particularly those with no income tax, may be more attractive to taxpayers from a purely financial perspective. However, Idaho’s tax system offers a balance between revenue generation and taxpayer considerations, providing a stable and predictable environment for individuals and businesses.

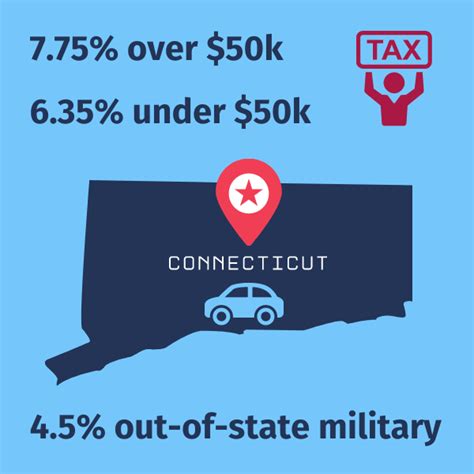

It's worth noting that the overall tax burden in Idaho goes beyond income taxes. The state also levies sales tax, property tax, and various other taxes and fees, which collectively contribute to the state's revenue. A comprehensive analysis of Idaho's tax landscape should consider these additional taxes to gain a complete understanding of the state's fiscal environment.

Conclusion

Idaho’s income tax system, with its progressive rates, deductions, and credits, offers a balanced approach to taxation. While the state’s tax rates may not be the lowest, the structure provides opportunities for taxpayers to optimize their tax liabilities. The availability of online filing systems and various payment options further enhances the efficiency and convenience of the tax process.

Understanding Idaho's income tax rates is crucial for individuals and businesses operating within the state. By staying informed about the tax system and utilizing the available deductions and credits, taxpayers can ensure compliance and optimize their financial strategies. As the economic landscape evolves, Idaho's tax policies will continue to play a vital role in shaping the state's fiscal health and its attractiveness as a place to live, work, and invest.

What is the average income tax rate in Idaho?

+

The average income tax rate in Idaho varies depending on an individual’s income level. As of 2023, the state has five tax brackets with rates ranging from 1.6% to 7.4%. The average rate, however, is difficult to determine as it depends on a person’s specific income and deductions.

Are there any special tax credits or deductions for specific groups in Idaho?

+

Yes, Idaho offers various tax credits and deductions to support specific groups. For instance, there is a Low-Income Tax Credit for qualifying low-income individuals and families, and a Dependent Care Tax Credit for those with dependent care expenses. Additionally, certain business-related expenses and property taxes may be deductible.

How does Idaho’s income tax compare to other states?

+

Idaho’s income tax rates are generally considered moderate compared to other states. While some states have no income tax at all, Idaho’s progressive tax structure ensures a fair distribution of tax burden. However, it’s important to consider the overall tax landscape, including sales tax and property tax, when comparing Idaho to other states.