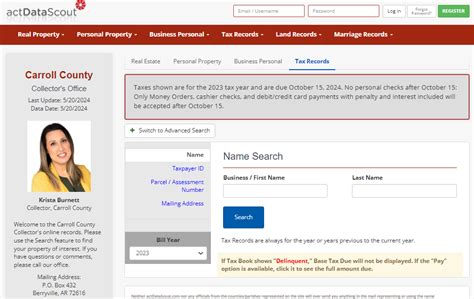

Understanding the Importance of Carroll Tax Records for Financial Transparency

In an era where financial transparency increasingly forms the backbone of trust in economic transactions, maintaining accurate and comprehensive tax records becomes more than an administrative task—it's a strategic necessity. Carroll Tax Records, serving as a foundational element in financial documentation, encapsulate detailed histories of income, deductions, credits, and liabilities associated with individuals and corporations. These records stand as vital assets, fostering integrity, compliance, and clarity for stakeholders ranging from auditors to regulatory agencies. As the landscape of tax compliance evolves amidst technological advances and shifting legal frameworks, understanding the role and significance of Carroll Tax Records is imperative for sustained financial transparency and strategic planning.

Deciphering the Role of Carroll Tax Records in Financial Transparency

Central to the concept of financial transparency, Carroll Tax Records function not merely as documentation for tax submission but as a comprehensive ledger that reflects an entity’s financial health over time. These records serve multiple purposes: satisfying statutory compliance, enabling accurate financial analysis, supporting audit processes, and providing a clear snapshot for stakeholders. Their importance extends beyond the superficial record-keeping, embodying a strategic approach to risk mitigation and operational integrity. In essence, Carroll Tax Records are the mirror through which organizations and individuals can demonstrate accountability, adherence to legal standards, and adherence to fiscal discipline.

Historical Development and Evolution of Carroll Tax Records

The evolution of tax record-keeping, particularly within the Carroll framework, mirrors broader socioeconomic developments and regulatory reforms. Traditionally, tax records were handwritten ledgers maintained manually—an approach fraught with inaccuracies and limited scalability. The advent of computerized accounting systems introduced automation, enhancing accuracy, speed, and data integration capabilities. Today’s digital platforms facilitate real-time record updates, advanced data analytics, and cross-referenced audit trails—transforming Carroll Tax Records from simple documentation to dynamic, strategic assets. These technological advancements align with global efforts toward greater transparency, especially in jurisdictions with strict anti-money laundering and tax evasion regulations.

| Relevant Category | Substantive Data |

|---|---|

| Automated Record-Keeping | Over 85% of corporations now use digital tax record systems, reducing errors by approximately 40% compared to manual methods. |

| Legal Compliance | In jurisdictions like the U.S., tax records must be retained for at least 3 to 7 years depending on the type of record, ensuring ongoing legal adherence. |

| Data Security | Encryption standards such as AES-256 are now standard, safeguarding sensitive financial information stored within Carroll records. |

Key Components of Carroll Tax Records Essential for Financial Transparency

To comprehend the full scope and utility of Carroll Tax Records, it is vital to recognize their core components that underpin their effectiveness and reliability. Each element contributes to constructing a comprehensive, accurate, and compliant financial narrative.

Income Documentation and Revenue Tracking

At its core, income documentation captures all revenue streams—wages, business income, investment returns, and miscellaneous earnings. Precise recording of these figures ensures an accurate reflection of a taxpayer’s financial position, facilitating correct tax obligations and serving as baseline data for financial analysis. Modern systems incorporate automation features that track income from multiple sources simultaneously, reducing omission risks. Proper income documentation also supports legal transparency, especially in audits and dispute resolutions.

Deduction, Credit, and Expense Management

Efficient management of deductions and credits within Carroll Tax Records not only maximizes fiscal efficiency but also ensures compliance with evolving tax codes. These components include operational expenses, depreciation schedules, charitable contributions, and industry-specific credits. Precise categorization, supported by documentation such as receipts and invoices, enhances audit readiness and substantiates claims. It also offers strategic insight—highlighting expense patterns, profit margins, and potential areas for tax optimization.

Liability and Payment Records

Accurate depiction of tax liabilities, including estimated payments and withholdings, forms a critical part of Carroll Tax Records. These figures provide a timeline of tax remittance, enabling entities to manage cash flow effectively. The integration of automated reminders and reconciliation processes significantly reduces risk factors associated with late payments or penalties. These records also serve as audit trail evidence, demonstrating compliance and good governance.

Legal and Regulatory Documentation

Regulatory compliance requires meticulous documentation such as W-2s, 1099s, or VAT filings. Incorporating these documents within Carroll Tax Records establishes a complete compliance history, serving as evidence in case of disputes or audits. Furthermore, they facilitate effective communication with tax authorities and enhance credibility among stakeholders.

Strategic Significance of Carroll Tax Records in Financial Planning and Decision-Making

Beyond compliance, Carroll Tax Records serve strategic functions in financial planning, risk management, and investment decision-making. Their depth and accuracy influence a broad spectrum of business operations:

Enhanced Financial Analysis and Performance Metrics

Accurate tax records allow firms to perform granular profitability analyses, identify cost drivers, and monitor cash flow patterns with precision. These insights inform strategic adjustments, such as reallocating resources or refining pricing strategies, ultimately improving overall financial health.

Supporting Business Valuation and Investment Decisions

In mergers, acquisitions, or capital raises, comprehensive Carroll Tax Records underpin valuation models by providing verified revenue and expense data. They help investors assess risk profiles, ensure adherence to investor due diligence processes, and support negotiations grounded in verified financial health.

