Site Valuation Tax

Site valuation tax is a crucial concept in the realm of property and real estate, playing a significant role in determining the value of land and influencing various financial aspects associated with it. This comprehensive guide aims to delve deep into the intricacies of site valuation tax, exploring its definition, importance, calculation methods, and real-world applications. By understanding the nuances of this tax, individuals and businesses can make informed decisions regarding property transactions, investments, and financial planning.

Understanding Site Valuation Tax

Site valuation tax, often referred to as land valuation tax or simply site value tax, is a type of property tax levied on the value of a piece of land, excluding any improvements or structures built on it. It is a crucial component of the property tax system in many jurisdictions and is used to assess the value of a property for tax purposes. Unlike traditional property taxes, which consider the overall value of a property including buildings and improvements, site valuation tax focuses solely on the intrinsic worth of the land itself.

The concept of site valuation tax stems from the idea that land, being a finite resource, holds inherent value that should be recognized and taxed accordingly. This tax aims to ensure that landowners contribute fairly to the financial needs of their respective jurisdictions, such as municipalities or local governments. By assessing the value of land separately from improvements, site valuation tax provides a more accurate representation of the economic value of a property, which can be crucial for various financial and legal purposes.

Key Characteristics of Site Valuation Tax

- Assessment Method: Site valuation tax is typically determined through a comprehensive assessment process that involves evaluating various factors such as the location, size, and potential use of the land. This assessment is conducted by qualified professionals or government agencies, ensuring a fair and standardized valuation.

- Tax Rate: The tax rate applied to the assessed value of the land can vary depending on the jurisdiction. It is usually expressed as a percentage of the land’s value and is used to calculate the annual tax liability for the landowner.

- Exemptions and Discounts: In some cases, certain types of land or landowners may be eligible for exemptions or discounts from site valuation tax. These exemptions can be based on factors such as the land’s use (e.g., agricultural or conservation purposes), the owner’s age or income, or specific local policies.

- Regular Review: Site valuation assessments are not static; they are typically reviewed periodically to account for changes in market conditions, land improvements, or other relevant factors. This ensures that the tax remains aligned with the actual value of the land over time.

Understanding the characteristics of site valuation tax is essential for landowners, investors, and financial professionals. It provides insights into the economic implications of land ownership and can influence decisions related to property development, investment strategies, and tax planning.

Calculation and Assessment of Site Valuation Tax

The calculation and assessment of site valuation tax involve a meticulous process that aims to determine the fair market value of a property’s land. This process is crucial as it directly impacts the tax liability of landowners and influences various financial decisions related to property ownership. Here, we explore the key steps and factors involved in assessing site valuation tax.

Step-by-Step Process

- Data Collection: The first step in assessing site valuation tax is gathering comprehensive data about the property. This includes details such as the location, size, zoning regulations, and any recent sales or transaction records involving similar properties in the area. Accurate data collection forms the foundation of a reliable assessment.

- Land Appraisal: Trained professionals, often referred to as land appraisers or assessors, conduct a detailed appraisal of the land. They consider various factors such as the land’s physical characteristics (e.g., topography, soil quality), proximity to amenities and infrastructure, and its potential for development or agricultural use. This appraisal provides an initial estimate of the land’s value.

- Market Analysis: A thorough analysis of the local real estate market is conducted to compare the appraised value of the land with recent sales prices of similar properties. This step helps validate the appraised value and ensures it aligns with market trends and conditions. Market analysis is crucial for determining the fair market value of the land.

- Adjustments and Final Assessment: After the market analysis, assessors may make adjustments to the appraised value based on unique features or limitations of the land. For instance, a property with environmental restrictions might be valued differently than a similar property without such constraints. The final assessment takes into account all these factors, resulting in the official site valuation tax assessment.

Factors Influencing Site Valuation

- Location: The location of the land is a significant factor in determining its value. Properties in desirable areas, close to amenities, or with easy access to transportation networks often command higher values.

- Size and Shape: The size and shape of the land can impact its usability and potential for development. Irregularly shaped lots or unusually large parcels may have different values compared to more standard-sized properties.

- Zoning and Land Use: Zoning regulations and the intended use of the land play a crucial role. Properties zoned for commercial or industrial use may have higher valuations than those designated for residential purposes.

- Market Conditions: Prevailing market conditions, including supply and demand dynamics, can influence the value of land. A hot real estate market may drive up values, while a sluggish market might result in more conservative assessments.

- Physical Characteristics: The physical attributes of the land, such as its terrain, soil quality, and the presence of natural resources, can significantly impact its value. For instance, fertile agricultural land may be more valuable than land with poor soil conditions.

