Arkansas State Taxes

Welcome to a comprehensive guide on the Arkansas State Taxes, a topic that affects every resident and business operating within the state. This article will delve into the specifics of Arkansas's tax system, providing an in-depth analysis of its various components and their implications. By the end, you'll have a thorough understanding of the tax landscape in Arkansas, complete with real-world examples and valuable insights.

Unraveling the Complexity of Arkansas State Taxes

Arkansas, like any other state, has its unique tax structure, which can often be complex and multifaceted. Understanding this system is crucial for individuals and businesses to navigate their financial obligations efficiently and avoid any potential pitfalls.

Income Tax: A Personalized Perspective

Arkansas imposes an income tax on its residents and nonresidents with income sourced from the state. The income tax structure is divided into seven tax brackets, ranging from 0% to 6.5%, with higher earners paying a progressive rate. For the tax year 2023, these brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,250 | 0% |

| $2,251 - $4,500 | 2% |

| $4,501 - $7,500 | 3% |

| $7,501 - $11,250 | 4% |

| $11,251 - $21,000 | 5% |

| $21,001 - $75,000 | 6% |

| Over $75,000 | 6.5% |

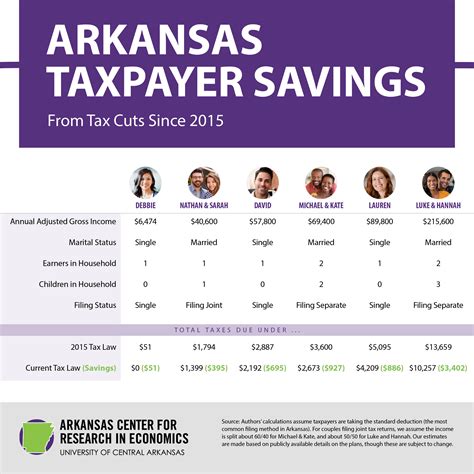

For example, consider a resident of Arkansas with a taxable income of $50,000 for the year. They would fall into the 5% tax bracket, meaning they'd owe $2,500 in state income tax. This is a straightforward calculation, but the real complexity arises when we consider various deductions, credits, and exemptions, which can significantly reduce the tax burden.

One notable deduction available in Arkansas is the Standard Deduction, which for tax year 2023 is set at $4,500 for single filers and $9,000 for married filing jointly. This deduction reduces the taxable income, effectively lowering the tax liability. Additionally, Arkansas offers various tax credits for specific expenses, such as education, child care, and healthcare costs, further reducing the tax burden.

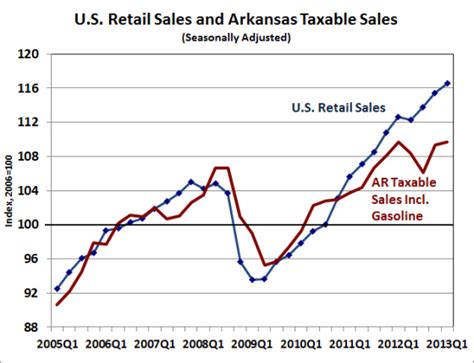

Sales and Use Tax: A Business Perspective

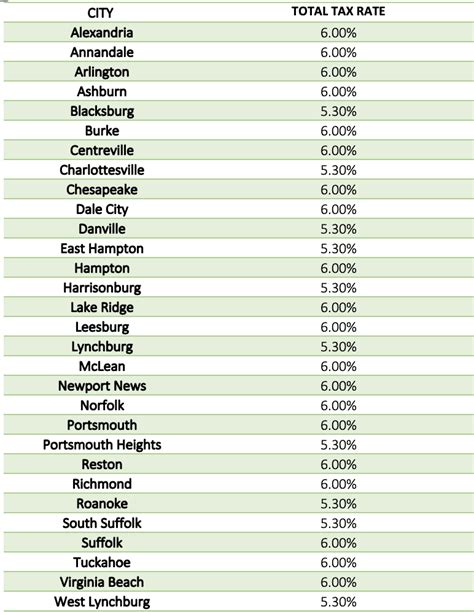

Arkansas levies a sales and use tax on the sale of tangible personal property and certain services within the state. The base sales tax rate is 6.5%, but this can vary based on local ordinances, resulting in a combined rate of up to 11.5% in some areas. This tax is collected by businesses and remitted to the state, with a portion going to the county and municipality where the sale occurred.

For instance, a business in Little Rock, Arkansas, sells a product for $100. With a combined sales tax rate of 9.25%, the customer pays an additional $9.25, of which $6.50 goes to the state, and the remaining $2.75 is distributed to Pulaski County and the City of Little Rock. This is a crucial consideration for businesses, as it impacts their pricing strategies and overall profitability.

Furthermore, Arkansas has a use tax for goods purchased out-of-state and brought into Arkansas for use. This tax is designed to prevent tax evasion and ensure a level playing field for local businesses. The use tax rate is the same as the sales tax rate, and it's the responsibility of the purchaser to remit this tax to the state.

