Sales Tax In Nc

Welcome to this comprehensive guide on understanding and navigating the intricacies of sales tax in the state of North Carolina. As a business owner or an individual handling financial transactions, it's crucial to have a clear understanding of the tax regulations to ensure compliance and avoid any legal pitfalls. In this article, we will delve into the specifics of North Carolina's sales tax system, providing you with valuable insights and practical information.

Understanding Sales Tax in North Carolina

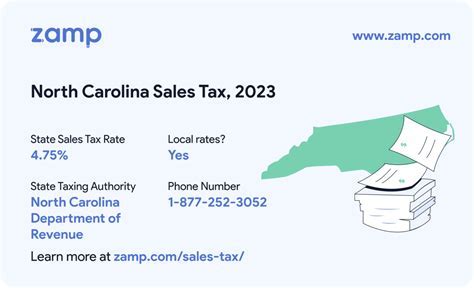

Sales tax in North Carolina is a critical component of the state's revenue system, contributing significantly to its economic growth and development. The state imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property, as well as the sale of certain services. This tax is collected by businesses and remitted to the North Carolina Department of Revenue, which plays a vital role in enforcing tax laws and ensuring fair taxation.

North Carolina's sales tax is a statewide tax, meaning it applies uniformly across the state. However, it's important to note that there are also local sales taxes that vary by county and city. These local taxes are in addition to the state sales tax and can further increase the overall tax rate for consumers. Understanding these local variations is crucial for businesses operating in multiple jurisdictions within the state.

The North Carolina Department of Revenue plays a pivotal role in administering and enforcing the state's tax laws. It provides extensive resources and guidance to help businesses and individuals navigate the tax system. The department's website offers a wealth of information, including tax rates, registration processes, and filing requirements. They also provide tools and calculators to assist in calculating sales tax accurately.

Sales Tax Rates and Calculations

The sales tax rate in North Carolina consists of both the state tax rate and any applicable local tax rates. As of [current year], the state sales tax rate stands at 4.75%. However, when combined with local taxes, the total sales tax rate can vary significantly. For instance, in the city of Charlotte, the total sales tax rate is 7.25%, including the state tax and the local tax of 2.5%. It's crucial for businesses to be aware of these variations to accurately calculate and collect the appropriate sales tax from customers.

To illustrate the impact of sales tax rates, let's consider an example. If a consumer purchases a laptop priced at $1,000 in Charlotte, they would be subject to a sales tax of $72.50 (7.25% of $1,000). This tax is then remitted to the state and local authorities by the business. Accurate calculation and collection of sales tax are essential to ensure compliance and maintain a positive relationship with both customers and tax authorities.

| Jurisdiction | State Tax Rate | Local Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| North Carolina Statewide | 4.75% | Varies by County/City | Varies |

| Charlotte | 4.75% | 2.5% | 7.25% |

| Raleigh | 4.75% | 2.5% | 7.25% |

| Durham | 4.75% | 2.5% | 7.25% |

Taxable and Exempt Items

Not all goods and services are subject to sales tax in North Carolina. Understanding which items are taxable and which are exempt is crucial for accurate tax calculation and compliance. Here's a brief overview of some common categories:

- Taxable Items: Most tangible personal property, including clothing, electronics, furniture, and vehicles, are subject to sales tax. Services such as repairs, installation, and certain professional services may also be taxable.

- Exempt Items: Certain items are exempt from sales tax in North Carolina. This includes non-prepared food items, prescription drugs, medical devices, and some agricultural products. Additionally, certain services like legal and accounting services are exempt from sales tax.

It's important to note that the taxability of items can be complex and may depend on specific circumstances. For instance, certain items may be exempt when purchased for business use but taxable when purchased for personal use. Consulting with tax professionals or referencing the North Carolina Department of Revenue's guidelines can provide clarity on specific scenarios.

Sales Tax Registration and Collection

Businesses operating in North Carolina are required to register for a Sales and Use Tax Permit if they meet certain criteria. This permit authorizes the business to collect and remit sales tax on behalf of the state and local authorities. The registration process involves completing an application, providing relevant business information, and understanding the responsibilities associated with tax collection.

Once registered, businesses are responsible for collecting sales tax from customers at the point of sale. This typically involves adding the appropriate sales tax to the purchase price and providing a clear breakdown of the tax on the customer's receipt. Accurate record-keeping of sales transactions and tax collections is crucial for compliance and audit purposes.

Sales Tax Remittance

Businesses are required to remit the collected sales tax to the North Carolina Department of Revenue on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to quarterly. The process involves submitting the collected tax amounts along with the appropriate forms and payment methods. Late or incorrect remittance can result in penalties and interest charges, so timely and accurate reporting is essential.

The Department of Revenue provides online tools and resources to assist businesses in managing their sales tax obligations. These include electronic filing options, payment gateways, and real-time tracking of tax accounts. Utilizing these tools can streamline the remittance process and reduce the administrative burden on businesses.

Sales Tax Exemptions and Special Considerations

North Carolina offers various sales tax exemptions and special considerations to certain entities and scenarios. Understanding these exemptions is crucial for businesses to ensure they are not overcharging customers or underpaying taxes.

