South Dakota Taxes

Welcome to an in-depth exploration of South Dakota's taxation system. In this comprehensive guide, we will delve into the unique features, rates, and implications of South Dakota's tax landscape. From its reputation as a tax-friendly state to the various revenue streams it relies on, we'll uncover the intricacies of how South Dakota manages its finances.

The Low-Tax Haven: An Overview of South Dakota’s Tax Structure

South Dakota is renowned for its conservative approach to taxation, often earning the title of a “low-tax state.” This reputation is well-deserved, as the state boasts some of the lowest tax rates in the nation, making it an attractive destination for businesses and individuals alike. The state’s tax structure is designed to foster economic growth and encourage investment, contributing to its thriving business environment.

One of the key aspects of South Dakota's tax system is its lack of personal income tax. Unlike many other states, South Dakota does not impose a tax on individual income, which significantly reduces the tax burden for residents and businesses operating within its borders. This absence of income tax is a major draw for individuals and companies seeking to minimize their tax obligations.

Additionally, South Dakota has a relatively straightforward and business-friendly sales tax system. The state sales tax rate is set at a competitive 4.5%, with local municipalities having the authority to add additional sales tax percentages. This flexibility allows cities and counties to generate their own revenue streams while keeping the overall sales tax rate manageable for consumers.

Furthermore, South Dakota's property tax system is designed to be fair and equitable. The state relies on property taxes as a significant source of revenue, but it ensures that the burden is distributed fairly among property owners. The property tax rate is determined by the assessed value of the property and the tax levy set by local governments. This approach ensures that property owners pay their fair share based on the value of their assets.

| Tax Type | Rate |

|---|---|

| Sales Tax | 4.5% (state) + local add-ons |

| Property Tax | Varies by county and property value |

| Corporate Income Tax | 4.9% (flat rate) |

| Excise Taxes | Varies by product and industry |

South Dakota also imposes excise taxes on various goods and services, such as tobacco, alcohol, and fuel. These taxes are designed to generate revenue while also serving as a deterrent for certain behaviors, such as smoking and excessive alcohol consumption. The state's excise tax rates are competitive compared to other states, further enhancing its tax-friendly reputation.

In terms of corporate taxes, South Dakota maintains a flat corporate income tax rate of 4.9%, making it one of the lowest in the country. This low corporate tax rate, coupled with the absence of personal income tax, makes South Dakota an appealing destination for businesses looking to minimize their tax liabilities.

South Dakota’s Tax Incentives and Business Benefits

South Dakota’s tax structure is not only characterized by its low rates but also by its strategic use of tax incentives to attract businesses and promote economic development. The state offers a range of tax credits and incentives to encourage investment, job creation, and innovation.

One notable incentive is the Research and Development Tax Credit, which provides a credit against corporate income tax for qualified research expenses. This incentive aims to foster innovation and technological advancement within the state. Additionally, South Dakota offers tax credits for investing in renewable energy projects, supporting the state's transition to a cleaner and more sustainable energy landscape.

The state also provides tax exemptions for certain industries, such as manufacturing and agriculture. These exemptions are designed to support the growth of these critical sectors, making South Dakota an attractive location for businesses in these fields. By offering tax relief, the state incentivizes investment and job creation, ultimately contributing to its robust economy.

Moreover, South Dakota has implemented various tax incentives to promote tourism and boost its hospitality industry. The state offers sales tax exemptions for certain tourism-related purchases, such as accommodations and admission fees, which can make South Dakota an even more appealing destination for travelers.

The combination of low tax rates and strategic incentives makes South Dakota an attractive proposition for businesses and investors. The state's tax-friendly environment not only reduces the financial burden on businesses but also encourages economic growth, job creation, and innovation.

South Dakota’s Revenue Sources: Beyond Taxes

While taxes are a significant source of revenue for South Dakota, the state also generates income from a diverse range of other sources. This diversification ensures a stable financial foundation and contributes to the state’s overall economic health.

One of the key revenue streams for South Dakota is its natural resources. The state is rich in minerals, including gold, silver, and various other valuable commodities. The mining industry plays a vital role in the state's economy, generating significant revenue through the extraction and sale of these resources. The state carefully regulates the mining industry to ensure sustainable practices and maximize revenue generation.

South Dakota also benefits from its agricultural sector. The state's fertile lands and favorable climate make it an ideal location for farming and ranching. The production of crops and livestock contributes to the state's economy, with revenue generated through the sale of agricultural products both domestically and internationally. South Dakota's agricultural industry is a key driver of its economic growth and stability.

Furthermore, South Dakota's tourism industry is a significant revenue generator. The state's natural beauty, including its national parks and iconic landmarks, attracts visitors from around the world. The hospitality and tourism sectors contribute to the state's economy through accommodation, dining, and entertainment services. South Dakota's tourism industry is a vital source of employment and revenue, especially in its vibrant cities and scenic destinations.