Property Tax: The Cost of Ownership

Property taxes are a significant component of Arkansas’s tax system, and they are levied on both real and personal property. The property tax rate varies across the state, with each county setting its own rate. On average, the effective property tax rate in Arkansas is 0.64%, which is slightly below the national average.

Let's consider a homeowner in Benton County, Arkansas, with a property assessed at $200,000. If the county's property tax rate is 0.75%, the homeowner would owe $1,500 in property taxes annually. This amount can be significantly reduced through various exemptions and homestead credits, which are designed to ease the tax burden on homeowners.

Other Arkansas State Taxes

In addition to the taxes mentioned above, Arkansas has a range of other taxes that affect specific industries and activities. These include:

- Franchise Tax: Corporations doing business in Arkansas are subject to a franchise tax, which is calculated based on their net worth.

- Severance Tax: This tax is levied on the extraction of natural resources, such as oil, gas, and timber.

- Motor Fuel Tax: A tax on gasoline and diesel fuel, which funds road construction and maintenance.

- Hunting and Fishing License Fees: Revenue from these fees goes towards wildlife conservation and habitat management.

The Impact of Arkansas State Taxes on Residents and Businesses

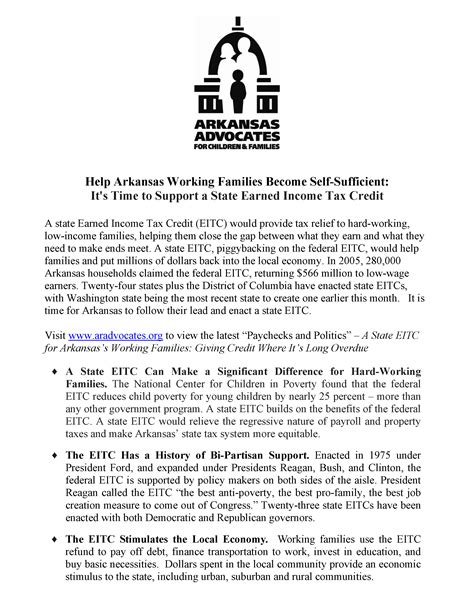

The tax system in Arkansas has a profound impact on both residents and businesses. For individuals, the progressive income tax structure means that higher earners pay a larger share of their income in taxes. However, the availability of deductions and credits can significantly reduce this burden, making Arkansas a relatively tax-friendly state for many.

Businesses, on the other hand, face a more complex landscape. The sales and use tax can impact pricing strategies and overall profitability, especially for businesses with a physical presence in multiple counties or cities with varying tax rates. Property taxes can also be a significant cost for businesses, especially those with large real estate holdings.

Looking Ahead: Future Implications and Potential Changes

As with any tax system, Arkansas’s structure is subject to change and evolution. Recent legislative initiatives and economic trends suggest some potential shifts in the near future:

Potential Income Tax Reforms

There have been ongoing discussions in the Arkansas legislature about reforming the income tax structure to make it more competitive with neighboring states. Some proposals include flattening the tax brackets or introducing a single-rate tax, which could significantly impact the tax burden for residents and businesses.

Sales Tax Expansion

With the increasing popularity of e-commerce, there is a growing push to expand the sales tax base to include more online transactions. This could mean that more businesses, even those without a physical presence in Arkansas, would be required to collect and remit sales tax to the state.

Property Tax Reforms

There have been calls for property tax reforms to make the system more equitable and predictable. Some proposals include limiting the rate of growth in assessed values or providing more generous homestead exemptions, which could significantly impact the tax burden for homeowners.

Economic Development Incentives

Arkansas has a history of offering economic development incentives, such as tax credits and abatements, to attract new businesses and industries. As the state continues to focus on economic growth, these incentives may become even more attractive and widespread, potentially offsetting some of the tax burdens for businesses.

Conclusion: Navigating the Arkansas Tax Landscape

Arkansas’s tax system is a complex web of various taxes and incentives, each with its own rules and implications. For residents and businesses, understanding this system is crucial for financial planning and strategic decision-making. While the state offers a range of benefits and incentives, the complexity of the system means that professional guidance and careful consideration are essential.

As we've explored in this guide, Arkansas's tax landscape is dynamic and ever-evolving. By staying informed and proactive, individuals and businesses can navigate this landscape successfully and make the most of the opportunities and challenges it presents.

What is the current income tax rate in Arkansas for 2023?

+

The income tax rates for Arkansas in 2023 range from 0% to 6.5%, with higher earners falling into higher tax brackets.

How does Arkansas’s sales tax compare to other states?

+

Arkansas’s base sales tax rate of 6.5% is slightly above the national average, but the combined rate can vary significantly depending on local ordinances.

Are there any tax incentives for businesses in Arkansas?

+

Yes, Arkansas offers a range of economic development incentives, including tax credits and abatements, to attract and support businesses.

What is the average property tax rate in Arkansas?

+

The average effective property tax rate in Arkansas is 0.64%, which is slightly below the national average.

Are there any proposed changes to Arkansas’s tax system in the near future?

+

Yes, there are ongoing discussions about reforming the income tax structure, expanding the sales tax base, and reforming property taxes to make them more equitable.