Harris County Tax Records

Welcome to an in-depth exploration of Harris County Tax Records, a critical aspect of property ownership and management in the vibrant region of Harris County, Texas. This article aims to provide an extensive overview of the tax system, its processes, and its impact on both residents and businesses, offering a comprehensive guide for those navigating the world of property taxes in this dynamic county.

Understanding the Harris County Tax System

The Harris County Tax System is a complex mechanism that plays a pivotal role in the financial stability and development of the county. It involves a series of processes and regulations that determine the tax liabilities of property owners, including both real estate and personal property taxes. This system is not only crucial for generating revenue for the county but also for funding essential services and infrastructure projects.

At the heart of this system is the Harris County Appraisal District (HCAD), an independent governmental unit responsible for discovering, appraising, and valuing properties within the county. HCAD plays a critical role in ensuring fairness and accuracy in property taxation, employing a team of professionals dedicated to this task.

The tax system in Harris County operates on an annual cycle, with various key dates and deadlines that property owners must be aware of. The process begins with the appraisal process, where HCAD assesses the value of each property, considering factors such as location, improvements, and market conditions. This value forms the basis for calculating property taxes.

Key Tax Dates and Deadlines

Understanding the timeline of the tax system is essential for property owners to ensure compliance and avoid penalties. Here’s a breakdown of the key dates:

- January to April: Property owners receive their appraisal notices, detailing the proposed value of their property for tax purposes.

- April to May: This period is crucial for protests. Property owners can file protests if they believe the proposed value is inaccurate or unfair. HCAD conducts hearings to address these protests.

- July: The appraisal roll, which is the official list of all appraised properties and their values, is finalized and approved by the Appraisal Review Board (ARB). This roll becomes the basis for tax calculations.

- October: Tax bills are mailed out to property owners, detailing the amount of taxes due for the year. This is a critical date as it marks the start of the tax payment period.

- January: The tax payment period ends, and any unpaid taxes may be subject to penalties and interest.

It's important to note that while these are the general timelines, specific dates may vary slightly from year to year. Property owners should refer to the official HCAD website or consult with a tax professional for the most accurate and up-to-date information.

Property Appraisal and Assessment

The property appraisal and assessment process is a cornerstone of the Harris County Tax System. HCAD employs a range of methods to determine the value of properties, ensuring fairness and accuracy in the taxation process.

Methods of Property Appraisal

HCAD uses three primary methods to appraise properties:

- Market Value Approach: This method considers the recent sales prices of similar properties in the area, taking into account factors such as size, age, and amenities. It provides a reliable indicator of the property’s market value.

- Cost Approach: This approach estimates the cost of rebuilding the property, minus depreciation, and adds the value of the land. It’s particularly useful for unique or custom-built properties.

- Income Approach: Used primarily for commercial properties, this method assesses the property’s income-generating potential, taking into account factors like rental income, operating expenses, and market conditions.

HCAD employs a combination of these methods, ensuring that each property is valued fairly and accurately. This process is crucial for determining the property's taxable value, which forms the basis for calculating property taxes.

Factors Affecting Property Value

Several factors can influence the value of a property, and thus its tax liability. These include:

- Location: Properties in desirable locations, such as those with proximity to schools, parks, or commercial hubs, often command higher values.

- Improvements: Any additions or renovations to a property, such as a new roof, an extension, or landscaping improvements, can increase its value.

- Market Conditions: The real estate market fluctuates, and these fluctuations can impact property values. During a seller’s market, for instance, property values may rise, leading to higher tax liabilities.

- Economic Factors: Economic conditions, such as interest rates and job market trends, can influence property values and, by extension, tax liabilities.

Understanding these factors can help property owners anticipate changes in their tax liabilities and plan their financial strategies accordingly.

Property Tax Calculation and Payment

Once the appraisal process is complete and the taxable value of properties is determined, the next step is to calculate and pay the property taxes. This process is critical for ensuring the financial stability of Harris County and funding essential services.

Tax Rate Determination

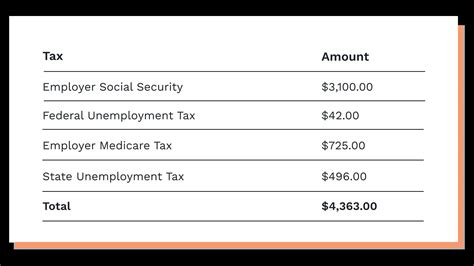

The tax rate, also known as the tax levy, is a critical component in calculating property taxes. It is set by the various taxing units in Harris County, such as the county government, school districts, and special districts. These taxing units use property taxes to fund their operations and provide services to residents.

