Income Tax Rates In South Carolina

Income tax rates play a crucial role in shaping the financial landscape of any state, and South Carolina is no exception. Understanding the income tax structure is essential for individuals and businesses alike to navigate their financial obligations and plan their finances effectively. This article aims to delve into the specifics of income tax rates in South Carolina, providing a comprehensive guide for taxpayers.

South Carolina’s Income Tax Structure

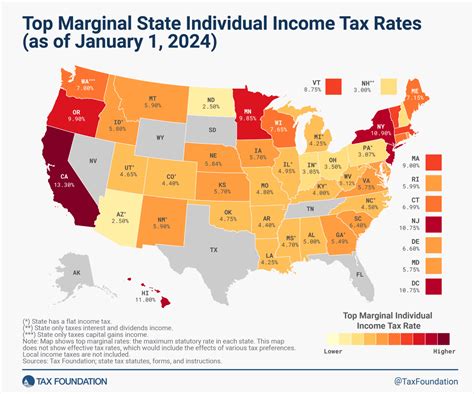

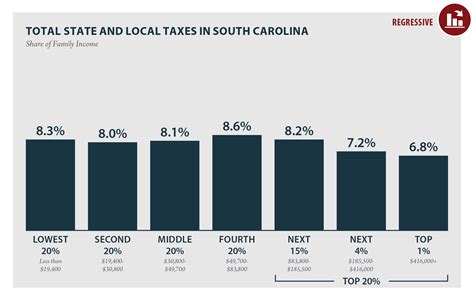

South Carolina operates a progressive income tax system, which means that as taxable income increases, the tax rate applied to that income also increases. This progressive nature ensures that individuals with higher incomes contribute a larger proportion of their earnings towards state revenue. The state’s income tax system is designed to promote fairness and support economic growth.

Tax Brackets and Rates

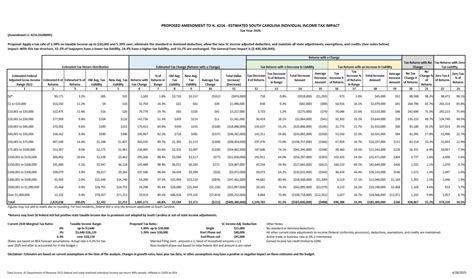

The income tax rates in South Carolina are divided into six tax brackets, each with its own tax rate. These brackets are determined by the taxpayer’s filing status and income level. As of the 2023 tax year, the tax brackets and corresponding rates are as follows:

| Tax Bracket (Single Filers) | Tax Rate |

|---|---|

| $0 - $2,900 | 2.5% |

| $2,901 - $5,800 | 3.5% |

| $5,801 - $11,600 | 4.5% |

| $11,601 - $160,000 | 5.5% |

| $160,001 - $3,500,000 | 6.5% |

| $3,500,001 and above | 7% |

For married couples filing jointly, the tax brackets are adjusted accordingly, resulting in slightly different income thresholds and tax rates. It's important to note that these rates are subject to change annually, and taxpayers should refer to the official South Carolina Department of Revenue website for the most up-to-date information.

Taxable Income and Exemptions

Not all income is subject to state income tax in South Carolina. Certain types of income, such as interest and dividends from municipal bonds, are exempt from taxation. Additionally, the state offers a standard deduction, which reduces the amount of taxable income. For the 2023 tax year, the standard deduction for single filers is 2,350</strong>, while married couples filing jointly can deduct <strong>4,700. Taxpayers can choose between taking the standard deduction or itemizing their deductions if they have eligible expenses that exceed the standard deduction.

Income Tax Withholding and Payment

South Carolina residents who have income from employment are subject to income tax withholding. Employers are responsible for withholding the appropriate amount of tax from employees’ paychecks based on the information provided on their W-4 forms. This ensures that taxpayers have already paid a portion of their tax liability throughout the year.

For individuals who are self-employed or have other sources of income, such as rental income or investment gains, estimated tax payments are required. These payments are made quarterly to cover the income tax liability for the current tax year. Failure to make estimated tax payments on time can result in penalties and interest charges.

Tax Deadlines and Filing

The deadline for filing South Carolina income tax returns is typically aligned with the federal tax deadline, which is April 15th of each year. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a natural disaster or pandemic. Taxpayers are encouraged to check the official state website for any updates regarding tax filing deadlines.

To file their income tax returns, residents can use the state's online filing system, which is secure and user-friendly. Alternatively, paper returns can be mailed to the South Carolina Department of Revenue. It's recommended to keep records and documentation of income, deductions, and credits for at least three years to facilitate any potential audits or inquiries.

Tax Credits and Incentives

South Carolina offers various tax credits and incentives to promote economic development and support specific industries. These credits can significantly reduce a taxpayer’s liability and provide financial benefits. Some notable tax credits include:

- Low-Income Housing Tax Credit (LIHTC): This credit aims to encourage the development of affordable housing by providing a tax credit to investors who finance qualified low-income housing projects.

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for a tax credit, which can offset a portion of their income tax liability.

- Film Production Incentive: South Carolina offers a film production tax credit to encourage the growth of the film and television industry within the state. Eligible productions can receive a credit of up to 25% of their qualified expenditures.

It's essential for taxpayers to explore these tax credits and determine their eligibility to take advantage of potential savings and incentives.

The Impact of Income Tax on South Carolina’s Economy

Income tax plays a significant role in funding essential services and infrastructure in South Carolina. The revenue generated from income taxes supports critical areas such as education, healthcare, public safety, and transportation. By contributing to the state’s income tax system, residents and businesses help ensure the continued growth and development of the state’s economy.

Analysis of Income Tax’s Economic Impact

A comprehensive analysis of income tax’s impact reveals its importance in shaping South Carolina’s economic landscape. The progressive tax structure ensures that higher-income earners contribute proportionally more, fostering a sense of economic fairness. Additionally, the state’s tax credits and incentives promote specific industries and attract businesses, leading to job creation and economic growth.

The income tax system also provides a stable revenue stream for the state, enabling consistent funding for public services and infrastructure projects. This stability is crucial for long-term economic planning and development.

Conclusion: Navigating South Carolina’s Income Tax System

Understanding the income tax rates and structure in South Carolina is essential for individuals and businesses to comply with their tax obligations and plan their finances effectively. By staying informed about tax brackets, deductions, credits, and deadlines, taxpayers can ensure they meet their financial responsibilities while taking advantage of potential savings and incentives.

South Carolina's progressive income tax system, combined with its tax credits and incentives, creates a balanced approach to taxation, promoting economic growth and fairness. As the state continues to evolve and adapt to economic changes, taxpayers can rely on the stability and transparency of the income tax system to support their financial journeys.

Are there any income tax deductions available for South Carolina residents?

+Yes, South Carolina residents can take advantage of various deductions to reduce their taxable income. These include the standard deduction, which varies based on filing status, and the option to itemize deductions for eligible expenses such as medical costs, charitable donations, and certain taxes.

How often are the income tax rates in South Carolina updated?

+The income tax rates in South Carolina are typically updated annually to account for inflation and economic changes. The South Carolina Department of Revenue announces any adjustments to the tax brackets and rates before the start of each new tax year.

Are there any special tax considerations for retirees in South Carolina?

+Yes, South Carolina offers a retirement income tax deduction, which allows retirees to exclude a portion of their retirement income from state taxation. This deduction applies to Social Security benefits, pension income, and certain types of retirement accounts.