Property Taxes In Jersey City Nj

Welcome to an in-depth exploration of property taxes in Jersey City, New Jersey, a critical aspect of homeownership and investment in this vibrant urban center. Jersey City, with its dynamic real estate market and diverse neighborhoods, presents a unique landscape for understanding the intricacies of property taxation. This article aims to provide a comprehensive guide, shedding light on the factors influencing tax rates, the assessment process, and strategies for effective management. Through an analysis of official data and industry insights, we aim to offer a clear and actionable framework for property owners and prospective buyers alike.

Understanding the Basics: Property Taxes in Jersey City

Property taxes are a significant component of the municipal revenue system in Jersey City, as they are in many municipalities across the United States. These taxes contribute to the funding of essential services such as education, infrastructure development, public safety, and more. The complexity of the property tax system in Jersey City, however, often leads to questions and concerns among residents and investors.

Jersey City's property tax system is primarily governed by state laws and local ordinances. The city's tax rate is determined annually and is applied uniformly to all taxable properties within the municipality. This rate is expressed as the millage rate, which represents the amount of tax per $1,000 of assessed property value. For instance, a millage rate of 2.5 means that a property with an assessed value of $500,000 would be taxed $1,250 ($500,000 x 2.5 mills) for the year.

Factors Influencing Property Tax Rates

Several key factors influence the determination of property tax rates in Jersey City. These include the city's overall budget requirements, the cost of providing public services, and the need to maintain or improve infrastructure. Additionally, state laws and guidelines play a crucial role in shaping the tax landscape. Here's a breakdown of some of the primary factors:

- Budget Needs: The city's annual budget is a significant determinant of the tax rate. As Jersey City's budget requirements change, so might the tax rate to meet these needs. This includes funding for education, public safety, healthcare, and other essential services.

- Cost of Services: The cost of providing public services, such as trash collection, snow removal, and street maintenance, can impact the tax rate. As these costs fluctuate, the tax rate may adjust accordingly.

- Infrastructure Upkeep: Maintaining and improving the city's infrastructure, including roads, bridges, and public buildings, is a substantial expense. The tax rate may reflect the need to finance these improvements.

- State Guidelines: New Jersey's state laws and regulations provide a framework for municipal taxation. These guidelines ensure that taxation practices are fair and consistent across the state.

Understanding these factors is crucial for property owners and investors as it provides insight into the rationale behind tax rates and potential future changes. It also highlights the importance of staying informed about local government initiatives and state legislation that could impact property taxes.

The Property Assessment Process in Jersey City

The process of assessing property values in Jersey City is a critical step in determining an individual property's tax liability. This assessment is a detailed evaluation conducted by the city's tax assessor, which takes into account various factors to arrive at a fair and accurate property value. Understanding this process can help property owners anticipate their tax obligations and potentially identify opportunities for appeal.

Key Steps in the Assessment Process

The property assessment process in Jersey City typically involves the following steps:

- Data Collection: The tax assessor's office collects information about each property in the city. This includes details such as the property's physical characteristics (e.g., size, number of rooms, age), recent sales data, and any improvements or renovations made to the property.

- Market Analysis: Using the collected data, the assessor conducts a thorough market analysis to determine the property's fair market value. This involves comparing the property to similar ones that have recently sold in the area, taking into account factors like location, condition, and any unique features.

- Assessment Calculation: Based on the market analysis, the assessor calculates the property's assessed value. This value is then multiplied by the city's millage rate to determine the annual property tax liability.

- Notification and Review: Property owners are notified of their assessed value and the corresponding tax liability. If a property owner disagrees with the assessment, they have the right to appeal and request a review by the tax assessor's office or a formal hearing.

It's important to note that the assessment process aims to ensure fairness and accuracy in taxation. However, given the dynamic nature of real estate markets and the potential for errors, property owners should remain vigilant and engage with the assessment process to protect their interests.

