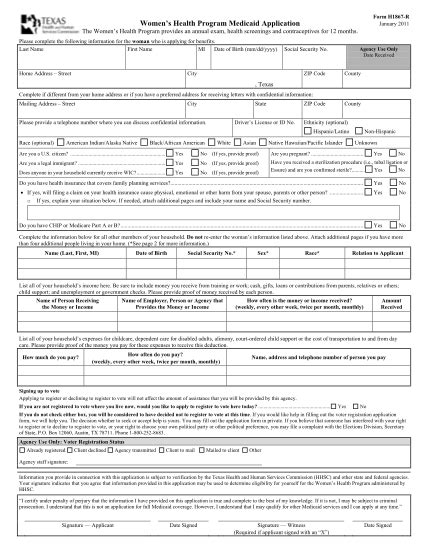

Medicaid Tax Form

The Medicaid Tax Form is an essential document for individuals and businesses to understand and complete accurately. It serves as a crucial component in the healthcare landscape, ensuring compliance with tax regulations and eligibility for Medicaid services. In this comprehensive guide, we will delve into the intricacies of the Medicaid Tax Form, providing a detailed analysis and practical insights to navigate this complex process.

Understanding the Medicaid Tax Form: An Overview

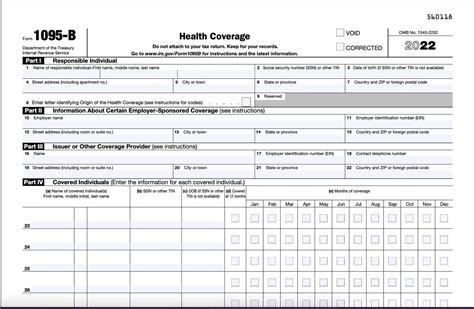

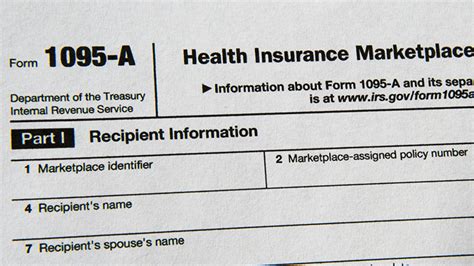

The Medicaid Tax Form, officially known as Form 1095-B, is a vital document issued by health insurance providers and certain government entities. It provides essential information regarding an individual’s or a business’s health coverage during the previous tax year. This form plays a pivotal role in determining eligibility for Medicaid, a government-funded healthcare program for low-income individuals and families.

Medicaid, established under Title XIX of the Social Security Act, offers comprehensive healthcare services to eligible individuals. The tax form serves as a critical tool to verify and report health insurance coverage, which is a key factor in determining one's eligibility for Medicaid benefits. Understanding the nuances of this form is essential for both individuals and businesses to ensure compliance and access to vital healthcare services.

Key Components of the Medicaid Tax Form

Form 1095-B contains several crucial sections that provide detailed information about an individual’s or a business’s health coverage. Let’s explore these components in depth:

Part I: Personal Information

This section includes the basic details of the individual or business, such as name, address, and tax identification number. It is crucial to ensure that all personal information is accurate and up-to-date, as it serves as a reference for tax authorities and Medicaid administrators.

Part II: Coverage Information

Part II provides a comprehensive overview of the health coverage held by the individual or business during the tax year. It includes details such as the type of coverage (e.g., individual, family, or employer-provided), the effective dates of the coverage, and any changes or gaps in coverage. This section is vital for determining continuous eligibility for Medicaid and ensuring compliance with the Affordable Care Act’s individual mandate.

Part III: Provider Information

Here, the form lists the details of the health insurance provider or government entity that issued the coverage. This includes the provider’s name, address, and contact information. This section is particularly important for individuals or businesses with multiple coverage options or when seeking clarification on specific coverage details.

Part IV: Additional Information

Part IV contains additional details that may impact an individual’s or business’s Medicaid eligibility. This section may include information about any applicable premiums, deductions, or adjustments. It is essential to review this part carefully, as it may contain critical information regarding one’s financial obligations or any special circumstances affecting Medicaid eligibility.

Completing the Medicaid Tax Form: A Step-by-Step Guide

Completing the Medicaid Tax Form accurately is crucial to avoid potential penalties and ensure eligibility for Medicaid services. Here’s a step-by-step guide to help you navigate the process:

Step 1: Gather Necessary Documentation

Before beginning the completion process, gather all relevant documents, such as previous year’s tax returns, health insurance cards, and any correspondence from your health insurance provider. Ensure that you have access to accurate and up-to-date information to complete the form correctly.

Step 2: Review Personal Information

Carefully review Part I of the form to ensure that your personal information is accurate and complete. Double-check your name, address, and tax identification number to avoid any discrepancies that may cause delays in processing.

Step 3: Verify Coverage Details

Part II of the form requires detailed information about your health coverage. Cross-reference your coverage details with your health insurance provider’s records or the insurance cards you have received. Ensure that the effective dates of coverage, plan type, and any changes in coverage are accurately reflected on the form.

Step 4: Enter Provider Information

In Part III, enter the details of your health insurance provider. This information should match the details provided by your insurance company. If you have multiple providers, ensure that you list them all accurately.

