Kansas Tax Return Status

The Kansas Tax Return Status is an important aspect of understanding the financial obligations and processes for residents and businesses operating within the state of Kansas. This comprehensive guide aims to provide an in-depth analysis of the tax return process, offering insights into the procedures, timelines, and strategies for efficient tax management in the Sunflower State.

Understanding the Kansas Tax System

Kansas, like most states, has its own unique tax system, which encompasses various types of taxes, including income tax, sales tax, property tax, and more. The Kansas Department of Revenue (KDOR) is the primary authority responsible for overseeing the state’s tax administration and enforcement. Understanding the Kansas tax system is crucial for individuals and businesses to navigate the process effectively and ensure compliance with state regulations.

Income Tax

The income tax system in Kansas operates on a graduated rate structure, meaning tax rates increase as taxable income rises. As of the 2023 tax year, Kansas has five income tax brackets ranging from 2.9% to 5.7%. These rates apply to various types of income, including wages, salaries, interest, dividends, and business income.

For example, a single filer with a taxable income of 40,000 would fall into the 3.15% bracket, resulting in an income tax liability of 1,260. On the other hand, a married couple filing jointly with a taxable income of 150,000 would be subject to a higher rate of 5.25%, leading to a tax liability of 7,875.

| Tax Bracket | Tax Rate | Applicable Income Range |

|---|---|---|

| 1 | 2.9% | Up to $15,000 |

| 2 | 3.15% | $15,001 - $30,000 |

| 3 | 3.55% | $30,001 - $50,000 |

| 4 | 4.6% | $50,001 - $75,000 |

| 5 | 5.7% | Over $75,000 |

Sales and Use Tax

Kansas imposes a sales tax on the sale of tangible personal property and certain services. The state’s general sales tax rate is 6.5%, which is applied to most retail sales. However, certain jurisdictions within Kansas may levy additional local sales taxes, resulting in a higher overall sales tax rate for specific areas.

Additionally, Kansas has a use tax that applies to out-of-state purchases made by Kansas residents. This tax ensures that all purchases, regardless of where they are made, are subject to the appropriate tax. The use tax rate mirrors the sales tax rate, so if the sales tax in a particular jurisdiction is 8%, the use tax would also be 8%.

Property Tax

Property taxes in Kansas are primarily assessed and collected at the local level, with rates varying by county and municipality. The property tax system is based on the assessed value of real estate and personal property. The assessed value is determined by the county appraiser and can vary based on factors such as location, improvements, and market conditions.

For instance, a homeowner in Johnson County with a property valued at 250,000 might expect to pay approximately 2,500 in annual property taxes, assuming a typical mill levy of 100 mills.

The Kansas Tax Return Process

Filing a tax return in Kansas involves several steps, from gathering necessary documentation to selecting the appropriate filing method and ensuring timely submission. Understanding this process is crucial for accurate reporting and timely compliance.

Gathering Documentation

To prepare a Kansas tax return, individuals and businesses must gather relevant financial documents. These typically include wage and salary statements (Form W-2), interest and dividend statements, business income and expense records, and any other documents related to income, deductions, and credits.

For instance, a self-employed individual might need to collect records of business income, expenses, and any applicable tax credits or deductions. On the other hand, a salaried employee would primarily focus on gathering W-2 forms and any other income-related documents.

Choosing the Right Filing Method

Kansas offers multiple filing methods, including traditional paper returns, online filing through the KDOR website, and various tax preparation software options. The choice of filing method depends on individual preferences, comfort with technology, and the complexity of the tax return.

Online filing is a popular choice due to its convenience and efficiency. The KDOR website provides a user-friendly interface, allowing taxpayers to input their information directly into the system. This method is especially beneficial for those who are comfortable with technology and prefer a more streamlined process.

E-Filing Benefits

Electronic filing, or e-filing, offers several advantages over traditional paper returns. It is faster, more secure, and reduces the risk of errors. The KDOR’s e-filing system provides real-time status updates, allowing taxpayers to track the progress of their return and receive notifications about any issues or discrepancies.

