Md State Sales Tax

Maryland, a vibrant state nestled on the East Coast of the United States, boasts a diverse landscape ranging from bustling urban centers to tranquil coastal areas. As one of the wealthiest states in the country, Maryland's economy thrives on a blend of sectors, including biotechnology, aerospace, and cybersecurity, with a significant presence in both the public and private sectors.

The Maryland Sales and Use Tax is a critical component of the state's revenue generation system, playing a vital role in funding essential public services and infrastructure. This comprehensive guide aims to unravel the intricacies of the Maryland Sales and Use Tax, shedding light on its history, structure, rates, exemptions, and impact on businesses and residents alike.

The Historical Context of Maryland Sales Tax

The journey of the Maryland Sales and Use Tax dates back to the early 20th century, when the concept of a sales tax was gaining traction across the United States. In 1933, Maryland took its first step towards implementing a sales tax with the passage of Chapter 445, which established a 2% sales tax on retail sales of tangible personal property. This marked a significant shift in the state’s revenue generation strategy, moving away from the traditional reliance on property taxes.

Over the years, the Maryland Sales and Use Tax has undergone several transformations. Notable among these changes was the expansion of the tax base to include services, which occurred in 1967 with the introduction of the Sales and Use Tax Act. This act not only broadened the scope of the tax but also introduced a 5% rate, a significant increase from the initial 2% rate. The subsequent decades saw further adjustments, with rates fluctuating based on economic conditions and legislative priorities.

Understanding the Structure of Maryland Sales Tax

The Maryland Sales and Use Tax operates on a destination-based principle, which means the tax is levied based on the location where the product or service is used or consumed. This differs from an origin-based system, where the tax is determined by the seller’s location. The destination-based approach ensures that the tax burden is borne by the final consumer, regardless of where the sale originates.

The tax is levied on both tangible personal property and certain services. Tangible personal property includes items like furniture, electronics, and clothing, while taxable services encompass a wide range, including repair services, entertainment services, and certain professional services. However, it's important to note that not all services are subject to the sales tax; some, like medical and legal services, are specifically exempted.

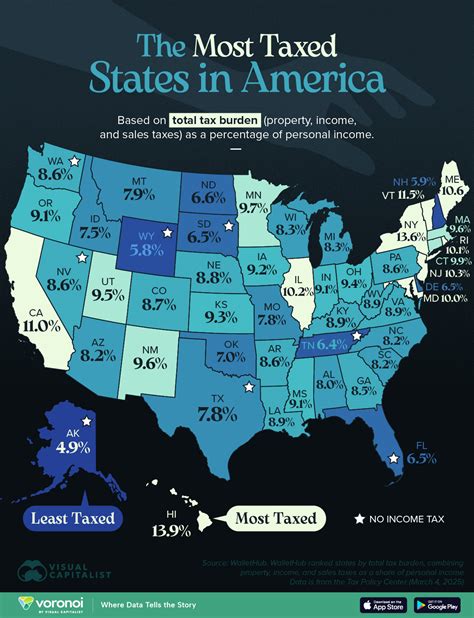

Maryland employs a statewide tax rate, meaning that a uniform tax rate is applied across the state. As of 2023, the statewide sales and use tax rate stands at 6%, which is applied to most taxable goods and services. However, it's worth mentioning that there are certain jurisdictions within Maryland that levy an additional local sales and use tax, resulting in a higher combined rate in those areas.

| Statewide Sales and Use Tax Rate | 6% |

|---|

Local Sales and Use Tax

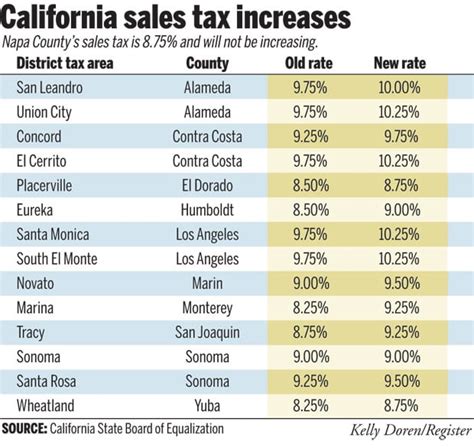

In addition to the statewide rate, local jurisdictions in Maryland have the authority to impose their own sales and use tax. These local taxes, often referred to as county or municipal sales and use taxes, can vary significantly across the state. As of 2023, the highest combined sales and use tax rate in Maryland is 9.25%, applicable in certain areas of Montgomery County. This rate includes both the statewide tax and the local add-on tax.

| Highest Combined Sales and Use Tax Rate (Montgomery County) | 9.25% |

|---|

Exemptions and Special Considerations in Maryland Sales Tax

While the Maryland Sales and Use Tax applies to a wide range of goods and services, there are several notable exemptions and special considerations worth highlighting.

Food and Drug Exemptions

One of the most significant exemptions in Maryland’s sales tax regime is for prepared food and drugs. This exemption, known as the Food and Drug Exemption, applies to items like ready-to-eat meals, snack foods, and certain beverages, as well as over-the-counter and prescription drugs. However, it’s important to note that this exemption does not extend to all food items; tangible personal property like canned goods and packaged snacks is subject to the sales tax.

