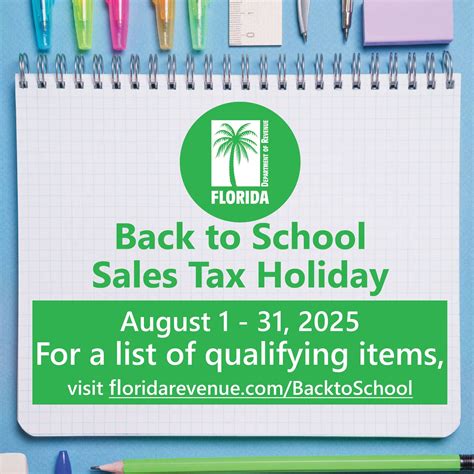

Tax Free Weekend In Florida

The tax-free weekend in Florida is an annual event that offers residents a unique opportunity to save on certain purchases, making it a highly anticipated time for shoppers and businesses alike. This event, officially known as the Back-to-School Sales Tax Holiday, is designed to ease the financial burden of back-to-school shopping and to stimulate the state's economy. In this article, we delve into the specifics of Florida's tax-free weekend, exploring its history, the eligible items, and its impact on both consumers and businesses.

A Brief History and Overview

Florida’s tax-free weekend is a legislative initiative aimed at providing relief to families preparing for the new school year. The event typically occurs over a long weekend, often coinciding with the end of August or the beginning of September, just before the start of the school term. This tradition began as a way to support families with the rising costs of education-related items, and it has since become a significant part of Florida’s retail calendar.

During this tax holiday, certain purchases are exempt from Florida's sales and use tax, which is currently set at 6% at the state level, with local surtaxes ranging from 0% to 2.5%. This exemption provides a substantial savings opportunity for shoppers, especially when purchasing multiple eligible items.

Eligible Items and Categories

The tax-free weekend in Florida focuses on items essential for education and school-related activities. Here is a comprehensive list of categories and specific items that are typically exempt from sales tax during this period:

Clothing and Accessories

- Apparel items, including shirts, pants, dresses, and skirts, with individual prices of 100 or less.</li> <li>Jackets, coats, and sweaters priced at 75 or less.

- Footwear, such as shoes, sandals, and boots, with prices of 60 or less.</li> <li>Accessories like belts, scarves, and hats, priced at 40 or less.

- Uniforms and protective clothing for specific occupations or sports, with prices capped at $50.

School Supplies

- Notebooks, paper, and writing pads.

- Pencils, pens, markers, and erasers.

- Backpacks, book bags, and lunch boxes.

- Rulers, protractors, compasses, and other basic school tools.

- Calculator prices up to $20.

Books and Educational Materials

- Textbooks, including digital textbooks.

- Reference books, dictionaries, and thesauruses.

- Maps, globes, and educational software.

- Art supplies like paint, clay, and craft kits.

- Musical instruments and instructional materials for grades K-12.

Computers and Electronics

- Laptops, tablets, and desktop computers with prices up to 1,000.</li> <li>Printers, scanners, and other computer peripherals priced at 250 or less.

- Software, including educational software, with a maximum price of 75.</li> <li>USB drives and flash drives.</li> <li>Calculators priced up to 20 (in addition to those mentioned above)

| Category | Price Cap |

|---|---|

| Clothing and Accessories | $100 |

| Uniforms and Protective Clothing | $50 |

| Footwear | $60 |

| Accessories | $40 |

| School Supplies | Varies (see list) |

| Books and Educational Materials | N/A |

| Computers and Electronics | $1,000 |

Impact on Consumers and Businesses

The tax-free weekend has a profound impact on both consumers and businesses in Florida. For consumers, it offers a chance to save significantly on essential school items, helping to stretch their budgets further. This event encourages early shopping, as many families plan their purchases strategically to take advantage of the tax exemption.

From a business perspective, the tax-free weekend presents a unique opportunity to boost sales and attract customers. Retailers often promote special deals and discounts during this period, further incentivizing shoppers. The increased foot traffic and sales can provide a much-needed boost to the local economy, especially for small businesses.

Strategies for Maximizing Savings

To make the most of Florida’s tax-free weekend, shoppers can employ several strategies:

Plan Ahead

Create a shopping list and research prices in advance. Many retailers offer pre-holiday sales, so you can get a head start on your purchases.

Compare Prices

Shop around for the best deals. With the tax exemption, prices can vary significantly between stores, so comparison shopping is key.

Take Advantage of Online Shopping

Many online retailers also participate in the tax-free weekend. This can be especially convenient for bulky items like computers or for those who prefer the ease of online shopping.

Combine with Coupons and Discounts

Look for additional savings by using coupons or taking advantage of loyalty program rewards. Some retailers offer special discounts specifically for the tax-free weekend.

Conclusion

Florida’s tax-free weekend is a unique opportunity for residents to save on essential school items. By understanding the eligible categories and planning their purchases, consumers can make the most of this event. For businesses, it presents a chance to boost sales and engage with customers, making it a mutually beneficial time for all.

When is the tax-free weekend in Florida typically held?

+The tax-free weekend usually occurs over a long weekend in late August or early September, just before the start of the school year.

Are all purchases exempt from sales tax during this period?

+No, only specific items related to school and education are exempt. The sales tax exemption does not apply to all purchases.

Can I buy multiple items under the price cap to save more money?

+Yes, as long as each item falls within the specified price cap for its category, you can purchase multiple items to maximize your savings.

Are there any limitations on the quantity of items I can buy during the tax-free weekend?

+There are no specific quantity limits, but some retailers might have their own restrictions or promotions that could impact the number of items you can purchase.