Property Tax Rebate Pa

In the state of Pennsylvania, property owners have access to various financial relief measures, including the Property Tax/Rent Rebate Program. This program offers eligible residents a rebate on property taxes or rent paid during the previous year, providing much-needed financial support and easing the tax burden on homeowners and renters alike. The Property Tax/Rent Rebate Program is a key initiative designed to make property ownership and renting more affordable for Pennsylvanians, particularly those with limited incomes or specific qualifications.

Understanding the Property Tax/Rent Rebate Program in Pennsylvania

The Property Tax/Rent Rebate Program is a crucial aspect of Pennsylvania’s commitment to supporting its residents. It aims to provide financial relief to eligible individuals by offering rebates on property taxes or rent payments. This program is especially beneficial for older adults, individuals with disabilities, and those with lower incomes, as it helps alleviate the financial strain associated with housing costs.

The program's eligibility criteria are designed to ensure that those who need it the most can access the benefits. To qualify for the Property Tax/Rent Rebate, applicants must meet certain age, residency, and income requirements. The program considers factors such as total income, property tax or rent payments, and the applicant's living situation.

For instance, let's consider a hypothetical scenario where an elderly couple, Mr. and Mrs. Johnson, reside in a modest home in Pennsylvania. They have lived in their home for over 30 years and rely primarily on their fixed retirement income. The Johnsons have heard about the Property Tax/Rent Rebate Program and are curious about their eligibility. By understanding the program's guidelines and requirements, they can determine if they qualify for this valuable financial assistance.

Eligibility Criteria and Application Process

To be eligible for the Property Tax/Rent Rebate Program, applicants must meet the following criteria:

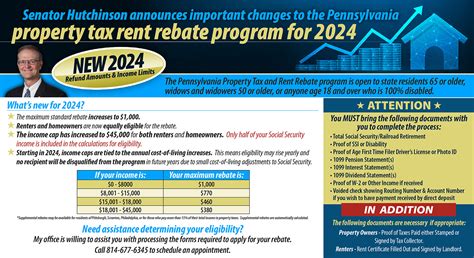

- Age: Applicants must be 65 years or older, a widow(er) aged 50 or older, or a person with disabilities of any age.

- Residency: Applicants must have resided in Pennsylvania for the entire previous calendar year and have owned or rented their primary residence in the state.

- Income: The applicant’s income must fall within the specified limits. For single applicants, the income limit is 35,000, while for married couples filing jointly, the limit is 40,000. Additional income limits apply for applicants with disabilities or dependent care expenses.

The application process for the Property Tax/Rent Rebate Program is straightforward. Applicants can download and complete the application form online or request a paper copy by mail. The form requires details about the applicant's personal information, income sources, and property tax or rent payments. It is essential to provide accurate and complete information to ensure a smooth application process.

Once the application is submitted, it undergoes a review process to verify eligibility. This may involve additional documentation or clarification of certain details. The Pennsylvania Department of Revenue aims to process applications within a reasonable timeframe, ensuring that eligible applicants receive their rebates promptly.

Calculating Rebates and Maximum Benefits

The amount of the Property Tax/Rent Rebate an applicant receives depends on their income and the type of housing they occupy. The rebate amount is calculated based on the applicant’s total income and the property tax or rent paid during the previous year.

For example, let's consider the case of Ms. Smith, a single woman living in a rental apartment in Philadelphia. Her annual income is $28,000, and she paid $7,500 in rent last year. By applying for the Property Tax/Rent Rebate Program, Ms. Smith can potentially receive a rebate of up to $500, which will help offset her rent expenses.

The maximum benefit an applicant can receive through the Property Tax/Rent Rebate Program is $650 for homeowners and $975 for renters. These maximum amounts provide significant financial relief to eligible Pennsylvanians, helping them manage their housing costs more effectively.

| Rebate Type | Maximum Benefit |

|---|---|

| Homeowners | $650 |

| Renters | $975 |

It's important to note that the rebate amount may be lower than the maximum benefit, depending on the applicant's specific circumstances and income level. The program's calculations consider various factors to ensure a fair and equitable distribution of financial assistance.

Impact and Benefits of the Property Tax/Rent Rebate Program

The Property Tax/Rent Rebate Program has had a significant impact on the lives of many Pennsylvanians, offering a range of benefits that go beyond financial relief.

Financial Relief and Improved Living Standards

One of the primary advantages of the program is the financial support it provides to eligible individuals. The rebates offered through the program directly contribute to reducing the financial strain associated with property taxes and rent. This financial relief allows residents to allocate their resources more effectively, improving their overall living standards.

For instance, consider a retired couple who rely solely on their pension income. With the Property Tax/Rent Rebate, they can allocate a portion of their rebate towards necessary home repairs or improvements, ensuring their residence remains comfortable and safe. This program enables them to maintain their quality of life and provides peace of mind regarding their financial obligations.

Encouraging Homeownership and Rent Stability

The Property Tax/Rent Rebate Program plays a crucial role in promoting homeownership and rent stability in Pennsylvania. By offering rebates to homeowners and renters, the program incentivizes individuals to invest in their housing situations and maintain their residences.

Renters, in particular, benefit from the program's focus on rent relief. The rebate assists renters in managing their monthly expenses, reducing the risk of eviction or displacement due to financial difficulties. This stability contributes to the creation of thriving communities and fosters a sense of belonging for renters across the state.

