Medicare Tax Rate 2025

The Medicare tax is a crucial component of the United States' healthcare system, ensuring the sustainability of the Medicare program. As we approach the year 2025, it is essential to understand the tax rate and its implications for individuals and employers.

Understanding the Medicare Tax Rate for 2025

The Medicare tax rate for 2025 remains a significant aspect of the healthcare landscape, impacting both employees and employers. With a focus on maintaining the financial stability of the Medicare program, the tax rate plays a pivotal role in shaping healthcare contributions and benefits.

As we delve into the specifics of the Medicare tax rate for 2025, it is essential to grasp the fundamental mechanics behind this critical component of the U.S. healthcare system. The Medicare tax is levied on earned income, primarily wages and self-employment income, to fund the Medicare program, which provides healthcare coverage to eligible individuals aged 65 and above, as well as certain younger individuals with disabilities.

The Medicare tax rate is subject to periodic adjustments to ensure the program's solvency and keep pace with the evolving healthcare landscape. For the year 2025, the tax rate remains at 2.9%, which is divided between employees and employers, with each contributing 1.45% of the total tax. It is worth noting that the Medicare tax rate applies to all earned income, regardless of an individual's income level.

Tax Rate Breakdown and Implications

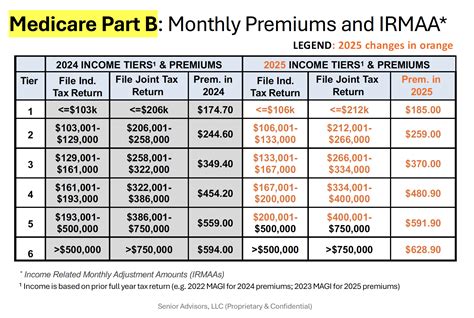

The Medicare tax rate for 2025 can be further dissected to understand its implications for different income brackets. For individuals earning up to a certain threshold, the 2.9% tax rate applies to their entire earned income. However, for high-income earners, an additional Medicare surtax may come into play, further increasing their contribution to the program.

For instance, individuals with earned income exceeding $200,000 for single filers or $250,000 for married couples filing jointly may be subject to an additional 0.9% surtax on their income above these thresholds. This surtax is designed to ensure that higher-income earners contribute a greater share towards the Medicare program, promoting fairness and sustainability.

The Medicare tax rate not only impacts individuals but also employers. Employers are required to withhold the employee's share of the Medicare tax from their wages and match it with their own contribution. This means that employers play a crucial role in facilitating the tax collection process and ensuring compliance with the Medicare tax regulations.

| Income Threshold | Medicare Tax Rate |

|---|---|

| Up to $200,000 (single) or $250,000 (married filing jointly) | 2.9% |

| Above the threshold | 2.9% (base rate) + 0.9% (surtax) |

Impact on Medicare Funding and Coverage

The Medicare tax rate for 2025 directly influences the funding and coverage aspects of the Medicare program. The tax revenue generated from the 2.9% rate, along with the potential surtax for high-income earners, plays a vital role in sustaining the program's operations and providing healthcare benefits to millions of Americans.

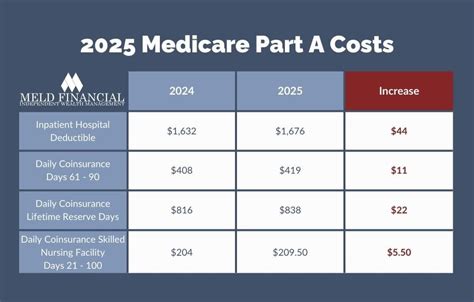

The Medicare program offers comprehensive healthcare coverage, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). The tax revenue collected from the Medicare tax rate contributes to funding these essential healthcare services, ensuring that eligible individuals have access to the care they need.

Furthermore, the Medicare tax rate also influences the program's ability to adapt to changing healthcare needs and advancements. With the tax revenue, the Medicare program can invest in research, technology, and infrastructure to improve healthcare outcomes and patient experiences. This ensures that the program remains dynamic and responsive to the evolving healthcare landscape.

Ensuring Program Sustainability

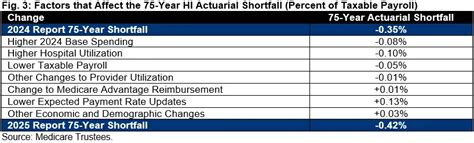

Maintaining the financial stability of the Medicare program is crucial to its long-term sustainability. The Medicare tax rate for 2025, along with the potential surtax for high-income earners, plays a critical role in achieving this goal. By ensuring a steady stream of revenue, the program can effectively manage its expenses, such as covering healthcare costs, administering the program, and investing in future improvements.

The Medicare program faces various challenges, including an aging population, rising healthcare costs, and advancements in medical technology. By adequately funding the program through the Medicare tax rate, policymakers and healthcare administrators can address these challenges and ensure the program's viability for years to come.

