Tax

Car Tax Ct

<p>Welcome to our comprehensive guide on car tax in Connecticut. Owning a vehicle in the Nutmeg State comes with a set of

unique responsibilities, and understanding the intricacies of car taxation is crucial for every driver. From

registration fees to emissions testing, we'll explore the key aspects that impact your wallet and your driving

experience.</p>

<p>Connecticut's car tax system is designed to fund infrastructure development, ensure road safety, and maintain

environmental standards. As a responsible driver, it's essential to stay informed about your obligations and the

benefits that come with them. Let's dive into the world of car tax and uncover the essential knowledge every

Connecticut driver should possess.</p>

<h2>The Fundamentals of Car Tax in Connecticut</h2>

<p>Car tax in Connecticut encompasses a range of fees and regulations that vary depending on the type of vehicle, its

age, and its intended use. The primary purpose of these taxes is to contribute to the state's infrastructure and

transportation network, while also promoting environmental sustainability.</p>

<h3>Registration Fees: The Gateway to Connecticut Roads</h3>

<p>When you purchase a vehicle in Connecticut, you're required to register it with the <em>Department of Motor

Vehicles</em> (DMV). This process involves paying a registration fee, which serves as your ticket to legally

operate your vehicle on Connecticut roads.</p>

<p>The registration fee is calculated based on the type of vehicle you own. For instance, passenger cars typically incur

a standard registration fee, while larger vehicles like trucks and SUVs may face higher fees. Additionally,

Connecticut offers discounted registration fees for certain vehicle types, such as electric and hybrid vehicles,

encouraging the adoption of eco-friendly transportation.</p>

<table>

<tr>

<th>Vehicle Type</th>

<th>Registration Fee</th>

</tr>

<tr>

<td>Passenger Car</td>

<td>$48</td>

</tr>

<tr>

<td>Light Truck</td>

<td>$60</td>

</tr>

<tr>

<td>Electric Vehicle</td>

<td>$30</td>

</tr>

</table>

<p>It's important to note that registration fees are subject to change annually, so it's wise to check the official DMV

website for the most up-to-date information.</p>

<h3>Emissions Testing: Connecticut's Clean Air Initiative</h3>

<p>Connecticut is committed to maintaining clean air quality, and as such, vehicle emissions testing is a critical

component of its car tax system. This testing ensures that vehicles meet certain environmental standards and

contribute to reducing air pollution.</p>

<p>Emissions testing is mandatory for all vehicles registered in Connecticut, regardless of their age or type. The

testing schedule varies depending on the county where your vehicle is registered. For instance, vehicles in Hartford

County are required to undergo testing every other year, while those in Fairfield County must test annually.</p>

<p>The cost of emissions testing is typically included in your registration fee. However, if your vehicle fails the test,

you'll need to pay for repairs and retesting, which can add up quickly. It's recommended to keep your vehicle well-

maintained to avoid costly repairs and ensure it passes the emissions test.</p>

<h3>Property Taxes: Assessing Your Vehicle's Value</h3>

<p>In Connecticut, vehicles are subject to <em>ad valorem</em> taxation, which means their value is assessed annually for

property tax purposes. This assessment is based on the vehicle's make, model, and age, and it's used to determine the

property tax you'll owe to your local municipality.</p>

<p>The property tax rate varies from town to town, so it's essential to check with your local tax assessor's office to

understand the specific rate applicable to your vehicle. This tax is typically paid alongside your real estate

property taxes, and it's due annually.</p>

<h3>Additional Fees and Taxes</h3>

<p>Beyond registration, emissions testing, and property taxes, Connecticut drivers may encounter additional fees and

taxes throughout their vehicle ownership journey.</p>

<p>For instance, if you purchase a vehicle from a private seller, you'll need to pay a transfer fee to register the

vehicle in your name. This fee varies depending on the vehicle's purchase price and is calculated as a percentage of

the sale.</p>

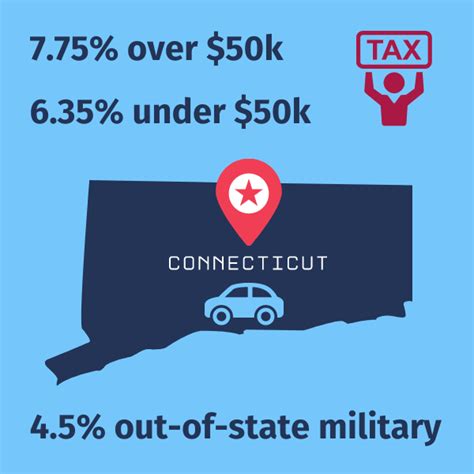

<p>Connecticut also imposes a sales tax on vehicle purchases. The current sales tax rate is 6.35%, which is applied to

the purchase price of the vehicle. This tax is collected by the seller and remitted to the state.</p>