Supporting Vulnerable Populations

The Property Tax/Rent Rebate Program is especially beneficial for vulnerable populations, including seniors, individuals with disabilities, and those with limited financial means. These individuals often face unique challenges when it comes to housing affordability.

For seniors on fixed incomes, the program provides much-needed support to cover their property tax or rent obligations. This financial assistance ensures they can continue to live independently in their homes, preserving their dignity and quality of life. Similarly, individuals with disabilities benefit from the program's inclusive approach, allowing them to maintain stable housing and access necessary accommodations.

Community Engagement and Economic Impact

The Property Tax/Rent Rebate Program also has a positive impact on community engagement and the local economy. When residents receive rebates, they are more likely to reinvest those funds into their local communities. This infusion of money supports local businesses, stimulates economic growth, and strengthens the overall vitality of Pennsylvania’s neighborhoods.

Additionally, the program's focus on property tax relief encourages property owners to maintain and improve their properties. This investment in real estate not only enhances the aesthetic appeal of communities but also contributes to the overall economic value of the state's housing market.

Future Outlook and Potential Enhancements

As the Property Tax/Rent Rebate Program continues to serve Pennsylvanians, there are opportunities for further enhancement and improvement to ensure its long-term effectiveness and adaptability to changing economic circumstances.

Expanding Eligibility Criteria

One potential area for improvement is the expansion of eligibility criteria. While the current guidelines cover a significant portion of the population, there may be individuals who fall just outside the income limits or have unique circumstances that prevent them from qualifying. By broadening the eligibility criteria, the program can reach a wider range of residents in need of financial assistance.

For example, considering the rising cost of living and inflation, adjusting the income limits periodically to keep pace with economic changes could ensure that more Pennsylvanians benefit from the program. Additionally, exploring alternative eligibility factors, such as medical expenses or caregiver responsibilities, could further expand the program's reach and provide support to those facing specific challenges.

Increasing Maximum Rebate Amounts

Another aspect to consider is the maximum rebate amounts. While the current limits provide substantial relief, there may be instances where the financial burden of property taxes or rent exceeds the maximum rebate. Increasing the maximum rebate amounts could provide even greater support to eligible residents, especially those with higher housing costs.

By conducting regular reviews and analyses of housing market trends and resident feedback, the program administrators can make informed decisions about adjusting the maximum rebate limits. This ensures that the program remains responsive to the evolving needs of Pennsylvanians and provides adequate financial assistance to those who rely on it.

Enhancing Program Awareness and Accessibility

Ensuring that eligible residents are aware of the Property Tax/Rent Rebate Program and understand the application process is crucial for its success. Enhancing program awareness through targeted outreach efforts and educational campaigns can help reach a wider audience.

Utilizing various communication channels, such as social media, community events, and collaborations with local organizations, can effectively spread awareness about the program. Providing clear and concise information about eligibility criteria, application procedures, and rebate calculations can empower residents to take advantage of the financial benefits offered by the program.

Additionally, exploring digital solutions and online platforms can improve the accessibility and convenience of the application process. Implementing user-friendly online portals or mobile applications can streamline the application journey, making it more efficient and accessible for residents with limited access to traditional resources.

Conclusion

The Property Tax/Rent Rebate Program in Pennsylvania is a vital initiative that provides financial relief and support to eligible residents, helping them manage their housing costs effectively. By understanding the eligibility criteria, application process, and benefits of the program, Pennsylvanians can take advantage of this valuable resource and improve their financial well-being.

The program's impact extends beyond financial relief, fostering homeownership, rent stability, and community engagement. It plays a crucial role in supporting vulnerable populations and promoting economic growth in local communities. As the program evolves, expanding eligibility criteria, increasing maximum rebate amounts, and enhancing awareness and accessibility will ensure its continued success and adaptability to meet the changing needs of Pennsylvanians.

How often can I apply for the Property Tax/Rent Rebate Program?

+

You can apply for the Property Tax/Rent Rebate Program annually. The program runs from July 1st of the current year until June 30th of the following year. It is important to note that the application deadline may vary each year, so it is advisable to check the official website or contact the Pennsylvania Department of Revenue for the most up-to-date information.

Can I receive a rebate if I own multiple properties in Pennsylvania?

+

Yes, you can receive a rebate for each property you own in Pennsylvania, provided you meet the eligibility criteria for each property. The rebate is calculated based on the property taxes paid for each residence, so you can potentially receive multiple rebates if you qualify.

What happens if I move out of Pennsylvania during the year?

+

If you move out of Pennsylvania during the year, you may still be eligible for a partial rebate. The eligibility period for the Property Tax/Rent Rebate Program is based on your residency status as of December 31st of the previous year. Therefore, if you meet the residency requirement as of that date, you can still apply for a rebate for the portion of the year you resided in Pennsylvania.

Can I apply for the Property Tax/Rent Rebate Program if I receive Social Security benefits?

+

Yes, you can apply for the Property Tax/Rent Rebate Program even if you receive Social Security benefits. Social Security income is considered when calculating your total income for eligibility purposes. However, it is important to note that the amount of Social Security benefits you receive may impact your overall income and, consequently, your eligibility for the program.

Is there an age limit for the Property Tax/Rent Rebate Program?

+

Yes, there is an age limit for the Property Tax/Rent Rebate Program. To be eligible, you must be 65 years or older, a widow(er) aged 50 or older, or a person with disabilities of any age. These age requirements are in place to ensure that the program provides support to those who may have limited financial resources and face challenges in meeting their housing costs.