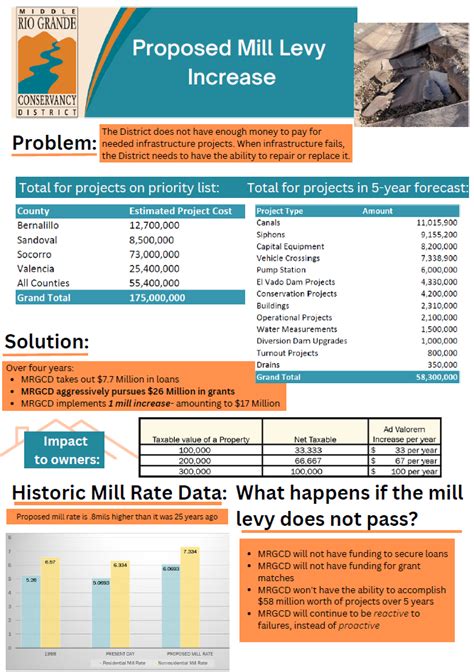

Tax Levy Meaning

In the complex world of finance and legal matters, understanding the terminology is crucial, especially when it comes to tax-related processes. One such term that often raises questions is "tax levy." In simple terms, a tax levy is a legal action taken by a government agency, typically the Internal Revenue Service (IRS) in the United States, to collect unpaid taxes from a taxpayer. However, the concept is far more intricate and carries significant implications for both individuals and businesses. This article aims to delve into the depths of tax levies, exploring their meaning, the processes involved, and their potential consequences.

Understanding the Tax Levy Process

A tax levy is a forceful collection method employed by tax authorities when other attempts to recover unpaid taxes have proven unsuccessful. It is a powerful tool that allows the IRS to seize a taxpayer’s assets, including bank accounts, wages, retirement accounts, or even property, to settle the outstanding tax debt. The process is not taken lightly and is generally a last resort after various other collection methods, such as liens and notices, have been attempted and ignored.

When Does a Tax Levy Occur?

The IRS initiates a tax levy after sending multiple notices to the taxpayer regarding their unpaid tax liability. These notices, known as CP notices, inform the taxpayer of the amount owed, the due date, and the potential consequences of non-payment. If the taxpayer fails to respond or make arrangements to settle the debt, the IRS may proceed with a levy. The IRS aims to provide fair notice and an opportunity for the taxpayer to resolve the issue before taking such drastic action.

It's important to note that a tax levy is not a one-size-fits-all solution. The IRS considers various factors, including the taxpayer's financial situation, the amount owed, and their willingness to negotiate. In some cases, the IRS may offer alternative solutions, such as a payment plan or an offer in compromise, to help the taxpayer resolve their debt without the need for a levy.

| Notice Type | Description |

|---|---|

| CP 501 | Balance Due Notice - First Notice |

| CP 503 | Balance Due Notice - Final Notice |

| CP 504 | Notice of Intent to Levy and Your Right to a Hearing |

Types of Tax Levies

Tax levies come in various forms, each targeting specific assets or income sources. Understanding these types can help taxpayers anticipate the potential consequences and plan accordingly.

Wage Levy

A wage levy, also known as a wage garnishment, is one of the most common types of tax levies. It allows the IRS to collect a portion of the taxpayer’s wages or salary directly from their employer. The employer is legally obligated to comply with the levy and remit a portion of the taxpayer’s earnings to the IRS until the debt is satisfied or alternative arrangements are made.

Bank Levy

A bank levy involves the seizure of funds from the taxpayer’s bank accounts. The IRS can freeze the account and withdraw funds to settle the tax debt. This type of levy can be particularly disruptive, as it may result in overdraft fees or other financial penalties if the account does not have sufficient funds to cover the levy amount.

Seizure of Property

In severe cases, the IRS may resort to seizing the taxpayer’s property, such as real estate, vehicles, or other valuable assets. This is a more drastic measure and is typically reserved for substantial tax debts or when other collection methods have failed. The property is then sold, and the proceeds are used to satisfy the tax liability.

Retirement Account Levy

Taxpayers who have retirement accounts, such as IRAs or 401(k)s, may face a levy on these assets. The IRS can seize a portion of the funds from these accounts, which can have significant tax implications and impact the taxpayer’s retirement plans.