Additionally, e-filing can expedite the refund process. In many cases, electronic returns are processed more quickly than paper returns, resulting in faster refund checks or direct deposits.

Filing Deadlines and Extensions

The standard deadline for filing Kansas tax returns is April 15th, aligning with the federal tax filing deadline. However, in years when April 15th falls on a weekend or holiday, the deadline is typically extended to the following business day.

Taxpayers who are unable to meet the filing deadline can request an extension. The KDOR offers a form for this purpose, which extends the filing deadline to October 15th. However, it’s important to note that an extension to file does not extend the deadline to pay any taxes owed.

Checking Tax Return Status

After filing a tax return, it’s natural for taxpayers to want to know the status of their return and, if applicable, the progress of their refund. The KDOR provides several methods for taxpayers to check their return status and obtain updates.

Online Status Check

The KDOR website offers an online tool specifically designed for taxpayers to check the status of their returns. This tool requires the taxpayer’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as other identifying information, to ensure security and privacy.

The online status check provides real-time updates, indicating whether the return has been received, is being processed, or has been accepted. It also provides information on any potential issues or errors that may have been identified during the processing stage.

Phone Status Updates

For those who prefer a more personal approach, the KDOR operates a taxpayer assistance hotline. Taxpayers can call this hotline to speak with a customer service representative who can provide status updates and answer any general tax-related questions.

However, it’s important to note that the hotline may experience higher call volumes during peak tax season, leading to longer wait times. Therefore, the online status check may be a more efficient option for obtaining quick updates.

Refund Status and Timelines

Taxpayers who are expecting a refund can also use the online status check tool to track the progress of their refund. The KDOR aims to process refunds within 45 days of receiving a complete and accurate return. However, this timeline can vary based on factors such as the complexity of the return, errors or discrepancies, and the volume of returns being processed.

In some cases, refunds may be delayed due to issues such as missing or incorrect information, suspected fraud, or additional verification requirements. The online status check tool provides updates on the progress of the refund, indicating whether it has been approved, is being processed, or if there are any hold-ups.

Common Issues and Resolutions

While the Kansas tax system is designed to be straightforward, taxpayers may encounter various issues during the filing and return status check process. Understanding these common issues and their resolutions can help taxpayers navigate potential hurdles and ensure a smooth tax experience.

Missing or Incorrect Information

One of the most common issues that can delay the processing of a tax return is missing or incorrect information. This can include errors in names, addresses, Social Security Numbers, or any other critical data. Taxpayers should carefully review their returns before submitting them to minimize the risk of errors.

If the KDOR identifies missing or incorrect information during the processing stage, it may send a notice to the taxpayer requesting additional documentation or clarification. Responding promptly to these notices is crucial to avoid further delays in processing.

Suspected Fraud or Identity Theft

In rare cases, tax returns may be flagged for suspected fraud or identity theft. This can occur when multiple returns are filed using the same identifying information or when there is a discrepancy between the return and the taxpayer’s actual financial situation.

If a return is flagged for fraud or identity theft, the KDOR will investigate the matter and may require additional documentation or evidence to verify the taxpayer’s identity and the legitimacy of the return. Taxpayers should cooperate fully with any such investigations to resolve the issue promptly.

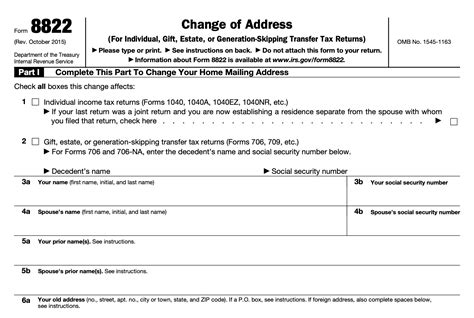

Address Verification and Correspondence

Maintaining an up-to-date address with the KDOR is crucial for receiving important tax-related correspondence, including notices, refund checks, and other communications. Taxpayers should notify the KDOR of any changes to their mailing address to ensure uninterrupted communication.