<h2>Navigating the Registration Process</h2>

<p>Registering your vehicle in Connecticut is a straightforward process, but it requires careful attention to detail to

ensure you comply with all the necessary requirements.</p>

<h3>Documents You'll Need</h3>

<ul>

<li>Proof of vehicle ownership (title or bill of sale)</li>

<li>Valid driver's license</li>

<li>Proof of insurance</li>

<li>Emissions test certificate (if applicable)</li>

<li>Payment for registration fees</li>

</ul>

<h3>The Registration Process</h3>

<ol>

<li>Visit your local DMV office or utilize the online registration system.</li>

<li>Provide the required documentation.</li>

<li>Pay the registration fee.</li>

<li>Receive your registration certificate and license plates.</li>

</ol>

<p>It's important to note that if you're registering a newly purchased vehicle, you'll have a specific timeframe to

complete the registration process to avoid penalties. Make sure to familiarize yourself with the deadlines and plan

accordingly.</p>

<h2>Staying Current with Your Car Tax Obligations</h2>

<p>To maintain your vehicle registration and avoid penalties, it's crucial to stay on top of your car tax obligations.

Here are some key considerations:</p>

<h3>Renewing Your Registration</h3>

<p>Connecticut vehicle registrations are valid for a specific period, typically one or two years. As your registration

expiration date approaches, you'll receive a renewal notice from the DMV. Make sure to renew your registration on

time to avoid late fees and potential legal consequences.</p>

<p>The renewal process is similar to the initial registration process, but you'll need to provide updated proof of

insurance and emissions testing (if applicable). You can renew your registration online, by mail, or in person at

your local DMV office.</p>

<h3>Keeping Your Vehicle Insured</h3>

<p>Connecticut requires all vehicle owners to maintain liability insurance coverage. This coverage protects you and

others in the event of an accident, providing financial protection for damages and injuries.</p>

<p>Make sure to keep your insurance policy up-to-date and provide proof of insurance when registering or renewing your

vehicle. Failure to maintain insurance coverage can result in significant penalties, including the suspension of

your registration.</p>

<h3>Emissions Testing and Maintenance</h3>

<p>As mentioned earlier, emissions testing is a critical component of Connecticut's car tax system. Make sure to stay

informed about your testing schedule and plan accordingly. Regular vehicle maintenance is essential to ensure your

vehicle passes the emissions test and remains in good working condition.</p>

<h2>The Future of Car Tax in Connecticut</h2>

<p>Connecticut is continually evolving its car tax system to align with changing transportation trends and

environmental goals. Here's a glimpse into the future of car tax in the Nutmeg State:</p>

<h3>Electric Vehicle Incentives</h3>

<p>Connecticut is actively promoting the adoption of electric vehicles (EVs) to reduce carbon emissions and combat

climate change. The state offers a range of incentives for EV owners, including reduced registration fees and

dedicated charging infrastructure.</p>

<p>As the popularity of EVs grows, Connecticut is likely to enhance its incentive programs to further encourage the

transition to electric mobility.</p>

<h3>Alternative Fuel Vehicles</h3>

<p>In addition to EVs, Connecticut is exploring other alternative fuel vehicles, such as hydrogen fuel cell vehicles and

plug-in hybrid electric vehicles. These vehicles offer reduced emissions and increased fuel efficiency, making them

attractive options for environmentally conscious drivers.</p>

<p>The state is expected to provide incentives and infrastructure support for these vehicles, making them more accessible

and affordable for Connecticut residents.</p>

<h3>Smart Transportation Technologies</h3>

<p>Connecticut is investing in smart transportation technologies to improve road safety and efficiency. This includes

implementing connected vehicle infrastructure, which allows vehicles to communicate with each other and with

roadside infrastructure, enhancing traffic flow and reducing congestion.</p>

<p>As these technologies become more widespread, Connecticut's car tax system may adapt to incentivize the adoption of

smart transportation solutions, encouraging drivers to embrace the future of mobility.</p>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>How often do I need to renew my vehicle registration in Connecticut?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Vehicle registrations in Connecticut are typically valid for one or two years. You'll receive a

renewal notice from the DMV as your expiration date approaches. It's important to renew on time to

avoid late fees and potential legal issues.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exemptions from emissions testing in Connecticut?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Certain vehicles, such as those powered by natural gas or hydrogen, are exempt from emissions testing

in Connecticut. Additionally, vehicles manufactured before a specific year (currently 1975) are

also exempt. Check with the DMV for the most up-to-date information on exemptions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I fail the emissions test in Connecticut?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your vehicle fails the emissions test, you'll need to make the necessary repairs and retest your

vehicle. The cost of repairs and retesting can vary depending on the issue. It's important to

address the problem promptly to avoid further penalties and ensure your vehicle is environmentally

friendly.</p>

</div>

</div>

</div>

</div>

<p>By staying informed about car tax in Connecticut, you can navigate the road to vehicle ownership with confidence.

Remember to keep your registration current, maintain your vehicle, and stay aware of the latest developments in

Connecticut's transportation landscape. Happy driving!</p>