Orange Tax Rate

Welcome to this comprehensive exploration of the Orange Tax Rate, a crucial topic for businesses and individuals alike. In this article, we will delve into the intricacies of the tax system applicable to the vibrant city of Orange, providing you with a detailed understanding of its tax landscape and its implications.

Unveiling the Orange Tax Rate: A Comprehensive Overview

The Orange Tax Rate, an essential component of the city's financial framework, plays a pivotal role in shaping the economic dynamics of the region. This section aims to provide an in-depth analysis of the tax structure, its historical context, and its impact on various sectors.

Orange, a bustling metropolis known for its vibrant culture and thriving businesses, has a tax system designed to support its economic growth while maintaining fiscal responsibility. The city's tax policies have evolved over the years, reflecting its commitment to sustainability and community development.

Taxation in Orange: Key Components

The Orange Tax Rate encompasses a range of tax types, each with its own specific purpose and rate. Understanding these components is crucial for businesses and individuals to navigate the tax landscape effectively. Here's a breakdown of the key elements:

- Income Tax: One of the primary sources of revenue for the city, the income tax rate in Orange varies based on income brackets. It contributes significantly to the overall tax revenue and funds essential public services.

- Sales Tax: Applicable to a wide range of goods and services, the sales tax rate in Orange adds a small percentage to the purchase price, generating funds for infrastructure development and maintenance.

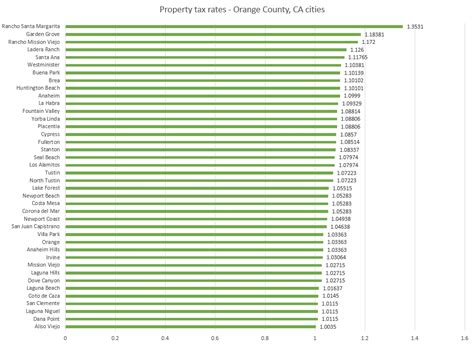

- Property Tax: Determined by the assessed value of properties, this tax supports local schools, fire departments, and other community services. Orange's property tax rates are carefully calibrated to ensure fairness and sustainability.

- Corporate Tax: Businesses operating within Orange's borders contribute to the city's revenue through corporate taxes. These taxes are structured to encourage economic growth while maintaining a competitive business environment.

- Excise Taxes: These taxes are levied on specific goods and activities, such as gasoline, tobacco, and certain recreational activities. Excise taxes in Orange contribute to targeted initiatives and support specialized public services.

| Tax Type | Rate | Key Features |

|---|---|---|

| Income Tax | Progressive Rates (0-5%) | Varies based on income, supports public services |

| Sales Tax | 8.5% | Applies to most goods and services, funds infrastructure |

| Property Tax | Varies (0.8-1.2% of assessed value) | Supports local communities, calculated fairly |

| Corporate Tax | Flat Rate (12%) | Encourages business growth, competitive environment |

| Excise Taxes | Varies (0.5-3%) | Targeted taxes for specific goods and activities |

Historical Perspective: Evolution of Orange's Tax Policies

The tax landscape in Orange has undergone significant transformations over the years, adapting to the changing needs of the city and its residents. Understanding this historical context provides valuable insights into the current tax structure.

In the early days of Orange's development, the tax system was primarily focused on generating revenue for basic infrastructure and public services. As the city grew and diversified, tax policies evolved to address emerging needs. The introduction of progressive income tax rates, for instance, aimed to promote social equity and support public welfare initiatives.

A notable milestone in Orange's tax history was the implementation of the Sales Tax Reform Act in the late 1990s. This act streamlined the sales tax system, simplifying the tax code and reducing administrative burdens for businesses. It also allocated a portion of the sales tax revenue specifically for infrastructure projects, contributing to the city's impressive network of roads and public transportation.

More recently, Orange has prioritized tax incentives and rebates to attract new businesses and foster economic growth. These incentives, coupled with a competitive corporate tax rate, have made the city an attractive hub for startups and established enterprises alike.

