City Of Scottsdale Az Sales Tax

Scottsdale, Arizona, is renowned for its vibrant culture, bustling business environment, and picturesque desert landscapes. As a resident or business owner in this vibrant city, understanding the sales tax landscape is essential. The city's sales tax structure is an integral part of its economic ecosystem, impacting both local businesses and consumers alike. This article aims to provide a comprehensive guide to Scottsdale's sales tax, covering its history, current rates, and practical implications for businesses and residents.

A Historical Perspective on Scottsdale’s Sales Tax

The evolution of sales tax in Scottsdale reflects the city’s growth and changing economic dynamics. Scottsdale’s sales tax history can be traced back to [Year], when the city first implemented a sales tax rate of [Original Rate]%. This initial rate was introduced to fund essential city services and infrastructure development, reflecting Scottsdale’s commitment to balancing economic growth with community needs.

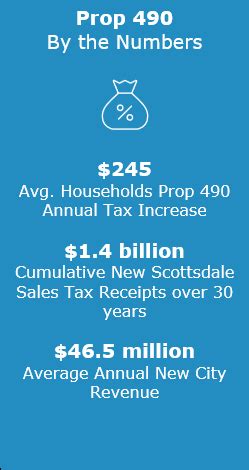

Over the years, Scottsdale's sales tax rate has undergone several adjustments. These adjustments were primarily driven by the need to adapt to changing economic conditions, fund specific initiatives, and maintain the city's financial stability. For instance, in [Year], the sales tax rate was increased to [New Rate]% to support [Initiative or Reason for Increase]. This strategic increase not only ensured the continuity of essential city services but also contributed to the development of [Specific Project or Improvement] – a project that has since become a cornerstone of Scottsdale's infrastructure.

Current Sales Tax Rates in Scottsdale

As of [Current Year], Scottsdale’s sales tax rate stands at [Current Rate]%, which is comprised of various tax components. These components include the state sales tax, which is set at [State Rate]%, and the city’s own sales tax rate, which is [City Rate]%. Additionally, Scottsdale levies a transaction privilege tax (TPT) at a rate of [TPT Rate]%, which is applicable to specific business activities.

To provide a comprehensive overview, here is a breakdown of the current sales tax rates in Scottsdale:

| Tax Type | Rate |

|---|---|

| State Sales Tax | [State Rate]% |

| City Sales Tax | [City Rate]% |

| Transaction Privilege Tax (TPT) | [TPT Rate]% |

It's important to note that these rates are subject to change, and it is the responsibility of businesses and consumers to stay informed about any updates. Scottsdale's official website provides regular updates on tax rates and relevant information for businesses and residents.

Sales Tax Exemptions and Special Considerations

While the standard sales tax rates apply to most goods and services, there are certain exemptions and special considerations in Scottsdale. For instance, certain essential items like groceries, prescription medications, and some clothing items are exempt from sales tax. Additionally, Scottsdale offers tax incentives and exemptions to promote specific industries and economic development initiatives.

To encourage sustainable practices, Scottsdale also implements a Green Business Program, which offers tax incentives to businesses that adopt environmentally friendly practices. This program not only promotes sustainability but also fosters a culture of innovation and responsibility within the business community.

Implications for Businesses

Scottsdale’s sales tax structure has significant implications for businesses operating within the city. For retail and service-based businesses, the sales tax rate directly impacts their pricing strategies and competitive positioning. Businesses must carefully calculate and include sales tax in their pricing to ensure compliance and maintain a competitive edge.

Moreover, businesses in Scottsdale are responsible for collecting and remitting sales tax to the appropriate authorities. This process involves accurate record-keeping, tax calculation, and timely submissions. Failure to comply with these obligations can result in penalties and legal repercussions. To streamline this process, Scottsdale provides businesses with resources and tools to facilitate tax compliance.

