Nys Efile Sales Tax

New York State's electronic filing (e-filing) system for sales tax offers a convenient and efficient way for businesses to meet their tax obligations. The New York State Department of Taxation and Finance has implemented this system to streamline the process, providing a modern approach to tax compliance. In this comprehensive guide, we will delve into the intricacies of e-filing sales tax in New York State, offering a detailed analysis of the process, its benefits, and its impact on businesses.

Understanding the Necessity of E-filing Sales Tax in New York

The implementation of electronic filing for sales tax in New York State is a significant step towards modernizing tax administration. With a diverse and dynamic business landscape, ranging from small local retailers to large multinational corporations, the state recognizes the need for a flexible and efficient tax system. E-filing provides a user-friendly platform that caters to the varied needs of these businesses, simplifying the often complex process of sales tax reporting and payment.

Sales tax is a crucial source of revenue for New York State, funding essential services and infrastructure projects. By encouraging e-filing, the state aims to improve tax compliance, reduce administrative burdens, and ensure a fair and transparent tax system for all businesses. This system also allows for better tracking of tax collections, aiding in the state's fiscal planning and management.

The Process of E-filing Sales Tax in New York

E-filing sales tax in New York State is a straightforward process, designed with user convenience in mind. Here’s a step-by-step breakdown:

Step 1: Registration

The first step involves registering with the New York State Department of Taxation and Finance. This can be done online through the Taxpayer Services portal. During registration, businesses will need to provide basic information, including their business name, address, and federal tax ID or Social Security number. Once registered, businesses will receive a unique identification number and login credentials for future access.

Step 2: Account Setup

After registration, businesses need to set up their e-filing account. This involves providing additional details such as the type of business, the nature of sales, and the sales tax rate applicable to their operations. Businesses can choose from various filing frequencies, including monthly, quarterly, or semi-annually, depending on their sales volume and the state’s regulations.

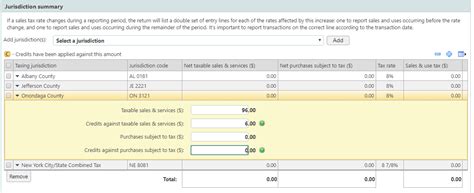

Step 3: Filing Sales Tax Returns

Filing sales tax returns electronically is a simple process. The system guides businesses through the process, prompting them to enter the relevant details such as sales transactions, taxable items, and any applicable exemptions. The system calculates the total tax liability based on the information provided, ensuring accuracy and reducing the risk of errors.

Step 4: Payment

Once the sales tax return is filed, businesses can make the payment through various electronic methods, including direct debit, credit card, or electronic funds transfer. The system provides a secure payment gateway, ensuring the safety and confidentiality of financial transactions. Businesses can also opt for automatic payment, where the tax amount is automatically deducted from their account on the due date.

Step 5: Record Keeping and Reporting

The e-filing system in New York State provides an efficient way to maintain sales tax records. Businesses can access their past filings, payments, and returns, ensuring easy access to historical data. The system also generates reports, providing a clear overview of tax obligations and payments, which can be useful for internal accounting and external audits.

| Filing Frequency | Due Date |

|---|---|

| Monthly | 23rd of the following month |

| Quarterly | 23rd of the month following the quarter |

| Semi-Annually | July 23rd and January 23rd |

Benefits of E-filing Sales Tax in New York

The transition to e-filing for sales tax offers numerous advantages to businesses operating in New York State. Here are some key benefits:

1. Convenience and Efficiency

E-filing provides a convenient and efficient way to manage sales tax obligations. The online system is accessible 24⁄7, allowing businesses to file and pay taxes at their convenience. The process is straightforward, eliminating the need for complex paperwork and manual calculations, thus saving time and resources.

2. Accuracy and Reduced Errors

The e-filing system reduces the risk of errors associated with manual filing. The system automatically calculates tax liabilities based on the information provided, ensuring accuracy. It also provides real-time error checking, prompting users to correct any discrepancies before final submission, thus minimizing the chances of penalties due to incorrect filings.

3. Enhanced Record Keeping

The e-filing system maintains a digital record of all sales tax transactions, returns, and payments. This provides an efficient way to keep track of tax obligations and ensures easy access to historical data. The system generates detailed reports, offering a comprehensive overview of tax activities, which can be valuable for internal analysis and external audits.

4. Secure and Confidential Transactions

The New York State Department of Taxation and Finance prioritizes the security and confidentiality of user data. The e-filing system employs robust encryption protocols to protect sensitive financial information during online transactions. This ensures that businesses can file and pay their sales tax securely, without compromising their data.

5. Timely Reminders and Alerts

The e-filing system provides timely reminders and alerts to help businesses stay on top of their tax obligations. Users can receive notifications about upcoming filing deadlines, pending payments, and other important updates via email or text messages. This proactive approach helps businesses avoid late fees and penalties, ensuring compliance with tax regulations.

Performance Analysis and Future Implications

The e-filing system for sales tax in New York State has shown significant improvements in tax compliance and efficiency. Since its implementation, the state has seen a steady increase in the number of businesses adopting e-filing, with a corresponding rise in tax collections. This trend indicates the system’s effectiveness in encouraging voluntary compliance and reducing administrative burdens.

Looking ahead, the state plans to further enhance the e-filing system by integrating it with other tax programs and services. This integration will provide a unified platform for businesses to manage their various tax obligations, simplifying the tax administration process. Additionally, the state aims to introduce more advanced features, such as real-time data analytics and predictive modeling, to optimize tax collections and improve the user experience.

In conclusion, the e-filing system for sales tax in New York State offers a modern, efficient, and user-friendly approach to tax compliance. By embracing this system, businesses can streamline their tax obligations, reduce administrative burdens, and contribute to the state's revenue stream. As the system continues to evolve, it promises to play a vital role in shaping the future of tax administration in New York State.

Can I register for e-filing sales tax online?

+Yes, the registration process for e-filing sales tax in New York State is entirely online. Businesses can register through the Taxpayer Services portal, providing basic information such as their business name, address, and federal tax ID or Social Security number.

What are the filing frequencies available for e-filing sales tax?

+Businesses can choose from various filing frequencies, including monthly, quarterly, or semi-annually. The choice depends on their sales volume and the state’s regulations. Monthly filing is suitable for businesses with high sales volumes, while quarterly or semi-annual filing is more convenient for smaller businesses with lower sales.

How secure is the e-filing system for sales tax in New York State?

+The e-filing system for sales tax in New York State employs robust security measures, including encryption protocols, to protect user data. The system ensures the confidentiality and security of financial transactions, giving businesses peace of mind when filing and paying their sales tax online.

Are there any penalties for late e-filing of sales tax returns?

+Yes, late e-filing of sales tax returns can result in penalties. The state imposes penalties and interest on late payments and returns. However, the e-filing system provides timely reminders and alerts to help businesses stay on top of their tax obligations, reducing the risk of late filings and associated penalties.