Strategies for Managing Property Taxes

Effectively managing property taxes is a key consideration for homeowners and investors in Jersey City. While the tax rate and assessment process are largely determined by the city and state, there are strategies that property owners can employ to optimize their tax obligations and potentially reduce their tax burden.

- Regular Property Maintenance: Keeping your property well-maintained can impact its assessed value. Regular upkeep and timely repairs can help ensure that your property is in good condition, which may positively influence its assessment.

- Stay Informed on Market Trends: Being aware of the local real estate market trends can provide valuable insights into property values. This knowledge can help you understand your property's value in the context of the market and potentially identify opportunities for tax savings.

- Explore Tax Incentives: Jersey City, like many municipalities, offers various tax incentives and exemptions. These can include homeowner tax credits, senior citizen or veteran exemptions, and more. Researching and understanding these incentives can help you maximize your tax savings.

- Consider Tax Appeals: If you believe your property's assessment is inaccurate or unfair, you have the right to appeal. The appeal process allows you to present evidence and arguments to support your case. It's important to gather documentation and consult with professionals who can guide you through this process.

By staying informed, proactive, and engaged with the tax assessment process, property owners can navigate the complexities of property taxation in Jersey City more effectively. This approach can lead to more favorable tax outcomes and a better understanding of the city's dynamic real estate landscape.