If a taxpayer does not receive expected correspondence, they can use the online status check tool to verify their address and ensure it is accurate. If the address is incorrect, the taxpayer can update it through the KDOR’s website or by contacting the taxpayer assistance hotline.

Future Outlook and Tax Strategies

Looking ahead, the Kansas tax system is likely to continue evolving to meet the changing needs of the state’s residents and businesses. Understanding these potential changes and developing effective tax strategies can help taxpayers optimize their financial situations and plan for the future.

Potential Tax Law Changes

Tax laws are subject to change at both the state and federal levels. In recent years, Kansas has implemented various tax reforms, including adjustments to tax brackets, credits, and deductions. Taxpayers should stay informed about these changes to ensure they are taking full advantage of available benefits and complying with new regulations.

For example, the state introduced the Kansas Reinvestment Tax Credit in 2020, which provides a tax credit for businesses that reinvest in their Kansas operations. Understanding such incentives can lead to significant tax savings for eligible businesses.

Strategic Tax Planning

Effective tax planning involves more than just filing a return. It requires a proactive approach to minimize tax liabilities and maximize available credits and deductions. This may involve adjusting financial strategies, optimizing business operations, or taking advantage of specific tax incentives.

For instance, businesses can consider strategies such as deferring income or accelerating deductions to manage their tax liabilities more effectively. Individuals may benefit from contributing to tax-advantaged retirement accounts or exploring education tax credits.

Exploring Tax Software and Professional Services

For those who find the tax system complex or want to ensure maximum accuracy, utilizing tax preparation software or engaging the services of a tax professional can be beneficial. These tools and services can provide guidance on tax laws, help identify potential deductions and credits, and ensure compliance with state regulations.

Tax preparation software often comes with built-in features that calculate deductions and credits based on individual circumstances, making the tax filing process more efficient and accurate. Additionally, tax professionals can provide personalized advice and assist with complex tax situations.

Conclusion: Navigating the Kansas Tax Landscape

The Kansas tax system, while comprehensive, is designed to be accessible and user-friendly. By understanding the various types of taxes, the filing process, and the methods for checking return status, taxpayers can navigate the system with confidence and efficiency. Staying informed about tax laws, utilizing available resources, and seeking professional guidance when needed can further enhance the tax experience and optimize financial outcomes.

How long does it typically take for a Kansas tax refund to be processed and issued?

+The KDOR aims to process refunds within 45 days of receiving a complete and accurate return. However, this timeline can vary based on factors such as the complexity of the return, errors or discrepancies, and the volume of returns being processed.

Can I file an amended return if I discover an error after submitting my original return?

+Yes, taxpayers can file an amended return using Form K-40, which is available on the KDOR website. It’s important to correct any errors promptly to ensure accurate tax reporting and avoid potential penalties.

What should I do if I don’t receive my refund within the expected timeframe?

+If a refund is not received within the expected timeframe, taxpayers can check the status of their return using the online status check tool. If the refund has been approved but not issued, taxpayers can contact the KDOR’s taxpayer assistance hotline for further assistance.

Are there any tax incentives or credits available for specific industries or circumstances in Kansas?

+Yes, Kansas offers various tax incentives and credits to support specific industries and promote economic development. These include the Kansas Reinvestment Tax Credit, which encourages businesses to reinvest in their Kansas operations, and the Kansas Rural Opportunity Zone Program, which provides tax benefits to individuals who move to designated rural areas.

How can I stay updated on changes to Kansas tax laws and regulations?

+Taxpayers can stay informed about changes to Kansas tax laws by regularly visiting the KDOR website, which provides updates and announcements. Additionally, subscribing to tax-related newsletters or following reputable tax blogs can provide valuable insights into tax law changes and their implications.