Step 5: Review Additional Information

Part IV may contain complex financial details or adjustments. If you have any questions or uncertainties about this section, it is advisable to consult with a tax professional or seek guidance from your health insurance provider. Accurate completion of this part is crucial for determining your Medicaid eligibility and avoiding potential issues.

Step 6: Sign and Submit

Once you have completed all sections of the form accurately, sign and date it. Ensure that you keep a copy of the completed form for your records. Submit the form to the appropriate tax authority or Medicaid administrator as per their guidelines. Timely submission is essential to avoid any delays in processing.

Medicaid Eligibility and the Tax Form

The Medicaid Tax Form plays a critical role in determining an individual’s or a business’s eligibility for Medicaid services. Here’s how it impacts eligibility:

Continuous Coverage Requirement

Medicaid requires individuals to maintain continuous health coverage throughout the year to be eligible for benefits. The tax form helps verify whether an individual or business has met this requirement by documenting the effective dates of coverage. Gaps in coverage may impact one’s eligibility, so it is essential to ensure that the form accurately reflects continuous coverage.

Income Verification

Medicaid eligibility is often income-based. The tax form provides crucial financial information, such as premiums paid and any applicable deductions. This data helps assess an individual’s or a business’s financial situation, which is a key factor in determining eligibility for Medicaid.

Special Circumstances

In certain cases, individuals may qualify for Medicaid despite having gaps in coverage or exceeding income limits. The tax form allows for the reporting of special circumstances, such as pregnancy, disability, or other qualifying events. These circumstances can impact Medicaid eligibility, so it is important to review this section carefully and provide accurate information.

Tips for Maximizing Medicaid Benefits

Understanding the Medicaid Tax Form is just the first step in navigating the complex world of healthcare coverage. Here are some additional tips to help you maximize your Medicaid benefits:

- Stay Informed: Keep up-to-date with the latest Medicaid guidelines and eligibility criteria. Changes in regulations can impact your eligibility, so staying informed is crucial.

- Review Coverage Options: Explore different coverage options available through Medicaid. Depending on your circumstances, you may be eligible for various programs, such as traditional Medicaid, Medicaid expansion, or other state-specific initiatives.

- Understand Cost-Sharing: Medicaid often requires participants to contribute to the cost of services through copayments or deductibles. Understand the cost-sharing structure and plan your finances accordingly to avoid unexpected expenses.

- Utilize Preventive Services: Medicaid covers a range of preventive services, such as vaccinations, screenings, and wellness visits. Taking advantage of these services can help maintain your health and catch potential issues early.

- Seek Professional Guidance: If you have complex financial or medical situations, consider seeking advice from a tax professional or a Medicaid specialist. They can provide personalized guidance and ensure you are taking full advantage of the benefits available to you.

The Future of Medicaid and Tax Forms

The landscape of healthcare and tax regulations is ever-evolving, and the Medicaid Tax Form is no exception. As healthcare policies and technologies advance, we can expect to see changes and improvements in the way tax forms are utilized and processed.

One potential future development is the integration of digital health records and tax forms. With the increasing adoption of electronic health records (EHRs), health insurance providers may be able to seamlessly share coverage information with tax authorities, simplifying the completion and verification process for individuals and businesses.

Additionally, advancements in data analytics and machine learning may lead to more efficient processing of tax forms. Automated systems could analyze and verify coverage information, reducing the potential for errors and streamlining the eligibility determination process.

Conclusion

The Medicaid Tax Form is a critical component in the healthcare and tax landscape, playing a pivotal role in determining eligibility for Medicaid services. By understanding the form’s components and completing it accurately, individuals and businesses can ensure compliance and access to essential healthcare benefits. As the healthcare industry continues to evolve, staying informed and adapting to changes in tax regulations will be key to maximizing Medicaid benefits.

How often must I complete the Medicaid Tax Form?

+The Medicaid Tax Form is typically required to be completed annually, covering the previous tax year’s health coverage. It is essential to stay updated with the tax filing deadlines to ensure timely submission.

Can I claim Medicaid benefits if I have gaps in coverage?

+Gaps in coverage may impact your eligibility for Medicaid benefits. However, certain circumstances, such as pregnancy, disability, or loss of income, may qualify you for coverage despite gaps. It is advisable to review your specific situation with a Medicaid specialist to understand your eligibility.

What happens if I fail to submit the Medicaid Tax Form on time?

+Failing to submit the Medicaid Tax Form on time may result in penalties and delays in processing your Medicaid application. It is crucial to adhere to the tax filing deadlines to avoid any complications with your Medicaid eligibility.

Can I apply for Medicaid if I am not a US citizen?

+Eligibility for Medicaid extends to certain non-citizens who meet specific criteria, such as being a lawful permanent resident or having refugee or asylee status. However, eligibility requirements vary by state, so it is essential to review your specific situation with a Medicaid specialist.

How can I verify the accuracy of the information on my Medicaid Tax Form?

+To verify the accuracy of your Medicaid Tax Form, cross-reference the information with your health insurance provider’s records and any correspondence you have received. If you have doubts or discrepancies, contact your provider or seek guidance from a tax professional.