Texas Auto Tax

Welcome to this in-depth exploration of the Texas Auto Tax, a topic of significant interest to residents and those considering vehicle ownership in the Lone Star State. Understanding the intricacies of vehicle-related taxes is crucial for making informed financial decisions and navigating the automotive landscape with ease. In this comprehensive guide, we will delve into the specifics of the Texas Auto Tax, covering its structure, calculation methods, and the various factors that influence the amount you might pay.

Understanding the Texas Auto Tax Landscape

The Texas Auto Tax, officially known as the Vehicle Sales Tax, is a critical component of the state’s revenue stream and plays a substantial role in the automotive industry’s functioning. It is levied on the purchase of new and used vehicles, with the proceeds contributing to essential public services and infrastructure development across the state.

Texas, known for its diverse geography and thriving cities, has a unique approach to automotive taxation. The state's tax structure is designed to accommodate the needs of its vast population, ranging from urban dwellers to rural residents. Understanding this tax is not merely a financial necessity but also a way to contribute to the state's economic growth and development.

Let's delve into the specific details of how this tax is calculated, the rates involved, and the various factors that can influence your overall tax liability when purchasing a vehicle in Texas.

Tax Rates and Calculation Methods

The Texas Auto Tax operates on a straightforward calculation method, applying a uniform 6.25% sales tax rate across the state. This rate is applied to the total purchase price of the vehicle, including any additional fees and charges. However, it’s important to note that this is not the only tax levied on vehicle purchases in Texas.

In addition to the state sales tax, local jurisdictions may impose their own local sales taxes, which can range from 0.5% to 2%, depending on the county and city. These local taxes are often referred to as local option taxes and are used to fund specific community projects and services.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Local Option Tax (Average) | 1.5% |

| Total Effective Tax Rate | 7.75% |

The table above provides an average estimate of the total effective tax rate, which includes both the state and local sales taxes. It's important to note that the local option tax can vary significantly, so it's advisable to check the specific rates for your area to get an accurate understanding of your potential tax liability.

Factors Influencing the Auto Tax

The amount of auto tax you pay in Texas is influenced by several key factors, each of which can significantly impact your overall liability. These factors include the vehicle’s purchase price, additional fees, and the duration of ownership before the next tax cycle.

The purchase price of the vehicle is a significant determinant of the tax amount. Higher-priced vehicles will result in a larger tax liability, as the tax is calculated as a percentage of the total cost. This means that luxury vehicles or those with extensive features can lead to a substantial tax burden.

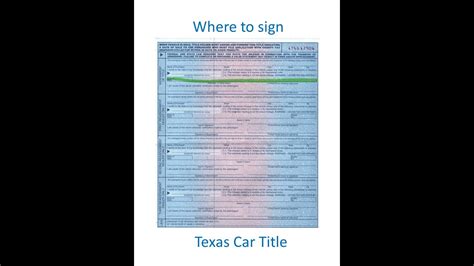

Additionally, various fees associated with vehicle purchases, such as title fees, registration fees, and dealer preparation fees, are also subject to the sales tax. These fees can add up quickly, increasing the overall tax amount. It's essential to consider these additional costs when budgeting for a vehicle purchase.

Another critical factor is the duration of ownership before the next tax cycle. In Texas, vehicles are typically taxed annually, with the tax due at the time of registration renewal. If you purchase a vehicle late in the year, you may be able to defer some of the tax liability until the following year, depending on the timing of your purchase.

Strategies for Minimizing Auto Tax Liability

While the Texas Auto Tax is a mandatory expense, there are strategies and considerations that can help minimize your tax liability. These strategies involve a combination of timing your purchase, understanding tax exemptions, and exploring financing options.

Timing Your Vehicle Purchase

One of the most effective strategies for managing your auto tax liability is to time your vehicle purchase strategically. As mentioned earlier, Texas vehicles are typically taxed annually at the time of registration renewal. By coordinating your purchase with the timing of this renewal, you can potentially minimize the tax you pay in the first year of ownership.