The Impact of a Tax Levy

A tax levy can have far-reaching consequences for taxpayers, affecting their financial stability and creditworthiness. It can lead to immediate financial strain, as assets are seized or wages are garnished. Additionally, a tax levy can result in:

- Damaged credit score: A levy can appear on the taxpayer's credit report, impacting their ability to obtain loans or favorable interest rates.

- Increased financial stress: The sudden loss of assets or income can make it challenging to meet daily expenses and may lead to debt accumulation.

- Legal complications: Failing to respond to a levy or comply with the IRS' requirements can result in further legal action, including potential criminal charges.

Protecting Assets During a Levy

While a tax levy can be daunting, there are steps taxpayers can take to protect their assets and mitigate the impact. Seeking professional tax advice is crucial in such situations. Tax professionals can guide taxpayers through the process, negotiate with the IRS, and explore potential solutions, such as:

- Requesting a levy release: In certain circumstances, the IRS may release a levy if the taxpayer can demonstrate financial hardship or prove that the levy is causing an undue economic burden.

- Setting up a payment plan: Taxpayers can negotiate a payment plan with the IRS, allowing them to pay off the debt over time with reduced or waived penalties and interest.

- Filing an appeal: If the taxpayer believes the levy was issued in error or is facing financial hardship, they can file an appeal to request a review of the case.

Preventing Tax Levies

Prevention is often the best strategy when it comes to tax levies. Taxpayers can take proactive measures to avoid the need for a levy, such as:

- Staying informed: Understanding your tax obligations and keeping track of your tax liabilities is crucial. Ensure you file your tax returns on time and pay any taxes owed.

- Communicating with the IRS: If you are facing financial difficulties or cannot pay your taxes in full, reach out to the IRS. They offer various programs to help taxpayers manage their tax debt, such as installment agreements or offers in compromise.

- Seeking professional help: Tax professionals can provide guidance on tax planning, help you identify potential tax savings, and ensure you comply with tax laws.

Common Misconceptions About Tax Levies

There are several misconceptions surrounding tax levies that can lead to unnecessary panic or confusion. It’s important to separate fact from fiction:

- Misconception: The IRS can levy any asset at any time. Fact: The IRS follows specific procedures and must provide notice before taking any levy action. Additionally, they prioritize certain assets over others, such as wages and bank accounts, before considering property seizures.

- Misconception: A tax levy is the same as a tax lien. Fact: While both are enforcement actions, a tax lien is a legal claim against a taxpayer's property, whereas a tax levy involves the actual seizure of assets to satisfy the debt.

- Misconception: A tax levy will lead to immediate asset seizure. Fact: The IRS typically allows taxpayers a grace period to respond to notices and make arrangements before initiating a levy. This period provides an opportunity to negotiate and avoid the levy altogether.

Conclusion

A tax levy is a serious matter that requires prompt attention and professional guidance. Understanding the process, your rights, and the potential consequences is crucial in navigating this complex situation. By staying informed, communicating with the IRS, and seeking expert advice, taxpayers can minimize the impact of a tax levy and work towards resolving their tax liabilities.

Frequently Asked Questions

Can the IRS levy my assets without prior notice?

+No, the IRS must provide notice and an opportunity for the taxpayer to respond before initiating a levy. This process typically involves multiple notices and a period for the taxpayer to resolve the issue.

What happens if I ignore a tax levy notice from the IRS?

+Ignoring a tax levy notice can lead to severe consequences. The IRS may proceed with the levy, seize your assets, and potentially take further legal action, including wage garnishments or property seizures.

Are there any alternatives to a tax levy for resolving tax debt?

+Yes, the IRS offers several alternatives, such as installment agreements, offers in compromise, and penalty abatements. Seeking professional tax advice can help you explore these options and find the best solution for your situation.

How can I protect my retirement accounts from a tax levy?

+Retirement accounts are not exempt from tax levies, but there are strategies to protect them. Rolling over your funds to a new account or converting them to a Roth IRA may provide some protection. However, it’s crucial to seek professional advice to understand the tax implications and potential risks.

Can a tax levy be released or reversed?

+In certain circumstances, a tax levy can be released or reversed. This is typically done when the taxpayer can demonstrate financial hardship or if the levy was issued in error. However, the process requires prompt action and professional guidance.