Strategies for Tax Compliance and Business Growth

To navigate the complexities of sales tax compliance, businesses in Scottsdale can adopt several strategies. First and foremost, investing in robust accounting and bookkeeping systems is crucial. These systems automate tax calculations, ensuring accuracy and reducing the risk of errors.

Additionally, businesses can leverage technology to streamline tax compliance processes. Various software solutions are available to manage sales tax obligations, from calculating tax rates to generating tax reports. By integrating these tools into their operations, businesses can save time and resources, allowing them to focus on core business activities.

Furthermore, staying informed about sales tax regulations and updates is essential. Scottsdale's economic development and tax departments provide resources and workshops to educate businesses about their tax obligations. Attending these sessions can help businesses stay compliant and avoid potential pitfalls.

Impact on Residents and Consumers

Scottsdale’s sales tax rates also have a direct impact on residents and consumers. The tax is included in the prices of goods and services, affecting the overall cost of living in the city. Residents must factor in sales tax when budgeting for their purchases, especially for larger ticket items.

However, Scottsdale's sales tax structure also benefits residents in several ways. The tax revenue generated supports essential city services, including public safety, education, and infrastructure development. This, in turn, enhances the quality of life for residents and contributes to the city's overall prosperity.

Maximizing Value for Residents

To make the most of their purchasing power, residents can explore strategies to minimize the impact of sales tax. For instance, comparing prices across different retailers can help residents identify the best deals and potentially save on sales tax. Additionally, residents can take advantage of sales tax holidays, which are designated periods when certain items are exempt from sales tax.

Furthermore, Scottsdale's vibrant culture and diverse business landscape offer residents a wide range of options for shopping and leisure. By supporting local businesses, residents not only enjoy a unique experience but also contribute to the growth and vitality of their community.

Future Outlook and Potential Changes

As Scottsdale continues to evolve and adapt to changing economic conditions, its sales tax structure may also undergo further adjustments. The city’s commitment to economic growth and community development is likely to drive future decisions regarding sales tax rates and incentives.

Looking ahead, Scottsdale's economic development plans may include initiatives to attract new businesses and industries, which could potentially impact the sales tax landscape. Additionally, changes in state-level tax policies or economic shifts could also influence Scottsdale's sales tax rates and strategies.

Preparing for Potential Changes

To navigate potential changes effectively, both businesses and residents should stay informed about economic developments and tax updates. Staying connected with local business associations, economic development agencies, and tax authorities can provide valuable insights into upcoming changes and their potential implications.

Furthermore, businesses can diversify their revenue streams and explore innovative strategies to mitigate the impact of potential tax changes. By staying agile and adaptable, businesses can position themselves for long-term success, regardless of changes in the sales tax landscape.

Conclusion

Scottsdale’s sales tax structure is a dynamic component of its economic ecosystem, reflecting the city’s growth and commitment to community development. By understanding the historical context, current rates, and practical implications, businesses and residents can navigate the sales tax landscape with confidence. As Scottsdale continues to thrive and evolve, its sales tax policies will undoubtedly play a pivotal role in shaping the city’s future.

What is the sales tax rate in Scottsdale, AZ, for online purchases?

+Online purchases in Scottsdale are subject to the same sales tax rates as in-person transactions. The current rate includes the state sales tax and the city’s own sales tax, resulting in a total rate of [Current Rate]%.

Are there any sales tax holidays in Scottsdale, and what items are typically exempt during these periods?

+Scottsdale does observe sales tax holidays, typically around specific holidays or events. During these periods, certain items, such as clothing, school supplies, and energy-efficient appliances, are exempt from sales tax. The dates and eligible items vary each year, so it’s advisable to check the official city website for updates.

How does Scottsdale’s sales tax compare to other cities in Arizona, and is it considered high or low compared to the state average?

+Scottsdale’s sales tax rate is generally aligned with the state average. While it may vary slightly from other cities, it is considered competitive and in line with the overall sales tax landscape in Arizona. The city’s rate reflects its commitment to balancing economic growth with community needs.