Richland County Sc Property Tax

Property taxes are an essential component of local government funding, contributing significantly to the financial stability and growth of communities. In Richland County, South Carolina, property taxes play a vital role in supporting various public services and infrastructure. This article aims to delve into the intricacies of Richland County's property tax system, shedding light on how it operates, the factors influencing tax rates, and its impact on both residents and the local economy.

Understanding Richland County’s Property Tax System

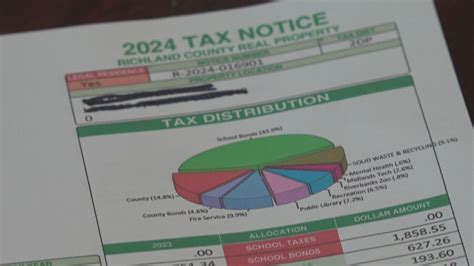

Richland County, nestled in the heart of South Carolina, employs a comprehensive property tax system to generate revenue for essential public services. This system is designed to ensure that property owners contribute fairly to the county’s overall financial health. The property tax revenue is utilized to fund critical services such as public education, emergency services, road maintenance, and various community development initiatives.

The property tax rate in Richland County is expressed as a millage rate, which represents the amount of tax levied per $1,000 of a property's assessed value. This rate is determined annually by the county government and can vary across different taxing jurisdictions within the county, including the county itself, municipalities, and special purpose districts.

Assessment Process

The property assessment process is a critical component of the tax system. Richland County employs a team of assessors who are responsible for determining the fair market value of each property within the county. This value is then used as the basis for calculating the property tax owed. The assessment process involves regular revaluations to ensure that property values remain current and accurate.

Property owners have the right to appeal their assessed values if they believe the assessment is incorrect. This process ensures transparency and allows for a fair and equitable tax system.

Tax Calculation and Payment

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the property tax due. The tax rate is a combination of the millage rates set by the various taxing jurisdictions. For instance, a property located within the city limits of Columbia, the county seat, will be subject to tax rates set by both the city and the county.

Property tax bills are typically sent out annually, and property owners are responsible for making timely payments. Failure to pay property taxes can result in penalties and, in extreme cases, the forced sale of the property to recover the outstanding taxes.

| Taxing Jurisdiction | Millage Rate |

|---|---|

| Richland County | 300 mills |

| Columbia City | 175 mills |

| Special Purpose District (Example) | 50 mills |

Factors Influencing Property Tax Rates

The property tax rates in Richland County are influenced by a multitude of factors, each playing a significant role in shaping the tax landscape.

Budgetary Needs

The primary factor driving property tax rates is the budgetary requirements of the county and its various taxing jurisdictions. As the cost of providing public services increases, so does the need for adequate revenue generation. Factors such as inflation, population growth, and changing service demands can all impact the county’s budget and, subsequently, the tax rates.

Economic Conditions

The local economy plays a crucial role in determining property tax rates. During periods of economic growth, property values tend to rise, leading to increased tax revenue. Conversely, economic downturns can result in decreased property values and, consequently, reduced tax revenue. Managing these economic fluctuations is a delicate balance for county officials.

Service Priorities

The priorities and initiatives of the county government and its various jurisdictions can also influence tax rates. For instance, if the county decides to invest in a major infrastructure project or enhance public safety services, additional funding may be required, potentially leading to higher tax rates.

Impact on Residents and the Local Economy

Property taxes have a significant impact on both the residents of Richland County and the local economy as a whole.

Resident Burden

For property owners, the property tax bill is a significant financial obligation. The tax rate and the assessed value of their property determine the amount they owe annually. While property taxes contribute to the community’s well-being, they can also be a financial burden, particularly for those on fixed incomes or with limited financial means.

To alleviate this burden, Richland County offers various tax relief programs, such as the Homestead Exemption, which provides a reduction in the assessed value of a primary residence for eligible homeowners.

Economic Development

From an economic perspective, property taxes play a crucial role in shaping the county’s business environment. Businesses, just like residents, are subject to property taxes based on the value of their commercial properties. Competitive tax rates can attract new businesses and investments, stimulating economic growth and job creation.

On the other hand, high tax rates can make the county less attractive to potential businesses, impacting its economic development prospects.

Future Outlook and Potential Changes

The property tax system in Richland County, like any other, is subject to continuous evaluation and potential reforms. As the county’s needs and priorities evolve, so too might the tax system.

Potential Reforms

There have been ongoing discussions about reforming the property tax system to make it more equitable and sustainable. Some proposed reforms include:

- Implementing a uniform tax rate across the county to ensure fairness.

- Introducing a property tax cap to limit the growth of tax bills, especially for long-term residents.

- Exploring alternative revenue sources to reduce the reliance on property taxes.

Impact of Technological Advancements

Technological advancements also have the potential to influence the property tax system. For instance, the use of advanced data analytics could enhance the accuracy and efficiency of the assessment process, leading to more precise tax calculations.

Conclusion

Richland County’s property tax system is a complex yet essential component of the local economy and community. It serves as a vital revenue stream, funding critical public services and infrastructure. While property taxes can be a financial burden for residents and businesses, they are also a necessary investment in the county’s future.

As Richland County continues to grow and evolve, the property tax system will undoubtedly adapt to meet the changing needs and priorities of its residents. By understanding the intricacies of this system, property owners can actively engage in the process, ensuring a fair and sustainable tax environment for all.

How are property tax rates determined in Richland County?

+Property tax rates in Richland County are set annually by the county government and can vary across different taxing jurisdictions. The rates are determined based on the budgetary needs of the county, economic conditions, and service priorities.

What is the assessment process for property values in the county?

+Property values are assessed by a team of assessors who determine the fair market value of each property. This process involves regular revaluations to ensure accurate and up-to-date assessments. Property owners can appeal their assessed values if they believe they are incorrect.

How often are property tax bills sent out, and when are they due?

+Property tax bills are typically sent out annually, and property owners are responsible for making timely payments. The due dates may vary, but most counties provide a grace period before penalties are incurred.

Are there any tax relief programs available for property owners in Richland County?

+Yes, Richland County offers tax relief programs such as the Homestead Exemption, which provides a reduction in the assessed value of a primary residence for eligible homeowners. Other programs may also be available, and residents are encouraged to explore these options to ease their tax burden.

How do property taxes impact the local business environment in Richland County?

+Property taxes can influence the business environment by attracting or deterring new businesses. Competitive tax rates can encourage economic growth and job creation, while high tax rates may make the county less attractive to potential investors.