Sales Tax Lookup Washington State

In the state of Washington, sales tax is an important aspect of doing business and understanding the tax landscape is crucial for both businesses and consumers alike. The sales tax system in Washington is unique, with a variety of rates and regulations that can impact transactions. This comprehensive guide aims to provide an in-depth analysis of the sales tax landscape in Washington, offering insights and practical information for all stakeholders.

Understanding Washington’s Sales Tax Structure

Washington state operates a complex sales tax system, comprising state, county, and municipal taxes, each with their own rates and regulations. The state sales tax rate is a flat 6.5%, one of the lowest in the nation. However, when combined with local taxes, the effective rate can vary significantly across the state.

County and City Sales Taxes

Washington’s counties and cities have the authority to impose additional sales taxes on top of the state rate. For instance, King County, home to Seattle, has a county tax rate of 0.5%, bringing the total sales tax to 7% within the county. Meanwhile, Spokane County levies an additional 0.5% tax, resulting in a combined rate of 7% as well.

Many cities also have their own sales taxes. For example, Seattle imposes a city sales tax of 2.25%, resulting in a total sales tax of 8.75% for businesses and consumers within city limits. This additional city tax funds various municipal services and projects.

| Location | State Rate | County Rate | City Rate | Total Rate |

|---|---|---|---|---|

| Seattle, King County | 6.5% | 0.5% | 2.25% | 8.75% |

| Spokane, Spokane County | 6.5% | 0.5% | N/A | 7% |

Sales Tax Exemptions and Special Considerations

Washington state offers a range of sales tax exemptions and special provisions, which can significantly impact the tax obligations of businesses and consumers. These exemptions are designed to encourage certain economic activities and support specific industries.

Food and Beverage Exemptions

One of the most notable exemptions in Washington is the food and beverage tax exemption. Prepared food and beverages, such as meals at restaurants, are generally exempt from sales tax. However, this exemption does not apply to certain items, including soft drinks, candy, and snack foods.

Manufacturing and Resale Exemptions

Businesses engaged in manufacturing and resale activities often benefit from sales tax exemptions. For instance, the purchase of raw materials and equipment used in manufacturing processes is typically exempt from sales tax. Similarly, resale certificates can be used by retailers to purchase goods for resale without paying sales tax.

Agriculture and Forestry Exemptions

The state also provides sales tax exemptions for agricultural and forestry industries. This includes exemptions for the purchase of farm equipment, livestock, and agricultural supplies. Additionally, the sale of certain forest products, such as timber and lumber, is often exempt from sales tax.

Other Exemptions and Special Considerations

Washington offers various other sales tax exemptions, including those for medical devices, prescription drugs, and certain types of construction materials. There are also special provisions for tourist destinations, such as tax-free zones at major airports and seaports, to encourage tourism and business travel.

Compliance and Reporting Requirements

Navigating Washington’s sales tax landscape requires a thorough understanding of the state’s compliance and reporting requirements. Businesses must ensure they are collecting the correct tax rates, filing accurate returns, and remitting payments on time.

Registration and Licensing

All businesses selling taxable goods or services in Washington must register with the Washington State Department of Revenue and obtain a Business License and a Sales Tax Permit. This process involves providing detailed information about the business, including its legal structure, ownership, and primary activities.

Sales Tax Collection and Remittance

Businesses are responsible for collecting sales tax at the point of sale and remitting these funds to the state on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly.

Filing Sales Tax Returns

Businesses must file sales tax returns with the state, providing a detailed account of their taxable sales, purchases, and tax collections. These returns must be filed by the due date, which is typically the last day of the month following the reporting period. Late filing can result in penalties and interest charges.

Sales Tax Rate Changes and Updates

Sales tax rates in Washington are subject to change, driven by a variety of factors including economic conditions, legislative decisions, and voter-approved initiatives. It’s crucial for businesses and consumers to stay informed about these changes to ensure compliance.

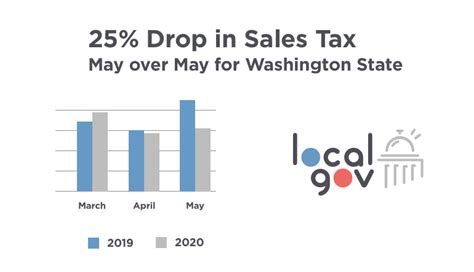

Recent Sales Tax Rate Changes

In recent years, several counties and cities in Washington have increased their sales tax rates to fund specific projects or services. For instance, in 2020, Pierce County implemented a 0.2% increase to fund transportation improvements. Similarly, Tacoma, the county seat of Pierce County, approved a 0.5% increase to support public safety initiatives.

