Walker County Property Tax

When it comes to property ownership, understanding the intricacies of property taxes is essential. In the United States, property taxes are a significant source of revenue for local governments, funding various public services and infrastructure. This article will delve into the world of property taxes in Walker County, Alabama, exploring the assessment process, tax rates, and how property owners can navigate this essential aspect of homeownership.

Understanding Property Taxes in Walker County

Property taxes are levied on real estate properties, including land and improvements such as buildings, within a specific jurisdiction. These taxes are a primary revenue stream for local governments, enabling them to fund vital services like schools, emergency services, road maintenance, and more. In Walker County, Alabama, property taxes play a crucial role in supporting the community’s infrastructure and services.

The property tax system in Walker County operates under a uniform assessment ratio of 20%, as mandated by the Alabama Department of Revenue. This means that the assessed value of a property is determined by multiplying its fair market value by 20%. The assessed value is then used to calculate the property tax due.

The formula for calculating property taxes in Walker County is straightforward: Property Tax = Assessed Value x Tax Rate. The tax rate, set by local governing bodies, varies across different municipalities within the county. This variation allows for a more tailored approach to funding local services based on the specific needs and resources of each community.

| Municipality | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Jasper | 17.50 |

| Carbon Hill | 16.00 |

| Dora | 15.50 |

| Cordova | 14.75 |

| Sipsey | 14.50 |

It's important to note that these tax rates are subject to change annually, influenced by factors such as the county's budget requirements and the need to support local initiatives. Property owners in Walker County can stay informed about any adjustments by monitoring local government websites and news sources.

Property Tax Assessment Process

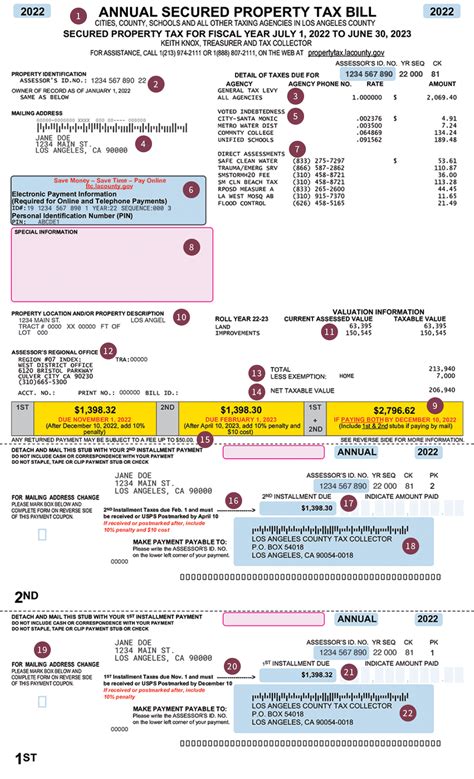

The property tax assessment process in Walker County involves several key steps. First, the county’s tax assessor’s office conducts regular property inspections to ensure accurate valuation. These inspections consider factors like property improvements, market trends, and other relevant data.

Once the assessed value is determined, property owners receive a notice of assessment, detailing the estimated value of their property. This notice also includes information about the appeal process, should the owner disagree with the assessed value. The appeal process provides an opportunity for property owners to present evidence supporting a different valuation.

After the assessment and potential appeals, the final assessed value is used to calculate the property tax due. Property owners then receive a tax bill, outlining the amount owed and the payment due date. It's essential for homeowners to review their tax bills carefully, ensuring the accuracy of the calculations and any applicable exemptions or deductions.

Navigating Property Taxes: Tips for Homeowners

Understanding the property tax landscape is crucial for homeowners in Walker County. Here are some tips to help navigate the process and ensure a smooth experience:

- Stay Informed: Keep abreast of local news and updates regarding property tax rates and assessments. Follow official channels like the county website and local government announcements to stay informed about any changes or initiatives that may impact your property taxes.

- Understand Your Assessment: When you receive your property assessment notice, take the time to review it carefully. Ensure the details, such as the property description and assessed value, are accurate. If you have any questions or concerns, reach out to the tax assessor's office for clarification.

- Explore Exemptions and Deductions: Walker County offers various exemptions and deductions that can reduce your property tax liability. These may include homestead exemptions, senior citizen discounts, or exemptions for certain types of properties. Research and understand the criteria for these benefits to determine if you qualify.