The calculation and assessment of site valuation tax require a nuanced understanding of the property market and the specific characteristics of the land in question. By considering these factors and following a meticulous process, assessors can provide landowners with a fair and accurate valuation, which is essential for tax purposes and financial planning.

Impact and Real-World Applications of Site Valuation Tax

Site valuation tax has far-reaching implications for both individual landowners and the broader economy. Its impact extends beyond tax liability, influencing various aspects of property ownership, investment strategies, and urban development. Here, we explore the real-world applications and consequences of site valuation tax.

Property Ownership and Planning

For individual landowners, understanding site valuation tax is crucial for effective property management and financial planning. The tax assessment directly affects the annual tax liability, which can be a significant expense. By being aware of the valuation process and factors influencing it, landowners can make informed decisions about property improvements, renovations, or even selling the land. Accurate site valuation assessments provide a basis for negotiating fair sale prices and understanding the true economic value of their property.

Investment Strategies and Real Estate Development

Site valuation tax plays a pivotal role in shaping investment strategies and real estate development projects. Investors and developers closely analyze site valuations to assess the potential return on investment for a particular property. A favorable site valuation can indicate the potential for profitable development or the ability to secure financing for a project. Conversely, a high site valuation might deter investors if the tax liability outweighs the potential returns.

Moreover, site valuation tax can influence the design and planning of real estate developments. Developers consider the tax implications when deciding on the scope and scale of a project. They may opt for more cost-effective strategies or explore ways to optimize the land use to minimize tax liabilities while maximizing returns.

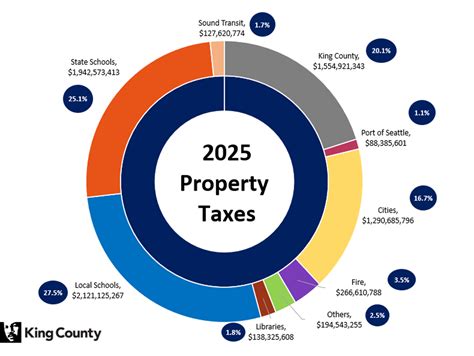

Urban Planning and Equity Considerations

Site valuation tax is a tool used by local governments and urban planners to promote equitable development and manage urban growth. By assessing the value of land, jurisdictions can ensure that landowners contribute fairly to the financial needs of the community. This tax revenue can be used to fund essential services, infrastructure development, and initiatives aimed at improving the overall quality of life in a given area.

Additionally, site valuation tax can be a mechanism for addressing social and economic inequalities. In some cases, jurisdictions may offer exemptions or discounts to certain landowners, such as low-income individuals or those using their land for community-oriented purposes. This approach can help promote social equity and ensure that the benefits of land ownership are accessible to a wider range of individuals.

Economic Impact and Market Dynamics

Site valuation tax has a significant impact on the real estate market and the overall economy. It influences property prices, rental rates, and the overall liquidity of the market. A well-managed site valuation tax system can encourage responsible land use, discourage speculation, and promote sustainable development. Conversely, poorly implemented or unfair assessments can lead to market distortions and hinder economic growth.

In conclusion, site valuation tax is a critical component of property ownership and management. Its impact extends beyond tax liability, influencing investment decisions, urban planning, and the overall economic landscape. By understanding the intricacies of site valuation tax, individuals and businesses can navigate the complexities of property ownership and make strategic decisions that align with their financial goals and the broader community's interests.

Frequently Asked Questions

How often are site valuation assessments conducted?

+Site valuation assessments are typically conducted periodically, often every few years, to account for changes in market conditions and land improvements. The frequency of assessments can vary depending on local regulations and practices.

Can landowners appeal their site valuation tax assessment?

+Yes, landowners have the right to appeal their site valuation tax assessment if they believe it is inaccurate or unfair. The appeals process usually involves submitting supporting documentation and evidence to a designated tax authority or an independent review board.

Are there any tax benefits or incentives associated with site valuation tax?

+In some jurisdictions, there may be tax benefits or incentives offered to landowners based on the site valuation. These could include tax credits, exemptions, or reduced tax rates for certain types of land use or development.

How does site valuation tax impact property transactions and sales?

+Site valuation tax can influence property transactions by providing a standardized measure of a property’s value. It helps buyers and sellers negotiate fair prices and ensures that tax liabilities are taken into account during the sale process.

What happens if a landowner fails to pay site valuation tax?

+Failure to pay site valuation tax can result in penalties, interest charges, and potential legal consequences. In severe cases, the property may be subject to a tax lien or even foreclosure to recover the outstanding tax liability.