New Tax Bill

The passage of the new tax bill has sparked significant interest and debate among economists, policymakers, and the general public. This comprehensive legislation, officially known as the Tax Reform Act of 2023, introduces a range of reforms aimed at reshaping the tax landscape in the United States. With potential impacts on individuals, businesses, and the economy as a whole, understanding the intricacies of this bill is crucial for navigating the future financial landscape.

Unraveling the Tax Reform Act of 2023

The Tax Reform Act of 2023 represents a monumental shift in the nation’s tax policy, aiming to simplify the tax code, promote economic growth, and provide relief to taxpayers. Let’s delve into the key provisions and implications of this groundbreaking legislation.

Individual Tax Brackets and Rates

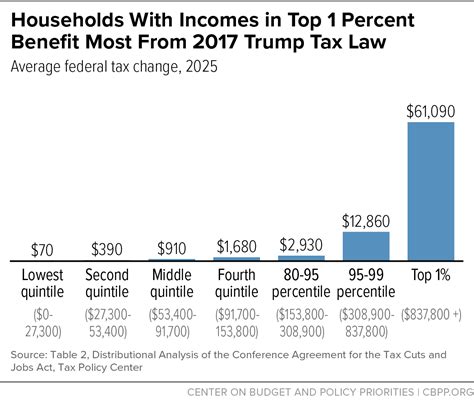

One of the most notable changes introduced by the Act is the modification of the individual income tax brackets. The new tax bill implements a progressive tax structure with seven brackets, each corresponding to a specific income range. The tax rates within these brackets have been adjusted, with the highest rate now applying to income exceeding 500,000 for individuals and 1,000,000 for married couples filing jointly. This adjustment aims to distribute the tax burden more equitably across different income levels.

Here’s a breakdown of the new individual tax brackets and rates:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | 0 - 10,000 | |

| 15% | 10,001 - 40,000 | |

| 20% | 40,001 - 80,000 | |

| 25% | 80,001 - 150,000 | |

| 30% | 150,001 - 250,000 | |

| 35% | 250,001 - 500,000 | |

| 37% | $500,001 and above |

Enhanced Child Tax Credit

The new tax bill expands the Child Tax Credit, a provision designed to provide financial support to families with children. Under the Act, the credit amount is increased to 3,000 per child under the age of 18 and 3,600 for children under the age of 6. Additionally, a larger portion of this credit is now refundable, ensuring that low-income families can benefit fully from this provision.

Business Tax Reforms

The Tax Reform Act of 2023 introduces significant changes to the way businesses are taxed, aiming to stimulate economic growth and investment. One of the key reforms is the reduction of the corporate tax rate from 21% to 20%, providing a competitive advantage to American businesses on the global stage. Furthermore, the bill encourages domestic manufacturing by offering tax incentives for companies that invest in research and development within the United States.

Another notable provision is the expansion of the Section 179 deduction, allowing businesses to deduct the full cost of qualifying assets in the year they are placed in service. This provision, combined with bonus depreciation, provides substantial tax savings for businesses investing in new equipment and technology.

Simplifying Tax Filing

Recognizing the complexity of the tax code, the new tax bill includes measures to simplify the tax filing process for individuals and businesses. The Act introduces a new standard deduction, replacing the previous deduction for personal exemptions. This change aims to streamline tax filing, making it more straightforward for taxpayers to calculate their deductions.

Impact on the Economy

The Tax Reform Act of 2023 is projected to have a significant impact on the U.S. economy. By reducing tax burdens and encouraging investment, the bill is expected to stimulate economic growth, create jobs, and boost consumer spending. The enhanced Child Tax Credit, in particular, is anticipated to provide a boost to families’ disposable income, potentially leading to increased consumer confidence and spending.

However, it is essential to note that the economic impact may vary across different sectors and regions. While some industries may thrive under the new tax regime, others may face challenges. For instance, the reduced corporate tax rate could benefit large multinational corporations, but small and medium-sized businesses might require additional support to navigate the changing tax landscape.

Navigating the Post-Reform Landscape

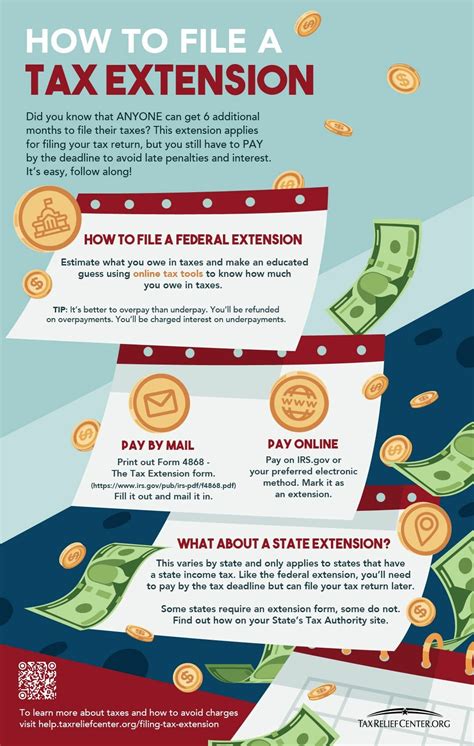

As the dust settles on the passage of the new tax bill, taxpayers and businesses alike are faced with the task of understanding and adapting to the changes. While the reforms aim to simplify the tax code, the transition period may present its own set of challenges.