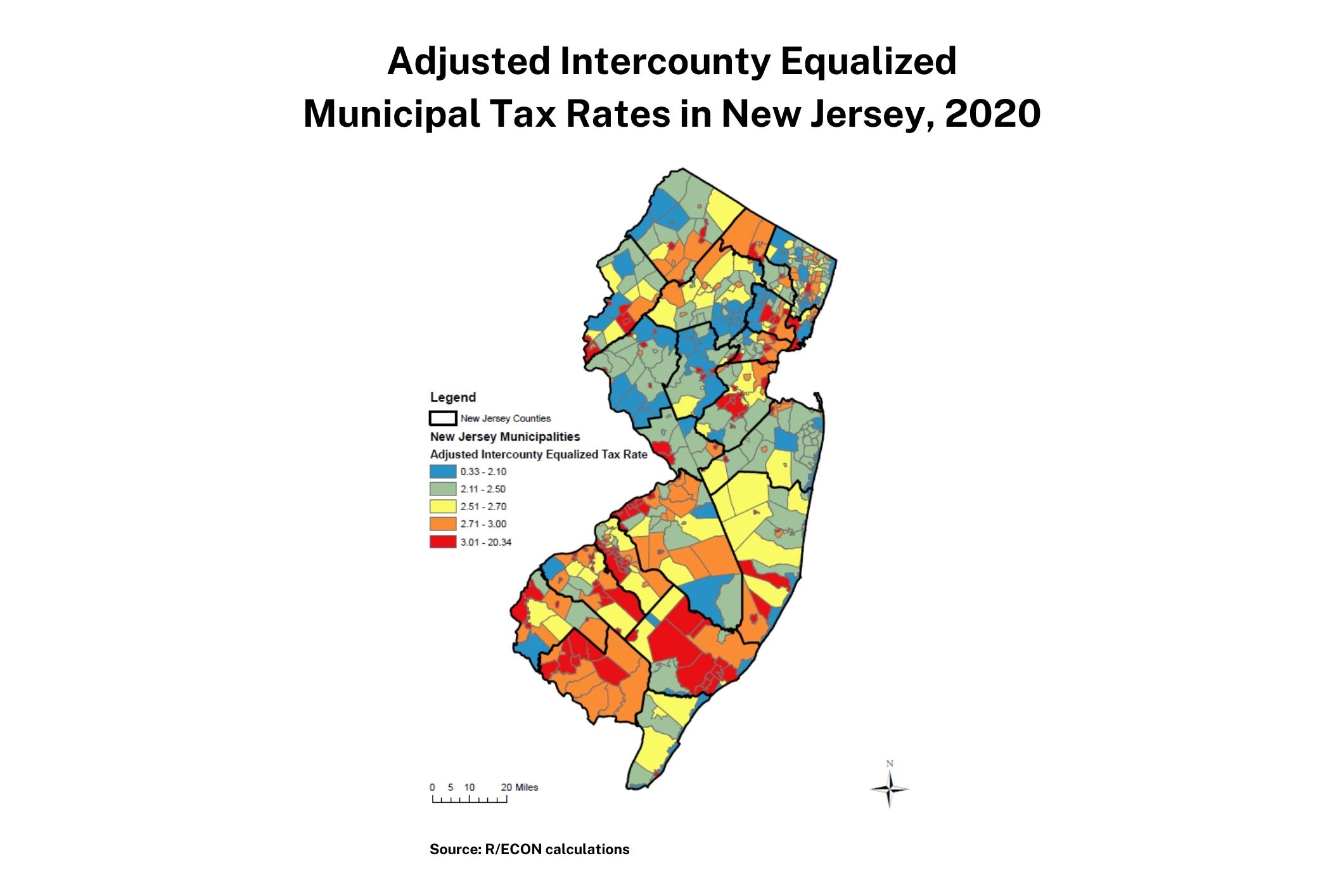

A Comprehensive Analysis of Jersey City's Tax Landscape

To gain a deeper understanding of property taxes in Jersey City, it's essential to delve into specific data and analyze trends. This section provides a comprehensive look at tax rates, assessed values, and the distribution of tax obligations across the city's diverse neighborhoods. By examining these factors, we can uncover insights that shape the tax landscape and influence the decisions of property owners and investors.

Tax Rates and Assessments by Neighborhood

Jersey City's diverse neighborhoods each present a unique tax profile. The city's tax assessor's office maintains detailed records of assessed values and tax obligations for each property. These records provide a wealth of information that can be analyzed to identify patterns and trends.

| Neighborhood | Median Assessed Value | Average Tax Rate | Tax Obligation (per $1,000 of Assessed Value) |

|---|---|---|---|

| Downtown | $650,000 | 2.6% | $1,690 |

| Journal Square | $520,000 | 2.5% | $1,300 |

| Bergen-Lafayette | $480,000 | 2.4% | $1,152 |

| The Heights | $600,000 | 2.55% | $1,530 |

| Liberty State Park | $720,000 | 2.7% | $1,944 |

| Greenville | $550,000 | 2.55% | $1,403 |

The above table provides a snapshot of median assessed values, average tax rates, and tax obligations for several prominent neighborhoods in Jersey City. It's evident that while the tax rate is generally consistent across the city, the assessed values and, consequently, the tax obligations vary significantly. This variation is influenced by factors such as property size, location, and market demand.

Trends and Patterns in Property Tax Distribution

A deeper analysis of Jersey City's property tax distribution reveals several interesting trends and patterns. By examining data over a longer period, we can identify shifts in tax obligations and understand how these changes impact different segments of the city's population.

One notable trend is the increasing tax burden on residential properties, particularly in neighborhoods experiencing rapid development and rising property values. As these areas become more desirable, property values increase, leading to higher tax assessments. This trend is evident in neighborhoods like Downtown and The Heights, where median assessed values have risen significantly over the past decade.

Conversely, in established neighborhoods with slower growth rates, property values may remain relatively stable, resulting in more consistent tax obligations. This stability can provide a sense of financial predictability for long-term residents. However, it's important to note that even in these areas, tax obligations can fluctuate due to changes in the city's budget needs or state-level tax policies.

Impact of Tax Policy Changes

Changes in tax policy at the state or municipal level can have a significant impact on property tax obligations in Jersey City. For instance, adjustments to the millage rate, introduction of new tax incentives, or changes in assessment methodologies can affect the tax landscape. Keeping abreast of these policy changes is crucial for property owners and investors to anticipate and plan for potential tax shifts.