The tax rate is typically expressed as a percentage and is applied to the taxable value of the property. For example, if a property has a taxable value of $100,000 and the tax rate is 2%, the property tax due would be $2,000. This rate can vary from year to year, and it's important for property owners to stay informed about changes in the tax rate to budget accordingly.

Tax Bill Breakdown

A typical property tax bill in Harris County includes several components. These include:

- Taxable Value: This is the assessed value of the property after any applicable exemptions or limitations.

- Tax Rate: The rate set by the taxing units, as discussed above.

- Tax Amount: The total amount of taxes due, calculated by multiplying the taxable value by the tax rate.

- Penalties and Interest: If taxes are not paid by the deadline, additional charges may apply.

- Other Fees: These may include appraisal district fees, late payment fees, or other administrative charges.

It's important for property owners to carefully review their tax bills to ensure accuracy and to understand the breakdown of the charges. Any discrepancies or questions should be addressed promptly with the relevant taxing authority or the HCAD.

Payment Options and Deadlines

Harris County offers several convenient payment options for property taxes, including online payments, payment by mail, and in-person payments at designated locations. Property owners can choose the method that best suits their preferences and needs.

The payment deadline is typically set for January, and it's crucial for property owners to meet this deadline to avoid penalties and interest. However, it's worth noting that there may be options for deferred payments or payment plans for eligible property owners who are facing financial difficulties. These options should be explored well in advance of the deadline to ensure compliance with the necessary requirements.

Property Tax Exemptions and Limitations

Harris County offers a range of property tax exemptions and limitations to certain property owners, providing relief from the full tax burden. These exemptions and limitations are designed to support specific groups of residents and promote community development.

Types of Exemptions and Limitations

Harris County offers several types of exemptions and limitations, each with its own eligibility criteria and application process. These include:

- Homestead Exemption: This exemption is available to homeowners who use their property as their primary residence. It reduces the taxable value of the property, resulting in lower property taxes. The exemption amount varies depending on the property’s location and the homeowner’s age.

- Over-65 Exemption: Property owners who are 65 years or older and meet certain income requirements may be eligible for this exemption. It provides a reduction in the taxable value of the property, similar to the homestead exemption.

- Disability Exemption: Individuals with disabilities may be eligible for this exemption, which reduces the taxable value of their property. The eligibility criteria include having a permanent disability and meeting certain income requirements.

- Charitable Organizations: Certain charitable organizations, such as religious institutions and nonprofit organizations, may qualify for exemptions on their properties. These exemptions support the important work of these organizations in the community.

It's important to note that these are just a few examples of the exemptions and limitations available in Harris County. Property owners should consult with the HCAD or a tax professional to determine their eligibility for these and other potential tax relief options.

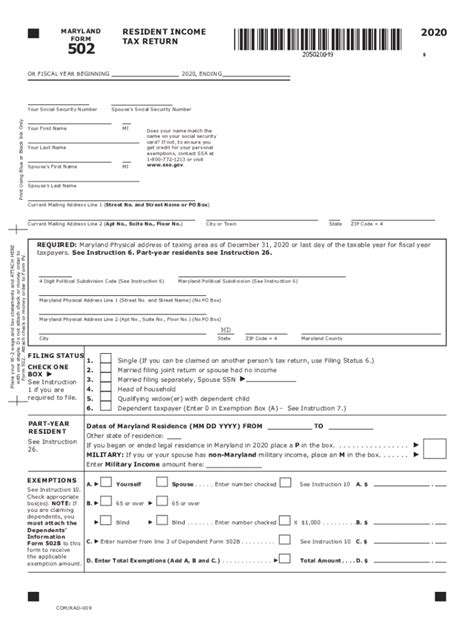

Application Process and Deadlines

The application process for exemptions and limitations varies depending on the type of exemption. Some exemptions require annual applications, while others are granted for a set period and may not require annual renewal.

It's crucial for property owners to be aware of the application deadlines to ensure they meet the requirements for the upcoming tax year. Missing the deadline may result in the loss of the exemption for that year, which can significantly increase the property's tax liability.

Property owners can typically apply for exemptions and limitations through the HCAD website or by visiting their local HCAD office. The application process may require documentation to support the claim, such as proof of residency, income statements, or disability certifications.

Appealing Property Tax Assessments

In some cases, property owners may disagree with the appraisal district’s determination of their property’s value or the resulting tax liability. In such situations, Harris County offers a formal process for appealing these assessments, ensuring that property owners have a voice in the taxation process.

Reasons for Appeals

Property owners may consider appealing their property tax assessment for various reasons. Some common reasons include:

- Overvaluation: If a property owner believes that the appraisal district has overvalued their property, resulting in a higher tax liability, they may wish to appeal.

