Tax Rate For San Francisco Ca

Welcome to our comprehensive guide on understanding the tax landscape in San Francisco, California. In this article, we will delve into the various tax rates applicable to individuals and businesses in the vibrant city of San Francisco. From income taxes to sales taxes, we will provide you with a detailed breakdown of the tax structure, ensuring you have all the information you need to navigate the fiscal obligations in this thriving metropolis.

Income Tax Rates in San Francisco

When it comes to income taxes, San Francisco operates under a progressive tax system, which means the tax rate increases as your income rises. This structure aims to ensure a fair distribution of tax obligations across different income levels.

California State Income Tax

As a resident of San Francisco, you are subject to California state income tax. The state’s income tax rates are determined by your taxable income and filing status. Currently, California has nine tax brackets ranging from 1% to 12.3%, with higher rates applicable to higher income levels.

Here’s a simplified table outlining the state income tax brackets for single filers in California:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - 8,450</td> <td>1%</td> </tr> <tr> <td>8,451 - 26,270</td> <td>2%</td> </tr> <tr> <td>26,271 - 36,950</td> <td>4%</td> </tr> <tr> <td>36,951 - 53,200</td> <td>6%</td> </tr> <tr> <td>53,201 - 76,700</td> <td>8%</td> </tr> <tr> <td>76,701 - 102,650</td> <td>9.3%</td> </tr> <tr> <td>102,651 - 257,650</td> <td>9.3%</td> </tr> <tr> <td>257,651 - 515,300</td> <td>10.3%</td> </tr> <tr> <td>Over 515,300 | 12.3% |

Please note that these rates are subject to change, so it's advisable to refer to the latest California tax guidelines for the most accurate information.

San Francisco Local Income Tax

In addition to state income tax, San Francisco imposes its own local income tax. The city’s income tax rate is set at 1.5% for all residents, regardless of income level. This local tax is applied on top of the state income tax, resulting in a combined rate that varies based on your income bracket.

For example, if you fall into the lowest tax bracket in California (0 - $8,450), your combined state and local income tax rate would be 2.5% (1% state tax + 1.5% local tax). As your income increases, the state tax rate rises, but the local tax remains consistent at 1.5%.

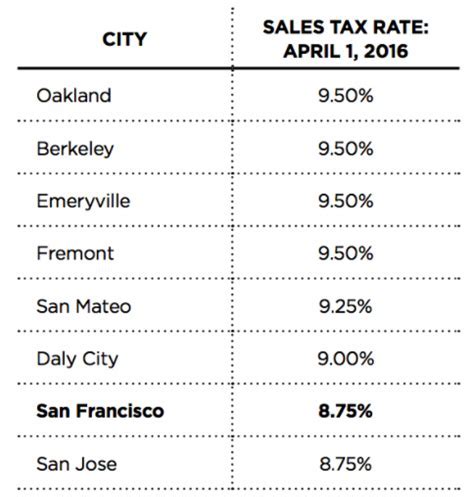

Sales and Use Taxes in San Francisco

Sales and use taxes are an essential part of the tax landscape in San Francisco. These taxes are levied on the sale of goods and services and are used to fund various public services and infrastructure projects.

California State Sales Tax

California imposes a state sales tax rate of 7.25% on most goods and some services. This rate is applied uniformly across the state, including San Francisco.

The state sales tax is applied to the purchase price of tangible goods, such as clothing, electronics, and furniture. It also applies to certain services, including repairs, installation, and delivery charges.

San Francisco Local Sales Tax

On top of the state sales tax, San Francisco imposes its own local sales tax rate of 1.25%. This additional tax brings the total sales tax rate in San Francisco to 8.5%.

The local sales tax is applied to the same types of transactions as the state sales tax. It helps fund various city-specific initiatives and services, ensuring the continued development and maintenance of San Francisco’s vibrant urban environment.

Use Tax in San Francisco

The use tax is similar to the sales tax but applies to goods purchased outside of San Francisco and brought into the city for use. This tax is designed to ensure that all purchases are subject to taxation, regardless of where they are made.