In recent years, Jersey City has implemented several tax policy changes aimed at promoting economic development and supporting specific community initiatives. These changes have included tax abatements for new construction projects and incentives for businesses investing in certain targeted industries. While these policies can provide short-term benefits, they also have long-term implications for the city's tax revenue and the distribution of tax obligations.

As Jersey City continues to evolve, both in terms of its real estate market and tax policies, staying informed about these changes is essential. This knowledge empowers property owners and investors to make informed decisions and effectively manage their tax obligations in this dynamic urban environment.

The Future of Property Taxation in Jersey City

Looking ahead, the future of property taxation in Jersey City is likely to be shaped by a combination of economic, demographic, and policy factors. As the city continues to grow and evolve, its tax landscape will adapt to meet changing needs and priorities. This section explores potential future scenarios and their implications for property owners and investors.

Economic Factors and Their Impact

The economic health of Jersey City and the broader New York metropolitan area will significantly influence the city's tax landscape. A robust economy, characterized by strong job growth and rising incomes, often leads to increased demand for housing and commercial spaces. This, in turn, can drive up property values and, consequently, tax assessments.

Conversely, economic downturns or recessions can have the opposite effect, leading to decreased property values and potentially lower tax assessments. However, it's important to note that the impact of economic fluctuations on property taxes is often lagged, as it can take time for market changes to reflect in official assessments.

Demographic Shifts and Property Ownership

Demographic changes, particularly shifts in population composition and migration patterns, can also influence the future of property taxation in Jersey City. As the city attracts new residents and businesses, the demand for housing and commercial spaces may change, impacting property values and tax obligations.

For instance, an influx of young professionals or families could drive up demand for certain types of housing, leading to increased property values and higher tax assessments in those areas. Similarly, changes in the age distribution of the population can influence the demand for specific amenities and services, which may impact the city's budget requirements and, consequently, tax rates.

Policy Considerations and Potential Reforms

The future of property taxation in Jersey City is also tied to policy decisions at the local, state, and federal levels. Proposed reforms or changes in tax laws can significantly alter the tax landscape, impacting both residential and commercial property owners.

Potential reforms could include adjustments to the assessment process, changes in tax rates or exemptions, or the introduction of new tax incentives. These changes can be driven by a variety of factors, including political ideologies, economic priorities, and public sentiment. Staying informed about these potential reforms is crucial for property owners to understand how their tax obligations may evolve.

In conclusion, the future of property taxation in Jersey City is a complex interplay of economic, demographic, and policy factors. While it's challenging to predict specific outcomes, staying informed and engaged with these factors can help property owners and investors navigate the evolving tax landscape and make informed decisions about their real estate holdings.

Frequently Asked Questions (FAQ)

How are property tax rates determined in Jersey City, NJ?

+Property tax rates in Jersey City are set annually and are influenced by factors such as the city's budget needs, the cost of providing public services, and the need to maintain infrastructure. The tax rate is expressed as a millage rate, which is then applied uniformly to all taxable properties.

What is the assessment process for properties in Jersey City?

+The assessment process involves data collection, market analysis, and calculation of assessed values. The tax assessor's office collects property details, conducts a market analysis, and determines the property's assessed value, which is then used to calculate the tax liability.

Are there strategies to manage property taxes effectively in Jersey City?

+Yes, strategies include regular property maintenance, staying informed about market trends, exploring tax incentives, and considering tax appeals if you believe your assessment is inaccurate. Being proactive and engaged can help optimize your tax obligations.

How do economic and demographic factors impact future property taxation in Jersey City?

+Economic factors like job growth and income levels can influence property values and tax assessments. Demographic shifts, such as population changes, can also impact demand for housing and services, affecting budget requirements and tax rates. Staying informed about these factors is crucial for future planning.

This comprehensive guide to property taxes in Jersey City, New Jersey, aims to provide a clear understanding of the tax landscape for both current and prospective property owners. By examining the factors influencing tax rates, the assessment process, and strategies for effective management, we hope to empower readers with the knowledge to navigate this critical aspect of homeownership and investment.