- Unequal Appraisal: If a property owner believes that their property has been appraised unequally compared to similar properties in the area, an appeal may be warranted.

- Exemption Denial: If a property owner has been denied an exemption or limitation for which they believe they are eligible, they can appeal the decision.

- Special Circumstances: Unique circumstances, such as damage to the property or a significant change in market conditions, may also be grounds for an appeal.

It's important to note that appeals should be based on factual evidence and should not be taken lightly. Property owners should carefully consider their reasons for appealing and gather the necessary documentation to support their case.

Appeal Process and Timeline

The appeal process in Harris County is a formal procedure that involves several steps. Here’s a general overview of the process:

- Notice of Protest: Property owners must first file a Notice of Protest with the HCAD, stating their reasons for appealing the assessment. This notice should be filed within a specified deadline, typically shortly after receiving the appraisal notice.

- Informal Review: The HCAD may schedule an informal review meeting to discuss the protest. This is an opportunity for the property owner to present their case and provide supporting evidence.

- Appraisal Review Board (ARB) Hearing: If the informal review does not result in a satisfactory resolution, the property owner can request a formal hearing before the ARB. The ARB is an independent body that reviews protests and makes decisions on property values.

- ARB Decision: The ARB will issue a written decision on the protest, which may uphold the original appraisal, adjust the value, or provide other relief. Property owners have the right to appeal the ARB’s decision to district court if they are not satisfied with the outcome.

It's important to note that the appeal process can be complex and may require the assistance of a tax professional or legal representation. Property owners should carefully review the HCAD's guidelines and timelines for protests and appeals to ensure they meet all the requirements.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure projects in Harris County, directly impacting the quality of life for residents and the overall development of the community.

Funding Essential Services

Property taxes are a significant source of revenue for local governments and school districts in Harris County. This revenue is used to fund a wide range of essential services, including:

- Education: Property taxes are a primary source of funding for public schools, ensuring that students have access to quality education and necessary resources.

- Public Safety: Revenue from property taxes supports police and fire departments, ensuring the safety and security of residents and businesses.

- Healthcare: Property taxes contribute to funding public health initiatives and programs, providing access to healthcare services for all residents.

- Social Services: These taxes support social welfare programs, such as assistance for low-income families, seniors, and individuals with disabilities.

- Infrastructure: Property taxes are invested in maintaining and improving roads, bridges, and other critical infrastructure, ensuring efficient transportation and a well-connected community.

Without property taxes, many of these essential services would be severely impacted or even unavailable, highlighting the critical role that property taxes play in the community's well-being.

Community Development and Growth

Property taxes also play a significant role in fostering community development and economic growth in Harris County. The revenue generated from property taxes is often reinvested into the community through various initiatives and projects, such as:

- Economic Development: Property taxes support efforts to attract and retain businesses, creating jobs and stimulating the local economy.

- Community Facilities: Revenue is used to build and maintain community facilities like parks, recreation centers, and public libraries, enhancing the quality of life for residents.

- Environmental Initiatives: Property taxes can fund environmental programs, such as waste management, water conservation, and green initiatives, promoting a sustainable and healthy community.

- Affordable Housing: Some of the revenue generated from property taxes may be allocated to affordable housing programs, ensuring that all residents have access to safe and affordable housing options.

By reinvesting property tax revenue into these initiatives, Harris County can continue to thrive and grow, creating a vibrant and prosperous community for its residents.

Conclusion

The Harris County Tax Records system is a complex but essential mechanism that plays a critical role in the financial stability and development of the county. From the appraisal and assessment process to the calculation and payment of taxes, every step is designed to ensure fairness and accuracy in property taxation.

By understanding the system, property owners can navigate the process with confidence, ensuring compliance with tax regulations and taking advantage of available exemptions and limitations. The system also provides a platform for property owners to appeal assessments if they believe their property has been unfairly valued, ensuring a fair and transparent taxation process.

Furthermore, the revenue generated from property taxes is a vital source of funding for essential services and community development initiatives, directly impacting the quality of life for Harris County residents. As such, the tax system is not just about revenue generation but also about supporting and enhancing the community's well-being.

In conclusion, Harris County Tax Records are a crucial aspect of property ownership and management, offering a comprehensive guide to understanding and navigating the complex world of property taxes. By staying informed and engaged with the tax system, property owners can ensure they are meeting their obligations while also contributing to the vibrant and thriving community of Harris County.

Frequently Asked Questions

What is the deadline for paying property taxes in Harris County?

+The deadline for paying property taxes in Harris County is typically in January. However, it’s important to note that this deadline may vary slightly from year to year. Property owners should refer to their tax bills or the official HCAD website for the most accurate and up-to-date information.

How can I check the status of my property tax payment?

+Property owners can check the status