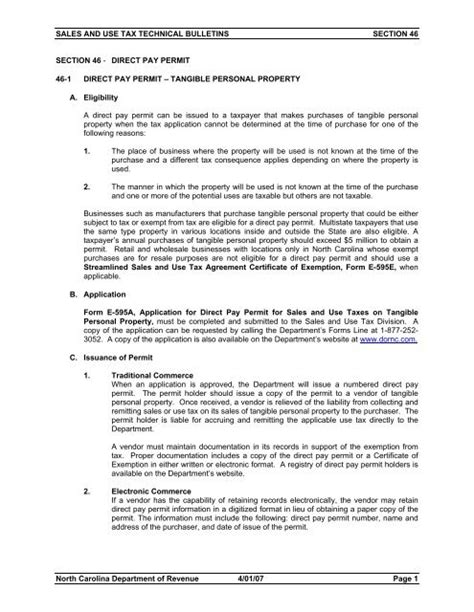

Resale Exemptions

Businesses that purchase goods for resale purposes are exempt from paying sales tax on those purchases. This exemption applies to retailers, wholesalers, and other businesses engaged in the resale of tangible personal property. To claim this exemption, businesses must obtain a Resale Certificate and provide it to their suppliers. This certificate verifies the business's status as a reseller and allows them to purchase goods tax-free.

Tax Exempt Organizations

Certain organizations, such as non-profit entities, religious institutions, and government agencies, are exempt from paying sales tax. These organizations must obtain a Sales and Use Tax Exemption Certificate to provide to vendors when making purchases. This certificate confirms their tax-exempt status and allows them to make tax-free purchases. It's important for businesses to verify the validity of these certificates before providing tax-exempt pricing.

Special Tax Rates and Programs

North Carolina offers special tax rates and programs for specific industries and situations. For instance, the state has a Tourist Development Tax applied to certain accommodations and rentals. This tax is collected by businesses and remitted to local authorities to support tourism-related initiatives. Additionally, there are Agricultural Sales Tax Exemption Programs that provide tax relief for agricultural producers and related industries.

Sales Tax Audits and Compliance

The North Carolina Department of Revenue conducts audits to ensure compliance with sales tax regulations. These audits can be random or triggered by specific indicators, such as inconsistent tax reporting or significant sales volume fluctuations. During an audit, the department examines a business's sales records, tax returns, and other relevant documents to verify the accuracy of tax calculations and collections.

To prepare for potential audits, businesses should maintain organized and detailed records of their sales transactions, tax collections, and remittances. Proper documentation and accurate record-keeping are essential to demonstrate compliance and avoid penalties. Additionally, staying updated on tax laws and regulations, and seeking professional guidance when needed, can help businesses navigate the complexities of sales tax compliance.

Penalties and Interest

Non-compliance with sales tax regulations can result in penalties and interest charges. The severity of these penalties depends on factors such as the nature of the violation, the amount of tax owed, and the business's cooperation during the audit process. Common penalties include fines, additional tax assessments, and suspension of the business's sales tax permit. Interest charges may also accrue on unpaid taxes, further increasing the financial burden.

Conclusion: Navigating North Carolina's Sales Tax Landscape

Understanding and complying with North Carolina's sales tax regulations is essential for businesses and individuals alike. The state's sales tax system, with its statewide and local variations, can be complex, but with proper knowledge and resources, it can be navigated effectively. By staying informed about tax rates, taxable items, and exemptions, businesses can ensure accurate tax calculations and collections, maintaining a positive relationship with customers and tax authorities.

The North Carolina Department of Revenue provides valuable guidance and tools to assist businesses in their sales tax obligations. From registration and collection to remittance and compliance, the department's resources are designed to streamline the tax process. By leveraging these resources and seeking professional advice when needed, businesses can navigate the sales tax landscape with confidence and ensure compliance with the state's tax laws.

How often do I need to remit sales tax in North Carolina?

+The frequency of sales tax remittance in North Carolina depends on your business’s sales volume. If your monthly sales exceed a certain threshold, you may be required to remit sales tax monthly. Otherwise, you can remit sales tax on a quarterly basis. It’s important to consult the North Carolina Department of Revenue’s guidelines for specific details and to ensure compliance with the remittance schedule.

Are there any sales tax holidays in North Carolina?

+Yes, North Carolina does observe sales tax holidays. These are designated periods when certain items, such as school supplies, clothing, and hurricane preparedness items, are exempt from sales tax. Sales tax holidays provide an opportunity for consumers to save on essential purchases. The dates and eligible items for sales tax holidays vary each year, so it’s important to stay updated with the North Carolina Department of Revenue’s announcements.

Can I claim a refund for overpaid sales tax?

+Yes, if you believe you have overpaid sales tax, you can claim a refund. The process involves completing a refund application and providing supporting documentation. It’s important to carefully review your records and ensure you have valid reasons for the refund claim. The North Carolina Department of Revenue has guidelines and forms available to assist with the refund process.

What happens if I fail to collect or remit sales tax correctly?

+Failing to collect or remit sales tax correctly can result in penalties and interest charges. The severity of the penalties depends on the nature of the violation and the business’s cooperation. It’s important to ensure accurate tax collection and timely remittance to avoid legal and financial consequences. Seeking professional advice and staying informed about tax regulations can help prevent such issues.