Additionally, the Medicare tax rate for 2025 promotes fairness and equity in healthcare contributions. By requiring individuals and employers to contribute a percentage of their earned income, the program ensures that healthcare coverage is not solely reliant on individual wealth or income levels. This approach fosters a sense of shared responsibility and solidarity within the healthcare system.

Employer Responsibilities and Withholding

Employers play a critical role in the Medicare tax collection process. They are responsible for withholding the employee's share of the Medicare tax from their wages and remitting it to the appropriate tax authorities. This process ensures that employees' contributions are accurately calculated and timely paid, contributing to the overall funding of the Medicare program.

Employers must stay informed about the Medicare tax rate and any changes or adjustments that may occur. They should implement accurate payroll withholding practices to ensure compliance with the tax regulations. This includes calculating the correct tax amounts, deducting them from employees' wages, and submitting the funds to the designated tax agencies.

Additionally, employers should provide clear and transparent information to their employees regarding their Medicare tax contributions. This helps employees understand the impact of the tax on their earnings and the importance of their contributions to the overall healthcare system. By fostering a culture of transparency and education, employers can encourage employees to take an active role in supporting the Medicare program.

Employer Compliance and Reporting

Employers must adhere to strict compliance requirements when it comes to Medicare tax withholding and reporting. They are responsible for accurately calculating and withholding the employee's share of the tax, as well as matching it with their own contribution. This ensures that the tax is collected and remitted to the appropriate authorities in a timely manner.

Employers should maintain detailed records of the Medicare tax withholding and payments. These records should include information such as employee names, wages, and the amount of tax withheld. These records are crucial for auditing purposes and ensure that employers can demonstrate compliance with tax regulations.

Furthermore, employers should stay updated on any changes or updates to the Medicare tax regulations. This includes being aware of any adjustments to the tax rate, income thresholds, or reporting requirements. By staying informed, employers can avoid penalties and ensure that their payroll processes are in line with the latest tax guidelines.

Future Implications and Potential Adjustments

As we look ahead to the future, it is important to consider the potential implications and adjustments that may impact the Medicare tax rate. While the rate remains stable for 2025, policymakers and healthcare experts continuously evaluate the program's financial health and make adjustments as necessary.

One potential area of focus is the rising healthcare costs and the impact they may have on the Medicare program. With advancements in medical technology and an aging population, healthcare expenses are expected to increase. To maintain the program's financial stability, policymakers may consider adjusting the Medicare tax rate or implementing additional measures to generate revenue.

Additionally, the changing demographics and healthcare needs of the population may also influence future adjustments to the Medicare tax rate. As the baby boomer generation ages and the number of eligible Medicare beneficiaries increases, the program may require additional funding to sustain its coverage and services. Policymakers may explore various options, such as increasing the tax rate or exploring alternative funding mechanisms, to ensure the program's long-term viability.

It is worth noting that any adjustments to the Medicare tax rate would be carefully considered and balanced with the goal of maintaining the program's accessibility and affordability. Policymakers would need to strike a delicate balance between generating sufficient revenue to support the program and minimizing the impact on individuals and employers.

Potential Alternatives and Reforms

In addition to adjusting the Medicare tax rate, policymakers may explore alternative funding mechanisms to support the program's sustainability. One potential approach is to broaden the tax base by including additional sources of income, such as capital gains or investment income, in the calculation of the Medicare tax. This could help generate additional revenue while maintaining fairness and equity.

Furthermore, reforms to the Medicare program itself may also be considered to enhance its efficiency and effectiveness. This could involve streamlining administrative processes, improving cost-control measures, or exploring innovative payment models that incentivize value-based care. By implementing these reforms, the program may be able to optimize its resources and better manage its expenses, potentially reducing the reliance on tax revenue.

It is important for stakeholders, including policymakers, healthcare professionals, and the general public, to engage in open dialogue and collaboration to shape the future of the Medicare program. By actively participating in these discussions, individuals can contribute to the development of sustainable solutions that ensure the program's longevity and accessibility for generations to come.

What happens if an employer fails to withhold or remit the Medicare tax?

+

Employers have a legal obligation to withhold and remit the Medicare tax. Failure to do so can result in penalties and interest charges. It is crucial for employers to stay compliant with the tax regulations to avoid legal consequences and maintain a positive relationship with their employees and the tax authorities.

How often does the Medicare tax rate change?

+

The Medicare tax rate is typically adjusted periodically to ensure the program’s financial stability. While the rate remains stable for 2025, future adjustments may be made based on the program’s funding needs and healthcare landscape. It is advisable for individuals and employers to stay informed about any changes to the tax rate.

Are there any exceptions or exemptions to the Medicare tax rate?

+

Generally, the Medicare tax rate applies to all earned income, including wages and self-employment income. However, there may be specific exemptions or exceptions for certain individuals, such as those with religious objections or those covered by certain government programs. It is recommended to consult with tax professionals or the relevant tax authorities for detailed information on exemptions.