The use tax rate in San Francisco is the same as the combined sales tax rate, which is 8.5% (7.25% state tax + 1.25% local tax). This means that if you purchase an item online from a retailer outside of San Francisco, you may be subject to the use tax when you bring the item into the city.

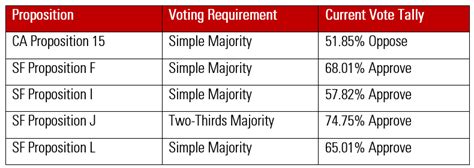

Property Taxes in San Francisco

Property taxes are an essential revenue stream for local governments and play a significant role in funding public services and infrastructure in San Francisco.

California Property Tax Rates

California operates under a unique property tax system known as Proposition 13. This proposition limits the annual increase in property tax assessments to 2% or the inflation rate, whichever is lower. It also allows for a one-time reassessment of a property’s value when it changes ownership.

The Proposition 13 rate for property taxes in California is 1% of the assessed value of the property. However, it’s important to note that this rate can vary slightly depending on local factors and special assessments.

San Francisco Property Tax Assessment

In San Francisco, the Assessor-Recorder’s Office is responsible for assessing property values for tax purposes. The assessed value of a property is determined by its fair market value as of the lien date, which is typically January 1st of each year.

Once the assessed value is established, the property tax rate (1%) is applied to calculate the annual property tax liability. This liability is then divided into two installments, due in February and November of each year.

Business Taxes in San Francisco

San Francisco is home to a thriving business community, and the city imposes various taxes on businesses to support its economy and infrastructure.

Business and Occupation (B&O) Tax

The Business and Occupation (B&O) tax is a gross receipts tax levied on businesses operating in San Francisco. It is calculated based on the gross income generated by the business within the city limits.

The B&O tax rate varies depending on the type of business and its activities. For most businesses, the rate is 1.5% of the gross income derived from San Francisco. However, certain industries, such as financial services and telecommunications, have different rates.

San Francisco Gross Receipts Tax

In addition to the B&O tax, San Francisco imposes a gross receipts tax on certain businesses. This tax is applied to the total gross receipts of the business, regardless of where the income is earned.

The gross receipts tax rate is 0.175% for most businesses, but it can vary based on the industry and the nature of the business activities. This tax is an additional obligation on top of the B&O tax, and businesses must carefully calculate and remit both taxes.

Conclusion: Navigating the Tax Landscape in San Francisco

Understanding the tax landscape in San Francisco is crucial for individuals and businesses alike. From income taxes to sales and use taxes, property taxes, and business taxes, the city has a comprehensive tax system in place to fund its vibrant public services and infrastructure.

By familiarizing yourself with the various tax rates and obligations, you can ensure compliance and take advantage of any available tax incentives or credits. Remember, staying informed and seeking professional advice when needed can help you navigate the complex world of taxes in San Francisco with confidence and efficiency.

Are there any tax breaks or incentives for homeowners in San Francisco?

+Yes, San Francisco offers various tax incentives for homeowners. These include the Homeowner’s Exemption, which reduces the assessed value of your property for tax purposes, and the Elderly and Disabled Exemption, which provides a further reduction for eligible homeowners. Additionally, the city offers programs like the Property Tax Postponement program, which allows eligible senior citizens and disabled homeowners to defer their property taxes.

How often do property tax assessments occur in San Francisco?

+Property tax assessments in San Francisco occur annually, as of the lien date, which is typically January 1st. However, there may be situations where a reassessment is triggered, such as a change in ownership or significant improvements to the property.

Are there any tax incentives for businesses in San Francisco?

+Yes, San Francisco offers a range of tax incentives for businesses, particularly those engaged in sustainable practices or community development projects. These incentives can include tax credits, exemptions, and reduced tax rates. It’s advisable to consult with a tax professional or refer to the city’s official tax guidelines for detailed information on available incentives.

What is the penalty for late payment of taxes in San Francisco?

+Late payment of taxes in San Francisco can result in penalties and interest charges. The specific penalties vary depending on the type of tax and the reason for the late payment. It’s crucial to stay informed about payment deadlines and seek assistance if you anticipate any difficulties in meeting your tax obligations.