Impact on Businesses: Navigating the Orange Tax Landscape

For businesses operating in Orange, understanding the tax implications is crucial for financial planning and strategic decision-making. The city's tax structure offers both challenges and opportunities, and a proactive approach can lead to significant advantages.

One of the key considerations for businesses is the impact of the city's sales tax rate. While this rate is slightly higher than some neighboring regions, Orange's vibrant economy and strong consumer base often outweigh this factor. Many businesses have found success by offering unique products and services that appeal to the discerning tastes of Orange residents.

Moreover, Orange's tax incentives for research and development (R&D) have proven to be a significant draw for innovative companies. These incentives, coupled with a skilled workforce and a supportive business environment, have positioned Orange as a hub for technological advancements and entrepreneurial ventures.

From a strategic perspective, businesses can leverage the city's progressive tax structure to their advantage. By optimizing their tax strategies and taking advantage of available incentives, companies can minimize their tax liabilities and allocate resources more efficiently. This proactive approach can lead to increased profitability and long-term sustainability.

Community Impact: Tax Revenue Allocation and Development

The revenue generated through Orange's tax system plays a critical role in shaping the city's development trajectory and enhancing the quality of life for its residents. Understanding how tax revenue is allocated provides valuable insights into the city's priorities and future prospects.

A significant portion of the tax revenue in Orange is dedicated to education. The city's commitment to providing quality education is evident in its investment in schools, infrastructure, and teacher development programs. This focus on education not only benefits the current generation but also lays the foundation for a skilled workforce in the future.

Infrastructure development is another key area where tax revenue is allocated. Orange's impressive network of roads, bridges, and public transportation systems is a testament to the city's long-term vision. By investing in infrastructure, the city not only enhances mobility and connectivity but also attracts businesses and residents, fostering continued growth.

In addition to education and infrastructure, Orange allocates tax revenue to support healthcare initiatives, social services, and cultural programs. This holistic approach to community development ensures that the city's residents have access to essential services and a high quality of life.

Future Outlook: Navigating the Changing Tax Landscape

As the economic landscape continues to evolve, so too will Orange's tax policies. Staying abreast of these changes is crucial for businesses and individuals to adapt and thrive in the future.

One of the key trends in Orange's tax landscape is the increasing focus on environmental sustainability. As the city aims to reduce its carbon footprint and promote eco-friendly practices, tax incentives and rebates are likely to play a pivotal role. Businesses that embrace sustainable practices and innovations may find themselves at an advantage in this evolving landscape.

Furthermore, the digital transformation of tax systems is expected to streamline processes and enhance transparency. Orange is likely to embrace technological advancements, such as blockchain-based tax systems, to improve efficiency and reduce administrative burdens. This digital transformation will not only benefit businesses but also enhance the overall tax experience for individuals.

As we look ahead, Orange's tax system is poised to adapt and evolve, continuing to support the city's growth and development. By staying informed and proactive, businesses and individuals can navigate the changing tax landscape with confidence and leverage the opportunities it presents.

How does Orange’s tax rate compare to neighboring cities?

+Orange’s tax rates are generally comparable to those in nearby cities, with some variations. While the sales tax rate is slightly higher, Orange’s vibrant economy and strong consumer base often offset this difference. The city’s progressive income tax rates and competitive corporate tax environment make it an attractive location for businesses.

Are there any tax incentives for businesses in Orange?

+Absolutely! Orange offers a range of tax incentives and rebates to attract and support businesses. These incentives include tax breaks for research and development, startup support, and incentives for companies that embrace sustainable practices. These initiatives aim to foster economic growth and innovation.

How is Orange’s tax revenue allocated for community development?

+Orange’s tax revenue is allocated to support various community development initiatives. A significant portion goes towards education, infrastructure, and healthcare. The city also invests in social services, cultural programs, and initiatives that promote environmental sustainability. This holistic approach ensures a high quality of life for residents.