In addition to these traditional revenue streams, South Dakota has also embraced the digital economy. The state has positioned itself as a hub for technology and innovation, attracting tech startups and established companies alike. The revenue generated from these digital enterprises further diversifies South Dakota's economic landscape and contributes to its overall prosperity.

By diversifying its revenue sources, South Dakota ensures a robust and resilient economy. The state's tax-friendly environment, coupled with its thriving industries and natural resources, creates a unique and attractive financial landscape that benefits both residents and businesses.

The Impact of South Dakota’s Tax Policies

South Dakota’s tax policies have had a profound impact on its economic development and overall financial health. The state’s low-tax environment has attracted a diverse range of businesses and industries, contributing to its thriving economy. By keeping tax rates competitive and offering strategic incentives, South Dakota has become a hub for economic growth and investment.

The absence of personal income tax has particularly benefited individuals and families. Residents of South Dakota enjoy a higher disposable income, allowing them to allocate their earnings towards savings, investments, and discretionary spending. This, in turn, stimulates the local economy and creates a positive feedback loop of economic growth.

The state's low corporate tax rate has been a significant draw for businesses, especially those looking to expand or relocate. By minimizing their tax liabilities, companies can allocate more resources towards growth, innovation, and job creation. South Dakota's business-friendly tax environment has attracted a diverse range of industries, from manufacturing and technology to agriculture and hospitality.

Moreover, South Dakota's tax policies have fostered a culture of entrepreneurship. The state's low tax burden and supportive business environment make it an ideal location for startups and small businesses. Aspiring entrepreneurs can launch their ventures with reduced financial barriers, contributing to the state's dynamic and innovative business landscape.

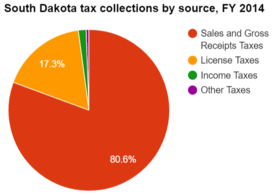

However, it's important to note that South Dakota's tax policies have also had their challenges. The state's reliance on sales and property taxes, while beneficial for economic growth, can place a heavier burden on lower-income individuals and families. Additionally, the absence of personal income tax may limit the state's ability to fund essential services and infrastructure projects.

To address these challenges, South Dakota has implemented various initiatives to ensure a balanced and equitable tax system. The state has focused on investing in education, healthcare, and infrastructure, while also maintaining a competitive tax environment. This approach aims to strike a delicate balance between economic growth and social welfare, ensuring that the benefits of South Dakota's tax policies are shared across all segments of society.

South Dakota’s Tax Future: Trends and Predictions

As we look ahead, South Dakota’s tax landscape is expected to remain largely stable, with a continued focus on maintaining its low-tax reputation. The state’s conservative approach to taxation has proven successful in attracting businesses and residents, and there is little indication of a significant shift in this direction.

However, South Dakota is not immune to the evolving tax landscape and economic trends. The state will likely continue to monitor and adapt to changes in federal tax policies, ensuring that its tax system remains competitive and aligned with national trends. This includes keeping a close eye on potential changes to income tax policies, corporate tax rates, and other federal tax incentives.

Furthermore, South Dakota is likely to explore new revenue streams and diversify its tax base. As the state continues to embrace technological advancements and digital economies, it may consider implementing new taxes or adjusting existing ones to accommodate the changing business landscape. This could include exploring taxes on digital services, online sales, or other emerging industries.

South Dakota's tax policies will also be influenced by the state's ongoing commitment to economic development and job creation. The state may continue to offer strategic tax incentives and credits to attract specific industries and promote innovation. By targeting sectors with high growth potential, South Dakota can further enhance its economic competitiveness and create sustainable job opportunities for its residents.

In conclusion, South Dakota's tax system is a well-crafted and strategic approach to managing the state's finances. By combining low tax rates, targeted incentives, and a diverse range of revenue streams, South Dakota has created an attractive and prosperous economic environment. As the state continues to navigate the evolving tax landscape, it is well-positioned to maintain its reputation as a tax-friendly haven while also ensuring the long-term financial stability and prosperity of its residents and businesses.

What is South Dakota’s corporate income tax rate?

+South Dakota’s corporate income tax rate is 4.9%, one of the lowest in the nation.

Does South Dakota have a personal income tax?

+No, South Dakota does not impose a personal income tax on its residents.

What are some of the tax incentives offered by South Dakota?

+South Dakota offers tax credits for research and development, renewable energy investments, and various industry-specific exemptions to encourage economic growth.

How does South Dakota generate revenue beyond taxes?

+South Dakota generates revenue from natural resources, agriculture, tourism, and the digital economy, contributing to its diverse and robust financial landscape.