Manufacturing Exemptions

Maryland offers a range of exemptions and special provisions for manufacturing activities. These provisions aim to encourage economic development and job creation in the state. For instance, manufacturers may be exempt from sales and use tax on the purchase of certain raw materials and machinery used in the manufacturing process. Additionally, there are provisions for inventory tax caps and resale exemptions, which further reduce the tax burden on manufacturers.

Sales Tax Holidays

To provide relief to consumers and boost economic activity, Maryland occasionally observes sales tax holidays. During these designated periods, certain categories of goods are exempt from the sales tax. For example, school supplies, clothing, and shoes may be tax-free during a designated school supply sales tax holiday. These holidays are typically announced in advance and offer a great opportunity for consumers to save on essential items.

Impact of Maryland Sales Tax on Businesses and Residents

The Maryland Sales and Use Tax has a significant impact on both businesses and residents in the state. For businesses, especially those engaged in retail and e-commerce, understanding and complying with the sales tax regulations is crucial for avoiding penalties and maintaining a positive relationship with customers.

Businesses must collect and remit the appropriate sales tax based on the location of their customers. This process, known as sales tax nexus, can be complex, especially for businesses with a physical presence in multiple jurisdictions. Maryland's tax authorities provide resources and guidance to help businesses navigate these complexities and ensure compliance.

For residents, the sales tax is a visible component of their purchasing decisions. While it adds to the cost of goods and services, it also funds essential public services and infrastructure. The tax revenue generated supports areas like education, healthcare, transportation, and public safety, directly impacting the quality of life in Maryland.

Compliance and Enforcement

The Maryland Comptroller’s Office is responsible for the administration and enforcement of the sales and use tax. The office provides a range of resources and tools to assist businesses and individuals in understanding and complying with the tax laws. This includes guidance on tax rates, registration processes, filing requirements, and tax payment options.

To ensure compliance, the Comptroller's Office employs a combination of audit programs and taxpayer education initiatives. Audits are conducted to verify the accuracy of sales tax reporting and collection, with penalties imposed for non-compliance. The office also offers educational workshops and webinars to help businesses and individuals understand their tax obligations and best practices for compliance.

Future Implications and Potential Changes

As with any tax system, the Maryland Sales and Use Tax is subject to potential changes and reforms. These changes can be driven by a variety of factors, including economic conditions, legislative priorities, and technological advancements.

Potential Rate Adjustments

One of the most significant changes that could impact the sales tax is an adjustment in the tax rate. While the statewide rate has remained stable at 6% for several years, local jurisdictions have the flexibility to adjust their rates. Additionally, there have been discussions at the state level about increasing the statewide rate to generate additional revenue, particularly in response to economic downturns or to fund specific initiatives.

E-Commerce and Remote Sellers

The rise of e-commerce has presented new challenges for sales tax collection. To address this, Maryland, like many other states, has implemented laws and regulations targeting remote sellers. These regulations often require remote sellers to collect and remit sales tax based on the destination of the sale, even if they do not have a physical presence in the state. This shift ensures that online retailers contribute their fair share to the state’s revenue and level the playing field for local businesses.

Streamlining and Simplification

There have been ongoing efforts to simplify and streamline the sales tax system in Maryland. These initiatives aim to reduce the administrative burden on businesses and improve compliance. Potential changes could include the consolidation of local tax rates, the introduction of sales tax holidays for specific sectors, or the expansion of exemptions to encourage economic growth in targeted areas.

Tax Reform Initiatives

Maryland, like many states, is exploring broader tax reform initiatives to enhance fairness, efficiency, and revenue generation. While sales tax is a significant component of the state’s revenue, it is just one part of the overall tax system. Potential reforms could involve a reevaluation of the tax structure, including considerations of income tax rates, property taxes, and corporate taxes, with the aim of creating a more balanced and equitable system.

Conclusion

The Maryland Sales and Use Tax is a dynamic and critical component of the state’s revenue generation system. With a rich history, a complex structure, and a wide range of exemptions and special considerations, it plays a pivotal role in funding public services and infrastructure. As Maryland continues to evolve, so too will its tax system, adapting to meet the changing needs of its residents and businesses.

For businesses and residents alike, staying informed about the latest developments in Maryland's sales tax landscape is essential. Whether it's understanding rate changes, navigating exemptions, or complying with evolving regulations, knowledge is power when it comes to sales tax. By staying engaged and proactive, individuals and businesses can ensure they are contributing to the state's prosperity while also protecting their own interests.

What is the current statewide sales and use tax rate in Maryland?

+The current statewide sales and use tax rate in Maryland is 6%.

Are there any local sales and use tax rates in Maryland?

+Yes, certain jurisdictions in Maryland levy an additional local sales and use tax. The highest combined rate as of 2023 is 9.25% in parts of Montgomery County.

What are some notable exemptions in Maryland’s sales tax regime?

+Maryland exempts prepared food, drugs, and certain manufacturing activities from sales tax. Additionally, there are provisions for sales tax holidays, offering temporary relief on specific categories of goods.

How does the sales tax impact businesses in Maryland?

+Businesses in Maryland must collect and remit the appropriate sales tax based on the location of their customers. Compliance with sales tax regulations is crucial to avoid penalties and maintain customer trust.

What resources are available to help businesses comply with Maryland’s sales tax laws?

+The Maryland Comptroller’s Office provides a range of resources, including guidance on tax rates, registration processes, and filing requirements. They also offer educational workshops and webinars to assist businesses in understanding their tax obligations.