For example, if you purchase a vehicle in January, you will likely pay the full tax amount for the entire year. However, if you purchase the vehicle in December, you may only be responsible for a portion of the tax, as the renewal cycle for the following year has not yet begun. This strategy can result in significant savings, especially if you are purchasing a high-value vehicle.

Understanding Tax Exemptions

Texas offers various tax exemptions that can reduce or eliminate your auto tax liability in specific circumstances. These exemptions are designed to support specific groups or situations, providing financial relief for eligible individuals.

One notable exemption is the Veterans and Military Exemption, which waives the state sales tax for eligible military personnel and veterans. This exemption is a token of appreciation for the service and sacrifice of those who have served our country. To claim this exemption, you must provide valid military identification or documentation of your veteran status.

Another exemption is the Disability Exemption, which applies to individuals with certain disabilities. This exemption can waive the sales tax on the purchase of a vehicle specifically modified to accommodate the individual's disability. It is an essential provision that promotes inclusivity and accessibility for those with special needs.

Additionally, there are exemptions for nonprofit organizations and certain types of government entities. These exemptions recognize the unique roles and contributions of these organizations and entities, providing tax relief to support their missions.

Exploring Financing Options

Financing your vehicle purchase can also impact your auto tax liability. When you finance a vehicle, you typically pay the tax on the full purchase price upfront. However, there are alternative financing options that can spread out this tax liability over time.

One such option is a lease-to-own program, which allows you to lease the vehicle for a set period and then have the option to purchase it at the end of the lease term. With this arrangement, you may only be responsible for a portion of the tax during the lease period, with the remaining tax due at the time of purchase. This can provide a more manageable financial structure, especially for high-value vehicles.

It's important to carefully consider the terms and conditions of any financing option to ensure it aligns with your financial goals and circumstances. Consulting with a financial advisor or tax professional can provide valuable insights into the most suitable financing strategy for your situation.

The Impact of Auto Tax on the Texas Economy

The Texas Auto Tax plays a pivotal role in the state’s economy, contributing significantly to its overall financial health and stability. The revenue generated from this tax is a critical component of the state’s budget, supporting essential services and infrastructure projects that benefit all Texans.

One of the key ways the auto tax impacts the economy is through its contribution to public infrastructure. The funds generated from this tax are often allocated towards the development and maintenance of roads, bridges, and transportation networks across the state. This investment in infrastructure not only improves the quality of life for residents but also attracts businesses and investors, fostering economic growth and development.

Additionally, the auto tax supports public services that are vital to the well-being of Texas communities. These services include education, healthcare, public safety, and social welfare programs. By funding these essential services, the auto tax ensures that Texans have access to the resources and support they need to thrive.

Moreover, the auto tax encourages responsible vehicle ownership and maintenance. The annual tax cycle, coupled with the potential for additional fees and taxes on certain vehicle transactions, incentivizes owners to keep their vehicles in good condition and up-to-date with registrations and inspections. This, in turn, promotes road safety and environmental sustainability.

The economic impact of the Texas Auto Tax extends beyond the state level. It also influences the automotive industry, shaping the market dynamics and consumer behavior. The tax can impact the pricing and sales strategies of dealerships and automotive businesses, affecting their profitability and market competitiveness.

In conclusion, the Texas Auto Tax is a vital component of the state's fiscal framework, contributing to its economic prosperity and the well-being of its residents. By understanding the intricacies of this tax and implementing strategic financial planning, individuals can navigate the automotive landscape with confidence, contributing to the vibrant economy of the Lone Star State.

What is the average auto tax rate in Texas?

+The average auto tax rate in Texas is 7.75%, including the state sales tax and the average local option tax. However, it’s important to note that local option taxes can vary, so it’s advisable to check the specific rates for your area.

Are there any tax exemptions for purchasing a vehicle in Texas?

+Yes, Texas offers several tax exemptions, including exemptions for veterans and military personnel, individuals with disabilities, and certain nonprofit organizations. These exemptions provide financial relief in specific circumstances.

Can I finance my vehicle purchase to minimize auto tax liability?

+Yes, financing options like lease-to-own programs can help spread out the tax liability over time. By leasing a vehicle and then purchasing it at the end of the lease term, you may only be responsible for a portion of the tax during the lease period.