- Consider Payment Options: Walker County provides flexibility in property tax payments. Homeowners can choose to pay their taxes in full by the due date or opt for a payment plan. Explore the available options and select the one that best suits your financial situation.

- Keep Records: Maintain a record of your property tax payments, assessments, and any relevant documentation. This practice ensures you have a clear history of your tax obligations and can provide evidence if needed for future references or appeals.

The Impact of Property Taxes on Walker County Communities

Property taxes in Walker County are a significant driver of local economic development and community growth. The revenue generated from these taxes directly funds essential services and infrastructure projects, shaping the quality of life for residents.

For instance, property taxes contribute to the maintenance and improvement of public schools, ensuring a robust educational system for the county's youth. Additionally, these funds support emergency services, ensuring prompt and effective response to the community's needs. The impact extends to road maintenance, ensuring safe and efficient transportation networks, and various other public works projects that enhance the overall well-being of Walker County residents.

Moreover, property taxes play a crucial role in promoting economic growth and development within the county. They provide the financial foundation for initiatives aimed at attracting businesses and fostering economic diversity. This, in turn, creates job opportunities and stimulates local commerce, benefiting both residents and the county's overall prosperity.

Community Engagement and Transparency

Walker County recognizes the importance of transparency and community engagement in its property tax system. The county’s tax assessor’s office maintains an open-door policy, encouraging residents to reach out with questions or concerns. Regular town hall meetings and public forums provide opportunities for residents to voice their opinions and understand the tax allocation process.

The county's commitment to transparency extends to its online presence. The official Walker County website offers a dedicated section for property taxes, providing residents with easy access to tax rates, assessment information, and payment options. This digital platform ensures that homeowners can stay informed and efficiently manage their property tax obligations.

Furthermore, Walker County actively promotes community involvement in the budgeting process. Residents are encouraged to participate in public hearings and provide feedback on proposed budgets, allowing for a collaborative approach to financial decision-making. This engagement fosters a sense of ownership and trust in the property tax system, ensuring that the community's needs and priorities are reflected in the allocation of tax revenue.

Conclusion: A Comprehensive Guide to Walker County Property Taxes

Understanding property taxes in Walker County, Alabama, is a crucial aspect of responsible homeownership. From the assessment process to the impact on local communities, property taxes play a pivotal role in shaping the county’s landscape and supporting its residents. By staying informed, engaging with the community, and utilizing available resources, homeowners can navigate the property tax system with confidence.

As you embark on your journey as a homeowner in Walker County, remember that property taxes are not just a financial obligation but a contribution to the vibrant and thriving community you call home. With a proactive and informed approach, you can ensure that your property taxes are accurately assessed and utilized for the betterment of your community.

How often are property tax assessments conducted in Walker County?

+

Property tax assessments in Walker County are typically conducted every four years. However, the tax assessor’s office may conduct reassessments earlier if significant changes to a property occur, such as improvements or market value fluctuations.

Can I appeal my property tax assessment if I disagree with the valuation?

+

Yes, property owners in Walker County have the right to appeal their property tax assessments. The appeal process involves submitting evidence and arguments supporting your case. It’s essential to review the guidelines and timelines for appeals to ensure a successful outcome.

Are there any property tax exemptions or deductions available in Walker County?

+

Yes, Walker County offers various property tax exemptions and deductions. These include homestead exemptions, senior citizen discounts, military exemptions, and more. It’s advisable to research and understand the specific criteria and requirements for each exemption to determine your eligibility.

How can I stay updated on changes to property tax rates and assessments in Walker County?

+

To stay informed about changes to property tax rates and assessments in Walker County, it’s recommended to follow official sources. This includes the Walker County website, local news outlets, and social media channels of the tax assessor’s office. Additionally, attending public meetings and staying engaged with your local government can provide valuable insights into tax-related matters.

What happens if I don’t pay my property taxes on time in Walker County?

+

Failure to pay property taxes on time in Walker County can result in penalties and interest charges. In extreme cases, non-payment may lead to tax liens on your property, potentially impacting your credit score and future financial opportunities. It’s crucial to prioritize timely payment to avoid these consequences.