Transition Period Challenges

The implementation of the Tax Reform Act of 2023 is expected to be gradual, with certain provisions taking effect immediately, while others will be phased in over time. This phased approach aims to provide a smoother transition for taxpayers and businesses, but it also means that tax planning strategies may need to be adjusted accordingly.

During the transition period, taxpayers should stay informed about the specific changes that apply to their tax situation. For instance, individuals who itemize deductions may need to reevaluate their strategies, as the standard deduction has been significantly increased. Similarly, businesses should assess how the new tax rates and incentives align with their financial goals and adjust their tax planning and investment strategies accordingly.

Maximizing Benefits for Individuals

For individuals, the new tax bill presents an opportunity to optimize their tax situation and potentially reduce their tax liability. Here are some strategies to consider:

- Reviewing income thresholds: Understanding the new tax brackets and rates is crucial for determining the most advantageous income level for tax purposes.

- Maximizing deductions: With the increased standard deduction, taxpayers who previously itemized may now find it more beneficial to take the standard deduction. However, those with significant medical expenses, mortgage interest, or charitable contributions may still find itemizing advantageous.

- Utilizing tax credits: The expanded Child Tax Credit and other tax credits, such as the Earned Income Tax Credit, can provide substantial savings for eligible individuals. It is essential to ensure that all eligible credits are claimed.

- Retirement planning: The new tax bill includes provisions related to retirement savings, such as increased contribution limits for certain retirement accounts. Individuals should review their retirement strategies and consider maximizing contributions to take advantage of these benefits.

Strategic Planning for Businesses

Businesses, too, have a range of opportunities and challenges presented by the new tax bill. Here are some key considerations:

- Tax rate analysis: With the reduced corporate tax rate, businesses should analyze their tax liability and determine if they are maximizing the benefits of the new rate. This may involve restructuring financial strategies to align with the new tax environment.

- Investment incentives: The expanded Section 179 deduction and bonus depreciation offer significant tax savings for businesses investing in equipment and technology. Strategic investment planning can help businesses optimize their tax positions while also modernizing their operations.

- International tax considerations: The Tax Reform Act of 2023 includes provisions related to international taxation, such as the Global Intangible Low-Taxed Income (GILTI) tax and the Base Erosion and Anti-Abuse Tax (BEAT). Businesses with international operations should carefully assess these provisions and seek expert advice to ensure compliance and maximize tax efficiency.

- Pass-through entity benefits: The new tax bill includes provisions specifically targeting pass-through entities, such as partnerships and S corporations. These entities may be eligible for a 20% deduction on qualified business income, providing a significant tax benefit. Business owners should consult tax professionals to understand their eligibility and maximize this opportunity.

Looking Ahead

The Tax Reform Act of 2023 marks a significant milestone in the nation’s tax policy, offering both challenges and opportunities for taxpayers and businesses. As the legislation takes effect, it is crucial for individuals and businesses to stay informed, seek professional advice, and adapt their financial strategies to navigate the evolving tax landscape effectively.

When does the Tax Reform Act of 2023 take effect?

+The Tax Reform Act of 2023 is already in effect, with certain provisions taking immediate effect upon passage. However, some provisions will be phased in over time, ensuring a gradual transition for taxpayers and businesses.

How can individuals maximize the benefits of the new tax bill?

+Individuals can maximize the benefits of the new tax bill by reviewing their tax situation, understanding the new brackets and rates, and taking advantage of expanded tax credits and deductions. Consulting a tax professional can provide personalized advice based on individual circumstances.

What impact does the new tax bill have on small businesses?

+The new tax bill offers opportunities for small businesses, such as reduced corporate tax rates and expanded investment incentives. However, small businesses may need additional support to navigate the changing tax landscape and take full advantage of these provisions. Consulting tax professionals and staying informed about relevant tax updates is crucial.

Are there any potential challenges or drawbacks to the new tax bill?

+While the Tax Reform Act of 2023 aims to simplify the tax code and provide tax relief, it may present challenges during the transition period. Additionally, certain provisions, such as the GILTI tax and BEAT, may have unintended consequences for certain businesses, particularly those with international operations. It is essential to stay informed and seek expert advice to navigate these potential challenges.