Future Rate Changes and Proposals

There are ongoing discussions and proposals at the state and local levels to adjust sales tax rates. These proposals often aim to address specific budgetary needs or to provide tax relief to certain industries or individuals. Staying informed about these proposals can help businesses and consumers plan their financial strategies accordingly.

The Impact of Sales Tax on Business and Consumers

Washington’s sales tax landscape has a significant impact on both businesses and consumers. For businesses, understanding and complying with sales tax regulations is essential to avoid penalties and maintain a positive relationship with the state. For consumers, sales tax can significantly impact their purchasing decisions and overall cost of living.

Business Impact

Businesses in Washington must factor sales tax into their pricing strategies and financial planning. They must also ensure that their point-of-sale systems and accounting processes accurately reflect the applicable tax rates. Non-compliance can result in audits, penalties, and negative public perception.

Consumer Impact

Consumers in Washington bear the burden of sales tax at the point of sale. The varying rates across the state can make it challenging for consumers to budget and plan their purchases effectively. However, sales tax exemptions and special provisions can provide significant savings for certain types of purchases.

Sales Tax Resources and Support

Navigating Washington’s sales tax landscape can be complex, but there are numerous resources available to help businesses and consumers understand and comply with the regulations. These resources provide detailed information, guidance, and support to ensure a smooth tax compliance process.

Washington State Department of Revenue

The Washington State Department of Revenue is the primary resource for sales tax information and compliance. Their website offers a wealth of resources, including tax rate tables, exemption guides, and detailed instructions for registration, filing, and payment.

Local Government Websites

County and city websites often provide detailed information about local sales tax rates and regulations. These websites can be a valuable resource for businesses and consumers looking to understand the specific tax landscape in their area.

Tax Professionals and Consultants

Engaging the services of tax professionals or consultants can provide specialized guidance and support for businesses navigating Washington’s sales tax landscape. These professionals can help with tax planning, compliance, and audits, ensuring that businesses are meeting their tax obligations effectively.

Conclusion

Washington’s sales tax landscape is complex and varied, reflecting the diverse needs and priorities of the state’s counties and cities. For businesses and consumers, understanding this landscape is essential to ensure compliance, avoid penalties, and make informed financial decisions. By staying informed about sales tax rates, exemptions, and compliance requirements, stakeholders can navigate this complex system with confidence.

How often do sales tax rates change in Washington state?

+

Sales tax rates can change annually, typically in response to legislative decisions or voter-approved initiatives. However, certain counties and cities may adjust their rates more frequently to address specific budgetary needs.

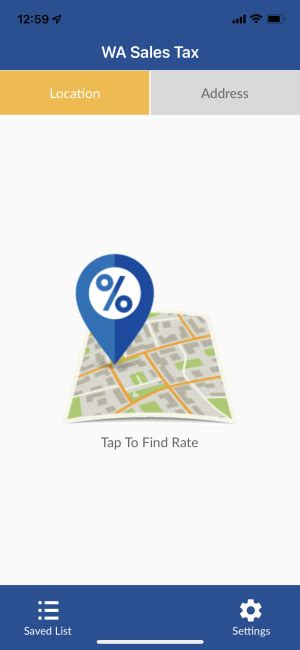

Are there any online tools to help me calculate sales tax in Washington?

+

Yes, the Washington State Department of Revenue provides an online Sales Tax Calculator tool. This tool allows users to input their location and purchase amount to calculate the applicable sales tax.

What happens if I make a mistake on my sales tax return?

+

If you discover a mistake on your sales tax return, it’s important to amend the return as soon as possible. The Washington State Department of Revenue provides guidance on how to correct errors and file amended returns.

Are there any sales tax holidays in Washington state?

+

Currently, Washington does not have any sales tax holidays. However, certain cities or counties may offer tax-free periods for specific types of purchases, such as school supplies or energy-efficient appliances.

Can I get a refund if I overpay my sales tax?

+

Yes, if you overpay your sales tax, you can request a refund from the Washington State Department of Revenue. The refund process involves filing a claim and providing supporting documentation.