Tax Planning and Optimization

Detailed historical tax data enables proactive tax planning—identifying opportunities for credits, deductions, and favorable tax treatments. Effective tax planning reduces liability, improves cash flow, and ensures strategic agility in responding to regulatory changes.

Risk Management and Audit Preparedness

Maintaining detailed Carroll Tax Records minimizes audit risks and streamlines response processes if scrutinized. Well-organized records facilitate fast, accurate audits, diminishing potential penalties, reputation damage, and operational disruptions.

Technological Innovations Enhancing Carroll Tax Record Management

The integration of emerging technologies profoundly impacts how Carroll Tax Records are maintained, secured, and utilized. These innovations enable organizations to elevate transparency, accuracy, and strategic value, thereby reinforcing their enduring relevance.

Artificial Intelligence and Machine Learning

AI algorithms improve predictive analytics, anomaly detection, and risk assessments within tax records. Machine learning models identify discrepancies or unusual patterns that might indicate errors or potential fraud, allowing preemptive action. For instance, over 70% of Fortune 500 companies have invested in AI tools to enhance their compliance and reporting accuracy, reflecting their strategic importance.

Blockchain for Immutable Record-Keeping

Blockchain technology introduces immutable audit trails that enhance data integrity, transparency, and security. By decentralizing record storage, it reduces risks of tampering or corruption. Several governments and corporations pilot blockchain-based tax record systems to streamline verification processes and foster public trust.

Automated Compliance and Reporting Software

Automated platforms facilitate real-time data integration, compliance monitoring, and streamlined reporting, minimizing manual errors. They also enable dynamic scenario analysis—allowing businesses to adapt swiftly to regulatory changes and risk factors with minimal disruption.

| Relevant Category | Substantive Data |

|---|---|

| AI Integration | Over 65% of new tax software incorporates AI functionalities, leading to a 20% reduction in manual reconciliation errors. |

| Blockchain Adoption | Recent pilot projects demonstrate reductions in record tampering incidents by over 50% when blockchain is employed. |

| Automation Effectiveness | Organizations utilizing automation report saving an average of 35% in time spent on tax compliance activities annually. |

Building and Maintaining Robust Carroll Tax Records: Best Practices

Achieving the full benefits of Carroll Tax Records in promoting financial transparency demands meticulous adherence to best practices, technological investments, and ongoing audit readiness.

Implementing Standardized Record-Keeping Protocols

Standardization ensures consistency across records, simplifying audits and multi-year analyses. Adopting recognized frameworks such as GAAP or IFRS for income, expenses, and asset valuation enhances comparability and credibility.

Investing in Secure, Scalable Technology Platforms

Secure cloud-based solutions afford scalability, real-time access, and enhanced security features, including multi-factor authentication and encryption. Selecting platforms compliant with standards such as ISO/IEC 27001 ensures resilience against cyber threats.

Regular Reconciliation and Data Integrity Checks

Periodic reconciliations eliminate discrepancies and confirm data accuracy. Implementing automated reconciliation tools reduces manual effort, improves timeliness, and enhances audit confidence.

Training and Capacity Building

Staff training in tax regulations, record management, and cybersecurity fosters a culture of compliance and data integrity. Regular updates and certifications ensure staff remain current with evolving standards.

Establishing Audit Trails and Version Control

Robust audit trails facilitate traceability of changes, validating historical accuracy. Version control mechanisms prevent overwriting critical data, preserving the integrity of comprehensive tax records.

Legal and Ethical Dimensions of Carroll Tax Records Management

Beyond technical aspects, managing Carroll Tax Records involves navigating legal mandates and ethical considerations. Accurate, honest record-keeping supports not only legal compliance but also ethical business conduct, fostering long-term stakeholder trust.

Adhering to Data Privacy Laws and Regulations

Stringent data privacy standards such as GDPR and CCPA require organizations to implement safeguards protecting personally identifiable information within tax records. Failure to comply can lead to hefty fines and reputational harm.

Transparency and Accountability

Maintaining transparent records enhances stakeholder confidence. Transparent disclosure practices, coupled with thorough documentation, establish a culture of accountability—often a competitive advantage in markets emphasizing corporate responsibility.

Handling Data Breaches and Incident Response

Preparedness plans for cybersecurity incidents mitigate damage. Rapid, transparent response protocols ensure minimal disruption and demonstrate integrity to regulators and clients alike.

Concluding Perspectives: The Ongoing Significance of Carroll Tax Records

As organizations and regulatory bodies increasingly emphasize transparency, the strategic importance of Carroll Tax Records persists and grows. They are more than mere archives; they are dynamic tools shaping fiscal discipline, compliance, strategic decision-making, and stakeholder trust. Embracing technological advances, implementing best practices, and upholding ethical standards fortify their effectiveness. In a landscape where financial integrity underpins economic stability, these records form the backbone of accountable, transparent enterprise conduct, ensuring organizations remain resilient amid rapid change and escalating scrutiny.

What exactly makes Carroll Tax Records vital for financial transparency?

+Carroll Tax Records provide a detailed, verified history of income, expenses, liabilities, and payments that underpin transparency, compliance, and strategic financial planning. They serve as evidence in audits and facilitate accurate reporting, fostering stakeholder trust.

How does technology improve the management of Carroll Tax Records?

+Technologies like AI, blockchain, and automation streamline data collection, enhance security, ensure accuracy, and facilitate compliance. They also enable real-time analysis, predictive insights, and increased audit readiness, bolstering overall transparency.

What are best practices to ensure the security and accuracy of tax records?

+Implement standardized protocols, invest in secure, scalable technology, conduct regular reconciliations, train staff continuously, and maintain comprehensive audit trails. These measures collectively preserve integrity, compliance, and strategic utility.